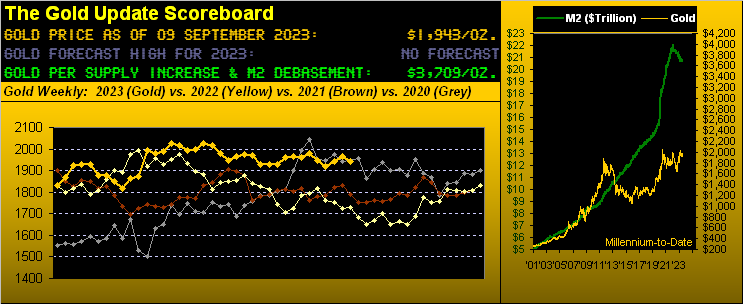

Quite the inauspicious start for Gold’s fresh parabolic Long trend as otherwise herein detailed a week ago. Indeed then we were all megaphones and pom-poms about Gold now being en route to a new All-Time High … and we’re still in that camp even though the drive to such high has commenced with a dive.

For having settled a week ago at 1966 in confirming the new up trend — and historically backed by the strength to surpass the present All-Time High (2089 on 07 August 2020) as we ascend — Gold instead this week fell to as low as 1940 toward settling yesterday (Friday) at 1943. Fortunately, ’tis not the end.

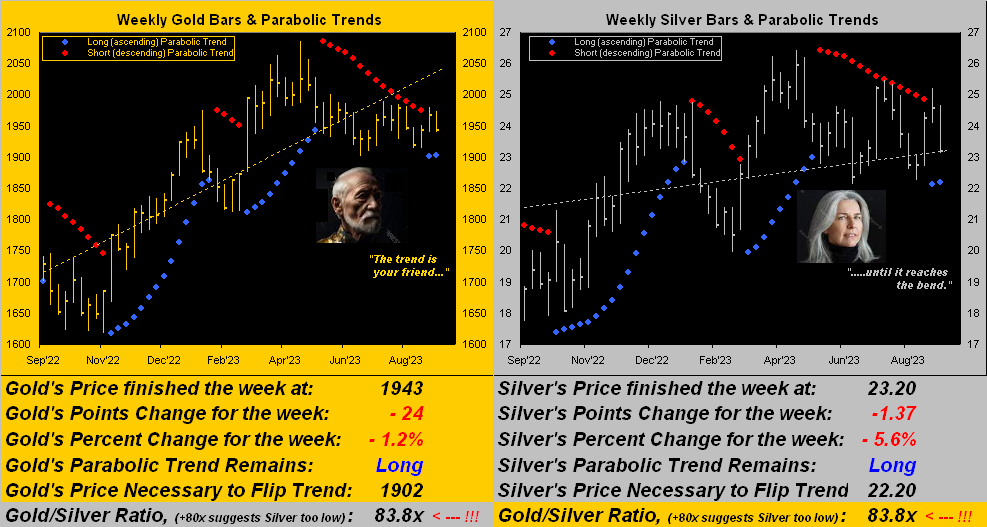

Further, this Gold uptrend remains intact, as does same for Silver. So let’s straightaway go to the two-panel chart of the precious metals’ weekly bars from one year ago-to-date with their respective parabolic trends in stride:

The optimistic news is that both the yellow and silver metals exhibit their rightmost two blue dots of fresh Long trend. The pessimistic news is that the margin for error — i.e. trend reversal — admittedly appears tight. Gold’s present distance from here (1943) to the flip-to-Short price (1902) is -41 points, which given Gold’s expected weekly trading range of 44 points is within a vulnerable distance. Similar is the case for Silver (currently 23.20) with her flip price just -1.00 point lower at 22.20; her EWTR? 1.32 points. Hang in there Sister Silver!

“But obviously you’re still bullish for higher Gold from here, eh, mmb?“

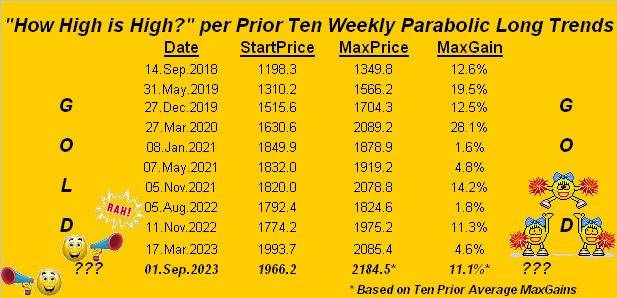

Would we otherwise be writing, dear Squire? Or to quote one JP from our Investors Roundtable: “The trend is your friend until it reaches the bend.” Moreover as cited a week ago in asking “How high is high?”, recall that Gold’s “maximum average” price follow-through per the prior 10 weekly parabolic Long trends is +11.1%. Thus again strictly in that vacuum, we’d see Gold 2184 on this run, eclipsing the still standing 2089 All-Time High by nearly +100 points. Here’s such historical table of positive percentage MaxGain follow-throughs:

“But if I may interject again, mmb, four of those last six ‘MaxGains’ have been less than +5%…“

Duly noted, Squire. Yet if we instead employ the weighted-average method, the “perfect world” MaxGain comes to +9.1%, which from that starting 1966 level still sets Gold for a new All-Time High at 2145. Either way, next week is important for the precious metals’ ascent to resume. Else these fresh uptrends face parabolic busts.

