When looking for an investment, the approach I take involves looking at the global, big picture conditions. I study trends, read the news, basically watch and listen to what’s going on in the world.

This is top-down investing.

Then I study the different sectors to select the one that I think is going to match up well with what I think is the overriding theme(s).

The second part of my search is a bottom-up approach.

I spend the majority of my due diligence time and effort on bottom-up searches — finding the companies involved in my chosen sectors. I pick the company I want to invest my money in based on the quality of its management team and its project(s).

To my way of thinking, there are currently two dominant investment themes in the world. The first theme is inflation and the coming recession, and how best to protect your wealth during a time of high prices, eroding purchasing power and stalled economic growth. Precious metals have long been seen as a hedge against inflation and a store of value. As recession fears continue, many investors are parking funds normally reserved for equities into gold and silver.

The second theme is electrification and decarbonization.

The move away from fossil-fuel-powered vehicles to EVs run on batteries is happening in almost every country. Governments are spending billions on EV charging infrastructure and subsidies to incentivize consumers to switch to hybrids and plug-in electric cars, vans and trucks. China is the leader but other countries are catching up, as large automakers like Volkswagen, Mercedes-Benz, GM and Ford come out with new EV models and plan new EV manufacturing/ assembly plants in North America and Europe.

Last year the amount of money invested in decarbonizing the world’s energy system surpassed a trillion dollars for the first time. 2022 was also the first year that the $1.1 trillion which poured into the energy transition matched the $1.1T global investment in fossil fuels.

While a trillion is obviously megabucks, it’s not enough to meet net-zero requirements by 2050. To get there, the world would need to immediately triple this $1.1 trillion spend — and add hundreds of billions of dollars more for the global power grid, according to a Bloomberg story.

Part of this massive capital outlay will involve the search for more raw materials.

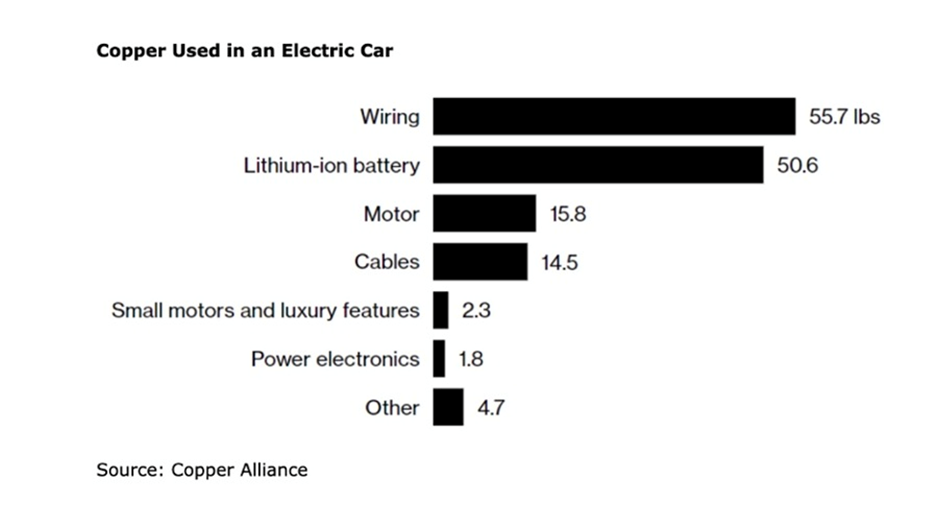

The electrification of the global transportation system doesn’t happen without copper, needed for electric vehicle wiring and other components, EV charging stations, and new transmission lines that will have to be built.

Electric vehicles use over three times as much copper as gasoline-powered cars, which contain about 30 kg.

