The gold miners’ stocks continue to grind lower in their latest correction, leaving increasingly-bearish sentiment in their wake. Even contrarian traders have mostly abandoned this high-potential sector. But the leading gold-stock benchmark has just converged with two key support zones. After the last time this happened, major gold stocks quickly rebounded over a third higher. So today looks like a good buying opportunity.

Stock trading is simple conceptually, buy low then sell high. But this plain mission is difficult to execute for the vast majority of traders. They get caught up in herd sentiment, leading them to do the opposite. Exciting popular greed as sectors top seduces them into buying high, the exact wrong time. Then after the subsequent sentiment-rebalancing selloffs, excessive prevailing fear scares them into selling low for big losses.

Buying low then selling high requires overcoming our own emotions to trade when we least want to. The worse a sector feels after a sizable selloff, the greater the odds it is bottoming ahead of a major rally. So the gold stocks languishing really out of favor and mired in apathy today is a bullish omen. We’ve been buying aggressively in recent weeks to refill our newsletter trading books, trying to straddle this bottoming.

The dominant GDX gold-stock ETF remains this sector’s leading benchmark, and it has had a tough go this month. At worst as of mid-week, it has fallen a sizable 5.5% so far in June. That’s certainly material, so it’s no wonder traders have really soured on gold miners. Their latest grind lower has been fueled by gold’s own May pullback extending to a 2.7% June-to-date loss. GDX has amplified gold’s losses by 2.0x.

Interestingly that’s on the lower side, as the major gold miners of this ETF tend to leverage gold moves by 2x to 3x. So the gold stocks have actually somewhat outperformed the metal they mine this month. June’s demoralizing slogs lower are extensions of bigger selloffs that started in early May, which have been exacerbated by gold’s usual summer doldrums. June is the peak month of this seasonally-weakest spell.

One big reason traders usually fail to overcome their own greed and fear as we humans have a strong innate immediacy bias. Our worldviews are tainted by heavy overweighting of whatever is happening to us right now. You can be greatly blessed for years, then one bigger challenge arises and it feels like your world is crashing down around you. Traders view markets through a what-have-you-done-for-me-lately lens.

After long decades of actively speculating and writing financial newsletters, I’ve found the best antidote for this is simply maintaining perspective. Instead of allowing our perceptions of markets to overwhelmingly dwell on the present, we need to consider ongoing price trends within broader context. A 4% GDX down day like last Tuesday feels terrible, but when considered within the past six months or so it isn’t a big deal.

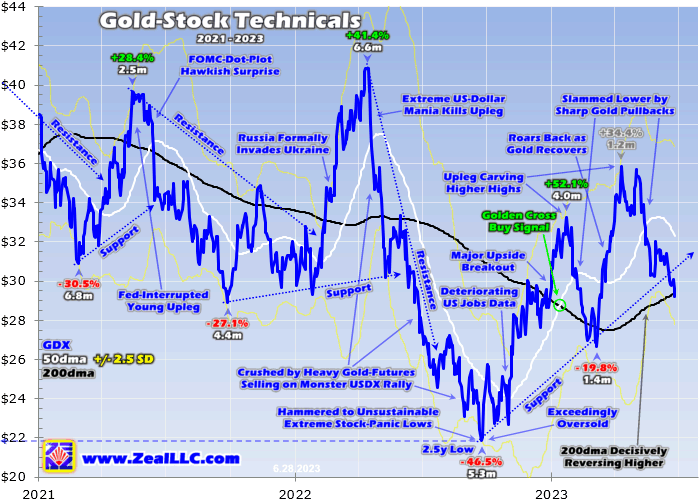

This basic GDX chart of the last few years or so really provides that essential framing. Yes gold stocks are correcting, and selloffs are painful to weather so they fuel increasingly-bearish sentiment. But from a more balanced longer-term perspective, this battered sector looks to be bottoming. That natural process prepares the way for the next big surge higher. So contrarian traders should be looking to buy, not ostriching.

Despite being increasingly abandoned since early May, the major gold stocks dominating GDX remain in a strong uptrend. They carved a major 2.5-year secular bottom in late September, after being crushed to extreme stock-panic-level lows. Since then they have powered higher in a major upleg, achieving both higher lows and higher highs since. At best in mid-April, GDX had blasted up an impressive 63.9% in 6.5 months!

