I may not be able to change the world; but, at least, I can have fun doing my best to humiliate the guilty. That is kind of my modus operandi. I don’t try to prove conspiracy theories or even sift out all the ones that get shared with me. (I don’t have time for that because there is so much that is so obviously wrong right on the surface.) I just observe what I can actually see and know from my own small place in the world about the corruption and the failures that happen right out in the open.

As I currently watch the world slide into chaos due to the scoundrels I love to ridicule, I hope enough of them go bankrupt to allow me to find a decent price on a newer used Range Rover and maybe some deflation in the price of caviar so that I might finally enjoy both of those together during my tailgate party while I watch the world go down (since there is nothing I can do any longer to try to stop it from falling).

Until I get the Range Rover, pull up a lawn chair, and let us observe our head regulators getting their butts chewed off in the show-and-tell of virtue exhibited today by a never-watchful congress that has let the Fed slide on these issues for years. In this grand game of CYA, the inquisitors must tread artfully before the cameras because they are as much responsible for failures of oversight as the regulators they are overseeing.

OK, not much actual grilling happened. The friendly interviews were more telling for the non-event that the whole thing was than for what anyone actually told us. Rest assured, all is well they said over and over, and that is why the regulators have been sleeping so soundly on the job.

The inquisition that wasn’t so grand

Today’s senate hearing was more of a meet-and-greet than a banking inquisition. It opened with our fearless Democratic leader of the Senate Banking committee, Sherrod Brown, recapping the rapid handiwork of the Fed & Co. in saving the nation from the latest banking crisis they created while they were tasked with preventing it. (You may want to watch his summary statement, and I’ll encapsulate the rest of the video for you.)

While Senator Brown gave a somewhat stirring opening speech on the evils of banks manipulating people like him in congress, where was he, and where were all of these senators, who are in charge of banking oversight, when all of us reading here saw this situation being laid in over past years of Fed fails, mediocre regulations, inattentive regulators, banking greed, and past bailouts that kept all the bad stuff in place and made too-big-to-fail banks even bigger?

We knew another rinse-and-repeat cycle was being baked right into the Fed’s fake recovery plans for years because there was no possible end game to the debt-dependency they were enticing and enabling. Why didn’t these senators know this? Staying on top of this is their job, not yours or mine.

More recently, where were these overseers of the overseers when this clear and present danger started showing up right in front of them at the Fed attempted to do the impossible by reining in interest rates enough to kill the scorching-hot inflation the Fed helped create without crashing the markets and banks and economy and ultimately the government that the Fed made utterly dependent on ultra-low interest?

Why did they fail to connect where those dots would go? Where were they in their programs that added to inflation? Where were they in their own choices in the past year to pile on mountains of debt to stimulate the economy even more?

As these senators look for someone to blame while they complain about the blame-shifting being played by regulators (which is also a fact), where were they in doing their own oversight?

In brief summary

The FDIC head boasted about the FDIC’s rapid response and promised to analyze what went wrong under its oversight and to advise the Senate on what new regulations might help it carry out the existing regulations that it was already not carrying out. Clearly it needs more powers than those it already is not using. Of course, he didn’t quite phrase it like that, but that is what it comes down to. And …

He assured us our banking system is strong.

The Fed head of regulation enforcement (Barr) pledged to stay the course with keeping our banking system safe and sound. By keeping on with that, I presume he meant the Fed will do its best to keep the banking system as unsafe and unsound as it already proved to be when two of the worst banking crashes in this nation’s history happened under the Fed’s faithful watch.

Like the FDIC head, he pledged the Fed would look into what new regulations might help the Fed and FDIC support the regulations they already failed to support or enforce. He stated that Fundamentally, the bank failed because it failed. To be more specific, it failed to pay any due attention to the brightly flashing red lights of this very low-rated (by the Fed, no less) bank that were alerting people to the fact that the bank was rapidly nearing stall speed.

He assured us our banking system is strong.

The Treasury, via a lesser head than Yellen, who has been very busy of late, boasted about the Treasury’s swift response, and, aside from being useless throughout the meeting,…

she assured us our banking system is strong.

The FDIC also admitted it was seeing “serious” signs at a number of banks of “systemic contagion” during the heat of the crisis.

Was that because our banking system is strong?

The Treasury, the FDIC and the Fed all agreed that they agree they did the right things in how they handled this extraordinary crisis.

Oh, and the future of regional banks is good.

Digging in shallowly

(Because you don’t have to go deep to see how bad supervision was at the bank and the regulators … and in congress, and because these senators did not go deep.)

Senator Warner said, as a former venture capitalist, that it seemed to him “interest-rate mismanagement is banking 101,” and he pointed out the ferocity of SVB’s bank run, which it could have survived had it known banking 101 and applied it: The nation’s largest bank failure ever, Warner noted, was Washington Mutual (WaMu), and it crashed when it had $16-billion flee the bank over a ten-day period. SVB, on the other hand, had $42-billion flee the bank in a mere six hours, leading Warner to aver that the very venture capitalists who banked there may have started the run by demanding all their ancillary companies take all their money out at once since ten of them had something like $13-billion deposited there.

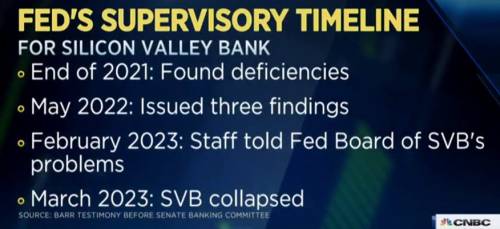

The Fed’s Barr, again, acknowledged that regulators knew how precarious the situation was but they did nothing to force SVB to take action. Of course, he phrased it a little differently by saying the bank did nothing to take action after regulators warned them of the banking-101 risks they were accumulating, emphasizing the more-than-obvious failure of the bank execs while minimizing the failure of Fed and FDIC regulators to actually DO anything other than squeak.

