Read full article on SilverSeek.com

No one is happy about the underperformance of the precious metal equities, but with 'da boyz' in firm control of precious metal prices, we'll have to wait a bit longer for the situation to improve. I know that Eric Sprott has some comments on this situation in his weekly interview posted in the Critical Reads section below -- and you may find it worth your while to check that out.

As per the COT and Days to Cover discussion a bit further down, the Big 8 traders are still mega short gold and silver in the COMEX futures market -- and that situation hasn't changed one bit from last week, or for the last many months. But more than enough gold has now been brought into the COMEX warehouses to cover their short positions by physical delivery, if that's its purpose. The short position of the Big 8 traders in gold decreased by a hair during this reporting week, However, their short position in silver increased by a material amount over the same time period. There's more on that in the COT discussion further down.

The CME Daily Delivery Report showed that 274 gold and 359 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, of the three short/issuers in total, the only one that mattered was JPMorgan, with 269 contracts out of its client account. There were a bunch of long stoppers, but by far the largest were JPMorgan and Morgan Stanley, as they picked up 134 and 109 contracts...JPMorgan for their own account -- and M.S. for their client account.

In silver, there were four short/issuers and the two largest by far were Morgan Stanley and ADM, with 195 and 154 contracts...M.S. from their house account -- and ADM from their client account. There was a big list of long/stoppers. The Big Kahuna/JPMorgan stopped the most...180 contracts for its client account. Australia's Macquarie Futures was in very distant second spot with 50 contracts for its own account -- and the list goes on and on once again.

The link to yesterday's Issuers and Stoppers Report is here.

So far in September there have been 3,457 gold contracts issued/reissued and stopped -- and that number in silver is 8,814 contracts.

The CME Preliminary Report for the Friday trading session showed that gold open interest in September rose by 260 contracts, leaving 384 still open, minus the 274 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 59 gold contracts were actually posted for delivery on Monday, so that means that 59+260=319 more gold contracts just got added to the September delivery month. Silver o.i. fell by 484 contracts, leaving 2,043 contracts still open, minus the 359 mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 440 silver contracts were actually posted for delivery on Monday, so that means that 484-440=44 silver contracts disappeared from September.

Total gold open interest on Friday rose by 6,251 contracts -- and total silver o.i. declined by 2,257 contracts.

There were no reported changes in GLD on Friday, but there was another big withdrawal from SLV, the third in as many days. This time an authorized participant took out 3,630,502 troy ounces.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD & SLV inventories, there was a net 52,621 troy ounces of gold added, but a net 131,220 troy ounces of silver was removed.

There was no sales report from the U.S. Mint yet again.

Not only have there been no mint sales so far in September, they haven't reported selling a single bullion coin in either silver or gold for more than two weeks now. And as I said the other day in this space, you have to wonder what the hell their doing to wile away their working day, since they're obviously not minting anything.

It was a very quiet day in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. There was only 38,580.000 troy ounces received/1,200 kilobars [U.K./U.S. kilobar weight] -- and all of that was dropped off at Loomis International. All of the out activity...739.470 troy ounces/23 kilobars [SGE kilobar weight...occurred at Brink's, Inc. The link to this is here.

i know that Ted will have something to say about the COMEX gold stocks in his weekly review later this afternoon.

But -- and as it has been all week, it was another very busy one in silver, as 3,076,034 troy ounces were received -- and 629,957 troy ounces was shipped out.

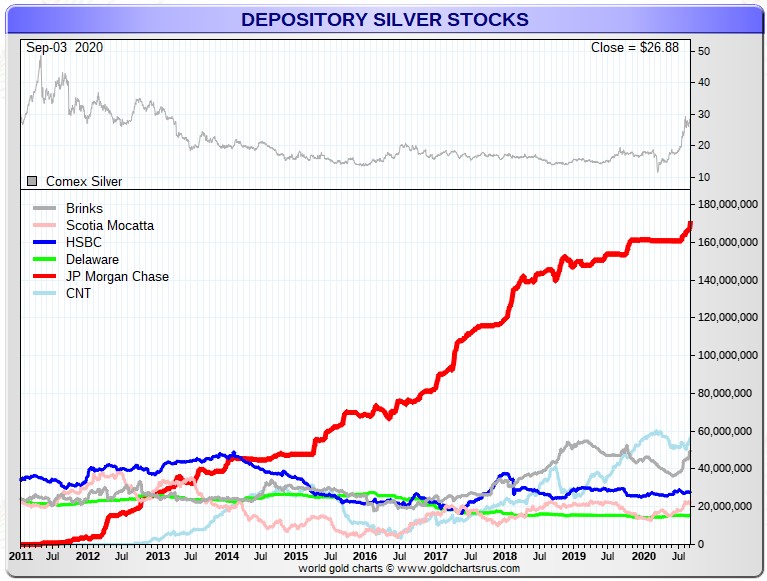

In the 'in' category, the largest amount received...1,485,900 troy ounces...ended up at JPMorgan -- and that's another new record high for them, as they now hold 171.10 million troy ounces in their COMEX depository, a hair under 49 percent of all the silver on the COMEX. Next was Canada's Scotiabank, as they received 984,567 troy ounces -- and they were followed by the one truckload...605,567 troy ounces...that was dropped off at Brink's, Inc. In the 'out' category, the largest amount by far...605,567 troy ounces...was shipped out of Manfra, Tordella & Brookes, Inc. -- and that's most certainly the amount that was reported received at Brink's, Inc. There were smaller amounts moved at three other depositories...16,423 troy ounces at CNT...5,029 troy ounces at Loomis International -- and 2,938 troy ounces at Delaware.

There was also some paper activity, as 497,602 troy ounces was transferred from the Eligible category and into Registered...no doubt destined for delivery this month sometime...492,697 troy ounces at JPMorgan, with the remaining 4,904 troy ounces being transferred in that direction over at CNT. The link to all this silver-related activity is here.

Here's the chart showing JPMorgan's total COMEX warehouse inventory, updated with Thursday's big deposit. Click to enlarge.

As Ted Butler said on the phone yesterday...anyone who doubts that JPMorgan is the big kahuna in all things silver [and gold] related, needs to get their head read -- and I agreed.

There was a bit of activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. They reported receiving 10 of them -- and shipped out 315. And except for 15 kilobars shipped out of Loomis International, the rest of the in/out activity occurred at Brink's, Inc. The link to that, in troy ounces, is here.

Here are the usual two 20-year charts...

https://silverseek.com/article/jpmorgans-comex-silver-stash-another-new-record-high