When President Nixon slammed shut the gold window for foreign holders of U.S. dollars, it was the final step in a planned exit from the gold standard. It was also tacit admission that the United States government, in conjunction with the Federal Reserve, had debased the world’s s reserve currency beyond a point that could no longer be ignored.

The Federal Reserve issued I.O.U’s were coming home to roost more nearly worthless than when they left the nest. The U.S. Treasury would have to give up the real money (gold) it held in safekeeping for uncountable amounts of their own fiat paper.

It was possible by this particular time to actually “break the bank.” In other words, if the United States honored the requirement to meet the redemption demands outstanding at the then current fixed dollar price of gold ($35 oz.), the gold supply would be exhausted before all of the demands could be met.

The situation described is what real bankruptcy is. If you were a foreign holder of U.S. dollars, the end of convertibility was justifiable reason for ‘weeping and wailing’ and ‘gnashing of teeth’.

The end of convertibility and the recognition of a market (price) for gold allowed participants to hedge their bets. If you own dollars, you had better own some gold, too.

The increasing price of gold from 1971-80 was a direct reflection of the deterioration in the U.S. dollar that had taken place over the previous decades dating back to inception of the Federal Reserve in 1913.

The decade of the 1970s added fuel to a fire that was already out of control, as prices for goods and services rose faster than at anytime since the war-torn years of the 1940s.

Regardless, the 1970s was a catch-up period for the price of gold. When the gold price peaked at $677 oz. (monthly average closing prices) in January 1980, it reflected a 97% loss in U.S. dollar purchasing power relative to its original fixed price at $20.67 oz.

In real terms, the price of gold has never been as high since.

TO INFINITY AND BEYOND

Expectations for infinitely higher gold prices in 1980 and shortly afterwards were unrealistic. The effects of inflation had been acknowledged and met. It would take many years for a new valuation to take place.

The frothiness of participants and the extreme conditions surrounding the huge increase in the gold price gave way to other forces. The Fed pursued higher interest rates with real intent and a serious recession ensued.

The price of gold dropped more quickly than it rose, falling fifty-five percent over the next two years. By June 1982, gold was priced at less than $300 oz.

Initially, the decline in gold’s price did little to temper the calls for higher prices amidst the expectations for extreme inflation.

Gradually, however, the proclamations of gold ‘bulls’ faded with the lack of satisfactory price action. The ultimate low ($252) did not come until 1999, nearly twenty years after its 1980 peak.

During the twenty years from 1980 to 2000, the U.S. dollar found favor the world over and economic growth surged.

GOLD 2000-11

With the beginning of the new millennium, several things were happening. The United States and the world were wrapping up a two-decade long season of phenomenal prosperity, the U.S. dollar was starting to attract the wrong kind of attention, and the price of gold moved resolutely from $250 oz. to $350 oz., a rise of forty percent.

When the gold price started its ascent from $252 oz., the move was met with skepticism for several years. However, by the time it clawed its way back to the old intraday high of $850 oz, the U.S. dollar was fast losing respect and stature.

After two decades in the limelight, the U.S. dollar became the financial pundits favorite scape goat. The rising price of gold seemed to reflect increasing sentiment of a negative nature for the world’s reserve currency. Sound familiar?

This continued until dollar sentiment and value reached a low in 2011 just about the time the gold price peaked. It was not a coincidence.

In August 2011, amidst threats of a government default and shutdown, Congress approved another extension of the debt ceiling. The gold price peaked at $1895 oz. indicating a cumulative loss in U.S. dollar purchasing power of 98.9%.

Even though the nominal price of gold had tripled from the January 1980 $677 oz. figure, its price in real (inflation-adjusted) terms was less than its 1980 peak by about eight percent.

About that same time, the U.S. dollar came into its own again and began a multi-year trend of strength and stability; whereas, the price of gold declined.

GOLD 2016-20

When the price of gold found a resting spot on the downside in December 2015 at $1060 oz., the measure of the price decline amounted to forty-four percent. That decline was subsequently erased over the next several years.