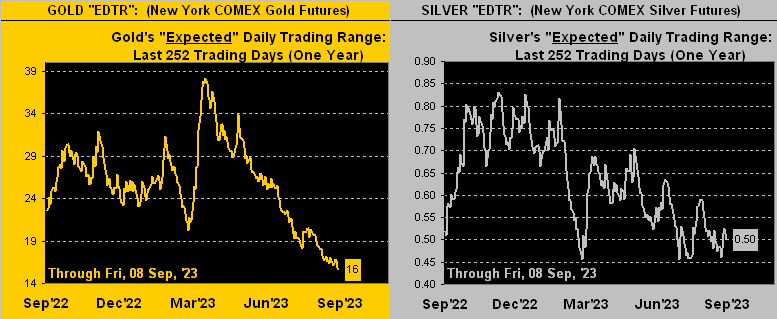

Too, we’ve another oft-overlooked analytical note: have you been following our Markets Ranges page? As we tweeted (@deMeadvillePro) this past Thursday night: “…Market Ranges becoming unusually narrow (save for that of the Spoo); may portend Big Moves ahead for the BEGOS Markets; have a look…”

Indeed for the month of September — wherein by conventional wisdom “it all goes wrong” — scant little has yet to happen, especially with respect to the precious metals in terms of day-to-day ranginess. Below on the left we’ve Gold’s “expected daily trading range” from one year ago-to-date; (for you WestPalmBeachers down there, this is not the price of Gold; rather ’tis how many points we expect Gold shall trade between its next day high and low). And the number “16” in the Gold box is as narrow an expected points range as we’ve seen in better than a year. Similarly on the right is the case for Sister Silver now with her 0.50 points expectation. ‘Tis said “Traders love volatility”, a condition rather absent of late. This is why understanding potential price movement from day-to-day is critical to cash management. Here’s the graphic:

‘Course, cash management has become a crap-shoot if investing via the StateSide trendless economy. “It’s up … no wait … it’s down … no wait … it’s ad nauseum…” Or as crooned by The Moody Blues: ![]() “School taught one and one is two. But by now, that answer just ain’t true…“

“School taught one and one is two. But by now, that answer just ain’t true…“ ![]() –[‘Ride My See-Saw’, ’68].

–[‘Ride My See-Saw’, ’68].

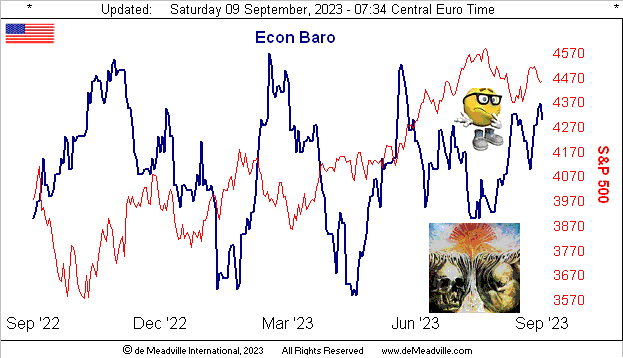

Too, there’s the standard verbage in the Policy Statements from the Federal Open Market Committee that it “will continue to monitor the implications of incoming information for the economic outlook”. Is it any wonder ongoing FedSpeak is so vague? Can you make heads or tails of it all? “In Search of the Lost Chord” indeed as we turn to the Economic Barometer:

And therein, we cite a notable number from this past week: Consumer Credit as calculated by the Fed for July was just $10.4B, the third-lowest reading since the core of COVID 30 months prior. Hitting the wall of the credit card limit? That rising variable interest rate is a credit killer.

Regardless, President Biden’s economy is said to be just fine, thank you. To wit these two headline doozies from Dow Jones Newswires as the past week unfolded: “Resilient U.S. Economy Defies Expectations” and “Why Higher Unemployment Is Good News Now“ (Clearly the FinMedia summer interns are closing out their stints at high writing levels as they return to University). Yet on this side of the pond, the EU’s leading economy — Germany — continues to falter. Further ’round the globe, China’s exports continue to plummet … does that mean Walmart (WMT) shan’t have anything to sell? Good grief…

