If inflation screams and no one hears it, does an airplane fall in the forest? That’s a good question for today. Inflation ripped upward, and the stock market shrugged it off as if it heard nothing, while a good part of the media reported satisfactory results … but not everyone because some saw it as horrible. So, let’s start with the really bad news that almost everyone ignored and then end at the really mundane and predictable news that almost everyone on Wall Street focused on.

To start off with, a few mainstream stories did hit the bad news right up front. Yahoo! reported,

Fed’s Preferred Inflation Metric Increases by Most in a Year

One would think that’s not good news about inflation. First, let’s note the title tells us this is THE measure of inflation the Fed looks at most intently when setting monetary policy. Second, let’s note that it was the largest increase in a year (even as I’ve reported the incremental increases for months). Next, let’s note its likely affect on interest rates at the Fed’s March meeting because of what it means to the Fed:

The Federal Reserve’s preferred gauge of underlying inflation rose in January at the fastest pace in nearly a year, helping explain policymakers’ patient approach to start cutting interest rates.

Economist Wolf Richter of Wolf Street phrased that a little more intensely:

Worst Monthly Spike of “Core Services” PCE Inflation in 22 Years, and … Powell’s Gonna Have Another Cow!

I like that better, but I just wanted to start by noting that the financial writers Yahoo! uses did, at least, get that this is the Fed’s key gauge and that its rise explains why the Fed is staying with high for longer, ending hopes of imminent rate cuts, and that this is the last one of their favorite reports they will have access to before their March FOMC meeting. So, it’s determinative.

As could be expected, some in Wall Street media, such as Bloomberg, did find a way to put lipstick on this pig:

We think a lot of one-off factors are at work – residual seasonality and portfolio management affecting the inflation data, cost-of-living adjustments driving income gains, and weather effects driving weak spending.

In other words, blame it on the usually helpful adjustments just not working right this time. (I’d be more inclined to say, “If you can’t get it where you want it because even the adjustments won’t manipulate it the right way, then you really are in trouble.” Call me jaded.)

So, I prefer Richter’s straightforward way of reading the data and digging into the details. Richter compared this mess to the inflation we had back in the Nixon and Carter years, which was our worst period of inflation. And then he noticed this little detail (where a few weeks ago I was the Lone Ranger in venturing it as the greater likelihood):

Mention of a rate hike crops up in a Fed speech.

I thought we might be going a little more in that direction today when the inflation report came out.

