- Hitting the Ceiling

- Choose Your Poison

- Stimulus, Inflation, and Monetization

- Supply Surge

- But Wait, There’s More

- Normalization, Travel, and Booster Shots

Having been Puerto Rico residents for almost three years now, Shane and I have learned a few things about living in the tropics. In Dallas, we didn’t often think about hurricanes, though we did have tornadoes and severe thunderstorms. Ditto for earthquakes. North Texas is pretty stable, geologically speaking.

Now hurricanes and earthquakes are part of normal life. We expect them to happen, and indeed they have happened since we came here. They weren’t too bad but could have been much worse. So, we have plans and precautions to deal with them, as does everyone else here. Last year, a hurricane came through and decided to drench the eastern part of the island and simply miss us. We had no wind or rain. But we were prepared, as were our neighbors. It’s just part of life. But then that same storm tragically devastated the Bahamas.

I was thinking about this in connection with my Sandpile letter, which we again reposted recently. Like those fingers of instability, our ability to predict the weather is far less than perfect. Technology can tell us when hurricanes/tropical storms are out there and the general direction they are moving. It’s still far from certain exactly where they will make landfall, and how strong they will be at the time. They can leave one corner of this small island devastated and the rest untouched.

So, the prudent course is to prepare for the worst, hope for the best—a trite saying but in this case it’s true. We would rather be overprepared than caught by surprise.

Investors face hurricanes, too, with even more uncertainty. The storm could hit someone else, or go back out to sea and dissipate. Do you bet everything that it will? I don’t.

Right now, several potentially big storms are brewing. They could be minor annoyances or catastrophic disasters, or anywhere in between. I truly hope they all resolve with minimal fuss. But they may not. They could even combine into a perfect storm of even greater magnitude… so now is the time to prepare.

I’ll describe several related but independent problems. The first one is US federal debt, which is approaching its limits. Literally so; the statutory debt ceiling, which Congress suspended for two years back in 2019, took effect again this month. The Treasury is now shuffling books to buy some time but we will reach the $28.5 trillion limit in the next few weeks.

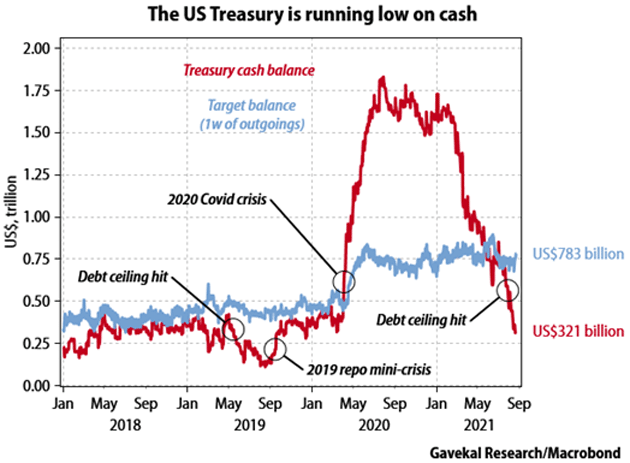

Unlike the Federal Reserve, Treasury can’t create money. It manages the government’s cash flow by issuing new debt as needed to pay for the spending Congress approves. It has discretion on when to borrow, and in what amounts, so “cash on hand” can vary a lot. Treasury built up a huge cash balance last year and has been drawing it down in 2021, as this Gavekal chart shows.

Source: Gavekal Research

The blue line is Treasury’s “target balance” needed to cover the spending it knows will occur. Notice that the target balance increased rather dramatically at the beginning of the COVID crisis and it has not changed. The actual balance (red line) plunged this year and is now almost $500 billion below the target, and headed lower still.

The “easy” solution is for Congress to raise the debt ceiling, which obviously doesn’t restrain actual spending, and may actually increase spending by letting them postpone more effective reforms. But, as with everything else these days, that collides with other issues and becomes a political fight.

Congress is presently considering two infrastructure bills, the smaller of which has modest Republican support and is actually what we mostly think of as infrastructure, plus a much larger “human infrastructure” plan the Democrats will try to pass on their own. It includes universal preschool, free community college, and subsidized long-term healthcare as well as a host of other government benefits.

It is not clear the second bill can pass, as some moderate Democrats are not fully aboard. They could, and I suspect will, attach a debt ceiling increase to that bill. But regardless, they have to somehow modify the debt ceiling soon. If they don’t, some government spending will have to stop and Treasury debt holders may miss interest payments—the kind of thing that would constitute “default” for a private borrower.

The chances of this actually happening are small, but very real. Having been through this what seems like a dozen times, there will be lots of drama and then the debt ceiling will be increased.