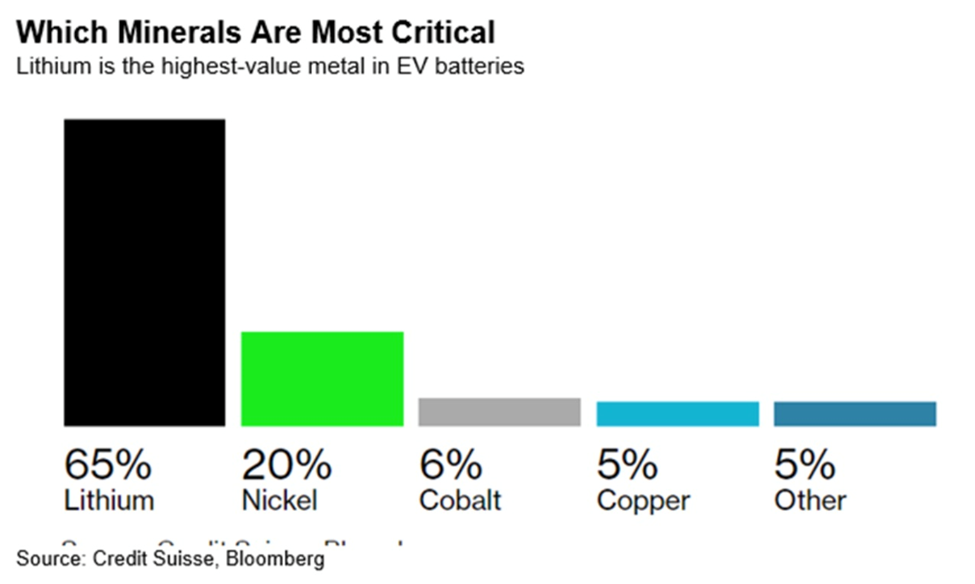

Lithium and graphite, meanwhile, are essential for the lithium-ion batteries that go into EVs.

These batteries consist of an anode, cathode, separator, electrolyte and two current collectors (positive and negative). The cathode contains lithium, either in the form of lithium carbonate or lithium hydroxide, while the anode is made up of graphite. There are no substitutes for either in a Li-ion battery.

The global lithium-ion battery industry is expected to grow at a CAGR of 16.4% from 2020 to 2025, reaching USD$94.4 billion by 2025 from $44.2 billion in 2020. Growth will be driven not only by the need for plug-in electric vehicles and hybrids, but grid storage applications for which the dominant technology is lithium-ion.

Demand for lithium carbonate is expected to rise at a compound annual growth rate of 10-14% until 2027, while lithium hydroxide demand is seen climbing at a 25-29% CAGR.

A recent study by BloombergNEF shows that 5.3 times more lithium will be demanded by 2030 compared to current levels.

Like lithium, graphite is indispensable to the global shift towards electric vehicles. It is the largest component in lithium-ion batteries by weight (even more than lithium), with each battery containing 20-30% graphite.

An average plug-in EV has 70 kg of graphite, or 10 kg for a hybrid. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

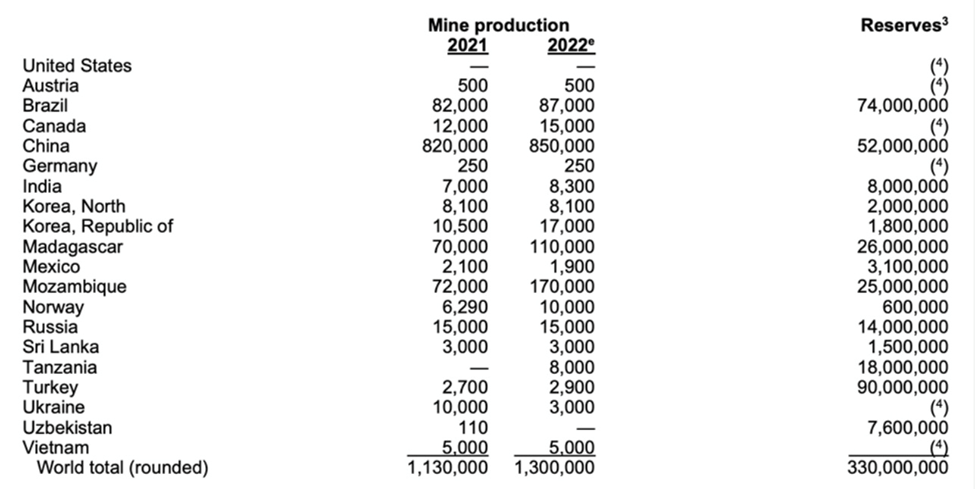

By estimates, at least 125 million EVs are expected to be mobile by 2030, nearly 20 times the global EV stock in 2019. That’s more than 8 million tonnes of battery-ready graphite needed by the next decade. Last year, the mining industry was only able to supply 1.3 million tonnes, and that was for all graphite uses, not just EV batteries. Other major applications include steelmaking, high-temperature lubricants, brushes for electrical motors, friction materials, and fuel cells.

Precious metals

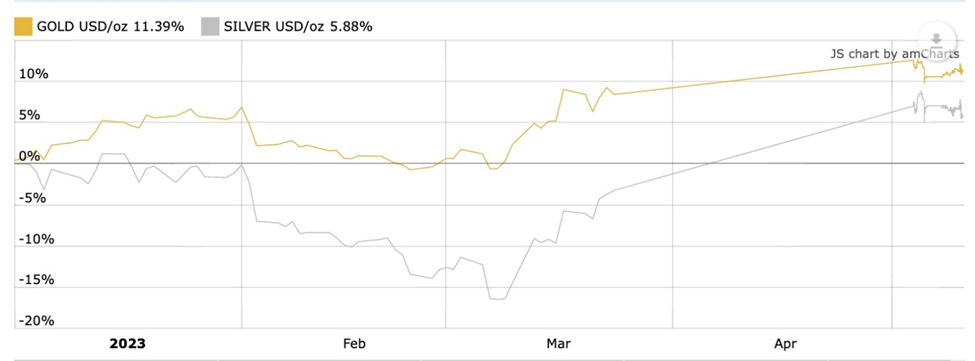

Back to our first investment theme, inflation and the possible coming recession, a wide range of market influences are steering investors towards gold and silver in 2023. Year to date, both have seen impressive jumps, with gold recently coming within cents of an all-time high, and silver also flirting with price levels last seen a decade ago.

