I’m entering my annual post-SIC decompression period. I say that only half-jokingly. The last two weeks were my version of a dive deep into the sea, where you see shocking things and endure crushing pressure. The weeks of preparation are fun, but the sheer volume of information creates its own kind of pressure. You don’t just shift back into normal life after that. Like diving into deep water, you have to come up and adjust slowly.

I must also say this 20th anniversary Strategic Investment Conference truly was the best yet, thanks to an amazing faculty and—equally important—the multitalented Mauldin Economics team that made it all happen. The logistics and technology to pull off an event like this don’t grow on trees. Many have been on the team for 10+ years and it shows in the execution.

I admit I am biased but I would put our conference up against any other, anywhere. Most conferences have a few headliners mixed with sponsors who pay to be on the stage. My main criteria for 20 years now has been to create an event I would want to attend and not miss a session. No one gets to pay to be on my (now virtual) stage.

In the next few letters, I’m going to give you a small sample of what we learned. I’ll highlight speakers and topics I think have broad interest. But really, the only way to get the wisdom you want is to have been there. Fortunately, you can still “be there.” Our Virtual Pass gives you full video, transcripts, slides, and even downloadable audio you can put on your own device. Click here to check it out.

Since we had a Fed meeting this week, today I’m going to share some analysis from three top experts we featured on SIC Day 1: Dave Rosenberg, Danielle DiMartino Booth, and Lacy Hunt. These sessions occurred on April 22 so they didn’t know what would happen this week. But as you’ll see, none of it surprised them.

Federal Reserve narratives are always shifting, but the last 6 months were especially jarring. As of December, we had inflation seemingly under control (though not yet at target) and 2024 was supposedly going to see several rate cuts (which was NOT my personal base case).

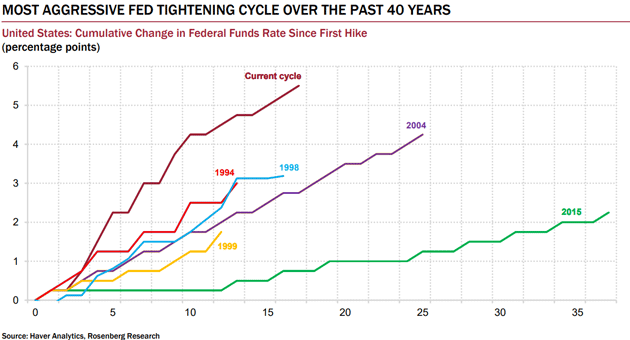

In short, the “soft landing” many thought impossible was at hand. We thought this because it was hard to fathom how such an aggressive tightening campaign could end in anything but recession. Here’s a chart Dave Rosenberg shared in his SIC presentation.

Source: Rosenberg Research

Responding to the post-COVID/Ukraine War inflation, the Fed raised rates both higher and faster than anything seen since the early 1980s. This is a well-tested central bank strategy. You stop inflation by suppressing demand, and you suppress demand by making credit more expensive. Painful but effective.

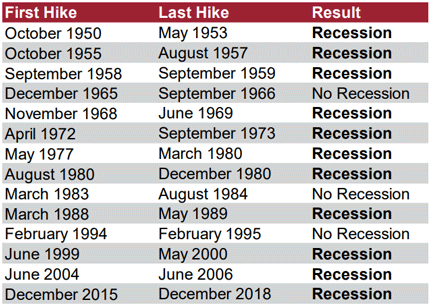

This doesn’t have to cause recession but usually does. Dave noted 11 of the 14 Fed hiking cycles since 1950 (excepting the current one) led to recessions.

Source: Rosenberg Research

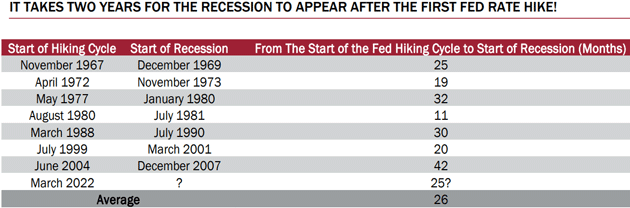

Seeing that pattern plus Powell’s clearly hawkish intent, recession seemed like a good bet. And that bet may yet pan out. Dave noted the last few recessions began an average of 26 months following the first rate hike (which would mean we are almost there) and sometimes longer.

