The gold to oil ratio is an important indicator of the global economy’s health.

Because gold and crude oil are both denominated in US dollars, they are strongly linked. That is because as the US dollar rises, commodities priced in USD fall, and vice versa. As the dollar drops, commodities generally go up.

Another important link between gold and oil is inflation. Because energy comprises about one-third of the Consumer Price Index (CPI), when crude oil rises it impacts inflation. Gold being a traditional inflation hedge, it follows that as higher oil prices lead to increased inflation, the gold price goes up, as more investors buy gold to diversify out of inflation-losing assets like bonds and cash.

Gold and oil are further related in that a spike in oil prices dampens economic growth, because so many industries depend on it and its derivatives as a fuel source, i.e., natural gas, gasoline and diesel.

(Diesel fuel is a major input for gold mining operations, therefore as fuel costs rise, so does a producer’s costs per ounce, which can lead to lower output. If this happens across the industry, lower gold supply versus demand will hike prices).

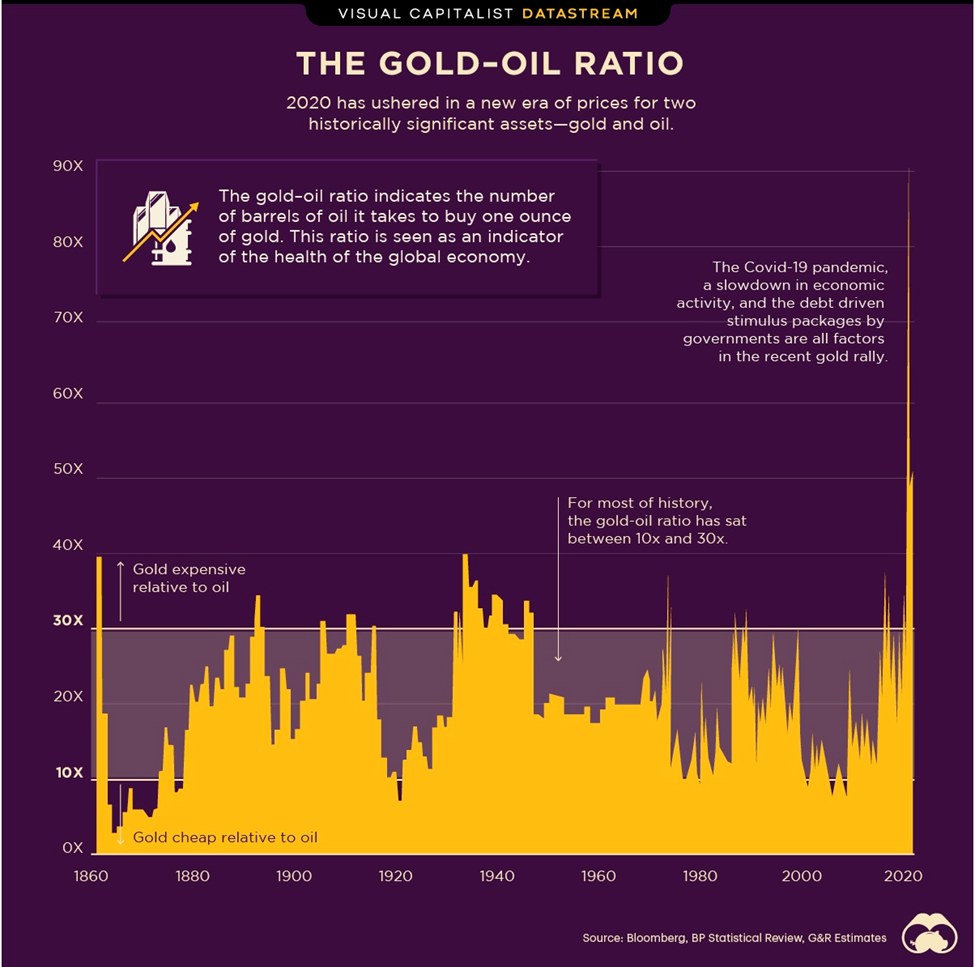

Source: Visual Capitalist

Source: Visual Capitalist

A drop in global growth, particularly in the two largest economies, the United States and China, might signal a recession is coming which is almost always bullish for gold prices.