5 reasons gold and silver will soar

Gold and silver prices, year to date. Source: Kitco

Gold and silver prices, year to date. Source: Kitco

Historically, gold thrives when global economic conditions get worse.

The latest report from the World Economic Forum shows while the economic outlook has improved since the start of the year, recession fears are still prevalent. Nearly half of the participants in the WEF’s latest survey said that a recession is likely.

In the US, inflation is still rampant, and the Federal Reserve continuing to hikes rates to quell rising prices, raises the odds of a recession. Then there’s the political standoff over the US debt ceiling and fears of a default, which many believe could accelerate the recession.

Investors are likely to favor gold as it provides a buffer against the possibility of a US recession this year, according to strategists at JPMorgan Chase.

“The US banking crisis has increased the demand for gold as a proxy for lower real rates as well as a hedge against a ‘catastrophic scenario,’”

JPMorgan analysts wrote.

Speaking of the banking industry, it seems that the worst might be yet to come.

The US banking sector fell into a deeper crisis earlier this month, when the government seized the assets of First Republic Bank and auctioned them to JPMorgan. This was the second-largest bank failure in US history and the third failure of a midsize lender in two months.

A selloff in bank stocks followed, a sign that uncertainty

continues to plague the industry despite assurances from financial regulators and bankers. Market attention is now placed on PacWest and Western Alliance, whose shares have been under pressure since Silicon Valley Bank failed in mid-March.

The bigger worry, though, is that the bank failures might lead to doubts

about relatively healthy banks, creating a financial contagion that could

impact the wider economy.

This bodes extremely well for the prospects of gold, which responded

positively to the market panic caused by accentuated fears among

investors. Gold futures matched their all-time high of $2,072/oz on May 4, while spot gold came within cents of setting a new record.

Also being monitored is the US Federal Reserve’s decision-making on interest rates. In a widely anticipated move last week, the Fed announced its 10th interest rate increase in a little over a year, while also hinting that the current tightening cycle is ending.

We’ve previously established that real interest rates are what truly determines gold’s performance in longer periods. Should the Fed decide to pause the rate hikes, that would further strengthen bullion as it generally displays a negative relationship with real rates.

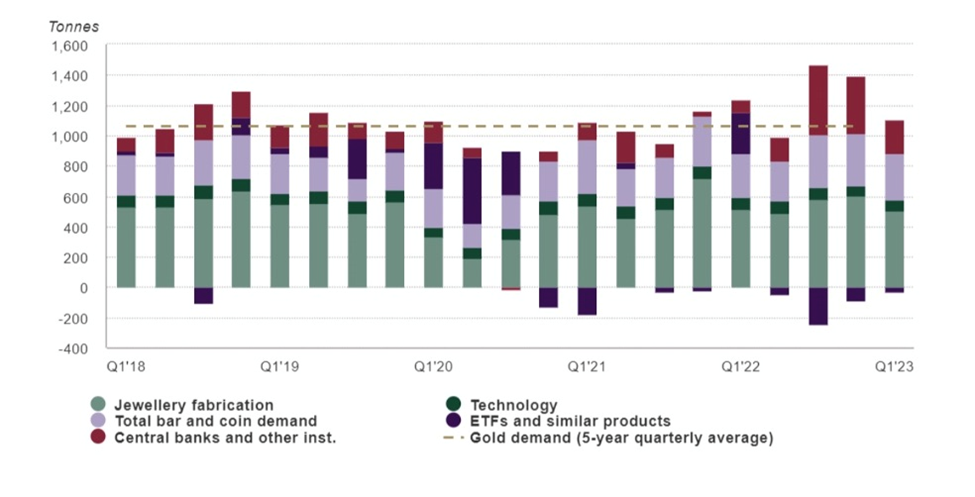

An indication of the precious metal’s strong appeal is robust demand from central banks, which bought a record high 1,087 tonnes of gold last year. The buying spree has continued into 2023. During the first three months, central banks added a total of 228 tonnes to global reserves, which is the highest rate of purchases seen in a first quarter, the World Gold Council said.

