Since mid-2021, we lived through the worst price inflation since the 1970s. CPI peaked in June 2022 at 9.1 percent.

During this inflationary period, a lot of people sold gold as evidenced by the rangebound price through most of 2023. Was selling a good move?

Looking closer at the trend, gold sellers prevailed over the last couple of years whenever news broke indicating price inflation was still hot. We’d see these selloffs whenever there were large increases in the CPI or “strong” economic news, particularly positive jobs reports.

Conversely, gold buyers jumped in when the inflation news was positive or if there were hints of an economic slowdown.

The mainstream thinking is that any hint of lingering price inflation meant the Federal Reserve would raise interest rates, or at least keep them higher for longer. Since gold is a non-yielding asset, higher interest rates tend to create headwinds for gold. Investors gravitate toward yielding assets such as bonds thinking they will get a better return than holding non-yielding gold.

While I understand this thinking, I still found it curious that mainstream investors consistently sold a traditional inflation hedge during the worst inflationary period in some 50 years.

I think at least some of the swings we’ve seen in the gold price in recent months were a “monkey see, monkey do” phenomenon. Traders assumed other traders would sell gold on hot inflation news and that they would buy as inflation cooled. They programmed their algorithms to follow that trend. No doubt, there was money to be made following short-term this strategy. But these traders didn't seem to be factoring in long-term trends or the economic fundamentals.

I also think there is some question as to whether or not gold is really an inflation hedge. There are plenty of investors who think gold is a “useless metal” and there is no reason to hold it in a modern portfolio. After all John Maynard Keynes declared gold “a barbarous relic.”

So, how did investors who bought gold early in this inflationary cycle fare?

Pretty darn good.

The price of gold has increased by about 29 percent since June 2021 (as inflation started heating up) from around $1,800 an ounce to today’s price of around $2,320 an ounce. In that same period, CPI increased by 12.30 percent based on official Bureau of Labor Statistics data.

So, the price of gold has increased by more than twice the rate of price inflation so far in this cycle. That’s a pretty solid inflation hedge!

Even if you double price inflation to keep it more in line with the more honest CPI formula used in the 1970s, gold still kept up with price inflation.

The Longer Trend

But what if we look at gold’s relationship with inflation over a longer period of time? Does the yellow metal still hold up as an inflation hedge?