But major uplegs are never clean linear affairs, they choppily advance taking two steps forward before retreating one step back. Traders’ collective greed-fear dynamic is the reason. After big surges greed grows excessive, threatening to pull in too much near-future buying too soon which prematurely exhausts and slays uplegs. So sharp corrections following those big surges eradicate greed to restore balance.

This major upleg’s initial big surge ran from late September to late January, where GDX racked up big 52.1% gains in just 4.0 months. That was largely a necessary V-bounce out of last summer’s extreme selloff. The major gold stocks’ big gains were fueled by gold’s underlying powerful 20.2% rebound during roughly that same span. So GDX’s upside leverage to gold ran 2.6x, right in the middle of that 2x-to-3x range.

But gold had rallied so far so fast it was getting really overbought, stretched way up above its baseline 200-day moving average. That was stoking excessive greed, so odds increasingly favored a mid-upleg selloff to rebalance sentiment. A sharp-yet-healthy pullback erupted in February, which quickly dragged the gold stocks down with it. GDX amplified gold’s 7.2% pullback by 2.8x to a 19.8% correction over 1.4 months.

This upleg’s first big one-step-back retreat really accomplished its mission of eradicating greed. After that selloff, gold-stock sentiment waxed pretty bearish in late February to early March. Traders figured this sector would keep grinding lower on balance, so they capitulated and sold low. Yet GDX was converging with two key support zones simultaneously, its upleg’s uptrend support and its more-important 200dma.

200dmas are ideal technical baselines from which to measure overboughtness and oversoldness. They gradually follow their prices as prevailing levels change, yet they move slowly enough to distill out all that daily volatility that so kindles traders’ greed and fear. These key technical lines often prove strong support for major selloffs within ongoing uplegs, heralding reversals. Minor selloffs tend to bounce higher near 50dmas.

Trend-line support zones are important too, yet they are somewhat subjective and often hand-drawn. But 200dmas are hard empirical data that is universally recognized. So technically-aware contrarian traders are more likely to resume buying with 200dma approaches. That indeed happened in GDX a few months ago soon after it converged with those two key support zones. Gold stocks’ upleg resumed in a sharp surge.

Over the next 1.2 months into mid-April, GDX blasted up another 34.4%! The resulting higher high really solidified this upleg’s strong uptrend. Those big gold-stock gains were fueled by a parallel 12.6% surge in gold in a similar span. The gold stocks amplified their underlying metal’s gains by 2.7x during that latest run higher. Their overall entire-upleg leverage to gold clocked in at 2.5x then, GDX’s 63.9% to gold’s 25.7%.

That second two-steps-forward surge of fast gains drove flaring popular greed and left both gold and GDX seriously overbought. They were stretched way up to 1.138x and 1.295x their 200dmas respectively! The big question then was whether these uplegs were climaxing after exhausting their potential buying, ready to give up their ghosts. Several factors argued they still had room to run after more rebalancing selloffs.

First although overboughtness was serious it hadn’t yet stretched to historical upleg-slaying levels. Over the last five years ago, the extreme-overboughtness thresholds for gold and GDX started over 1.16x and 1.35x their 200dmas. Both remained well shy of those warning signs in mid-April! Second gold rallied to a subsequent higher high in early May, so its own upleg driving gold stocks’ definitely didn’t peak a month earlier.

Third up 25.7% at best in mid-April, gold was enjoying its strongest upleg by far since the last big ones peaked in 2020. Once gold uplegs grow to major status, they tend to take on lives of their own as traders love chasing upside momentum. Gold’s last two similar uplegs grew much larger to 42.7% and 40.0% gains on massive investment buying! There hasn’t been much of that yet in today’s upleg, giving it room to run.

And if gold’s driving upleg didn’t terminally peak in early May up 26.3%, then the selloff since is another healthy mid-upleg pullback. And gold’s total selloff so far as of mid-week is just 6.9%, still a pullback well shy of the 10%+ correction threshold. That is right in line with this upleg’s previous 7.2% pullback into late February, after which gold surged sharply to major new upleg highs. If gold’s upleg isn’t over, neither is GDX’s.

At worst as of mid-week, GDX’s own latest correction is running 18.5% which is normal 2.7x downside leverage to gold. Gold’s pullback probably wouldn’t have lasted this long if not for the summer doldrums. June has long proven the weakest time of the year seasonally for gold and its miners’ stocks, devoid of any outsized recurring demand surges. Gold’s initial $1,941 pullback low in late May held for several weeks.