Source: World Gold Council

Source: World Gold Council

In an interview with CNBC, WGC senior markets analyst Louise Street

emphasized gold’s growing importance to central banks during uncertain times, stating that:

“Top of the tree for gold in terms of why official sector institutions hold it is always things like its role as a diversification asset, its long-term store of value, but increasingly over the last two years, we’ve seen the importance that they placed on its performance during times of crisis.”

On the investment front, Street also told CNBC that the Council saw a

noticeable spike in demand in March, marked by a significant inflow into gold-backed ETFs after the collapse of Silicon Valley Bank, which partially offset outflows in the first two months.

Bar and coin demand also rose 5% year-on-year, with US demand hitting its highest quarterly level since 2010 on the back of recession fears and a flight to safety amid the banking turmoil.

Giving a preview of what’s ahead, Street noted that: “Positive demand for gold ETFs has continued in Q2 so far, and the looming threat of developed market recession may be the trigger for inflows to accelerate later in the year. Central bank buying is likely to remain strong and will be a cornerstone of demand throughout 2023.”

On the other side of the coin is supply, which the WGC estimates grew by 1% year-on-year to 1,174 tonnes in Q1 2023, driven by a marginal 2% growth in mine production and a 5% uptick in recycling.

However, with demand likely trending up through the rest of the year, it remains to be seen whether supply growth will be sufficient to avoid a market deficit.

Previously we proved peak gold, referring to the point when gold production is no longer growing. It reaches a peak, then declines.

In 2021, 4,021 tonnes of gold demand minus 3,560.7t of gold mine production left a deficit of 460.3t. Only by recycling 1,150t of gold jewelry could the demand be met.

As for silver, the latest data from the Silver Institute reveals that annual silver demand surged by 18% to a record high 1.24 billion ounces against a stagnant supply in 2022. This resulted in a second straight year of undersupply at 237.7 million ounces, which the Institute says is “possibly the most significant deficit on record.”

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

In 2023, we are most likely going to see a repeat of last year, according to the Institute, which expects the market deficit to remain high at 142.1 million ounces on the back of solid demand.

As concerns of undersupply linger, the precious metals market appears

well-positioned to maintain its bullish trend for the remainder of 2023.

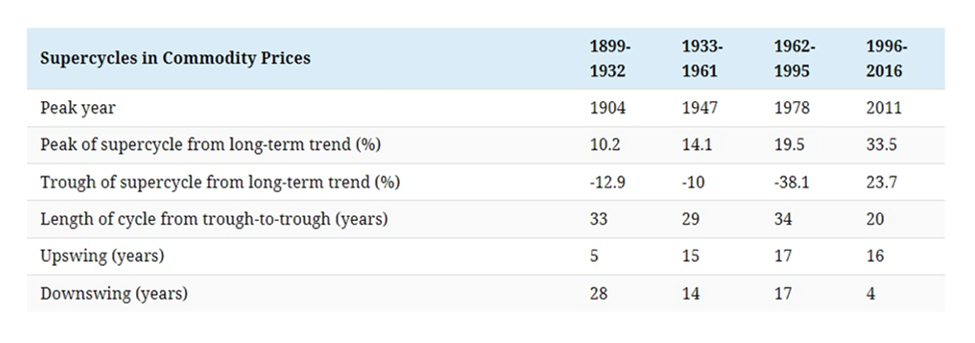

Dawn of a new commodity supercycle

Commodity supercycles occur because of the lag between commodity price signals and changes in supply. While each commodity is different, the following is a rundown of a typical boom-bust cycle:

As economies grow, so does the demand for commodities, and eventually the demand outstrips supply. That leads to rising commodity prices, but the commodity producers don’t initially respond to the higher prices because they’re unsure whether they will last. As a result, the gap between demand and supply continues to widen, keeping upward pressure on prices.

Eventually, prices get so attractive that producers respond by making additional investments to boost supply, narrowing the supply and demand gap. High prices continue to encourage investment until finally, supply overtakes demand, pushing prices down. But even as prices fall, supply continues to rise as investments made during the boom years bear fruit. Shortages turn to gluts and commodities enter the bearish part of the cycle.

The most recent commodity supercycle started in 1996 and peaked in 2011, driven by raw material demand from rapid industrialization taking place in markets like China, Brazil, India and Russia.

Data source: Bank of Canada, IHS. Image: Visual Capitalist

Data source: Bank of Canada, IHS. Image: Visual Capitalist

In fact, we may be right at the early stages of a new commodity supercycle, something analysts have been predicting for years.

All signs point to the early stages of a new “commodity supercycle”

A big proponent of the current “supercycle” talk other than AOTH is Goldman Sachs, which predicted back in October 2020 that commodities were beginning a supercycle that could last years, and possibly a decade.