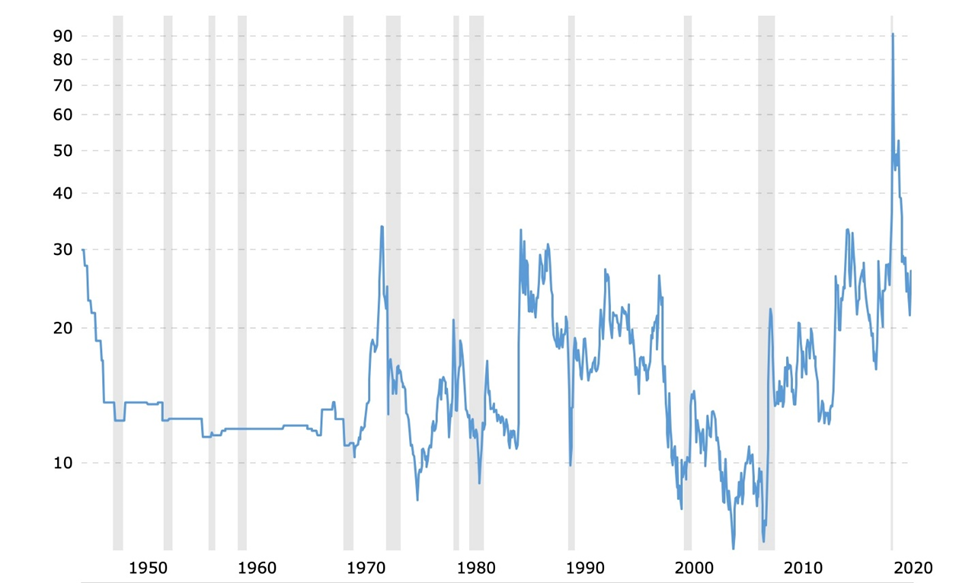

The chart below shows the historical ratio between the gold price and West Texas Intermediate (WTI) crude. Simply put, the gold to oil ratio is how many barrels of oil can be bought with an ounce of gold.

Historical gold to oil ratio. Source: Macrotrends

Historical gold to oil ratio. Source: Macrotrends

The chart is interesting for a number of reasons.

Notice that almost all of the low points in the chart, when the ratio was below the historical average of 16, correspond to recessions (gray bars). This makes sense due to the fact that crude oil declines go hand in hand with low economic growth.

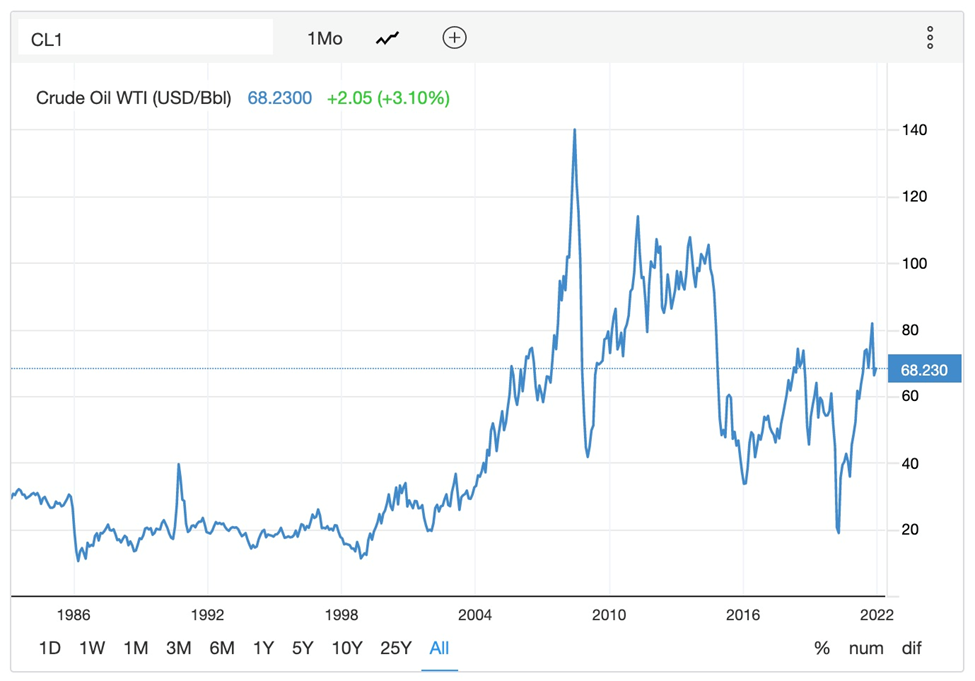

In September 1990 the gold to oil ratio was 9.84, it was 9.26 in January 2001, 6.64 in June 2008 and 22.06 in January 2009. What was happening to WTI crude and spot gold during these times? For the first two data points, both WTI and gold are relatively low — oil was $29/barrel and gold was $386/oz in September 1990; in early 2001, oil was $26 and gold was $266. In June 2008 oil was $139 and gold had risen to $871, squeezing the ratio to 6.64. However six months later, in January 2009, the ratio jumps to 22.06, as a result of oil falling to $42, and gold holding its own at $905.