Source: Rosenberg Research

Let’s think back to the 2004‒2007 episode. I happen to remember that period pretty well, and it had some similarities to today. Both stocks and housing looked pretty bullish right up to the cycle’s end. Unemployment was 5.6% when the Fed started hiking in 2004 and it kept falling almost 3 more years, bottoming at 4.4% in mid-2007.

At the time, I thought recession seemed highly likely, and said so repeatedly, but many people didn’t. They had plausible arguments, too. This is why today’s contradictory outlooks don’t surprise me. The picture is always confusing and inconsistent.

Every recession has its own unique triggers, which are often in plain sight, but people underestimate their importance. In 2007, it was pretty clear that mortgage risk was out of control. That’s not the problem now but we have others, one of which will eventually go critical. The question is when. Here’s Dave from the SIC transcript.

“Once again, and there's a wide range, it's not the first time that there's been a long lag. A lot of stuff got in the way that prevented the recession call, but it's been, in my opinion, delayed, not derailed. We had long lags in the late eighties, long lags in the late seventies, during the housing boom and bubble back when I was at Merrill back in ’07, over 40 months. But the average, and we look at the average because the average is the norm. The norm, which is normal, is that it's 26 months from the time the Fed starts to tighten to the start of the recession. The Fed started tightening when? In March of 2022. So it's actually shame on all of us who were there calling for recession as early as we did because the lags haven't kicked in yet. Call me up when the second- or third-quarter data comes in.

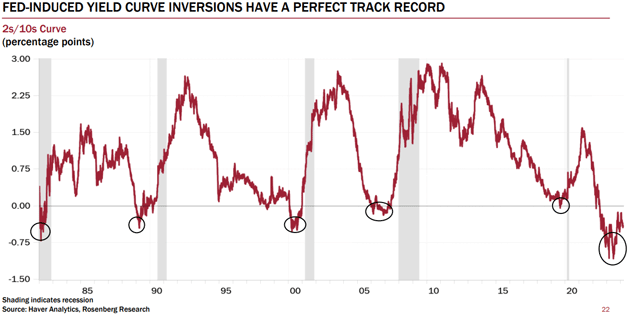

“But the lags are usually more than a couple of years, and I still think that the clock is ticking on this expansion. And I mentioned before about the yield curve, the Fed kept on tightening into the inverted yield curve, and the yield curve is just a price signal. It's just the bond market's way of crying uncle that the Fed has gone too far. There's nothing else magical about the yield curve any more than you would draw the chart of Dow Transports to Utilities, or anything else. It is a bellwether barometer and a leading indicator for recession, and I'm not going to throw it out the window like everybody else has.”

The inverted yield curve is still our best recession indicator, in my opinion, but it, too, is often early. Let’s look at it a little closer.

Rosie showed this yield curve chart at SIC. (You may see similar ones based on different data points. This one compares the 2-year and 10-year Treasury yields.)

Source: Rosenberg Research

Before we get to the current situation, let’s note the nagging oddity of the yield curve inverting shortly before the pandemic. Did bond investors know COVID was coming? Of course not. We can’t know the counterfactual of what would have happened in 2020 if not for the virus. But the yield curve says a recession was probably brewing anyway.

But more to the point, notice how the yield curve inverts (i.e., drops below the zero line) months before recession, then rises and is back above zero before the recession arrives. Currently we are in the first part of that process: The yield curve, while still inverted, is headed back to its normal condition. If the pattern holds, it will cross back above zero and then another one of those gray recession bars will appear soon after.

For this to happen, we need some combination of lower short-term rates and higher long-term rates. (That’s the definition of inversion; the 2-year Treasury yield is above the 10-year yield.) When that happens, you’ll probably see a bunch of analysts sound the all-clear. But in fact, we will be entering the danger zone.

When could it happen? This week’s FOMC statement showed (if there was still any doubt) lower short-term rates are unlikely for several more months, at least. Fed officials are correctly realizing inflation is not as dead as they thought.

That’s not to say they will raise rates. Inflation isn’t that bad yet. But to preserve their credibility, they now need to stay “higher for longer,” waiting for softer inflation data before any easing decision. One or two good reports won’t do it; they need a trend. I think we are looking at November/December, at best, for the first rate cut. This makes a certain sort of sense, as hiking right before an election is generally considered verboten. Or at least not politic.