Behind the bank’s supercycle call was the brutal decade for commodities in the aftermath of the 2008 financial crisis. By 2020, investors had all but abandoned the asset class in favor of equities.

“The lack of investment in commodities for tomorrow is startling,” Goldman said. “Without sufficient capex to create spare supply capacity, commodities will remain stuck in a state of long-run shortages, with higher and more volatile prices.”

In an interview with Bloomberg in January, 2022, Goldman’s global head of commodities research Jeff Currie stated that commodities are “the best place to be right now.”

While no two supercycles look the same, they all have three indicators in common: a surge in supply, a surge in demand and a surge in price.

The new commodity supercycle, however, looks different from previous ones for one simple reason — an increased focus on climate change.

According to S&P Global, a more aggressive commitment to the energy transition across G-20 nations could create the conditions for a sustained surge in demand, supply and prices.

Consider: past commodity supercycles were driven by strong demand for raw materials, manufactured goods and sources of energy. The energy transition serves as a major catalyst for all the key inputs to our renewable energy infrastructure, propelling demand for “green economy” metals to levels never seen before.

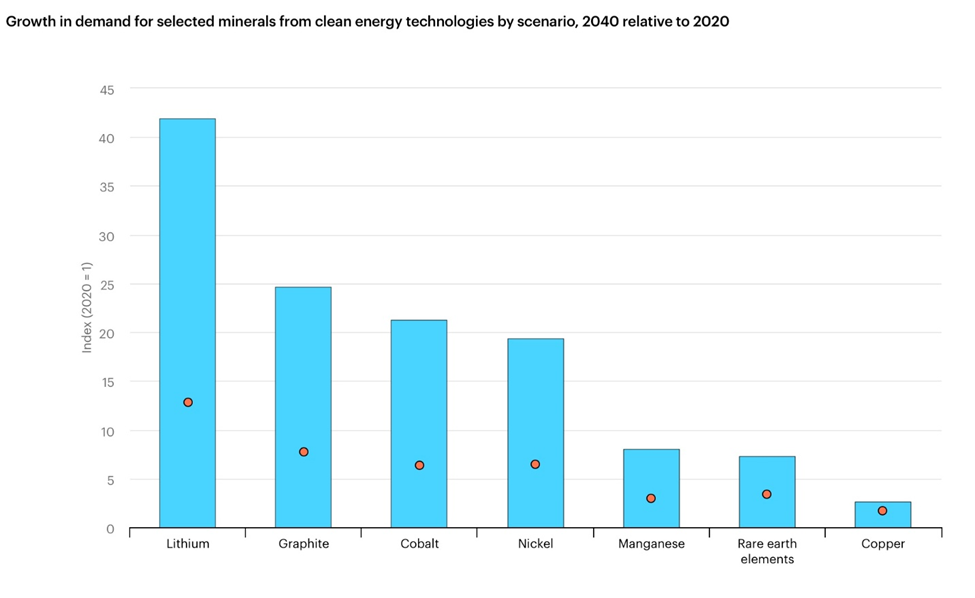

Electrification and mineral usage

The International Energy Agency forecasts mineral demand for use in EVs and battery storage will grow at least 30 times by 2040. Lithium should see the fastest growth, with demand growing by over 40x in its Sustainable Development Scenario by 2040, followed by graphite, cobalt and nickel (around 20-25 times). The expansion of electricity networks means that copper demand more than doubles over the same period.

