Strengths

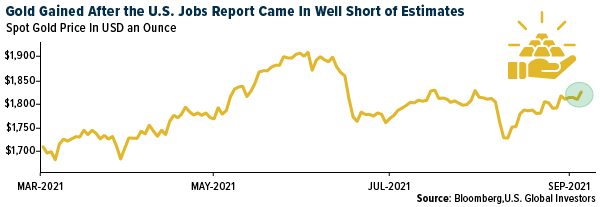

- The best performing precious metal for the week was silver, up 2.87%, outpacing gold on the sensitive jobs report update. Gold jumped after a key labor-market report showed the U.S. economy added fewer jobs than forecast, diminishing the possibility that the Federal Reserve will taper stimulus soon. Nonfarm payrolls data showed the U.S. added 235,000 jobs in August, well below economists’ forecasts and far less than the gains seen last month, reports Bloomberg. The dollar sank after the report, boosting gold. Bullion has struggled this year amid a global economic rebound from the pandemic, which has raised the prospect of central banks reining in their monetary stimulus.

- Sales of gold bracelets, pendants, earrings, and necklaces that draw on dragons, phoenixes, peonies and other traditional Chinese patterns and symbols, are flying among consumers, especially those in their 20s and 30s, reports Reuters. The popularity among millennials is helping drive a rebound in gold demand in the country after a pandemic-induced slump. An e-commerce boom and national pride are fueling the rise in demand for what is known as heritage gold jewelry, which requires intricate craftsmanship and can command premiums of 20% or more over conventional gold jewelry, industry executives say.

- Impala Platinum Holdings Ltd. announced a four-fold increase in its dividend after surging platinum prices yielded a record profit. The final dividend of 9.8 billion rand ($680 million) brings the total payout for the year to the equivalent of about 50% of free cash flow.

Weaknesses

- The worst performing precious metal was palladium, which finished the week essentially unchanged in price. Australia’s gold production was 157 tons in the first half of 2021, four tons more than China’s output in the same period, according to Surbiton Associates. China’s gold output was adversely affected by accidents and resulting shutdowns, director Sandra Close said in a statement.

- Centerra Gold Inc. is claiming that a Kyrgyz open-pit mine it once ran has flooded and poses safety and environmental risks, reports Bloomberg, although the government-appointed administrator says the water has always been there. There could be at least 40 meters of water at the bottom of the Kumtor central pit, the Canadian mining company said in a statement, citing photos on Kumtor Gold Co.’s website and a company video posted mid-August on Facebook.

- Gunmen attacked a convoy of Iamgold Corp vehicles traveling to the Essakane gold mine in Burkina Faso on Tuesday, reports Reuters, wounding one police officer before being repelled by the convoy's security detail, the Canadian mining company said. Following the attack, Iamgold has suspended convoys to and from Essakane, which is the company's biggest operating mine and is near the border with Niger.

Opportunities

- K92 Mining reported its latest batch of assay results from its ongoing drilling program on the Judd vein system at the Kainantu Mine. These 17 holes, part of the initial drill program at Judd, showcase high-grade intercepts over a strike length of 650 meters, thus defining an area of notably high-grade mineralization with solid thickness. Silver X Mining reported channel samples from its Tangana 1 vein of up 70.88 grams per ton gold over 0.95 meters, 1,675 grams per ton silver over 0.95 meters, 7.37% lead over 0.60 meters, and 6.75% zinc over 0.80 meters. The sampling program now extends the mineralized horizon by 120 meters and vertically another 200 meters in depth.

- Veteran investor Mark Mobius says investors should have 10% of a portfolio in gold as currencies will be devalued following the unprecedented stimulus rolled out to fight the coronavirus pandemic. At this stage, “10% should be put into physical gold,” said Mobius, who set up Mobius Capital Partners after more than three decades at Franklin Templeton Investments.

- After 14 years of trailing China, Australia is poised to be the world’s largest gold producer this year. In the first half of 2021, Australia produced 157 tons of gold versus 153 tons in China. Exploration successes like De Grey Mining’s Hemi gold project and Chalice Mining’s Julimar Nickel Copper-PGE project are world class mineral discoveries formed in Australia in recent years.

Threats

- Sibanye Stillwater CEO Neal Froneman said palladium could decline to about $1,000 an ounce after 2025, as automakers switch to using more platinum in auto catalysts used to curb pollution from vehicles. “Palladium is somewhat at risk post-2025 and in addition, as the demand drops off, there are a number of new palladium-rich projects coming into production,” he said. “If demand falls and supply increases, the prices will drop, they will probably drop down to levels of around $1,000 an ounce”

- Around 28% of Brazilian gold exports in 2019 and 2020 likely came from illegal mines, a report by public prosecutors and the Federal University of Minas Gerais found, pointing to widespread forging of documents and lack of effective law enforcement. This gold production is unregulated, and mercury is typically used to extract the gold, creating an environmental risk.

- Nevada lawmakers on the final day of the 81st Legislative Session set in motion a significant shift in tax policy toward an industry that has long been scrutinized for having a unique constitutional carve-out protecting it from tax hikes. Assembly Bill 495 was a bipartisan compromise forced by multiple proposed ballot questions aimed at some of the most politically powerful industries within the state. The bill would create a new excise tax on gold and silver mining companies with more than $20 million in gross revenue annually. Gross revenue between $20 million and $150 million would be taxed at 0.75% and gross revenue above $150 million would be taxed at a rate of 1.1%.