The Biden Administration can count on Wall Street to celebrate meaningless economic data and bogus GDP growth with steep rallies, even as the visible economy continues to implode. It will become increasingly difficult to ignore signs of impending collapse, however, as anyone who lives in San Francisco could tell you. The city’s growing wretchedness is arguably no worse than what you would find in Chicago, Portland, Seattle or L.A., but it seems more appalling because San Francisco, with its cable cars, spectacular scenic vistas, hilly, charming neighborhoods and the world’s most beautiful bridge, has always been regarded as a special place. In no song will anyone ever leave his heart in Minneapolis, Boston, Milwaukee or Miami.

Labor Market Hubris

New York is no better off, with even mighty BlackRock struggling to turn a profit on commercial real estate. Rents are higher than ever, but they haven’t kept up with an even steeper rise in the cost of servicing property loans. Nor will they, for the U.S. economy is on the down slope of an inflation/deflation Mt. Everest, so hopelessly burdened by debt as to lie beyond the quack nostrums of Fed policy, let alone capable of regenerating itself with a robust revival. Consumers appear to be tapped out, tech firms are still laying off by the thousands, small businesses are closing at an appalling rate, and the Mother of All Yield-Curve Inversions is predicting a commensurately extreme recession,

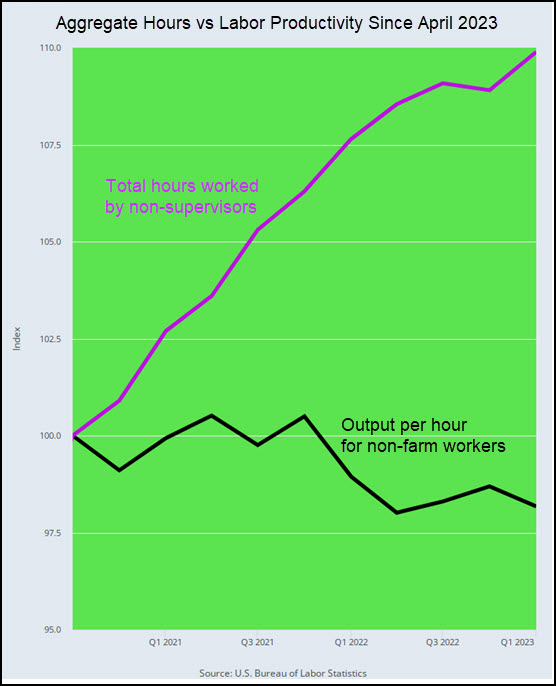

Against all these troubles, the spinmeisters would juxtapose the supposed creation of 339,000 jobs in May. Armed with this dubious evidence of economic growth, officialdom is able to speak of a “strong” labor market with a straight face. However, 201,000 of the jobs, or 60%, were in government, health, education, leisure and hospitality, notes economist David Stockman. With growth mainly in low value-added jobs, he points out, private sector labor productivity (black line) has actually been falling from its Q3 2020 peak, even as total hours worked (purple line) have risen by nearly 10%.

Damn the Torpedoes

All of this has had little impact on a stock market that looks primed to challenge old highs. Investors have become inured to bad news, having shrugged off weak earnings for the last two quarters. That was an impressive feat of mass self-deception, and it worked because the bad news had been overly anticipated and discounted. It’s difficult to imagine what investors are anticipating at the moment, however, as money moves feverishly from one investment “theme” to the next, most recently from tech stocks to small-caps. Get short into the parabola if you dare, but don’t expect it to bend to reality on your schedule.