All this has market impact even if ultimately resolved. Government spending and borrowing is critical to bond market liquidity. When this last happened in 2019, the related liquidity crisis forced the Fed to end its attempt to normalize policy. The FOMC decided in an October 4, 2019, secret meeting, unrevealed until a week later, to permanently add reserves to the system.

As I said at the time, “We have reached a point where the Fed believes it must have nuclear weapons just to swat flies.” A few months later COVID came along and the Fed enthusiastically fired those nukes. That brings us to the next problem.

This week is the Fed’s Jackson Hole retreat—again virtual this year, but still an important policy decision point. Powell’s Friday morning speech was basically a nonevent. He did signal the initial taper could begin this year if all goes well. The speech was uber-dovish overall. Is the Fed really going to take its foot off the gas when Congress may ensure Fed support is needed more than ever? Hard to believe.

A further complication, as I discussed recently in Policy Errors Have Consequences, is the Fed’s own leadership is uncertain. Powell’s term as chair expires soon. President Biden still hasn’t announced whether he will renominate Powell or appoint someone else, although, as Peter Boockvar said, this speech did sound like someone campaigning to retain his job.

Treasury Secretary (and former Fed chair) Janet Yellen wants Powell to stay. This week we learned that much of the White House staff also wants Powell reappointed. While progressive Democrats wanted Biden to appoint Lael Brainard or another uber-dove, Powell increasingly seems like the likely choice.

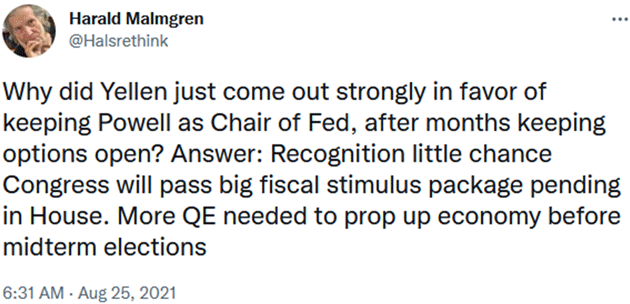

Why suddenly shift back to Powell? The highly connected Harald Malmgren has a theory, stated succinctly in a recent tweet.

Source: Twitter

Read that a few times to let the implications sink in. Then remember this year’s recovery depended heavily on massive fiscal spending—stimulus payments, unemployment benefits, etc. The bipartisan infrastructure bills, while massive, will be spread over years and have less immediate effect. And if the White House now believes the second infrastructure bill’s passage is in jeopardy, then it is certainly worried about next year’s economic prospects.

In that case, they need a credible dove in charge at the Fed. Powell fits that bill, with the understanding he is to keep the economy moving even if Congress is paralyzed. How would he do that? Beats me. Monetary stimulus doesn’t have the kind of direct impact fiscal stimulus does. Powell himself (and before him Greenspan, Bernanke, and even Yellen to some degree) has been saying so for years. That raises the possibility of not just continued or additional QE, but other as-yet-untried stimulus tools.

This would mean we are between a rock and a hard place. Passage of the two infrastructure bills would push federal debt even higher than the already-unsustainable level. But if not passing those bills will make the Fed go nuclear on steroids (sorry, I lack suitable metaphors to describe all this), an outcome I predicted we would see a few years down the road, then it just means the monetization process begins earlier.

Stimulus, Inflation, and Monetization

Although it is not portrayed this way in the headlines, Nancy Pelosi actually did compromise. The so-called “Unbreakable Nine” (which is now theoretically 10) simply agreed to allow a discussion about the human infrastructure bill in return for a “date certain” vote on the bipartisan infrastructure bill. Which is basically exactly what happened in the Senate. Now here’s where it gets tricky.

First, the current cost of the human infrastructure bill is $3.5 trillion. Kind of, sort of. Rather than the normal 10-year projections, they are projecting some of the spending for five years since it theoretically could expire. If you project those same programs out over 10 years, the bill’s cost grows to well over $5 trillion. As Milton Friedman so wittily observed, “There is nothing so permanent as a temporary government program.”

Senator Kyrsten Sinema (D-Arizona) says she won’t vote for a $3.5 trillion bill. Senator Joe Manchin (D-West Virginia) has said the same. My sources tell me the tax increases required to pay for such a bill are the key sticking points. What we don’t know is how much of a tax increase the key players will accept. Is it a 3–4% increase in corporate taxes? A 5% increase in capital gains? Higher capital gains rates for those making over $400,000? We simply don’t know. But my educated suspicion is the tax increases will dictate the ultimate size and content of the bill.