I am sure there is no one who doesn’t already realize the bankers failed miserably due to their abject greed for high returns over conservative security of depositors’ money. So, he admitted no failure on the Fed’s part and went with as much of the truth as we can all agree on.

Senator Menendez stated that the present actions taken by the regulators seem to be creating …

…a flight from regional and community banks to … too-big-to-fail banks. A concentration of deposits at select institutions also brings about its own risks to the financial system. At the end of the day, it seems that we are incentivizing entities to go to too-big-to-fail banks…. Is that what we want to achieve in this process?

Lesser Fed Head Barr, of course, answered that the goal is to achieve a “thriving and diverse system of banking in the United States.”

It’s hard to see how the present plan, which has clearly driven even more deposits more quickly to large banks, is accomplishing that; but Barr was let off with that simple answer, maybe because he just acquired his post.

When pressed on why the Fed knew and reported the problems to the banks and then did nothing about them, Barr disagreed and diverted by saying the Fed did know, but it reported the problems to the banks and required actions. Senator Kennedy stated flatly, “You didn’t follow up, did you?” (And then the bell rang just in time to save Barr from having to answer.)

SVB had months to rectify its risks after regulators pointed out the liquidity problem that could emerge from rising interest rates on bonds (falling value), but it DID nothing, and the Fed allowed it to DO NOTHING throughout those months.

Let’s skip to this particular interchange with Senator Tester, who nailed it (from 1:43:12, where I have it set to start, to 1:46:19). The Fed actually put the bank on notice as far back as November of 2021 but did nothing:

So, the Fed’s Regulator-in-Chief primarily blames the banksters, who enriched themselves on the way out the bank’s doors, for not taking action, even though the Fed’s regulators, it would appear, did nothing to even attempt to force action.

But …

The banking system is sound and resilient

And again …

Banks are safe and sound.

At least, Senator Britt did grill one of them (for less than a minute):

The main thing is that all is now well

Today I read, according to Dallas Fed President James Bullard, assurance the problem has been fixed:

My sense is that the level of systemic risk associated with financial turmoil has fallen dramatically. For this reason, I think the FOMC should begin to de-emphasize systemic risk worries…

My sense is that, because the turmoil has been ongoing for some time, all of the major players have made adjustments as best they can to contain the fallout from the failure of another firm in the industry. They have done this not out of benevolence but out of their own instincts for self-preservation.

As one of my contacts at a large bank described it, the discovery process is clearly over. I say that the level of systemic risk has dropped dramatically and possibly to zero.

Federal Reserve F.O.M.C. notes

Oops. My bad! That was from 2008 … a month before Lehman collapsed. So, that’s how much confidence we should have in assurances from these Fed higher-ups, who promise transparency, at times like this.

Of course, Bullard thinks of creating inflation as a “sales target” where you don’t want it to come in lower than expected.

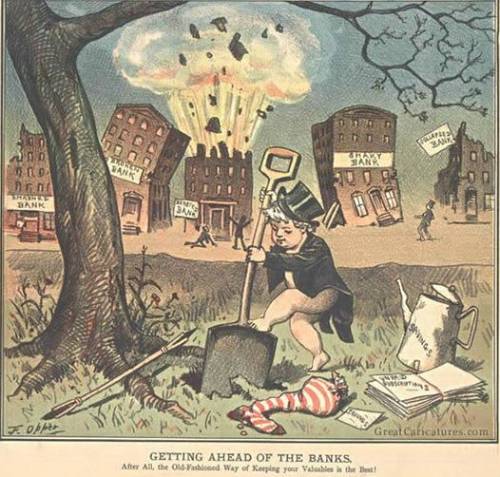

If you don’t, for some reason, trust their assurances that the banking system is resilient and fundamentally sound, you can always go to the underground banking system for greater safety:

Time to get the rust off the old coffee can. With virtually no interest from your bankster bank on deposits, even now that short-term Treasury’s offer 4%, in a time of multiple exploding banks and admitted “systemic risk,” the backyard may be truly safer. Thank God we have absolutely no hints of nepotism or professionally groomed and “gifted” regulators (by which I refer not to their natural talents but the gifts they receive) in the present system as verified in this footage of the Senate’s counterpart, the House Financial Services Committee, meeting to discuss this very issue of bank regulation:

"Oversight" of US banks 5 months ago

by u/KAX1107 in wallstreetbets

Rest assured, we were told multiple times in today’s senate’s meeting by Fed, FDIC and Treasury that all is well this time. Banks are much stronger than in 2008. They certainly wouldn’t make those same old bank-busting mistakes again. I mean, how many times have we learned that? They’ve told us many times … each time the banks failed. Having been told this so frequently, we must be slow learners.

Clearly, all evidence, on the other hand, points away from banks being fundamentally sound and strong, because would fundamental strength look like this:

Federal Reserve Bank of St. Louis

Federal Reserve Bank of St. Louis

Banks borrowing to the sky to stay ahead of bank runs? That is steeper and higher than during the Covidcrisis in 2020 and right about where banks were in needing to borrow rapidly at the worst point in the Great Recession, although getting there much, MUCH faster.

Fundamentally sound, they said many times at this meeting.

All right, but, at least, deposits in commercial banks are not sinking very quickly:

Federal Reserve Bank of St. Louis

Federal Reserve Bank of St. Louis

Uh oh.

Fine, but, at least, the economy is sinking. “So, that’s sumpin’,” as I believe one of the Three Stooges used to say.

We’ll get into that another time.

Liked it? Take a second to support David Haggith on Patreon!