Historical WTI. Source: Trading Economics

Historical WTI. Source: Trading Economics

Historical spot gold price. Source: Goldprice.org

Historical spot gold price. Source: Goldprice.org

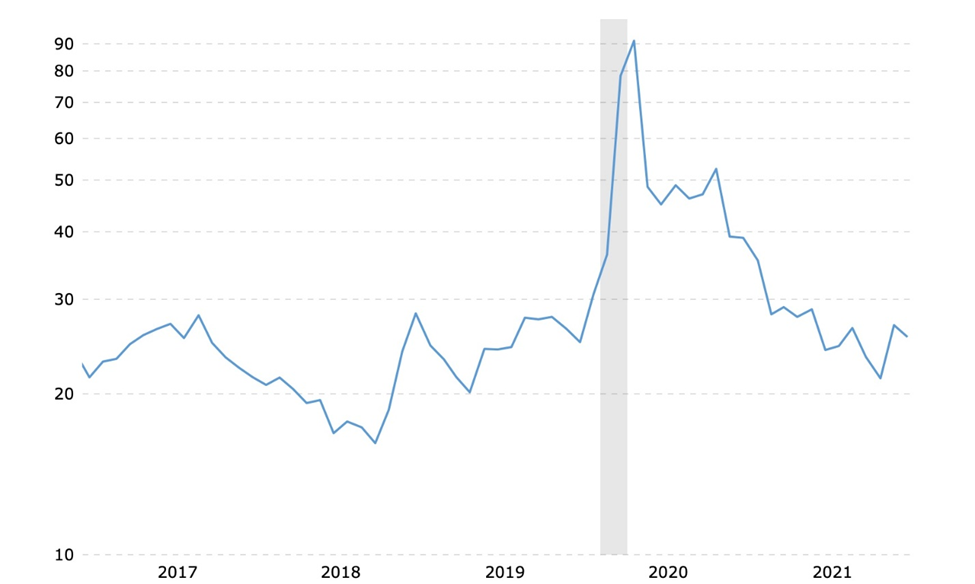

For what’s been happening with the gold to oil ratio recently, it helps to consult the five-year chart below. The ratio spikes to an “off the charts” 91 in April 2020, the worst month of the coronavirus pandemic, before recovering about half to 46.62 in May, from which point it continues to fall to the current December 2021 ratio of 25.5. The all-time high of 91 in April 2020 was a combination of plummeting WTI which at that time was $16.80 against a gold price of roughly $1,625. Remember oil usually falls during recessions and gold rises. However the covid-19 recession was extremely short-lived, depicted in the historical gold to oil ratio chart as a very thin gray line. As economies recovered, growth and oil demand surged, thus lowering the ratio. When gold hit its all-time high of $2,034 in August 2020, WTI was still floundering at around $32. It took a more than doubling of WTI over the next 15 months, and gold to fall around $200, for the ratio to revert back to 25, a long way from its historic high of 91 but still higher than its average 16.

5-year gold to oil ratio. Source: Macrotrends

5-year gold to oil ratio. Source: Macrotrends

Energy prices going ballistic

This year China and Europe experienced an energy crisis.

Flooding across China’s key coal-producing provinces, resurgent demand for Chinese goods in the wake of pandemic easing, and market distortions including power rationing and price controls, were behind an energy shortage that pushed coal and natural gas prices to record highs.

In Europe, a colder-than normal last winter depleted natural gas inventories, causing electricity prices to soar, as demand from rebounding economies surged too fast for supplies to match, BNN Bloomberg reported.

