The precious metals sector performed poorly during the last three bear markets in stocks. Those include 2022 during initial Fed tightening, the Covid crash of spring 2020, and the heart of the global financial crisis in autumn 2008.

Investors steadfastly believe that precious metals will decline during the next economic downturn. History has solidified their view.

However, we are talking about recent history.

Investors are succumbing to recency bias, a cognitive bias that favors recent events over historical ones and gives greater importance to the most recent events.

Hence, because of what transpired over the past 15 years, everyone is convinced that precious metals will decline when the stock market crashes.

Investors are neglecting the 2000 through 2002 period when Gold, gold stocks, and, to a lesser degree, Silver, negatively diverged from the stock market.

Furthermore, investors neglect the stagflationary 1970s when a negative correlation between precious metals and stocks persisted.

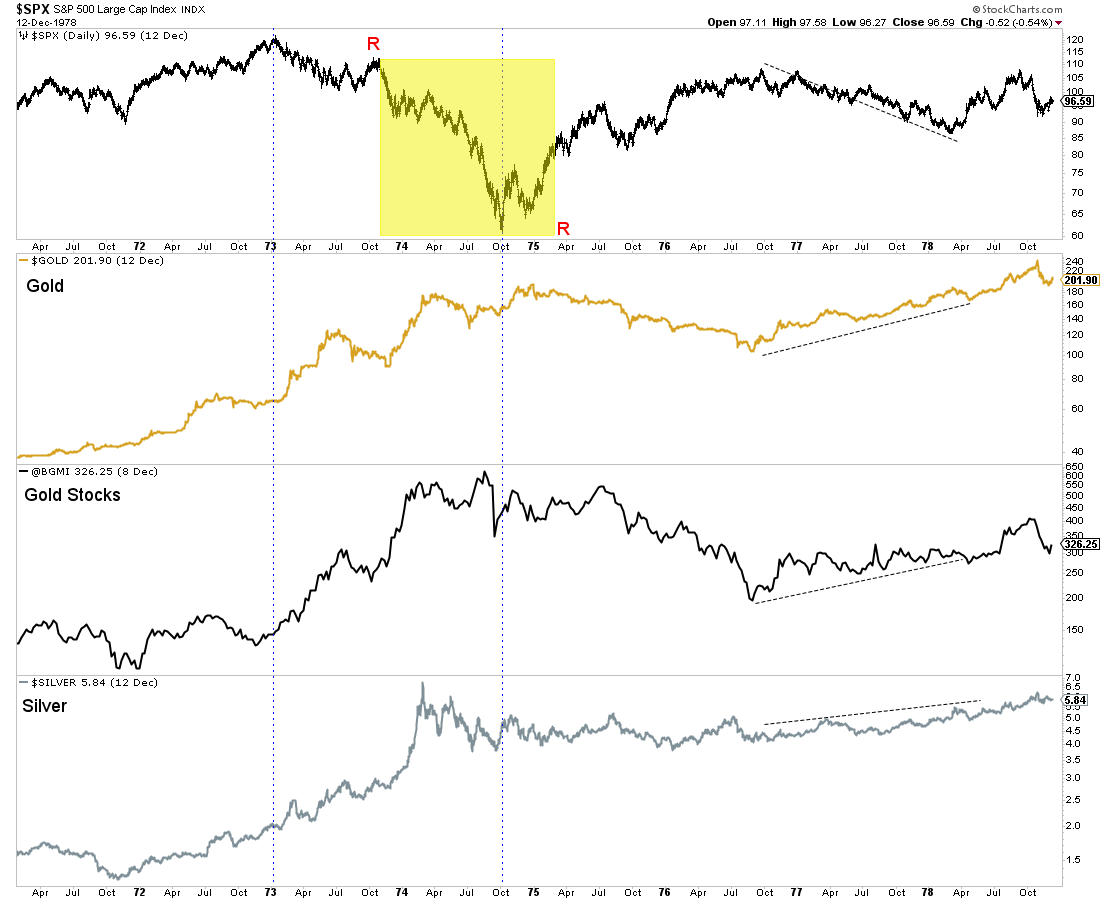

The negative correlation was especially sharp from 1973 to 1977.

From 1973 through 1974, the stock market lost half its value. Precious Metals exploded higher.

From the end of 1972 into mid to late 1974, Gold gained as much as 240%, Silver surged 315% and the Barron's Gold Mining Index exploded by almost 400%.

The big downturn in precious metals in 1975-1976 (45% decline in Gold and 60% decline in gold stocks) transpired after inflationary pressures subsided and the economy recovered.

Gold has broken out, and Silver is in the process of breaking out just as storm clouds (stagflation) gather on the horizon.

Fear of the 2008 Boogeyman is very strong, but if you think precious metals will get hit, you are misreading the situation. A repeat of 1973-1974 is far more likely.

Gold is only two months into its most significant breakout in 50 years. This will carry Silver much higher. The outperformance from junior gold and silver stocks is just starting.