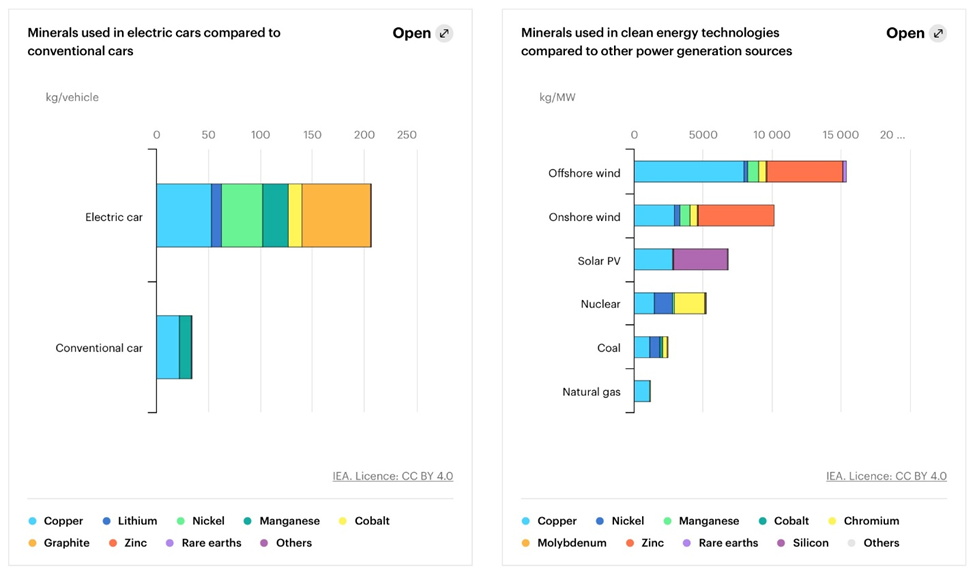

Source: IEA

Source: IEA

The IEA says solar plants, wind farms and electric vehicles generally require more minerals to build than their fossil fuel-based counterparts. A typical electric car requires 6x the mineral inputs of a conventional car and an onshore wind plant requires 9x more mineral resources than a gas-fired plant.

Source: IEA

Source: IEA

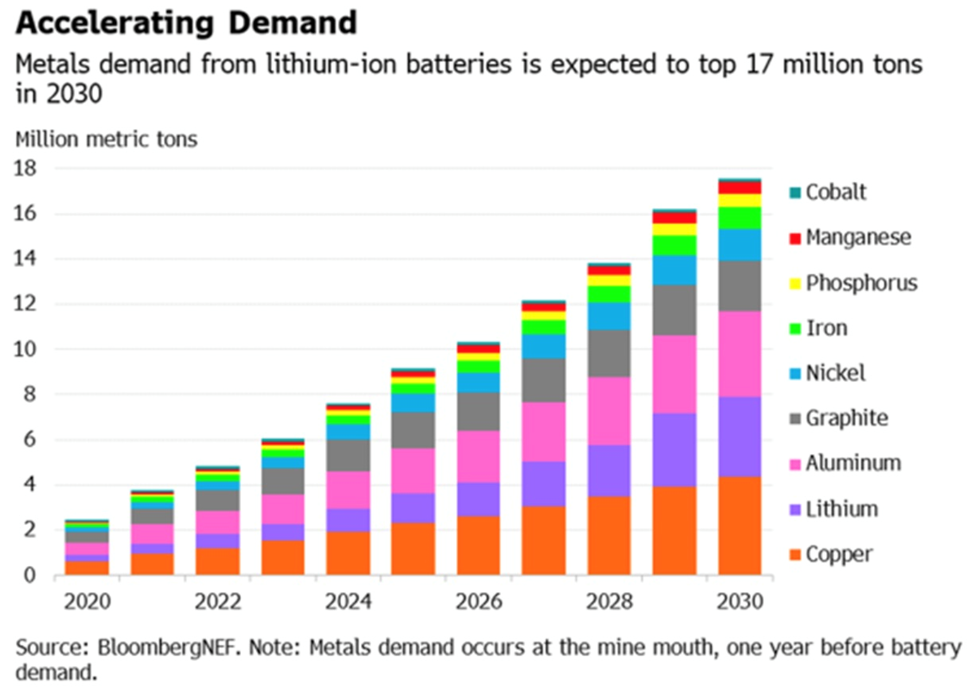

To reach net-zero, demand for these key metals needed for the deployment of energy transition technologies such as solar, wind, batteries and electric vehicles will grow fivefold by 2050, Bloomberg New Energy Finance adds.

Source: BloombergNEF

Source: BloombergNEF

Copper

Simply put, electrification doesn’t happen without copper.

Along with the usual applications, in construction wiring and plumbing, transportation, power transmission and communications, there is the added demand for copper in electric vehicles and renewable energy systems.

Millions of feet of copper wiring will be required for strengthening the world’s power grids, and hundreds of thousands of tonnes more are needed to build wind and solar farms. Electric vehicles use triple the amount of copper as gasoline-powered cars. There is more than 180 kg of copper in the average home.

However, some of the world’s largest mining companies, market analysis firms and banks, are warning that by 2025, a massive shortfall will emerge for copper, which is now the world’s most critical metal due to its essential role in the green economy. The deficit will be so large, The Financial Post stated last September, that it could itself hold back global growth, stoke inflation by raising manufacturing costs and throw global climate goals off course.

How big are we talking? Well, the speed at which copper demand outpaces supply will depend on the successful meeting of net-zero emission goals. According to a 2022 study by S&P Global, these goals will double the demand for copper to 50 million tonnes annually by 2035. Bloomberg New Energy Finance predicts demand will increase by more than 50% from 2022 to 2040.

“The energy transition is going to be dependent much more on copper than our current energy system,” Daniel Yergin, S&P Global vice chairman, told CNBC. “There’s just been the assumption that copper and other minerals will be there. … Copper is the metal of electrification, and electrification is much of what the energy transition is all about.”