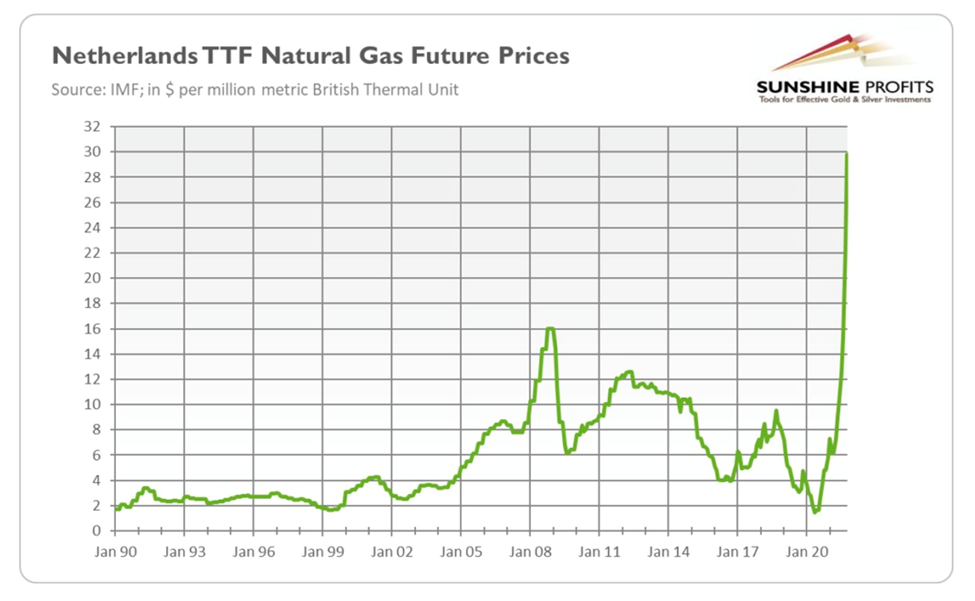

Natural gas futures hit a record earlier this year, climbing several times from their May 2020 lows, as the graph below by Sunshine Profits shows.

Source: Sunshine Profits

Source: Sunshine Profits

The price rise was not only due to last year’s depleted inventories and a cold autumn, but a faster than expected recovery from the pandemic, ultra-low interest rates and record-level government spending on pandemic relief that boosted spending and increased demand for energy.

More fundamentally, the decline in energy prices in response to the economic crisis of 2020 prompted many producers to stop drilling and later supply simply didn’t catch up with surging demand, Sunshine Profits states.

Oil reportedly extended gains to the highest in three weeks, last Thursday, as US crude stockpiles dropped the most since September.

The usual energy market dynamics are being overshadowed by the global transition from fossil-fueled energy generation to renewable power sources namely wind, solar and hydro.

As governments and institutional investors divest themselves of funds that traditionally flowed into fossil fuels, i.e. coal/ oil & gas producers, or pipeline infrastructure, they are trying to bring on renewables to replace the lost output. Read more here

However, with this year’s calm conditions in Europe generating little wind energy, and with no easy way to store the energy generated from renewables, utilities are finding they must continue to utilize “dirty” coal and NG, despite commitments to lessen their dependence on fossil fuels to fight climate change.

In fact according to new data from the International Energy Agency (IEA), global power generation from coal this year is forecast to soar 9%, to an all-time high of 10,350 terawatt-hours. Coal use is being driven by a huge increase in natural gas prices, with power plants sourcing coal as a cheaper alternative.

“The rebound is being driven by this year’s rapid economic recovery, which has pushed up electricity demand much faster than low-carbon supplies can keep up,” the IEA said, via Mining Weekly.

The organization notes that energy-intensive industries like cement and steel are expected to increase coal demand by 6% in 2021, and says a new record high could be set in 2022.

Asia dominates the global coal market with China and India accounting for two-thirds of demand.

“Coal is the single-largest source of global carbon emissions, and this year’s historically high level of coal power generation is a worrying sign of how far off track the world is in its efforts to put emissions into decline towards net zero,” said IEA executive director Faith Birol.

“Without strong and immediate actions by governments to tackle coal emissions — in a way that is fair, affordable and secure for those affected — we will have little chance, if any at all, of limiting global warming to 1.5 °C.”

In Europe, all eyes are on the weather as the northern hemisphere winter sets in, and how the cold could affect energy demand and supply.