Getting the votes won’t be easy. The House progressives want a guarantee on the human infrastructure bill before they support the bipartisan bill, and it doesn’t have enough Republican support to pass without them. Nor can either bill pass without the moderate House Democrats, who are seeking re-election in Republican-leaning districts.

There is literally no telling what will happen in the next month. I see a reasonable chance both bills pass, with the “human infrastructure” bill significantly reduced, but also a nontrivial chance neither passes. Both sides have begun digging in their heels.

The immediate consequence is a little clearer. I think the Fed will wait until Congress somehow resolves these spending and debt ceiling issues before it makes any taper decisions, even though Powell says they may start tapering this year. The White House may be waiting as well before announcing Powell’s reappointment, even though he seems to have the necessary support.

All this means a month or two of uncertainty and guesswork, potentially sparking some market fireworks. And next year? Choose your poison. None of the likely outcomes are good for the economy. Though, oddly, more QE might boost asset prices.

But in one asset class, we have another problem brewing.

One of the pandemic’s more surprising effects has been a boom in housing prices and home construction. It’s partly logical; in an era where we spend more time at home, cities have less allure and people want space. Some urban residents are moving to suburbs and rural areas, driving up prices. But that’s not all.

For one, we have a long-term trend in effect. The Millennial generation is forming households and needs starter homes. This has been the case for some time, as my friend Barry Habib has been saying (see Tiny Housing Bubbles) and will go on several more years.

Add to that the pandemic stimuli. The Fed’s mortgage bond purchases have essentially capped mortgage rates at a historically low level. But probably more important, cheap borrowing and low yields elsewhere incentivize investors to buy/build homes for rental, generating higher yields than they can get from other fixed income instruments. This is just another form of private credit, and with a little leverage can produce high single-digit yields, for which there is clearly high demand.

And on top of that, the various forbearance programs have kept homes that would otherwise be for sale (voluntarily or via foreclosure) off the market. This reduced supply helps boost prices. The effect has been significant... and it’s about to end.

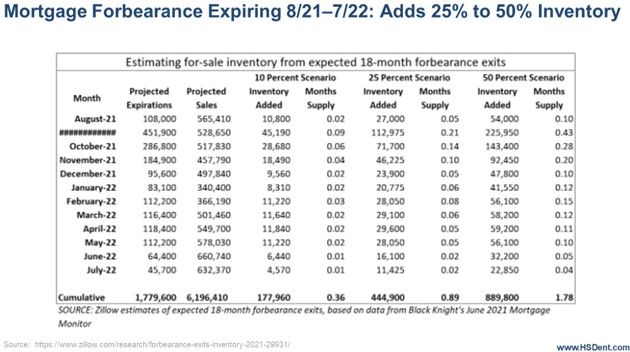

My good friend (and fellow Puerto Rico resident) Harry Dent pointed out last week that almost 1.8 million homes are now in forbearance. These owners will have to resume making payments soon. Some will be able to do so, others won’t. What next? Here’s Harry.

Zillow estimates that 25% of these forbearances will end up on the market, as the owners cannot sustain their mortgages when they are forced to pay them again, but they allow that number could be as high as 50%.

In my scenario, the number starts around 25%, adding to recession pressures that then rapidly turn that number to 50% and ultimately to more like 100% before the recession bottoms by late 2023 or so. [JM: Clearly Harry is more bearish on the economy that I am, but he does have a point.]

…The point is this: Home prices are about to peak, as sales have fallen 23% already since January due to rising unaffordability. Home prices will start to fall with rising inventory, which mostly will hit by the end of November. Falling home prices and sales guarantee we’ll get a recession, as housing has been the strongest recovery sector as a result of extremely low mortgage rates from the unprecedented stimulus that has gone on for 13 years.

Here’s the chart from Zillow via Harry:

That’s scary enough, but it’s not all. Many homeowners who haven’t sold, and have no desire to, have used this time to refinance and in some cases pull cash equity out of their homes. Similarly, homebuilders and contractors have added debt to buy properties, materials, and equipment. All this added leverage could become problematic in a recession/falling home price environment. And we know how debt problems cascade through the economy.

Now, recognize this problem could blow up just as the Fed is trying to either normalize or get more aggressive, and Congress is unable to agree on any kind of helpful response. It’s a bit like living on a tropical island and seeing on TV that three different hurricanes are all headed your way. I can assure you, it won’t be a good feeling. It might make Shane and me get on an airplane and show up on your doorstep.

Those of us of a certain age remember the late-night infomercials by the legendary Ron Popeil, who passed away last month. His classic line was, “But wait, there’s more!” As if all of the above weren’t concerning enough, there’s more.