Meanwhile, we are in a kind of “liminal space,” an in-between economy that’s neither great nor terrible.

Trained to Spend

At SIC I paired Danielle DiMartino Booth and Lacy Hunt to talk about the Fed and recession because they’re both Fed veterans. Putting them together made for a great session and the audience loved it. Lacy and Danielle have seen how the sausage is made, so to speak. But more important, they understand how policy affects the economy.

They got right to the point, with Danielle explaining recession is close, if not already here. She said this so clearly and eloquently, I will just quote her in full.

“Where's the recession? The recession was in money expended by the government that prevented the natural cycle, the natural business cycle and its ebbs and flows. Of course that was required. 2019 we had negative global trade for the entire year. The US was slipping into a plain vanilla recession in early 2020. $12 trillion of spending arguably saved the Federal Reserve that needed to launch full-blown quantitative easing. By that time not-QE was not working anymore. The strange thing about this particular episode, if you will, in US history of handing money to people, cash to people, directly deposited into their checking accounts is that so much of it went to the wealthy—so, so much of it went to the wealthy.

“Remember 38.6% of consumption in a GDP that is 70% consumption, that's accounted for by the top quintile of income earners. You roll in the second quintile of income earners to get the top 40% of earners in America and that gets you to 61% of consumption. It is largely these two cohorts that were in receipt of some of the largest programs, millions of dollars that went to families. It's why we saw international travel take off. It's why there was no recession in 2023. It's why France went into recession when the plug was pulled on the employee retention credit. Yes, there really is that close of a tie because generations of families that had not been able to monetize were able to use the paycheck protection program, the employee retention credit, to indeed monetize their life's work and be able to take the family to the Champs-Élysées instead of Disney World. It was what it was.

“Of course, now we have the aftermath of that, consumption has come tumbling down. If you look at the past 52 weeks or so, we've seen through Bank of America proprietary debit and credit card spending that both brick and mortar and online—this is live real data spending—has indeed fallen into the red. There's going to have been some noise around a very early Easter compared to what it was in 2023, but I will tell you that prior to Easter coming early, we had witnessed 12 consecutive weeks of declining year-over-year hotel occupancy in the United States of America. In order to find a corollary to that wherein disposable discretionary spending is so deeply crimped, you have to go back to the fall of Lehman Brothers itself.

“Again, the aftermath of giving people money directly—what does that look like when people continue to take on habits in their spending, habits that were formed by one stimulus check, two stimulus checks, three stimulus checks, emergency unemployment benefits extended using FEMA, the rental eviction and foreclosure moratoriums extended temporarily through the Centers for Disease Control. Americans taking out buy-now-pay-later that is growing at a third of the rate at which credit card spending is growing on a monthly basis according to Wells Fargo analysis.

“What do you get on the back side of this? You get 50%. We have crossed the line. American households are spending more than 50% of what they put into interest expense in their household budgets toward non-mortgage interest. As a percentage of disposable personal income, it's near the highest on record. If you can imagine personal income payments per capita are pushing into $1,800. These are unfathomable figures. They're reflective of the damage that is done when you attempt modern monetary theory and train Americans to spend far, far beyond their means. We already were a society that was predisposed to spending beyond our means and look where we are now.”

I hadn’t thought of the last few years in exactly those terms. The COVID stimulus, necessary though some of it was, had a side effect of inducing excess confidence. People got used to spending more freely and kept doing it. That can only end with a hangover, which Danielle thinks is now beginning.

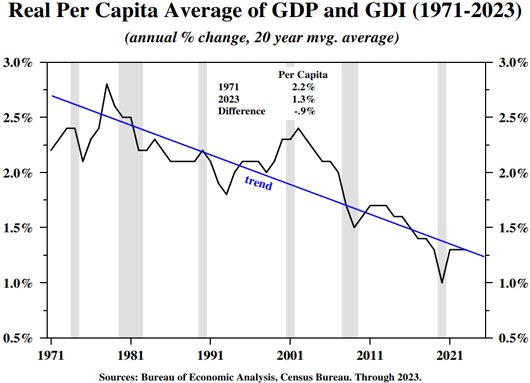

Lacy Hunt then explained this has been brewing for a long time. I’ll skip the math, but Lacy’s key insight is that economic growth falls as debt becomes so excessive it stops adding new productive capacity. That’s how we get this trend.