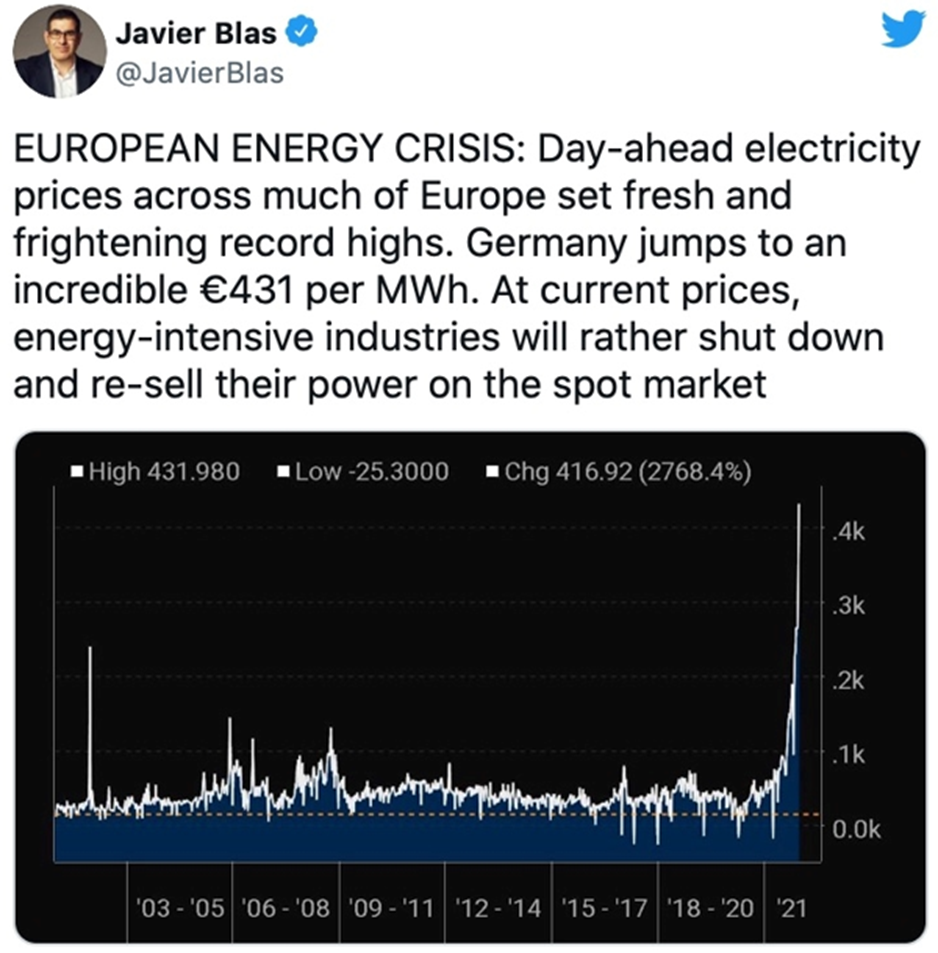

Natural gas prices in Germany and France are already at record highs while the weather is relatively mild; the forecast calls for colder than normal for the rest of December and into January.

Zero Hedge reports benchmark natural gas prices surged to a new high last week. German “day-ahead” electricity prices are at a record-high 431 euros per megawatt hour, while in France, power prices are at decade highs.

Bloomberg reports Surging energy prices are driving inflation and forcing gas-hungry industries to curb output. If it’s cold too, then rolling blackouts could be a last resort.

Analysts say it would only take a few degrees colder to trigger a market meltdown. The worry is that, while there is currently enough natural gas capacity to see the region through the winter, it could run out before the weather warms up.

Geopolitical tensions are also playing into the energy crisis. There is the potential for Russian gas destined for Europe to be curbed or halted completely if Russia invades Ukraine. A conflict could also further delay the start of the Nord Stream 2 pipeline linking Russia and Germany.

Commodities consultant Wood Mackenzie says if Russian gas exports stay at current levels, Europe’s storage sites will be 15% less full at the end of March, the lowest on record.

“We believe there is a high likelihood of both prolonged and even higher prices through winter with after-effects that could stretch beyond the next two years,” Bloomberg quoted Nathan Piper, head of oil and gas research at Investec Bank Ltd.

Making matters worse, a third of France’s nuclear capacity will be halted in January and three of Germany’s nuclear plants will be shut by the end of this month.

A wildcard is whether the surge in the omicron variant of covid-19 triggers lockdowns and curbs energy output.

For now higher energy prices are having an effect on European inflation. The European Central Bank is projecting 3.2% inflation in 2022 with 66% of that increase due to energy price gains. Persistent inflation in Britain was behind a decision last week to raise interest rates for the first time in three years.

Oil demand outstripping supply

At AOTH, we don’t see energy inflation stopping, due to what was mentioned previously — the lack of exploration spending on finding new sources of oil supply.

Trouble is, we’ve been so focused on expanding renewable energy, before it can actually replace fossil fuels, that we have virtually guaranteed oil (and natural gas) prices will stay high for the foreseeable future.

A very interesting Washington Post article has Saudi Arabia’s Oil Minister, Abdulaziz bin Salman, warning of a collapse in oil supply due to falling investment in fossil fuels:

The prince warned that worldwide oil production could fall by 30 million barrels a day by the end of the decade because there is not enough being spent on the exploration for and development of new resources. That implies production of less than 70 million barrels a day.

If Saudi Arabia is right, and stats by the IEA suggest it is, the article goes on to explain that the world’s affordable oil isn’t going to disappear anytime soon; and that despite its vast oil reserves, Saudi can’t supply the market all by itself.

Notwithstanding the global movement to electrification and decarbonization, Saudi Arabia does not see much of a reduction in oil demand — only around 9 million barrels of oil a day, or 9%. Even with COP26, the Saudi minister says the world will need about 90 million bod by 2030, leaving a shortfall of 22Mbod, more oil than was consumed by the US in 2019.

Where will this new supply come from? According to the article, Saudi Arabia, holder of the world’s largest oil reserves, only plans on adding another 1Mbod in the next few years. There are plans to bring on other big projects in places like Kazakhstan, Azerbaijan and Brazil, but with output from all the fields currently in production declining, at an average rate of anywhere from 4% to 8% a year depending whose estimates you take, you need a lot of investment just to stand still.

US shale oil producers will continue to frack away at their reserves, but by the end of next year, the United States is expected to be 760,000 bod below its pre-pandemic production peak:

The heady days of the first and second shale booms have passed.

Global expenditure on oil and gas projects slumped 30% to $309 billion in 2020 and has only recovered slightly this year. It needs to get back to near pre-pandemic levels of $525 billion a year for the rest of the decade to meet demand growth, according to Riyadh-based think tank the International Energy Forum and consultants IHS Markit…

We ignore those warnings at our peril. A 30-million barrel a day drop in oil supply might seem like a victory to the most short-sighted of environmental campaigners, but without an accompanying fall in oil demand, it will come with a price tag none of us can afford — oil prices at levels never before imagined.

(At AOTH, we have already written the real story of fracked gas. The US ‘Sultans of Shale’ have had it good for a long time, but the party in the Permian and other US oil shale basins is coming to an end. Not right away, but at most, the fast-depleting shale oil fields which produce via hydraulic fracturing and horizontal directional drilling, are likely to last another few years. 2020, Reuters reported that output from seven major shale formations is expected to decline by about 68,000 bopd, to 7.6 million bopd.

This is because shale oil wells are gushers in their first year, then deplete rapidly. Shale companies are therefore money losers because they have to keep ploughing more money into production just to keep output flat, a phenomenon known as “The Red Queen Syndrome.” Shale wells typically bleed off 70 to 90% in their first three years, and drop by 20 to 40% a year without new drilling.)

A recent report by earth scientist David Hughes confirms these findings. His Shale Reality Check 2021 rejects forecasts made by the US Energy Information Administration’s forecasts counting on shale for 69% of US oil production from 2020-50 and 77% of all US natural gas production in the same period. Of the 13 major plays he evaluated, Hughes rated the EIA’s production forecast for five as “moderately optimistic,” five as “highly optimistic” and three as “extremely optimistic”.

Energy inflation and gold

As for what surging oil and natural gas prices might mean for gold, Sunshine Profits notes that energy shortages will be a drag on GDP, with a slowdown in economic growth being positive for the precious metal especially if it brings us closer to stagflation, defined as low growth plus high inflation.

The publication also says higher natural gas prices could support high producer and consumer inflation. As we reported last week, US CPI was up 6.8% in November compared to a year earlier, while the latest PPI data point clocked in at 9.6% for November, year over year — close to double-digit inflation.

Another inflationary factor is power shortages in China as they will add to current supply disruptions, Sunshine Profits asserts, before concluding:

So far, gold has rather ignored the unfolding energy crisis, but we’ve already seen that market narratives can change quickly. It’s therefore possible that prolonged supply disruption and high inflation could change investors’ attitude toward the yellow metal at some point.