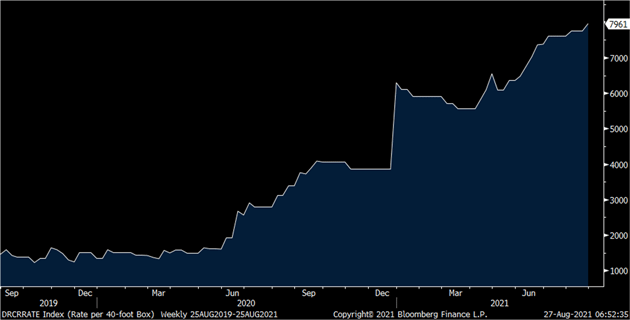

- As of Friday morning, five out of five regional Fed presidents have come out in favor of tapering earlier than waiting till next year. Most indicated they are worried about inflation.

- And inflation is a problem. Taiwan Semiconductor just raised their prices 20%. Hong Kong/LA container prices are almost doubled since the beginning of the year, and 4X since last summer.

Source: Peter Boockvar

Inflation (CPI) is running well north of 5% and looks to be picking up steam. The longer the Fed goes without tapering and raising rates, the longer “transitory” inflation will last. I do not believe this Fed will make the mistake that Arthur Burns did in the 1970s by doing nothing and then allowing inflation to get to 10% plus.

- Thus, Powell will be under pressure to begin tapering sooner than the market thinks. A slowing economy and rising inflation? Can you say stagflation boys and girls? Do you want to run for reelection in 2022 on that premise? How do you think the market will react? Me too.

- Long COVID, a very debilitating disease that now affects more than 15 million Americans, could see as many as 1 ½ million Americans on disability which is almost 1% of the work force. GDP is simply the number of workers times productivity. If you reduce the number of workers without raising productivity, GDP will drop.

- Consumer spending came in weak Friday morning. Part of it is COVID and part of it is stimulus is beginning to go away.

I wrote pre-COVID that I thought the 2020s would see much closer to 1% real GDP annual growth than the 2% we have been experiencing for two decades. Debt pressure is inexorable. Then COVID came along and simply blew out all the prior debt projections. I’ve said we were looking at $50 trillion by 2030. I now think it will be at least another $5 trillion more and maybe double that. I don’t believe the bond market can handle that by itself.

The same logic that made me project early in the last decade that the Bank of Japan would monetize Japanese debt at levels nobody then thought possible makes me think the Federal Reserve will do the same thing. I firmly believe a $25 trillion+ Federal Reserve balance sheet is likely by the end of this decade.

That level of balance sheet debt, which will be duplicated percentagewise in Europe, means the developed world, including the US, will be lucky to grow 1% by the end of the decade.

That’s not a disaster, as both Europe and Japan are wonderful places to live. But it means traditional investment portfolios, especially passive index funds and bond funds, are not going to perform anywhere nearly as well as they have in the past. You are going to need to develop a completely different approach to investing if you want to see your portfolio grow on average in the high single digits.

On the investment side of my business (separate from Mauldin Economics) we look for strategies that will still work in this low-growth world. If you want to discuss some of these opportunities just click here. I guarantee you it’s worth a phone call to learn what’s in the Mauldin Kitchen. You don’t have to take a full menu—you might find some ingredients which will please your investing palate. (In this regard, I am chief economist and an investment advisor representative of CMG Wealth.)

Normalization, Travel, and Booster Shots

I’m not certain what “future normal” looks like, but it is not going to look like 2019. I think my life of 200–250,000 airline miles a year is over. I might not see 100,000 again. Many of those miles were for international speeches, and it will be years before they return, if ever.

As Mike Roizen and I keep saying to each other, this is just a damn tricksy virus. He was telling me earlier this summer the boosters would be after six months. And now it gets announced this week. Hopefully I get mine in October. COVID may be around for more than a few years, with booster shots somewhat like the annual flu shot. We’ll learn to live with the reality and get on with our lives. I used to travel with Theraflu packets in my briefcase as a precaution. Still do. I am not certain what I will carry in the future, but I do plan to get on planes.

I plan to travel to meet clients and prospects at least once a month and I always enjoy New York. I will be in Dallas prior to Thanksgiving and south of Fort Worth at Lake Granbury for Thanksgiving. It will be good to see family and friends.

This month marks my 22nd year of writing this letter. Many of you have been with me since the beginning. Some are brand-new. But I appreciate the attention each and every one of you give me. Time is the greatest gift anyone can give in a world of constant demand for our time. Thank you! Have a great week!

Your curious to see what our politicians will do analyst,

|

|

John Mauldin |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.