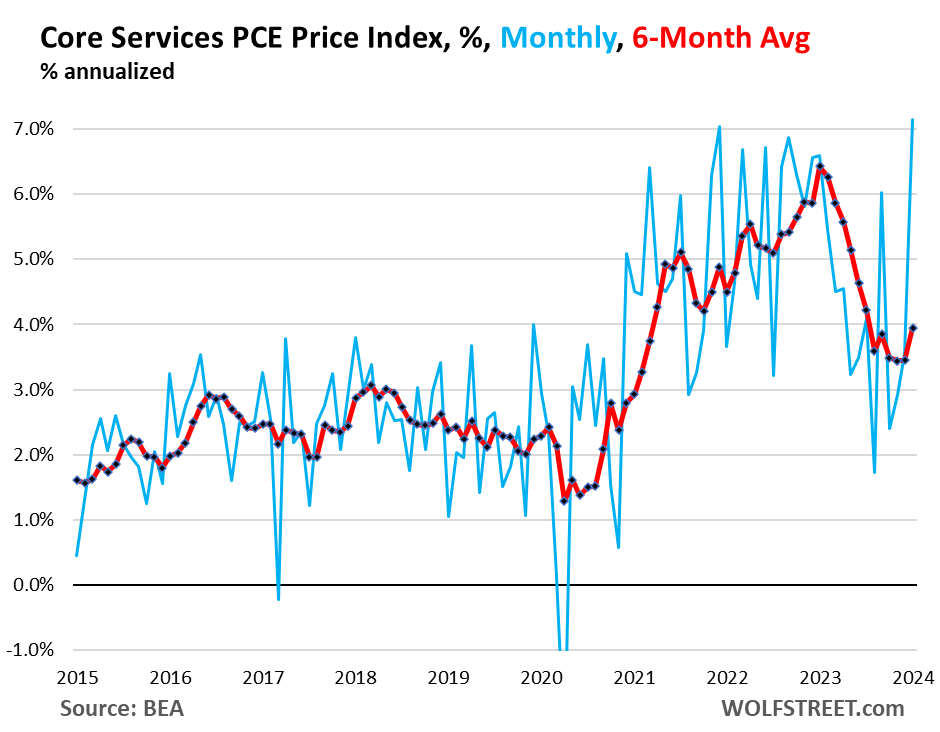

Over the past year or so, the Fed has been intensely discussing inflation in “core services,” which is where inflation had shifted to in 2022, from goods inflation which had spiked into mid-2022 but then cooled dramatically. So “core services” is where it’s at. Core services is where consumers spend the majority of their money. Core services are all services except energy services. Core services inflation has been behaving badly for months, and in January, it spiked out the wazoo.

Those months are the months I’ve said since last summer were setting the new trend for year-on-year inflation to come. It was today’s the YoY inflation that still gave the market the narrow exit it needed from this report to breathe easy and go back to betting high, but the MoM inflation just got so much worse. One would be a fool not to pay attention to a burst this big:

The “core services” PCE price index spiked to 7.15% annualized in January from December, the worst month-to-month jump in 22 years (blue line).

Richter has also been on the incremental MoM inflation since last summer:

The bad behavior of core services inflation that we have been lamenting since June – and which was confirmed earlier this month by the nasty surprise in the CPI – is why Fed governors have said this year in near unison that they’re in no hurry to cut rates, but have taken a wait-and-see approach. And now the concept of rate hikes is cropping up in their speeches again.

Confirming what I wrote yesterday:

The bond market, however, still hasn’t tightened financial conditions back to where they were before bond investors all went to sleep last November. They’re about halfway back to that level, and they need to get yields back up to that level if yields are going to continue to press down on inflation to where the market does the Fed’s work for it, which is why I said I’d give higher odds to a rate hike in March than to a cut…. Does [Powell] have the courage to do that? Probably not unless inflation kicks up more notably in the next reports.

We may have a little better sense where this is going tomorrow when we see if those monthly rises that have been happening in inflation are going to show up a little more clearly in the headline year-on-year numbers. We should be at the point where they do, but we’ll know soon enough.

We got all of that today because inflation did actually turn up a tiny poke of its head in the YoY numbers today, too:

For example, Fed governor Michelle Bowman said in the speech yesterday, that she was “willing to raise the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or reversed.”

Even year-over-year, core services inflation has now reversed and accelerated to 4.1%.

So, the most important part (to the Fed) of the most important gauge (to the Fed) has now turned up YoY, too. However, core services are not what the media watches; they’re not the media headline number. As I’ve said, you keep stacking in enough incremental rises in MoM, and those eventually start stacking into the longer YoY measures to start pushing them up, too.

The second rise in housing prices that came along many months ago is now starting to price though that long lag time I’ve written about to show up in the actual inflation data, too:

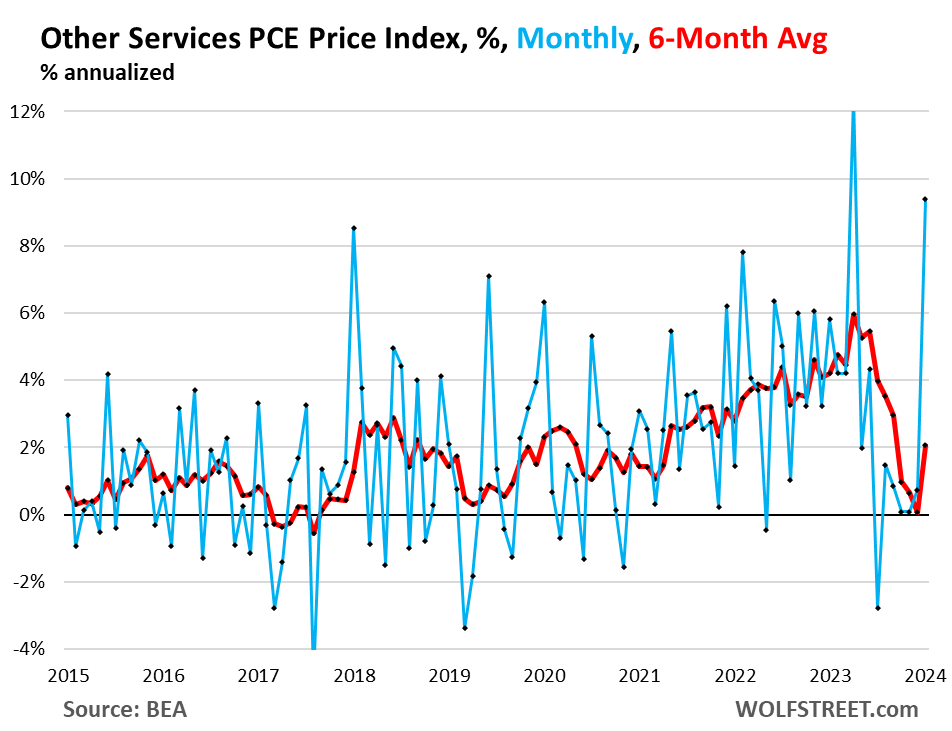

Housing inflation is hot. The PCE price index for housing accelerated to 6.4% annualized in January from December, the worst since September.

Actual prices in the housing industry have continued rising in most areas, so there is not likely to be any relief there in the inflation reports for a long time. Other big price rises were in financial services and insurance, food services and accommodations, and all other services combined, which saw a huge spike.

And that’s why Powell is having a cow.

But Wall St. yawned and bet stocks up higher because surely all of this will be transitory and because, well, higher!

So, that’s what inflation was really about … all over the inside, but the good news that the gave warm milk to the market to help it sleep this off was that the headline number did as was expected. Its YoY rise was incrementally smaller than January’s.

All Powell will hear, however, is …

Moooooo!

With Powell’s cow ringing in our ears, let’s touch back on the one other thing I had said yesterday, ahead of today’s reports:

I still don’t think inflation or labor is going to let [Powell] off the tightening hook until he gets us into full recession…. Certainly, what Powell saw in the labor report for January told him he likely needs to tighten harder; but I don’t think the glorious image for labor that sprang upon us in January like a winter heat storm in Texas under the accounting of Biden’s government is going to follow through in the February report.

Zero Hedge responds to the jobless claims released today like this:

WTF Is Going On With The Jobless Claims Data...

They start by laying out a huge string of data about layoffs this year, concluding,

In the real world labor market, 2024 has been a shitshow of layoffs.

Data on Jobless claims have been a mess, too, for the last three months with non-seasonally adjusted numbers spiking very high, especially in January, and seasonally adjusted numbers going lower most of the time. Unlike the earlier months on the chart where they reasonably correspond with each other, they look like a contradictory mess, even going opposite ways in the today’s report:

As I say, labor a broken gauge for the Fed, in bad need of recalibrating. If the labor market without seasonal adjustments was loosening up (more unemployment claims), it’s now tightening way back up. If you believe the adjusted numbers, on the other hand, it’s hard to get a clear reading.

So, what the Fed will hear is ….

Moooo!

And, in terms of where the economy is, according to the much-watched Chicago PMI today …

prices are rising and business is falling:

New orders fell at a slower pace; signaling contraction

Employment fell at a faster pace; signaling contraction

Inventories fell at a slower pace; signaling contraction

Supplier deliveries fell and the direction reversed; signaling contraction

Production fell at a faster pace; signaling contraction

Order backlogs fell at a slower pace; signaling contraction

Worse still, Prices paid rose at a faster pace...

So, moooove over rate cuts; step in rate hikes but at a time when the economy is sinking. With jobs looking upside down, and yield curves re-inverting, as inflation flips, Powell’s soft landing might look like this: