VANCOUVER, BC, Sept. 5, 2023 - New Pacific Metals Corp. (TSX: NUAG) (NYSE American: NEWP) ("New Pacific" or "the Company") is pleased to report the inaugural independent National Instrument 43‐101 – Standards of Disclosure for Mineral Projects ("NI 43-101") mineral resource estimate (the "MRE") for its 98%-controlled Carangas silver-gold polymetallic deposit (the "Carangas Project") in Bolivia. The MRE was completed by RPMGlobal (Canada) Ltd. ("RPM"). The effective date of the MRE is August 25, 2023. The Company will host a webcast (the "Webcast") to discuss the MRE on September 6, 2023 at 11:00 a.m. (Eastern Time) / 8:00 a.m. (Pacific Time). Further information pertaining to the webcast can be found at the bottom of this news release.

HIGHLIGHTS

- Total indicated mineral resources of 214.9 million tonnes ("Mt") containing 205.3 million ounces ("Mozs") of silver ("Ag"), 1,588.2 thousand ounces ("Kozs") of gold ("Au"), 1,444.9 million pounds ("Mlbs") of lead ("Pb"), 2,653.7 Mlbs of zinc ("Zn"), and 112.6 Mlbs of copper ("Cu"); or collectively 559.8 Mozs silver equivalent ("AgEq").

- Total inferred mineral resources of 45.0 Mt containing 47.7 Mozs of silver, 217.7 Kozs of gold, 297.9 Mlbs of lead, 533.7 Mlbs of zinc, and 16.8 Mlbs of copper; or collectively 109.8 Mozs AgEq.

- Carangas is a globally significant Ag-Au polymetallic discovery.

- Mineralization starts at or near surface, potentially allowing for open-pit mining with an average stripping ratio for the conceptual pit of approximately 1.8:1 (tonnes of waste : tonnes of mineral resource).

- Below the pit constraint, substantial gold-dominant mineralization, similar in size and grade to the reported gold domain (as defined below), has the potential for conversion to underground mineable resources pending further evaluation for reasonable prospects of eventual economic extraction.

- Favorable initial metallurgical test work indicates laboratory‐based recoveries of up to 90% for silver and 98% for gold based on a combination of flotation and cyanide leaching.

OVERVIEW

The Carangas Project is hosted within a volcanic caldera system. This system is centered around a Tertiary-aged diatreme. The mineralization process was influenced by the heat gradient from rhyolitic intrusions within the diatreme. This process resulted in the formation of three distinct zones: an upper zone rich in silver, a middle zone dominated by zinc and lead, and a lower zone with a higher concentration of gold.

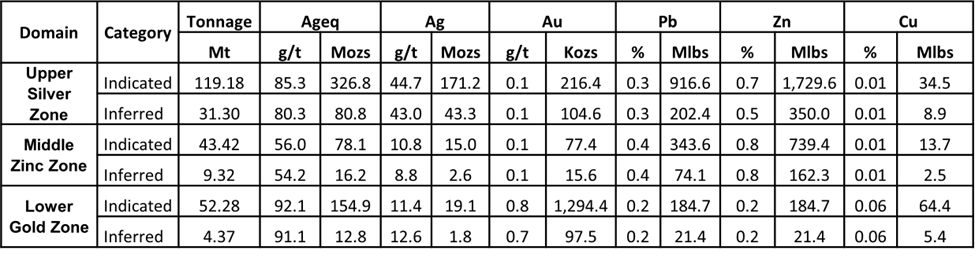

For the MRE, the deposit was divided into three domains: one focused on silver (Upper Silver Zone), one on zinc and lead (Middle Zinc Zone), and the last one on gold (Lower Gold Zone). The MRE is reported inside the Carangas Project's property boundary and constrained by potential open pit mining scenarios. The results are detailed in Table 1, considering a cut-off grade of 40 grams per tonne ("g/t") of AgEq.

Table 1: Carangas Project ‐ Conceptual Pit1 Constrained Mineral Resource as of 25 August 2023

Notes:

- CIM Definition Standards (2014) were used for reporting the mineral resources.

- The qualified person (as defined in NI 43-101) for the purposes of the MRE is Anderson Candido, FAusIMM,

Principal Geologist with RPM (the "QP"). - Mineral resources are constrained by an optimized pit shell at a metal price of US$23.00/ounce ("oz")

Ag, US$1,900/oz Au, US$0.95/pound ("lb") Pb, US$1.25/lb Zn, US$4.00/lb Cu, recovery of 90% Ag,

98% Au, 83% Pb, 58% Zn and Cut-off grade of 40 g/t AgEq. - Mineral resources are reported inside the property boundary.

- Average stripping ratio for the conceptual pit is ~1.8:1. The conceptual pit has a dimeter of approximately

1.4 kilometers and extends to a maximum depth of approximately 600 meters from the Central Valley. - Drilling results up to June 1, 2023.

- The numbers may not compute exactly due to rounding.

- Mineral resources are reported on a dry in-situ basis.

