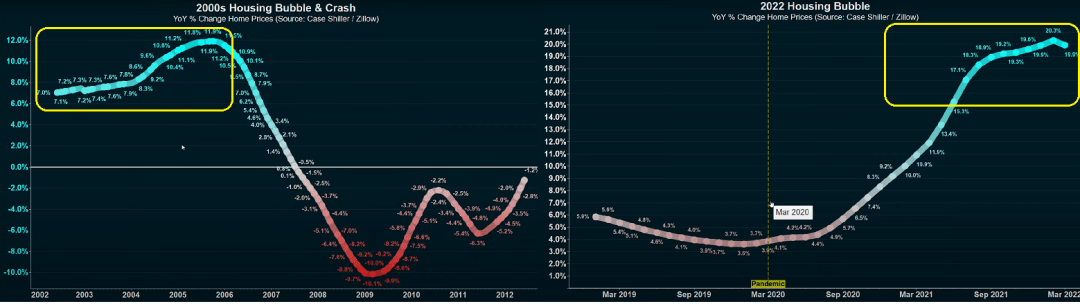

I’m starting to believe that the housing market may have hit a wall in April. The graphic below is my reconstitution of the two charts sourced from Reventure Consulting (RC). It’s self-explanatory:

Amusingly, I’ve noticed articles in the mainstream media which acknowledge that the market is slowing down but assert that “a crash is not likely.” For me, that sentiment puts me on “crash alert.” The housing market at peaks is like a runaway freight train without brakes. But when it runs out power, it tends to derail quickly. All off a sudden multiple-offer listings become “for sale” signs that sit followed by price cuts. Then, rather than chasing prices higher, prospective buyers wait to see how low prices will go down.

Silver Liberties invited to have a conversation about the housing market. At the end we also chat about the precious metals sector:

*******************************

A portion of the above commentary is an excerpt from my latest Short Seller’s Journal . I’ve managed to hit several home runs in stocks like $HOOD, $DKNG, $ARKK, $Z, $CVNA, $MSTR etc. In my latest issue I lay out the case why I believe the homebuilders and related equities are no-brainer shorts. $RLGY is down 36.4% since I recommended it as short about two months ago. There’s several stocks that not homebuilders but directly related to the housing market that I have recently presented. I’m working another one for the next issue. You can learn more about my newsletter here: Short Seller’s Journal Information