- Four Horsemen

- Pleasing Markets

- Where the Future Is

- Back in New York, Anniversaries, and Father’s Day

“At the end of the day” is a trite figure of speech, but it sometimes fits. It signals you’ve used all your time, and now you’ll wrap up and begin thinking about tomorrow.

I like to say designing the Strategic Investment Conference agenda is my personal art form. There’s more to it than just picking speakers and topics. The order matters, too, as does each session’s combination of viewpoints—especially pairing the speakers in panels and letting them test their views against one another.

I try to build toward a finish so, at the end of the (final) day, attendees reach a satisfying conclusion. It may not be the conclusion they wanted, but it should at least be coherent and help them decide what to do next. That’s a bit different in an online format, but it turned out even better in some ways.

This year’s SIC closing day was a blockbuster. In this letter, I’ll wrap up my conference reviews by wrapping that day for you.

In recent years, I’ve asked Mark Yusko to open the final day. That’s partly because he is really good at waking a crowd which, at our live events, was probably up late the night before. His rapid-fire slide presentations are legendary. Any one of his points could take hours to unpack, and he always has dozens.

Another reason is that, in the range of topics Mark covers, he brings back to mind many of the points previous speakers made. This helps the audience remember what they heard in the last few days, often with a new twist. The twists are important, too.

Summarizing everything Mark said would take a dozen letters. You really had to be there. You can’t characterize him as either bullish or bearish; his outlook varies by asset class and region.

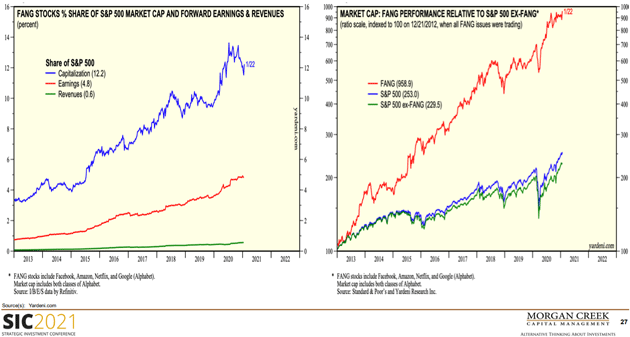

Mark isn’t optimistic for 2020’s new crop of day traders or the (somewhat) less enthusiastic investors who have piled into the “FANG” stocks. He noted those four (Facebook, Amazon, Netflix and Google/Alphabet) represent less than 1% of S&P 500 revenues but account for 12% of the index… and 4X the rest of the index’s gain since 2012.

Source: Mark Yusko

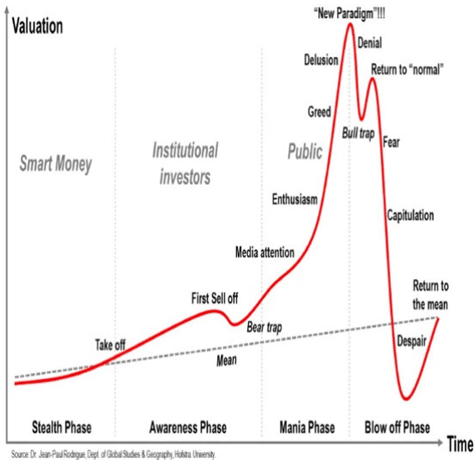

Mark believes this results from central bank stimulus, not just last year but dating back to the financial crisis. Valuation bubbles historically don’t end well, as he showed in this all-too-familiar illustration.

Source: Mark Yusko

The sad part is the kind of “mean” return shown in that dotted line is actually pretty good. It would suffice for most investors who have reasonable goals. But the allure of “more” entices them to expect too much and over time, they don’t even reach the average.

From there, Mark went on to talk about energy, gold, China, Bitcoin, and more. While he thinks the economy could rally a bit more, that’s not the same as a “return to normal.” COVID-19 and its fallout will be headwinds for years.

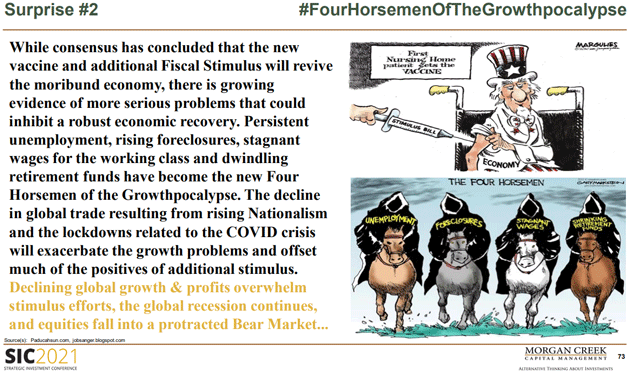

Source: Mark Yusko

If you can’t see the cartoon above, the “Four Horsemen of the Growthpocalypse” are unemployment, foreclosures, stagnant wages, and shrinking retirement funds. To which I would add—millions of Americans, approximately 50%, have no retirement funds at all except for Social Security so there’s nothing to shrink. Another 15 to 20% have less than $100,000.

That’s not optimistic, but Mark didn’t leave us with gloom and doom. He sees a lot of opportunity in Bitcoin and other cryptocurrency assets. But more interesting, he has a very different view of the current boom in Special Purpose Acquisition Companies, or SPACs. Many analysts see them as borderline shady “blank check” entities with no history or assets. But Mark thinks they are proving to be a useful end-run around an initial public offering process that has become slow, expensive, and unfair to both investors and company founders. It’s why so many “unicorn” startups are remaining private far longer, and some may never go public. The result is less opportunity for small investors.

I have seen the SPAC space from both sides. I have several friends who have created what had become successful companies. I will soon be involved with a private company that will be using a SPAC to go public in a much more democratic and far less expensive way than an IPO.

While it should be intuitively obvious, not all IPOs are winners. Perhaps the most egregious were some of the late 1990s dot-com companies (Pets.com?) But I imagine more than a few of us wish we could have participated in the Facebook or Netflix IPOs. I suspect at the end of the day, SPACs will likely have a similar track record.

Mark Yusko was followed by Bill White and Howard Marks, both of whose presentations I discussed in recent letters. But I haven’t told you about Richard Fisher, former Dallas Fed president. In that role from 2005–2015, he sat in some interesting meetings during the crisis years. I’m sure there’s much he still can’t reveal, but he gave us a few hints. I should point out that in his introduction, I said that he was and still is my favorite central banker.

More important, though, was the insight Fisher gave us into the current Fed’s thinking. It appears to have changed radically just in the few years since he left. Now, I would argue radical change is just what the Fed needs, but it must be the right kind of change. Instead, it has become even more politicized, partly because of Trump and partly because the pandemic created an entirely new kind of crisis.

There are calls from many corners that the Federal Reserve should be turned into some type of environmentalist institution. Shouldn’t the Fed use its balance sheet for the Green New Deal and climate change? Still others argue that the Fed should be thinking about social justice.

The Fed was originally charged with preventing bank crises and controlling inflation. In 1977, Congress—in what I think shifted responsibility from where it should be—gave the Federal Reserve an explicit mandate for full employment. That should be a congressional mandate, but now Congress can point its collective fingers at the Fed.

Like it or not, the Fed is now back in cahoots with the Treasury Department, to the point a former Fed chair now heads Treasury, and both Fed and Treasury work closely with Congress to “coordinate” policy that pleases the markets. Fisher thinks Jerome Powell is making the best of a bad situation, but he isn’t sure how long Powell will be there. His term expires later this year, and it looks like Lael Brainard may be the next chair. That might lead to some other departures, so a year from now we could have a significantly different Fed. I am not sure the markets are ready for that.

I am very concerned Congress will want to use the Federal Reserve balance sheet to fund a whole slew of new programs, which might sound nice in theory, but it will have the high probability of distorting the actual working of the economy.

In a conference full of highlights, our final panel was the highest. My good friend David Bahnsen interviewed Richard Fisher, Bill White, Felix Zulauf, and yours truly. In almost 90 minutes, we went around the world several times.

David kindly gave me the first pitch, asking me to sum up what we’d heard.

It's probably going to come as no surprise that I'm going to kind of pick a middle muddle through path. I really think that Bill White nailed it when he said it's a process. We have a short-term process where we're clearly going to have some inflation. In my conversations with Bill, short-term to him is six months, a year, 18 months. It's not two or three months.

Then, I think the forces that Lacy and others have been talking about, that Felix was bringing up, begin to come back in. Then, we have to see what happens. I think the real danger in all of this is the Federal Reserve does what Ben Hunt calls, "loses the narrative." If they lose the confidence and trust of the markets, it's game over. It would make this last week's volatility look like a picnic. Going back to what Richard said, I think they need to start giving us some language that makes us realize that the captain is in the pilot chair. Daddy's home and all is going to be right with the world.

Right now, they say we don't need a pilot. It is on auto pilot. We're not going to pay any attention to this turbulence. Don't mind the crowds. Nothing is happening here. That's not, I don't think, the proper message. I think the message [they should be saying] is we're here. We're paying attention. Telegraphing 30 months out [is fraught with danger]. They don't know what's going to happen in 30 months, let alone one or two quarters. None of us do.

If they have to pull that back in the fourth quarter because we don't know what's going to happen, then there is a real potential they lose some of their credibility. [Again, what Ben Hunt calls losing the narrative.] I think this forward guidance and trying to telegraph stuff is precisely the wrong thing, especially 30 months out… I agree with Richard or Bill. I think the business of setting the price for the most important thing in the world. Howard Marks said this actually earlier. Setting the price for money is not something that the federal reserve, central bank, should be in the process of doing.

[This has always made me uncomfortable. My personal feeling is that if we allow the markets to set the price for short-term rates, they would be far from where they are today. And if they work? That would mean that the market is absorbing the impact.]

Since I mentioned forward guidance, and Richard Fisher was actually one of the guides, he jumped in to expand on my point.

Looking at so-called forward guidance in terms of the dot plot and what it tells you and what they issue, I wouldn't pay a lot of attention to it, as John just mentioned, long term. Why? You can never forecast very long term, except for you end up at 2% inflation because that's your target and you have to plot it as such.

Secondly, you have to remember, the people that are sitting around that table won't be there long term. Presidents turn over. We have two big ones next year, by the way. Then you also have the governor's turnover and the chair’s turn over. And then you have the rotation of the votes amongst the banks and how the New York Fed will turn over.

Don't put too much emphasis on this forward forecasting exercise known as guidance. It's a very imperfect tool, and I actually think Powell does the right thing at his press conferences to downplay it. It's how he thinks at the moment, and we're basically guided by the nearest term.

They have gone out and said, though, they're not going to change for a very long time. I don't think the market believes that, and I think that will change over the year or over the next few years.

Felix Zulauf noted China’s central bank is bucking the trend, tightening policy while the others stay loose.

I think at the present time, the one central bank that is operating very differently is China. China seems to run to a different drummer. China is tightening monetary policy. They are also tightening fiscal policy. They are creating decent positive real rates of return in the interest rate markets. In the fixed income markets. Because they understand that if they want to perform well long term, you need high savings rates. You need interest rates that attract money… I think they are actually maneuvering in a much more capitalist way when it comes to economic policy.

Whereas the Western governments and central banks together operate in a much more socialist fashion by bailing out everybody and helping the system and taking the high price of leveraging up the system, which is becoming a danger over the long term.

[JM here: What kind of crazy upside-down world do we live in where a Communist central bank is the most conservative—what Charles Gave would call the Wicksellian bank—and the theoretically “free market” central banks are driving real interest rates well below zero?]

Later, Bill White talked more about this danger and how the debt Western central banks have created and encouraged is going to spark a crisis. How do you prepare for that? How do we prepare the system for it? Here’s Bill.

As you both said, take out some insurance. When you've got some money, stick it in the bank. I think another one of these buffers. Assuming you're being realistic here—and I think I am being realistic, and agreeing with Felix in particular. A crisis is coming and in that crisis, there's going to be a lot of bankruptcies and insolvencies. What steps are we taking now to ensure that those debt problems that will be resolved get resolved in an orderly way, as opposed to a disorderly way?