- Mineral resources are not Mineral Reserves and do not have demonstrated economic viability.

POTENTIAL FOR FURTHER EXPANSION

Below the conceptual pit constraint exists gold-dominated mineralized material of similar size and grade to the reported mineral resources of the Lower Gold Zone within the conceptual pit. This mineralized material has the potential to be converted to mineral resources amendable to underground mining pending further evaluation for reasonable prospects of eventual economic extraction. Gold mineralization remains open to the north and northeast at depth.

The Company also completed a 3D Bipole-Dipole IP-MT survey in an area of approximately 29 square kilometers over the entire Carangas caldera basin in early 2023. This survey demonstrated that the known gold mineralization system overlays a strong chargeability anomaly in the Central Valley area. In addition, multiple strong IP chargeability anomalies were identified beyond the drilled areas. The Company believes that these anomalies may host mineralization similar to what has been drilled thus far, underscoring the potential for mineral resource growth through additional drilling campaigns.

RESOURCE ESTIMATION DETAILS

The MRE is based on a geological model that incorporated assay results received by New Pacific for the Carangas Project up to June 1, 2023. This included assay results from all 189 drill holes completed from June 2021 to April 2023. The MRE is reported inside the Carangas Project's property boundary and constrained by potential open pit mining scenarios and uses a cut-off grade of 40 grams per tonne of AgEq. A mineralization wireframe was constructed by New Pacific and validated by RPM as a reproducibility/materiality protocol. The domain was reviewed by the QP and no major biases were identified in the model. The model was used for sample constraint and block model construction.

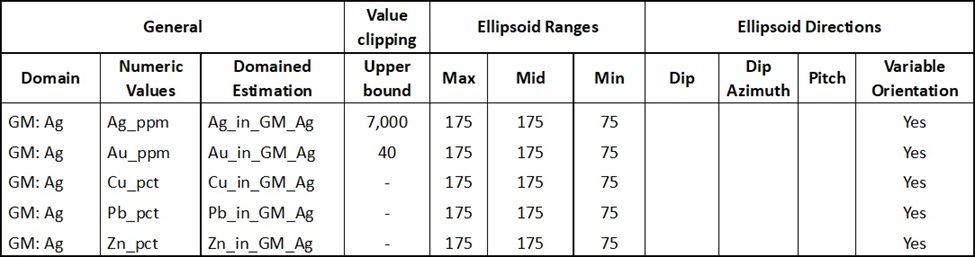

RPM completed an Inverse Distance Squared (ID2) estimate on these domains. Prior to estimation, drill hole data were submitted into exploratory data analysis to domain verification and then composited to 1.5 m long intervals and samples were capped for all variables within each domain where required. Silver values were capped at 7,000 g/t Ag, and gold values were capped at 40 g/t Au.

The parent block size was 5m E x 5m N x 5m RL with no sub‐blocking employed. A total of 14,953,680 blocks were generated to cover the entire mineralized area. The model origin is 538.490 E, 7.904.850 N, 4.100 RL, and there is no rotation in the model.

As mineralization is hosted in various types of volcanic rocks, the densities of mineralized materials are estimated using the ID2 method. The number of samples used to estimate density varies from 1 to 4 samples. Density values vary between 1.2 to 3.48 in the block model.

Mineral resources grade was completed using the ID2 method for each variable in each domain. As an example, Table 2 shows the search parameters and number of samples used for grades in the Upper Silver Zone.

No records of historical mining are available. Compared to the size of the mineralization system, the estimated mined tonnage is minimal; hence no depletion has been applied in the MRE.

Table 2: Minimum and maximum sample parameters

Mineral resource classification was completed using an assessment of geological and mineralization continuity, data quality and data density. Average distance of samples was used to classify the block with an average distance of 70m used as threshold for indicated / inferred definition. The block model was assigned as indicated and inferred mineral resource categories.

TECHNICAL REPORT

Further details supporting the geological model, estimation procedure and metallurgical testwork will be available in a NI 43‐101 technical report in respect of the Carangas Project (the "Technical Report"). The Technical Report will be posted under the Company's SEDAR+ profile at www.sedarplus.ca within 45 days from the date of this news release.

QUALITY ASSURANCE, QUALITY CONTROL AND DATA VERIFICATION

The QP determined sample preparation, analytical, and security protocols employed by New Pacific to be acceptable. The QP reviewed the quality assurance and quality control ("QA/QC") procedures used by New Pacific including certified reference materials, blank, duplicate, and umpire data, and identified no major bias. The QP determined that the assay database was adequate for mineral resource estimation.

The QP determined that the use of a reasonable number of different control samples is robust and returns a good variety of verification throughout the whole process, and the umpire lab check analysis gives a good level of reproducibility of the database.

The QP found that the insertion ratio of control samples is 24%, which is higher than the industry benchmark (15-20%).

The QP is of the opinion that the results are acceptable and accomplished within industry standards and recommended that New Pacific maintain a continuous QA/QC program for new exploration drill campaign to maintain the database quality.