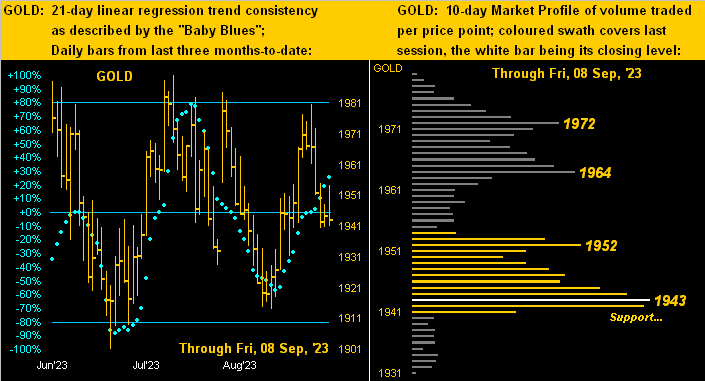

Returning to Gold, ’twas a week of grief as told, made graphically bold in the graphic below: to the left we’ve Gold’s daily bars from three months ago-to-date, this past week not looking so great. Still, the baby blue dots of trend consistency continue to climb. And to the right, despite Gold’s plight, the most dominantly-traded price of the past two weeks — indeed the 1943 settle — has essentially held as support per the Market Profile’s fortnight:

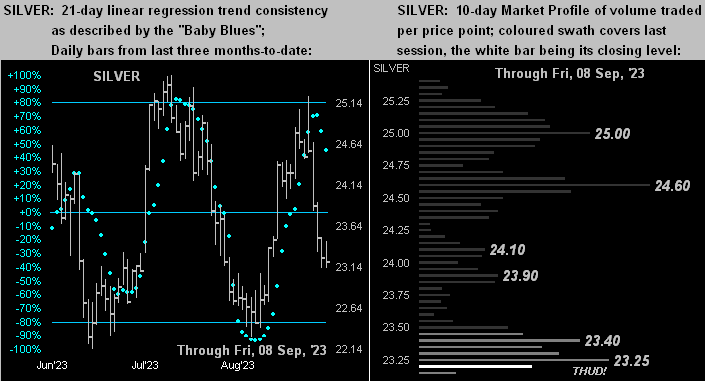

As for poor ol’ Sister Silver, the like graphic is weaker, her “Baby Blues” at left having just turned tail, whilst her Market Profile at right finds price having taken quite the “THUD!” Hopefully it shan’t leave a bruise…

Notwithstanding the precious metals needing a boost into the new week, we wrap this missive with “Breaking News”:

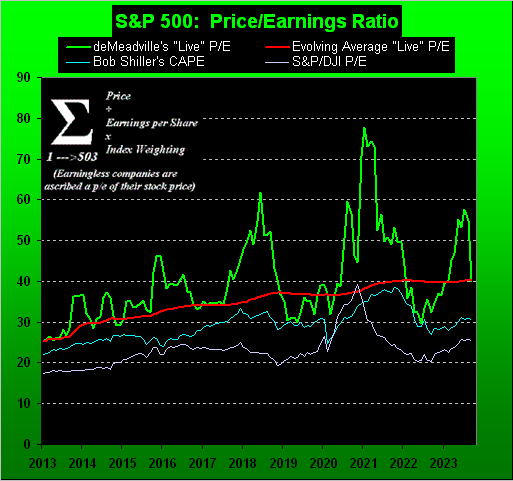

The long-sought reversion of our “live” price-earnings ratio to its mean has finally occurred. And both elements of the fraction thereto contributed. The “P” of the S&P 500 at 4457 is -7% below its all-time high (4819 on 04 January 2022). And the Index’s “E” — which for Q2 grew year-over-year by +6% — was recently enhanced by post-earnings season power profits, notably from the large market capitalization likes of Nvidia (NVDA) and Berkshire Hathaway (BRK.B). Indeed, those two companies by cap-weighting comprise 4.1% of the S&P 500’s total of 503 constituents. Here’s our enhanced graphic, the green line having once again reverted to the red line:

So is that as low as the S&P shall go? Per what we know: no. With our “live” P/E today at 39.9x, ’tis still a very strained distance above Bob Shiller’s CAPE, which in turn has yet to re-meet with the oft-parroted S&P/DJI version of “twenty-something”. And should the economy recess and earnings not grow, a return to the “live” P/E’s low (25.4x in January 2013) means an S&P “correction” from here of -36%; (that’d be to 2852, just in case you’re scoring at home … and recall our musing earlier this year of an S&P sub-3000). As well, the imputed S&P yield per the P/E ( 1 ÷ 39.9 ) is 2.507%; but the actual cap-weighted yield is only 1.537% … and yet the three-month annualized T-Bill yield is more than triple that at 5.293%, and ’tis risk-free! Thus you can see where your money ought be.

But for security above and beyond risk-free we’ve the world’s best currency: Gold! Today’s 1943 level prices it at just 52% of its Dollar debasement valuation, which per the opening Gold Scoreboard’s calculation of 3709 even accounts for the increase in the supply of Gold itself. And save for smart sovereigns, just because “nobody” owns Gold yet, do not be without! Got Yours?

Never in a million years, Sweet Sister Silver!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on Twitter(“X”): @deMeadvillePro