Source: Hoisington Investment Management

Lacy pointed to the COVID recession as ominous. Growth fell, as you would expect, and adding $6 trillion in debt still didn’t bring it back. All that money simply restored growth to the previous declining trendline. So what happens in the next recession? We can expect more stimulus, regardless of which party controls the government, but the resulting debt will likely suppress growth even more.

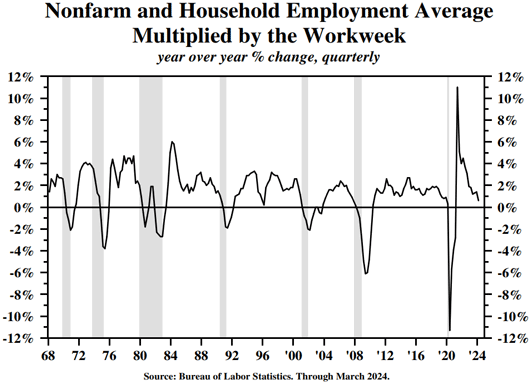

Since we got a new jobs report, I’ll end this with Lacy’s comments on employment. He made this chart showing growth in the aggregate number of work hours in the US economy—not per worker, but the total time we all worked. GDP growth is tough if this isn’t growing, either because we have more workers or people are working more hours.

Source: Hoisington Investment Management

Here’s Lacy:

“In the last four quarters ending in the first quarter, the aggregate hours worked in the US economy using average employment data is only up about 0.6% down from 1.3% year-over-year last year, and it's at the lowest point since the last recession. The labor markets are not nearly as strong… which suggests that the unemployment rate is going to be moving higher and even though no one seems to be aware of the fact, the unemployment rate is already up four-tenths of a percentage point from a cyclical low.”

Again, he said that before the latest report, but it doesn’t change the big picture. Short of some dramatic increase in worker productivity, this is a terrible sign for growth.

Nonfarm payrolls came in at 175,000, Certainly not the expected 240,000 jobs. Unemployment picked up 0.1% to a still low 3.9%. Average hourly wages rose slightly.

In short, this was weaker than previous years (back to 2022), but 175,000 new jobs are still enough to keep unemployment in check. There was certainly nothing to suggest to Jay Powell and Company that they need to start cutting rates anytime soon.

Finally, I know a lot of people want rate cuts, but I wonder if they will be happy with the conditions that come with those rate cuts. Rates will eventually come down as inflation falls, and the Fed should keep real rates positive which is required in a balanced, properly growing economy.

Cape Town, Salmon Fishing, and Somewhere in the Caribbean

Shane and I will be traveling to Cape Town, South Africa, in early June. She has decided she would like to visit some of the other Caribbean islands rather than Europe this summer. I had some great suggestions from readers and I'm looking for more.

I will be in far northwest British Columbia in late August at the West Coast Fishing Club, along with 30 readers and friends hopefully catching trophy salmon along with halibut and cod. A true five-star fishing club with friends for the start of my 75th birthday celebrations. I don't typically celebrate birthdays but 75 seems to me to be a big number. Certainly not something that I was thinking about 30 or 40 years ago.

One thing that is helping keep me in shape might seem a little odd, but it really does work. I have a Hungarian trainer, who is built like a 5-foot 7-inch Arnold Schwarzenegger, come in twice a week with something called electromagnetic stimulation (EMS). He puts this suit on me which covers me from my shoulders down to my knees. It shoots electric pulses into my body. He can control the intensity. It basically forces your muscles to fire and engage, and can get VERY intense depending on the level. But I have never had anything work my core and glutes like this does. I lift weights and work out while doing this for “only” 20 minutes which feels like an intense 90-minute workout. Shane and I laugh much of the time because it is so intense. What else can you do? But I can see the results as can many of my friends who do the same thing.

You can likely find someone in your area to do this for you. You can buy your own suit to do it, but as it is FDA regulated, it is hard to get the same level in a private suit as opposed to using a trainer. Just part of the good fight to stave off old age. Note: You will be muscle-sore if you do it right.

And with that, I will hit the send button. Have a great week and don’t forget to follow me on X.

Your still decompressing analyst,

|

|

John Mauldin |

P.S. If you like my letters, you’ll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price.

Click here to learn more.