The mid-tier and junior gold miners just finished reporting their latest quarterly results last week. These fundamentally-superior smaller producers are in the sweet spot for upside potential in major gold uplegs. And indeed their Q2’23 operational and financial results proved much better than their larger peers’. The mid-tiers generally enjoyed rising output and falling costs, boosting profitability which is bullish for their stocks.

The leading mid-tier-gold-stock benchmark is the GDXJ VanEck Junior Gold Miners ETF. With $3.8b in net assets this week, it remains the second-largest gold-stock ETF after its big brother GDX. That is dominated by far-larger major gold miners, although there is much overlap between these ETFs’ holdings. Still misleadingly named, GDXJ is overwhelmingly a mid-tier gold-stock ETF with little weighting allocated to juniors.

Gold-stock tiers are defined by miners’ annual production rates in ounces of gold. Small juniors have little sub-300k outputs, medium mid-tiers run 300k to 1,000k, large majors yield over 1,000k, and huge super-majors operate at vast scales exceeding 2,000k. Translated into quarterly terms, those thresholds shake out under 75k, 75k to 250k, 250k+, and 500k+. Only three of GDXJ’s 25 biggest holdings are true juniors!

That means they produce less than 75k ounces per quarter, and that gold output generates over half their quarterly revenues. That excludes primary silver miners producing byproduct gold, and the royalty and streaming companies that buy future gold output for big upfront payments used to finance mine builds. While we’ve traded countless great juniors over the decades, mid-tiers are really in the sweet spot for upside.

These gold miners dominating GDXJ offer a unique mix of sizable diversified production, excellent output-growth potential, and smaller market capitalizations ideal for outsized gains. Mid-tiers are less risky than juniors, while amplifying gold uplegs much more than majors. