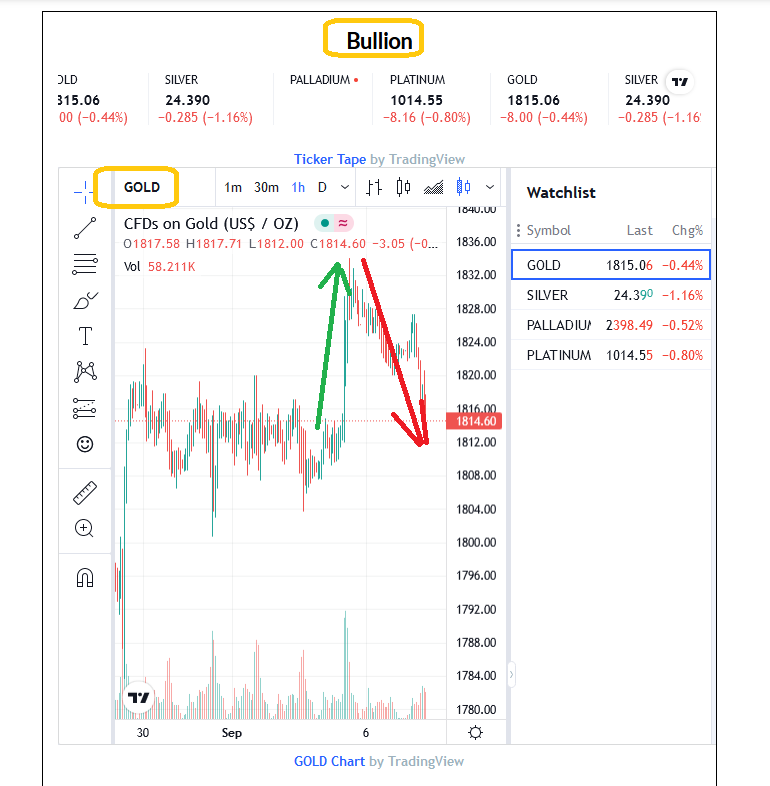

- Gold rallied strongly after Friday’s jobs report was released, but all the gains have been lost.

Double-click to enlarge this short-term gold chart. Gold tends to consistently retrace most violent rallies and declines… and often quite quickly.

Double-click to enlarge this short-term gold chart. Gold tends to consistently retrace most violent rallies and declines… and often quite quickly.- Tuesdays are often a down day for the metals and today that mantra is in play.

Double-click to enlarge this medium-term gold chart. A dip to $1750 would be disappointing, but it would only add to the already very-positive look of this chart.

Double-click to enlarge this medium-term gold chart. A dip to $1750 would be disappointing, but it would only add to the already very-positive look of this chart. - I urge all gold market investors to begin their day by drawing an “arrow of disappointment” on the gold chart.

- When I start my day expecting to be disappointed, I often am, but it’s not a surprise. That helps me stay firmly focused on key chart levels and the big picture.

Double-click to enlarge this spectacular long-term gold chart. An enormous “once a decade” opportunity may be at hand for investors, as a gargantuan inverse H&S bull continuation pattern nears completion.

Double-click to enlarge this spectacular long-term gold chart. An enormous “once a decade” opportunity may be at hand for investors, as a gargantuan inverse H&S bull continuation pattern nears completion.- The price drivers are solid and have synergy:

- Indian gold imports are surging again and the world’s “fear trade headquarters” (America) looks set to fall into a disturbing stagflationary gulag that could be much bigger than 1966-1980… because the debt to GDP ratio is so much bigger.

- An ominous war cycle (both civil and global) for 2021-2025 adds to the bullish posture for gold.

- The bottom line: All the technical, fundamental, and cyclical stars are aligned, for a 2022 breakout and journey towards my $3000 target zone!

Double-click to enlarge this Nasdaq ETF moving averages chart. The annual Sept/Oct “crash season” is upon us, and a sell signal on the short-term moving averages would be an initial “Get out of Dodge” warning.

Double-click to enlarge this Nasdaq ETF moving averages chart. The annual Sept/Oct “crash season” is upon us, and a sell signal on the short-term moving averages would be an initial “Get out of Dodge” warning.- The SP500 PE ratio is in nosebleed territory at about 35, yet the Fed still talks about the need to provide rich stock market investors with more “liquidity” (welfare handouts for the elite).

Double-click to enlarge this long-term Dow chart. Bloomberg stock market analysts note that the Dow is about 40% higher than the 60MMA (60 month moving average).

Double-click to enlarge this long-term Dow chart. Bloomberg stock market analysts note that the Dow is about 40% higher than the 60MMA (60 month moving average). - They expect the market will “normalize” by falling to that moving average (currently at about 26,000).

- I’ll simply highlight the madness of giving rich stock market investors QE welfare money handouts while the nation’s sick and elderly get nothing.

- Ben Bernanke, Janet Yellen, and Jay Powell have been incredibly successful at creating substantial inflation…. in the stock, bond, OTC derivative, and real estate markets where they put all the money they printed.

- They have been equally successful in deflating the average citizen, something that appears deliberate given that the average citizen got none of the printed money.

- The bottom line: The Fed doesn’t need an audit. It needs to be shut down.

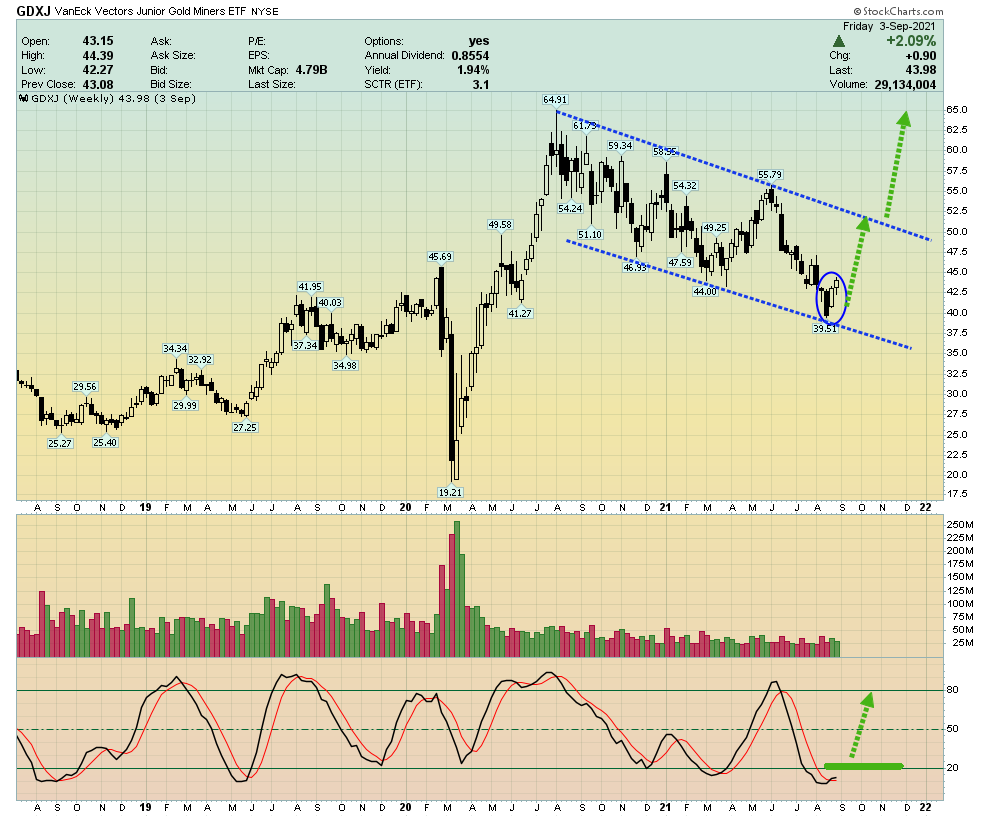

Double-click to enlarge this weekly GDXJ chart. I’ve highlighted the bullish posture of the 14,5,5 Stochastics oscillator at the bottom of the chart.

Double-click to enlarge this weekly GDXJ chart. I’ve highlighted the bullish posture of the 14,5,5 Stochastics oscillator at the bottom of the chart.- A gold bullion dip to $1750 would create a “flat line” event for the oscillator. The good news:

- That’s only a minor concern, and a Stochastics move above the 20-line should usher in the start of one of the greatest rallies in the history of mining stocks.

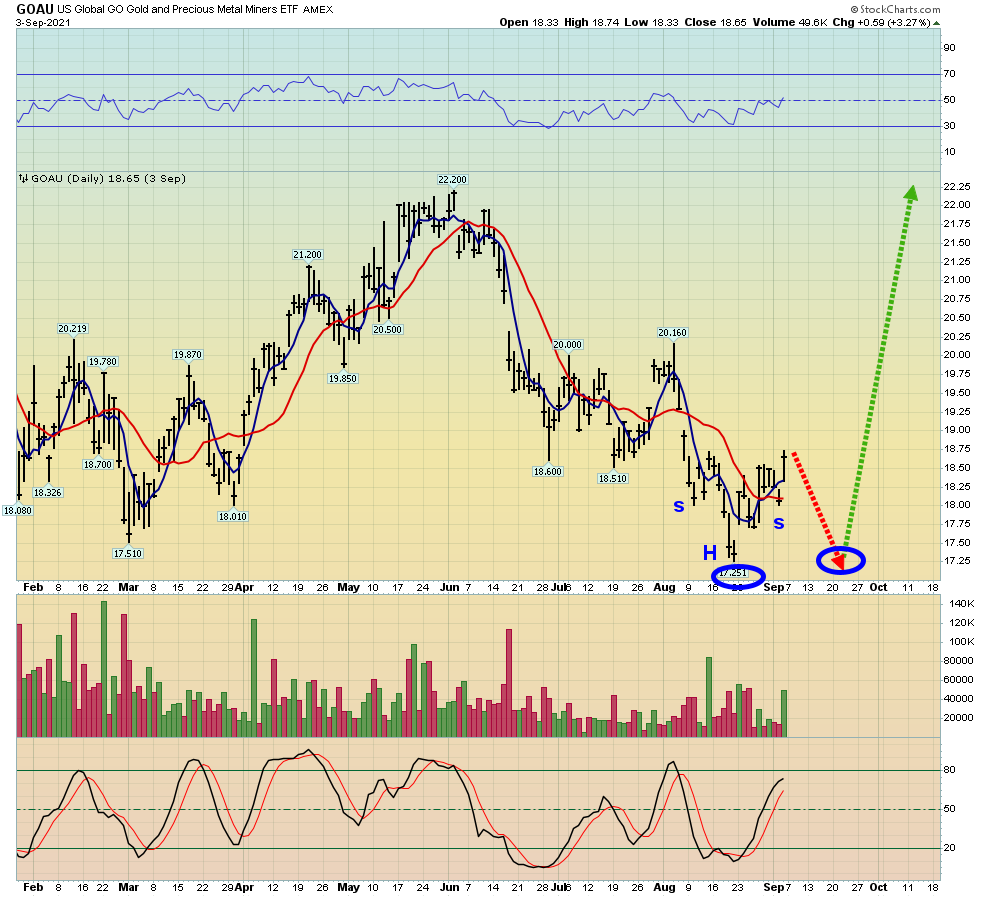

Double-click to enlarge this daily GOAU chart. Small inverse H&S bottom patterns often become part of a larger double bottom scenario, and that could be what is happening with a lot of mining stocks now.

Double-click to enlarge this daily GOAU chart. Small inverse H&S bottom patterns often become part of a larger double bottom scenario, and that could be what is happening with a lot of mining stocks now.- With their trusty “arrows of disappointment” drawn on the short-term gold and mining stock charts, savvy investors can stay laser-focused on the fabulous long-term cyclical, fundamental, and technical picture… a picture that is set to become even more fabulous in the years ahead!

Thanks!

Cheers

St