Analysts at Goldman Sachs are extraordinarily bullish on the metal due to its high demand, predicting that “we’ll be at the lowest observable inventories that have ever been recorded at 125,000 tonnes” this year.

By year-end, the copper market is expected to be undersupplied, and some time in 2024, peak copper will arrive, generating deficits from that point, the investment bank said.

To prevent a depletion of copper supply within two years, prices must rise now to encourage investment and an expansion in output, according to Goldman.

In its report, the bank estimates a long-term supply gap of 8.2 million tons by 2030, twice the size of the gap that triggered the bull market for copper in the early 2000s.

Lithium

According to Benchmark Mineral Intelligence (BMI), to meet demand, the global lithium industry needs to invest up to $42 billion by the end of the decade. This works out to $7 billion each year from now until 2028, helping it to meet predicted demand of 2-4 million tonnes per annum by 2030, which is four times higher than the 600,000 tonnes of lithium that was expected to be produced in 2022.

Bloomberg notes the forecast, from a recent BMI report, comes as Europe and North America look to reduce their dependency on Chinese lithium imports and to try to develop their own lithium production.

The Biden administration has earmarked billions to help process key battery metals including lithium, while in Canada, 2022’s budget included CAD$3.8 billion to build a domestic critical metals supply chain.

Despite the healthy trade in batteries, looming supply shortages of battery metals including lithium and graphite could derail the global transition to clean energy, according to Trafigura CEO Jeremy Weir.

Automakers could have problems increasing electric-vehicle output unless there is significant new investment in new supply, said Weir, head of the commodities trading house. He warns higher prices are needed to incentivize miners to bring new production online, and cautions that delayed permitting process could stymie new supply even if prices do move higher (Mining Weekly, March 9, 2023).

Albemarle executives quoted by Reuters warned of the “potential for significant deficits” by the end of the decade without new mines and processing plants.

Fastmarkets previously forecast a small surplus in 2023 but this has been revised to a deficit because of increased battery demand and some expected supply disruptions. The introduction, in the United States, of the Investment Reduction Act, has resulted in Fastmarkets upgrading its forecast for battery electric vehicle (BEV) sales by 80% in 2023 and 107% in 2024.

Mine supply could increase by 35%, year on year, to 984,000 tonnes, mostly fueled by Australia and China, but Fastmarkets is predicting a 2023 deficit of about 14,000 tonnes lithium carbonate equivalent (LCE).

Reuters metals columnist Andy Home agrees that The world has been running short of lithium, with a surge of new supply failing to catch up with a still faster demand wave as the electric vehicle revolution accelerates.

The lithium nationalization bombshell dropped in April by Chile is good news for North American lithium miners, that are likely to become more important as potential suppliers of the white metal needed for making lithium-ion batteries used in electric cars and trucks, as well as energy storage and an array of consumer electronics.

Graphite

Due to its natural strength and stiffness, graphite is an excellent conductor of heat and electricity. It is also stable over a wide range of temperatures.

Hence, graphite is considered indispensable to the global shift towards electric vehicles. It is also the largest component in batteries by weight, constituting 45% or more of the cell. It may surprise some readers to learn that there is nearly four times more graphite feedstock consumed in each lithium-ion cell than lithium and nine times more than cobalt.