We know that the courts are already creaking, even in the United States and the United Kingdom, with commercial stuff. The IMF, the BIS, the OECD, the Group of 30. They've all come up with big studies in recent years to show our bankruptcy proceedings, whether in the courts or out of the courts, are inadequate. If you look reality in the face, and this is all part of the resiliency stuff that everybody's talking about these days, another crisis is coming. The least we can do is to make ex-ante preparations so that we can deal with it in as good a fashion as we can. I don't think that's happening and that's unfortunate.

Bill was describing what may be part of the “Great Reset” I expect. Much of the world’s debt is going to get liquidated somehow. Bankruptcy is one method, and it could be a better one if we had a better-prepared court system.

David closed by asking each of us where, ten years from now, we will wish we had invested in the 2020s. Bill thought Europe, which he believes has been a laggard but is poised to catch up. Felix agreed Europe will outperform, but said he would go with China because it is at the forefront of new technologies.

Richard Fisher? Noting China’s repressive system in the end can’t compete with free markets, he said he would put his money in Texas, because “That’s where the future is.” [I have a paper in my reading queue that talks about the economic powerhouses of Dallas, Austin, Houston, and San Antonio. Richard may be on to something.]

As for me, you won’t be surprised…

My answer is I'm still long humanity. I want to be long, emerging technologies, especially biotechnology. If we're talking 10 years. I'm short governments. We've been talking about the problem with governments. I am long humanity. I think the coming technological revolutions and transformation are going to be astounding. There's going to be massive fortunes made and that's where I'm putting most of my money. It really is.

That’s what I’ve thought for a long time, and I’m not wavering.

Back in New York, Anniversaries, and Father’s Day

When I scheduled my trip to New York six weeks ago, I simply did not notice that it was Father’s Day. Too late to change, I made my way to the United Airlines boarding gate, feeling somewhat strange as I have flown on United maybe half a dozen times in my entire life. But it is the only nonstop to New York (actually Newark) where I can take the train and can be in Manhattan very quickly. As I walked on the plane, there was a lady buckling in a young girl in the seat next to me. I offered to change places with her, but she pointed out that her younger girl was sitting up with her.

The young lady promptly pulled out a large iPad and began to watch what is evidently a spin off TV series from a DreamWorks movie called How to Train Your Dragon. She sat very contentedly for four hours smiling and laughing, sometimes sharing a particularly poignant moment in the show with her sister sitting in front of her. I must confess it brought back memories of my own children when they were young and how much I miss my grandchildren.

Then I get to the hotel where my children, along with their children, had arranged a Zoom call for all of us to get together. Shane and her son joined in. Zoom isn’t quite the same as being there, but I am grateful for it.

Then it was nonstop meetings. Ian Bremmer graciously gave me 90 minutes for lunch, where we mostly talked about common business issues as opposed to geopolitics. Steve Blumenthal came in to talk with clients and then we had dinner with Rory Riggs about upcoming opportunities. A few biotech meetings (which were off the record) and then Tuesday night I met with David Bahnsen and René Aninao at Hunt and Fish. We all remarked that the last time I had been in New York was with the same two gentlemen last March when we left the next day just as the COVID crisis was hitting the city. The restaurant graciously gave us five hours at the corner booth to sit and randomly free-associate all sorts of ideas (some of which you may read here soon).

The next evening I was with Ben Hunt, Peter Boockvar, Constance Hunter, and Brent Donnelly, who gave me one of the first copies of his new, soon-to-be blockbuster book called, Alpha Trader, where I was surprised to see my name on the front cover with an endorsement. Again, the conversation was amazing and the conclusion was the same for every dinner and even the Father’s Day call. Zoom is useful, but it’s just not the same.

This Saturday, Shane will celebrate her (something annual) 39th birthday as well as we will celebrate our wedding anniversary. Only one day for me to remember, but it still requires two presents. Since we have moved to Puerto Rico, we get the same corner table literally on the beach early enough to watch the sunset. It is a glorious time of celebration. And with that, I will hit the send button. You have a great week and I hope you do something fun for July 4. And don’t forget to follow me on Twitter.

Your glad to be back and traveling analyst,

|

|

John Mauldin |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.