When the gold price peaked in the summer of 2020 at more than $2000 oz., it was consistent with a full 99% decline in U.S. dollar purchasing power up to that point.

Leading up to that point, the U.S. dollar, once again, came in for its fair share of ridicule and contempt.

GOLD PRICE IS ALL ABOUT THE US dollar

The pattern and extent of gold’s price action is tied directly to the U.S. dollar.

Periods of strength and stability in the U.S. dollar are similar to periods of temporary strength and stability in terminally ill patients. These periods of temporary strength and stability are usually concurrent with lower prices for gold.

This action is consistent with the fact that a higher price for gold over time reflects the loss of purchasing power in the U.S. dollar that has already occurred. Once the gold price reflects that loss in purchasing power, it cannot continue higher.

There are two charts below. The first one shows nominal prices for gold over the past century. The second one shows the same prices (same time line) adjusted for the effects of inflation.

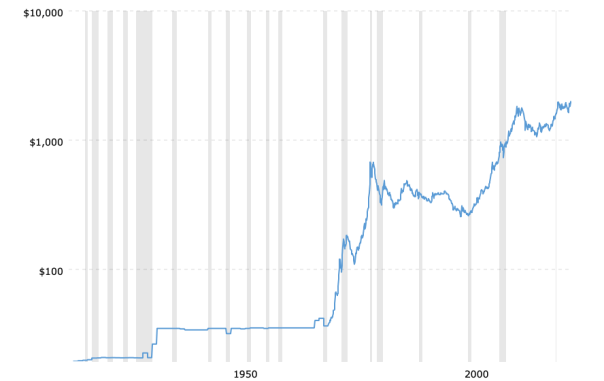

Gold Prices – 100 Year Historical Chart

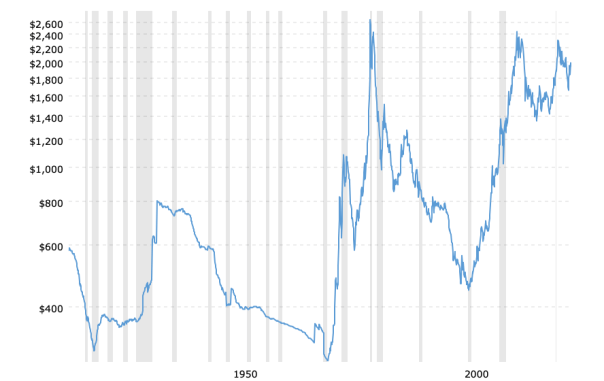

Gold Prices (inflation-adjusted) – 100 Year Historical Chart

The chart of inflation-adjusted gold prices presents a more realistic -and accurate -representation of what is happening to the gold price. The major peaks and low points shown on the chart above are labeled for reference in an earlier version of the same chart which appears below…

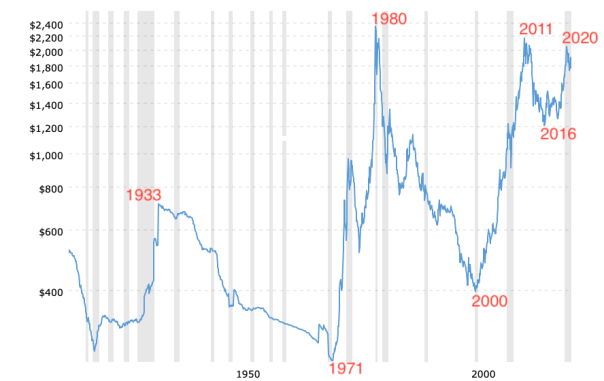

Gold Prices (inflation-adjusted) – 100 Year Historical Chart

There are six major turning points for gold’s price that are reflected on the charts. All six turning points (1933, 1971, 1980, 2001, 2011, 2016) coincided with changes in direction of the relative value and perception of the U.S. dollar.