QUALIFIED PERSONS

The MRE and data verification was completed by RPM. Anderson Candido, FAusIMM., Principal Geologist with RPM, is the QP for the purposes of the MRE. The scientific and technical information contained in this news release has been reviewed and approved by the QP. The QP has verified the information disclosed herein using standard verification processes, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties or any limitations on the verification process that could be expected to affect the reliability or confidence in the information discussed herein.

WEBCAST DETAILS

The Company will host the Webcast 11:00 a.m. (Eastern Time) / 8:00 a.m. (Pacific Time) on September 6, 2023 to provide further information on the MRE. Participants are advised to dial in five minutes prior to the scheduled start time of the Webcast. A presentation will be made available on the Company's website prior to the Webcast. Webcast details:

Date: Wednesday, September 6, 2023 at 11:00 a.m. (Eastern Time) / 8:00 a.m. (Pacific Time)

Toll‐free Canada/USA: 1‐800‐319‐4610

Toronto: 1‐416‐915‐3239

International: 1‐604‐638‐5340

Webcast: https://www.gowebcasting.com/12691

ABOUT NEW PACIFIC

New Pacific is a Canadian exploration and development company with precious metal projects in Bolivia, including the Company's flagship project, the Silver Sand Silver Project, the Company's recently discovered Carangas Silver-Gold Project and the Company's third project, the Silverstrike Silver-Gold Project.

For further information, please contact:

Andrew Williams, President

New Pacific Metals Corp.

Phone: (604) 633-1368 Ext. 236

1750-1066 Hastings Street, Vancouver, BC V6E 3X1, Canada

U.S. & Canada toll-free: 1-877-631-0593

E-mail: invest@newpacificmetals.com

For additional information and to receive company news by e-mail, please register using New Pacific's website at www.newpacificmetals.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain of the statements and information in this news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects", "is expected", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategies", "targets", "goals", "forecasts", "objectives", "budgets", "schedules", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Such statements include, but are not limited to, statements regarding: anticipated exploration, drilling, development, construction, and other activities or achievements of the Company; inferred, indicated or measured mineral resources or mineral reserves on the Company's projects; the Webcast; and the completion and timing for the filing of the Technical Report.

Estimations of mineral resources are inherently forward-looking. Risks relating to legal, political, environmental, or other factors that could materially affect the potential development of the mineral resources or mineral reserves include political and economic risks in Bolivia, the regulatory environment in Bolivia, community relations and social licence to operate, acquisition and maintenance of permits and Government approvals, operations and explorations subject to Governmental regulations, impact of environmental laws and regulations, environmental protection, title to mineral properties, outcome of future litgation or regulatory actions, and other factors described under the heading "Risk Factors" in the Company's annual information form for the year ended June 30, 2022 ("AIF"), its management discussion and analysis for the year ended June 30, 2023 ("MD&A") and its other public filings which are incorporated by reference hereto. This list is not exhaustive of the factors that may affect the mineral resources or mineral reserves.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: global economic and social impact of COVID-19; fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, general economic conditions, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management, uncertainties relating to the availability and costs of financing needed in the future, environmental risks, operations and political conditions, the regulatory environment in Bolivia and Canada, risks associated with community relations and corporate social responsibility, and other factors described under the heading "Risk Factors" in the Company's AIF, MD&A and its other public filings. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements or information.

The forward-looking statements are necessarily based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this news release that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates, assumptions, beliefs, expectations and options include, but are not limited to, those related to the Company's ability to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development and exploration activities; the timing, extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company's ability to meet or achieve estimates, projections and forecasts; the stabilization of the political climate in Bolivia; the Company's ability to obtain and maintain social license at its mineral properties; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits, including the ratification and approval of the Mining Production Contract with the Corporacion Minera de Bolivia ("COMIBOL") by the Plurinational Legislative Assembly of Bolivia; the ability of the Company's Bolivian partner to convert the exploration licenses at the Carangas Project to administrative mining contracts; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

Although the forward-looking statements contained in this news release are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. All forward-looking statements in this news release are qualified by these cautionary statements. Accordingly, readers should not place undue reliance on such statements. Other than specifically required by applicable laws, the Company is under no obligation and expressly disclaims any such obligation to update or alter the forward-looking statements whether as a result of new information, future events or otherwise except as may be required by law. These forward-looking statements are made as of the date of this news release.

CAUTIONARY NOTE TO US INVESTORS

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada which differ from the requirements of United States securities laws. All mining terms used herein but not otherwise defined have the meanings set forth in NI 43-101. Unless otherwise indicated, the technical and scientific disclosure herein has been prepared in accordance with NI 43-101, which differs significantly from the requirements adopted by the United States Securities and Exchange Commission.

Accordingly, information contained in this news release containing descriptions of the Company's mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

Additional information relating to the Company, including the Company's annual information form, can be obtained under the Company's profile on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov, and on the Company's website at www.newpacificmetals.com.

SOURCE New Pacific Metals Corp.