Last week a majority of the Federal Open Market Committee (FOMC) forecasted three quarter-point rate increases in 2022, a tightening of monetary policy after holding borrowing costs near 0% since March 2020.

The Fed is reacting to higher-than-expected inflation which officials previously argued would fade as supply chain pressures owing to covid-19 eased. Instead inflation has soared, with the US Consumer Price Index reaching a 40-year high fanned by a continuation of the pandemic, supply chain bottlenecks and strong demand for goods and services amid unprecedented fiscal and monetary policy support.

But, raising rates by <1% will not stop food inflation. Skyrocketing prices of everything from meat and eggs to dairy and pasta, both in Canada and the United States, is only partially due to supply chain disruptions. Food inflation is also being driven by record-high fertilizer prices and climate change.

The fertilizer market has been pummeled this year due to extreme weather, plant shutdowns and the soaring cost of natural gas, the main feedstock for nitrogen fertilizer.

As for climate change, we know that higher temperatures lower crop production, droughts like we experienced this past summer ruin crops and cause feed prices to soar, leaving ranchers no choice but to cull their herds. The prices of staple crops like corn, wheat and soybeans have all tracked higher.

The costs of shelter and transportation have also risen dramatically. From a year ago this past June lumber prices rocketed 377%, partly due to high demand for renovations by covid-bound homeowners. Lumber prices will likely be pressured in coming years with regular forest fires, along with a shorter logging season.

Wolf Street reports “actual home prices have spiked by historic amounts,” with the Case-Schiller Home Price Index which tracks price changes of the same house over time, soaring 20% year over year. The “owner’s equivalent of rent” which measures the costs of home ownership is also tracking higher.

Conclusion

Interest rates are staying at zero for now and we have a very modest set of increases next year that will do next to nothing to reduce inflation. How can a 1% increase at the high end of the range possibly do anything to stop the 9% increase in goods prices and the 7% inflation in services?

Is it any wonder that spot gold shot up immediately following the Fed announcement, two days later hitting $1,812?

In our opinion we see nothing but positives for gold going forward, given the Federal Reserve’s inadequate response to rising inflation which is not longer seen as temporary, or transitory, but a more “sticky” feature of the economy.

The longer that energy, food and transportation prices, three main components of the CPI, remain elevated, the better it is for gold, the oldest and arguably the most successful hedge against inflation.

Inflation erodes the purchasing power of fiat currencies and eventually they become worthless.

The dollar has lost 90% of its purchasing power since 1950. By contrast, since 1972 gold has gone from $35/oz to $1,800.

Earlier on we discussed the gold to oil ratio, finding that while the ratio hit a record 91 in April 2020, it has since fallen to about 25, due mostly to the phenomenal rise in oil prices built on the economic recovery from the pandemic.

That is still higher than the ratio’s historical average of 16, suggesting it could tighten further. For that to happen either gold prices need to rise or oil prices need to fall.

Our research has found a lot of evidence to suggest that oil prices will keep going up.

We believe the Saudis are right in saying that, without a major increase in oil exploration, global oil production could fall by 30 million barrels a day by the end of the decade.

This is being allowed to happen because governments around the world wish to see a shift to renewable energy. A lot of oil and gas investment is being moved to renewables, at least partly driven by ESG concerns; we’re rushing pell mell into “green” everything without adequately replacing our fossil-fuel resources. That means not looking for enough oil, not pumping enough oil, and not putting enough into key energy infrastructure projects like pipelines.

We only have to look at what’s happening in Europe, which is hitting record energy prices that are being foisted on a populace who most certainly didn’t vote for that.

Unfortunately, Europe’s energy crisis could soon reach across the Atlantic. American shale oil production has reached its peak and is in decline, due to the “Red Queen Syndrome” of depleted reservoirs. Output from other big fields currently in production are also declining, anywhere from 4 to 8% a year, meaning it’s going to take a lot of investment “just to stand still”. Again, the Red Queen Syndrome.

Without this investment materializing, and we don’t think it will, after all, investing in oil and gas is now seen by a lot of people as regressive, we can’t see any other scenario than for oil and NG prices to keep moving higher, and for gold to follow suit, as the reality of inflation is brought home to investors and they look to gold bullion and/or junior gold stocks as a smart way to hedge their bets.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.