A wild week in the stock market has come to a close. There have been rumblings of Reddit, and Reddit like traders (whose goal is to screw over shorts) try to put the squeeze on silver. Maybe but it won't work. Unlike the funds that were squeezed shorting Gamestop and AMC, the silver shorts are large commercial banks with far more capital at their disposal. But we could see it in silver stocks. The anticipation may have bled into the great performance of First Majestic this week. However, silver had a strong week, and the company won a small victory in the ongoing dispute with the Mexican tax authorities. Based on the silver price and its peer group, First Majestic is very expensive, reaching a market cap of over $4.1B. For example, Pan-American has a $6.8B market cap but produces about twice as much silver and over 500-550k oz. of gold (in 2020/21). It also has unapparelled optionality (amongst silver companies) with Escobal (permitting stage and will take 6-9 months to re-commence operations, producing 18m+ oz. of silver annually @ AISC of $9-$10/oz) and Navidad (massive silver resource and when in production will produce approx 12-15m oz. Ag p.a.).

Despite the strong rally in the mining stocks on Thursday and Friday, gold continues to look weak technically and looks like it will continue to trade down or sideways in the near-term.

$ABRA.V, $AGI, $BSR.V, $EDV.TO, $EXK, $F.V, $GORO, $GBR.V, $MAG, $MAI.V, $SKE.TO, $AUY

AbraPlata Resource Corp: Announced the latest assays from five drill holes at the Oculto deposit. These intercepted significant near-surface silver and gold mineralization at its flagship Diablillos project. Highlights include:

- 3m @ 1.52 g/t Au

- 15.5m @ 1.85 g/t Au

- 1m @ 2.19 g/t Au

- 61m @ 1.13 g/t Au & 105 g/t Ag

- 53m @ 1.27 g/t Au & 103 g/t Ag

- 13m @ 2.03 g/t Au & 141.6 g/t Ag

Alamos Gold: The good news keeps coming for Alamos Gold’s Island Gold project and what has become its most valuable asset. The following drill results (from surface and underground) extended high-grade gold mineralization in Island Main, East, and West.

Island East:

- 6.54m @ 32 g/t Au

- 5m @ 15.75 g/t Au

Island Main:

- 5.89m @ 18.64 g/t Au

- 2m @ 36.4 g/t Au

Island West:

- 2m @ 72 g/t Au

Bluestone Resources: The company provided an update on its activities in 2020 and the outlook for 2021. In 2020, a project readiness update was undertaken, which involved a thorough review of the current mine plan, engineering, process flow sheet, and capital and operating cost estimates. This will be further optimized after completing an updated MRE and mine plan to incorporate the 2020 drill program. 2020 highlights included:

- $30m credit facility (which will likely be increased when construction activities ramp-up)

- Completion of C$92m equity financing

- Technical, environmental, and social due diligence for the Project finance banks

- Jack Lundin appointed as CEO

- Basic engineering completed

- 15k meters of infill drilling that returned the highest-grade intercept ever drilled at the Project.

Highlights of the interim update are preliminary, incorporating results of the basic engineering and various optimization and trade-off studies.

- Average annual gold production in-line with the 2019 FS

- Average LOM AISC @ sub-$675/oz.

- Initial capital costs of $225m

Both initial capital costs and operating costs (AISC) are higher relative to the FS, but the project is still very robust. The project has significant upside both from a production and mine life point of view.

Endeavour Mining: Reported record Q4 production of 344k oz. Au (+41% increase) vs. the previous quarter @ AISC of $770/oz. 2020 production was 908k oz., also a record. In 2021, Endeavour will set another record for production, driven by the assets in the Teranga acquisition [Sabodala-Massawa, Wahgnion], partially offset by the sale of the Agabou mine. Endeavour provided 2021 guidance, but that excludes the Teranga acquisition, which should be closed within the next 3-weeks. Potential 2021 catalysts include more institutional buying as it announced its inaugural dividend to be paid on February 5th, the pre-feasibility study (PFS) for Fetekro and Kalana.

Endeavour Silver: The company provided 2021 production and cost (capital costs, exploration budget, operating costs) guidance. This is highlighted by:

- Silver production of 3.6-4.3m oz. and gold production of 31-35.5k oz.

- Cash costs and AISC of $7-$8/oz. and $19-$20/oz.

- Costs will be higher relative to 2020 due to higher royalty and mining duty payments. This isn't much higher than usual as Endeavour isn't a low-cost production, but its costs should drop a fair amount once Terronera is built.

- $32.8m will be invested in capital projects, including $16.7m @ Guanacevi (development of 6.8km's of mine access at the Milache, SCS, and P4E orebodies and upgrading mining fleet), $14.1m @ Bolanitos ($7.8m for 5.3km of mine development to access reserves and resources in the Plateros-La Luz, Lucero-Karina and Bolanitos-San Miguel vein systems and $5.9m to upgrade the mining fleet).

- The FS for Terronera is being prepared, including the results of additional engineering studies and revised cost estimates. Endeavour could have moved the project more quickly, and, unfortunately, the company won't benefit from Terronera operating for a longer period of time during this bull market. 50,000m of drilling are planned for 2021, 16k meters @ Terronera, and 11.5k meter each at Guanacevi and Bolanitos, with the remaining 11k meters to be drilled at Parral and Paloma (in Chile).

Fiore Gold: The company reported drill results from its Gold Rock Project in Nevada. The company continues to expand oxide mineralization. Highlights from the 29-holes drilled include:

- 15.2m @ 1.14 g/t Au

- 19.8m @ 1.33 g/t Au

- 12.2m @ 1.61 g/t Au

- 12.2m @ 1.75 g/t Au

Gold Resource Corp: Released Q4 and FY 2020 production results. With its Nevada Mining Unit (NMU) spin-off via Fortitude Gold, the company can focus on its prospective Mexican operations. Excluding the NMU, the company produced 20.4k oz. Au and 1.2m oz. Ag [operations were impacted in Q2 due to the mandated suspension of mining operations], with Q4 output of 6.85k oz. Au and 277k oz. Ag. The company can be more aggressive regarding exploration and mine development given its debt-free balance sheet and $25.4m in cash. Growth should be forthcoming in 2022, if not shortly thereafter.

Great Bear Resources: As the company continues to advance what is looking like a tier-I deposit, the company reported 97% recovery rates from the Dixie Limb zone metallurgical testing. The Dixie Limb zone contains both low and high sulphide content mineralization types. Dixie Limb zone mineralization with low accessory sulphide content within quartz veins is indistinguishable from the adjacent hinge zone mineralization, which has yielded 95-97% recovery rates. Gold recoveries were high for both high sulphide and low sulphide samples. Finally, ground material had recoveries of 96.10% vs. 93.1% for more coarsely ground material. Fast gold dissolution kinetics and slightly higher gold recoveries were exemplified in samples treated with lead nitrate (96.7% and 96.9% vs. 96.10%). Increased cyanide concentration led to even higher recoveries of 97.50%.

MAG Silver: Reported Q4 production from Juanicipio. Production will remain negligible until the Juanicipio mill's commissioning, which has been pushed back a few months due to some infrastructure contracts that have been delayed due to CV-19 and related CV-19 preventative measures. Until such time, Fresnillo will process approx. 16k tons per month at the Fresnillo mill. MAG has started generating cash flow that will offset Capex. It continues to gain valuable metallurgical understanding, which will make for a smooth transition when processing material at the Juanicipio mill. In Q4, attributable production for MAG Silver was 100k oz. Ag and 195 oz. Au, which brings total 2020 attributable production to 274k oz. Ag and 463 oz Au. This slight delay isn't surprising given the project's scope and considering the mine was built ahead of schedule.

Minera Alamos: Provided a construction update at its Santana mine, Mexico. Construction activities continue with the leach solution ponds fully lined and ready for operations, the plant foundation has been completed. All plant structures have been delivered to the site, the majority of civil works for the heap leach pad area have been completed, and the liners' installation has commenced. The crushing system acquired for future expansions at Santana or Cerro de Oro is in transit from the U.S. to Sonora's staging facilities.

Skeena Resources: Additional drill core results from the Phase II campaign at Eskay Creek include the following highlights (Infill Drilling):

- 2.79m @ 22.23 g/t Au + 1,605 g/t Ag

- 6.45m @ 20.92 g/t Au + 258 g/t Ag

- 10.75m @ 8.50 g/t Au + 182 g/t Ag

- 4.10m @ 23.13 g/t Au + 613 g/t Ag

- 12.75m @ 5.74 g/t Au + 247 g/t Ag

- 71.85m @ 5.38 g/t Au

- 25.50m @ 8.82 g/t Au

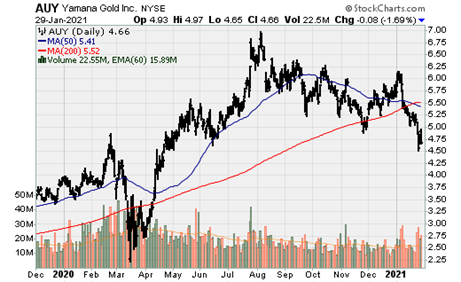

Yamana Gold: Q4 production totaled 221k oz. Au and 2.6m oz. Ag and full-year 2020 production totaled 779k oz. Au and 10.37m oz. Ag. CV-19 related suspensions did impact the company, notably at Cerro Moro. Yamana also provided 2021-2023 guidance as well as a 10yr outlook. Guidance for the next three years are as follows:

- 862k oz. Au + 10m oz. Ag

- 870k oz. Au + 9.36m oz. Ag

- 889k oz. Au + 8m oz. Ag

Using a 70:1 gold-to-silver ratio (GSR), GEO production in each of the next 3yrs is projected to be 1m oz.