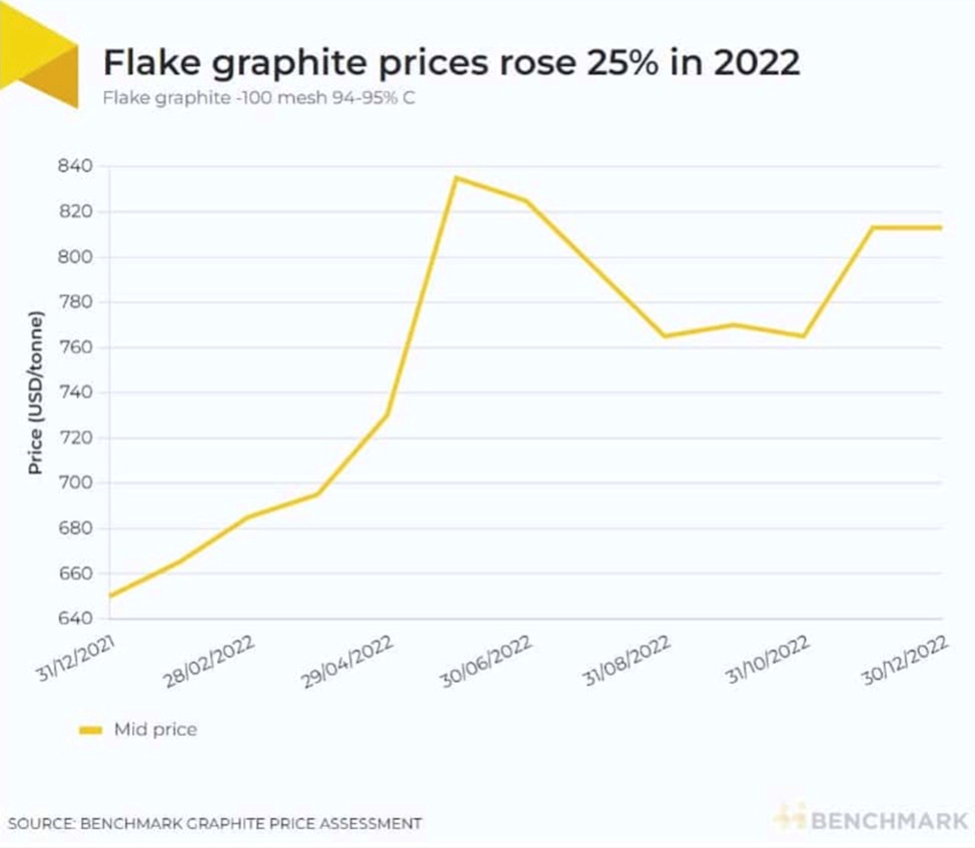

According to Benchmark Mineral Intelligence (BMI), the flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. The amount of mined graphite for all uses in 2022 was just 1.3Mt (USGS)

Source: USGS

Source: USGS

Furthermore, the London-based price reporting agency forecasts demand for graphite from the battery anode segment could increase by seven times in the next decade as the growth in EV sales continues to drive construction of lithium-ion megafactories.

BloombergNEF expects graphite demand by 2030 to quadruple.

The International Energy Agency (IEA) goes 10 years further out, predicting that growth in demand for selected minerals from clean energy technologies by scenario, 2020 relative to 2040, will see: increases of lithium 13x to 42x, graphite 8x to 25x, cobalt 6x to 21x, nickel 7x to 19x, manganese 3x to 8x, rare earths 3x to 7x, and copper 2x to 3x.

Some of the world’s largest auto and battery makers are racing to secure graphite supplies ahead of the coming supply shortage. By 2030 demand for natural graphite is projected to outstrip supply by about 1.2 million tonne, states BMI, via the Wall Street Journal.

Tesla and Panasonic are among the companies that have signed graphite off-take agreements. Syrah Resources, for example, has an off-take with Tesla to ship graphite from its mine in Mozambique to a processing facility in Louisiana.

Late last year, WSJ said the United States gave grants totaling about $500 million to three graphite producers — Syrah, Novonix and Anovion — to kickstart domestic supply using money from the $1 trillion infrastructure bill.

The Inflation Reduction Act provides US consumers tax credits of up to $7,500 per electric vehicle, provided the parts or materials are sourced from countries with which Washington has a free trade agreement. This increases the focus on graphite and other critical minerals.

Conclusion

In investing, themes matter.

The electrification of the global transportation system and up to grid-sized energy storage is one of the most overriding and long-lasting global themes currently underway.

More ephemeral but no less important are precious metals, which dovetail perfectly with the global inflation trend that is hitting consumers hard in the pocketbook, preventing them from spending at normal levels. Everything costs more. When combined with the higher cost of borrowing, this is a serious problem because consumers make up about 70% of the US economy and roughly two-thirds of global GDP.

Historically, gold thrives when global economic conditions get worse.

The latest report from the World Economic Forum shows while the economic outlook has improved since the start of the year, recession fears are still prevalent.

The political standoff over the US debt ceiling and fears of a default could accelerate the recession, as could a worsening of the banking crisis. More bank failures might cast doubts about relatively healthy banks, creating a financial contagion that could impact the wider economy.

Precious metals have long been seen as a hedge against inflation, a store of value, and a safe haven in times of economic, political or geopolitical uncertainty.

The second part of my search for the dominant investment is a bottom-up approach. Having honed in on the metals which present the best investing case, due to high demand for electrification & decarbonization, amid tightening supply — i.e. gold, silver, copper, lithium and graphite — my next move is to pick a junior resource company(ies) with high potential upside. My two key criteria are the management team and the quality of the project(s).

Investing early in the development cycle of the right junior, one that has an excellent project in a safe jurisdiction led by experienced management with the ability to raise money, can reap huge rewards — 5, 10, even 20 times your money isn’t uncommon.

Whether we are talking about gold, silver, lithium or graphite, juniors own the deposits that will become the world’s next mines.

Personally I have positions in junior resource companies that already have a resource that can be easily scaled up to what the majors require.

I plan to seriously capitalize on the delta between what these companies are currently worth, and what they will be trading for once the predicted shortages in metals become Main Street reality and the herd reacts.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.