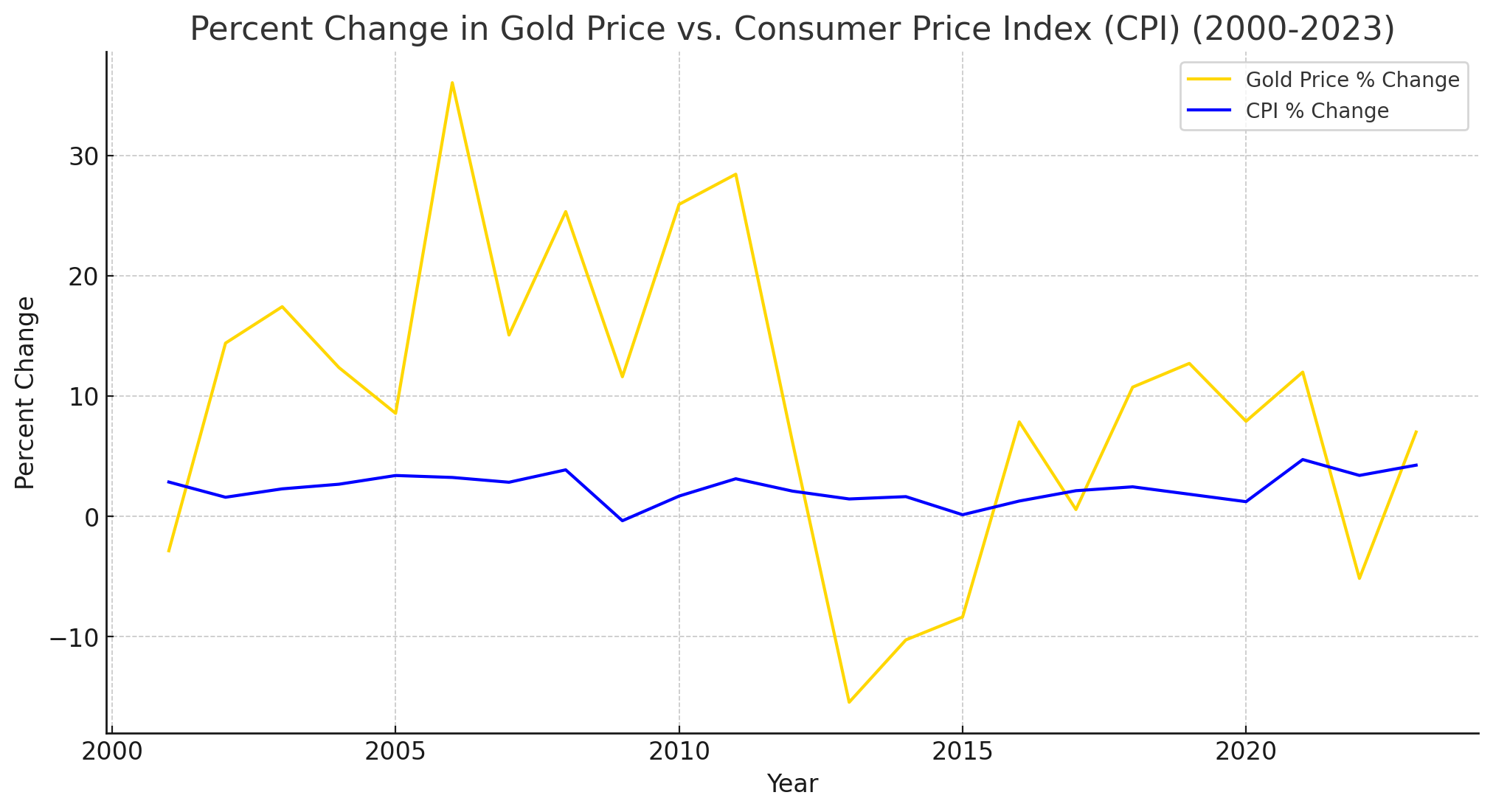

Let's consider the price of gold and its relationship with price inflation during the 21st century.

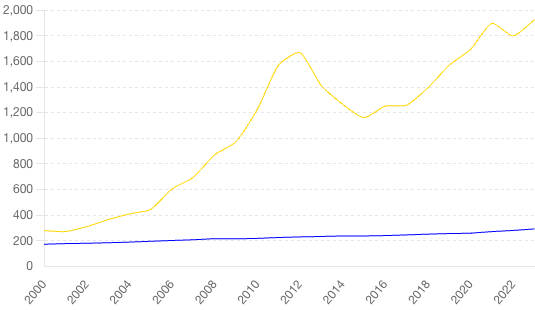

The spot price of gold in January 2000 was around $285 an ounce. If you bought an ounce of gold that month and sold it today, you would earn about 714 percent on your investment.

During that same period, the CPI has increased by about 81 percent.

Again, gold was more than adequate as an inflation hedge during that period of time (That's a bit of an understatement, eh?).

Of course, the return on any investment depends on exactly when you buy and when you sell. If you happen to buy gold at the peak of a bull cycle and sell at the bottom of a bear run, you will likely lose money in both real and inflation-adjusted terms. There is always an inherent risk in investing. That means one can select arbitrary dates to "prove" that gold failed as an inflation hedge. That's why one must always look at longer trends.

A lot of people like to point to 2011 to prove that gold has been a poor investment. They chose 2011 because gold peaked that year in the wake of the 2008 financial crisis and Great Recession. It took about a decade for gold to regain that level.

So, if you bought gold in early 2011 and sold it today, how would you do?

Not too bad.

In January 2011, gold was selling at around $1,400 per ounce. If you bought an ounce then and sold it today at $2,320, you would chart a gain of 65.7 percent. In that same period, price inflation has increased by 38.55 percent.

Even if you bought gold at the peak of around $1,900 an ounce in August 2011, your investment has still slightly outpaced price inflation based on the CPI.

While the correlation breaks down for short periods, gold has generally outpaced price inflation during this century.

Maybe the “smart money” that sold gold during this inflationary run wasn’t so smart after all.