Gold and gold stocks were both stabilizing and starting to advance again in early June, holding their own until last Tuesday when some crazy-improbable Fed-hawkish economic data drove a minor breakdown to new pullback lows in the metal. That’s why these pullbacks have re-intensified over the week or so since. But just like in early March, GDX has again converged with both its upleg’s uptrend support and its 200dma.

That doesn’t guarantee gold stocks will bounce sharply from here, but it really ups the odds they are in the process of bottoming ahead of another big surge higher. While fear abounds after this latest selloff, these technicals are really bullish. That’s why we’ve been boldly buying new gold-stock trades low to refill our newsletter trading books. Buying low requires deploying capital when sectors don’t look or feel good.

Gold stocks are likely to soon resume powering higher on balance growing this upleg because gold itself does. Gold uplegs are driven by three sequential telescoping stages of buying. This upleg’s initial stage-one gold-futures short-covering buying is spent. But a whopping 5/6ths or so of its much-larger stage-two gold-futures long buying remains! Speculators have only bought longs 1/6th up into their likely trading range.

If you want to get up to speed, I analyzed all this in depth a couple weeks ago in another essay on gold bottoming despite the hawkish Fed. I also cover the latest spec gold-futures positioning and its near-term implications for gold in all our subscription newsletters. These super-leveraged traders who bully around gold prices still have huge room to buy in. Gold’s upleg likely won’t fail before long buying exhausts itself.

And gold’s ultimate stage-three investment buying has barely even started. Those monster 42.7% and 40.0% gold uplegs cresting in 2020 were fueled by enormous identifiable investment buying. The best high-resolution daily proxy for that is the combined holdings of the mighty world-dominant GLD and IAU gold ETFs. Their bullion soared 30.4% or 314.2 metric tons during the first and 35.3% or 460.5t in the second!

Surprisingly still at best in today’s strongest gold upleg since those, GLD+IAU holdings have only climbed a tiny 4.3% or 58.2t between mid-March to late May! So investors still have vast room to buy and chase gold’s upside momentum. That will likely be rekindled by Fed-dovish news, either the FOMC nearing the end of its extreme rate-hike cycle or big downside surprises in key economic data, sparking gold-futures buying.

The end of the summer doldrums will play a role too, as Asian harvest buying ramps up pushing global gold prices higher. That starts in July then accelerates in August. During gold’s modern bull-market years over the past couple decades or so, gold has averaged 0.2% losses in June before excellent 1.1% and 1.8% average gains soon follow in July and August! So gold and gold stocks are poised to resume climbing.

Another reason gold stocks look really bullish at this seasonal-low buying opportunity is their upcoming Q2’23 earnings season. As analyzed in last week’s essay, quarterly-average gold prices surged up to a record high this quarter while many major gold miners are forecasting lower mining costs. That should really boost their earnings, leaving gold stocks even more undervalued relative to prevailing gold prices.

So with gold stocks at key support zones, today sure looks like a good time to buy low technically. This sector is really out of favor with fear and apathy abounding, thus bearish herd sentiment also implies gold stocks are bottoming. Maintaining this essential perspective for context is enabling us to aggressively add trades in great fundamentally-superior mid-tier and junior gold miners at some excellent bargain prices!

Successful trading demands always staying informed on markets, to understand opportunities as they arise. We can help! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

Our holistic integrated contrarian approach has proven very successful, and you can reap the benefits for only $12 an issue. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential. Sign up for free e-mail notifications when we publish new content. Even better, subscribe today to our acclaimed newsletters and start growing smarter and richer!

The bottom line is gold stocks have converged with two key support zones, really increasing the odds their latest mid-upleg pullback has largely run its course. This healthy selloff accomplished its mission of rebalancing sentiment, eradicating excessive greed. That paves the way for gold-stock traders to return in force, driving this upleg’s next big surge higher. Gold’s own imminent resuming rallying will fuel their buying.

Gold is exiting June’s summer-doldrums seasonal slump, with both gold-futures speculators and investors still having huge buying firepower left. The former will flock back as Fed hawkishness wanes with this epic rate-hike cycle mostly behind us. The resulting big gold gains will entice investors back to chase them. As gold’s interrupted upleg starts powering higher again, capital will flood into gold stocks with a vengeance.

Adam Hamilton, CPA

June 30, 2023

Copyright 2000 - 2023 Zeal LLC (www.ZealLLC.com)