Since gold is priced in U.S. dollars and since the U.S. dollar is in a state of perpetual decline, the U.S. dollar price of gold will continue to rise over time. There are ongoing subjective, changing valuations of the U.S. dollar from time-to-time and these changing valuations show up in the constantly fluctuating price of gold in U.S. dollars.

However, in inflation-adjusted terms, the price of gold has never exceeded its 1980 peak and has actually failed to match it, both in 2011 and 2020. In addition, each successive peak is visibly lower than the previous peak.

GOLD PRICE 2020-23

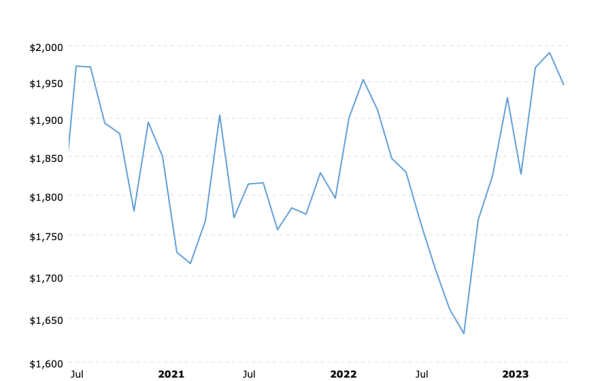

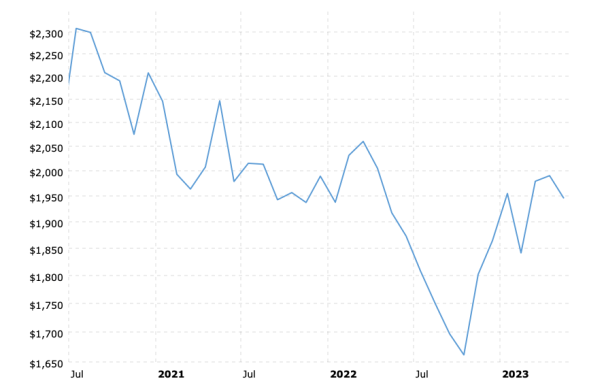

Below are two charts. The first chart shows nominal gold prices since the peak in August 2020. While the recent intraday price exceeded the 2020 peak in nominal terms, it did not hold and turned back down.

In the second chart, the gold price is shown in inflation-adjusted terms. When gold prices are adjusted for inflation, the price is shown to be in a clear downtrend.

Gold Prices 2020-23

Gold Prices (inflation-adjusted) 2020-23

FACTS AND CONCLUSION

When the price of gold peaked in 1980 at $677 (monthly average closing price) it recognized fully the loss of purchasing power in the U.S. dollar that had taken place up to that point.

Again, in 2011 when the gold price peaked near $1900 oz., the price was a reflection of the effects of inflation (loss in US dollar purchasing power) that had occurred up to that point.

More specifically, the higher price of $1900 compared to the previous peak of $677 allowed for the effects of inflation that had occurred in the intervening years since 1980.

When gold peaked in 2020, the $2000 price reflected the additional loss of purchasing power in the U.S. dollar that had occurred since the prior peak in 2011.

The higher price of gold tells us nothing about gold. Its price is an inverse reflection of the ongoing loss of purchasing power in the U.S. dollar that has already occurred. There are no other fundamentals for gold. (see Gold’s Singular Role)

When the gold price moved to a new nominal high (barely) recently, it confirmed the validity of the 2020 peak plus additional inflation effects since then.

To expect hugely higher gold prices at this point for any reason other than a swift and complete collapse of the U.S. dollar is to expect something unreasonable and unrealistic.

Given current U.S. dollar strength, a full-scale collapse of the U.S dollar is not likely at this point.

The price of gold would have to exceed $2300 just to match its 2020 peak. Beyond that it would need to move as high as $2400 to match its 2011 peak.

As far as the significance of the 1980 peak, the gold price would need to exceed $2600 oz. just to match the $677 price in inflation-adjusted terms.

In the meantime, any other increase in the gold price is just a retracement of previously lost ground. (see Gold Price – What New Highs?)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!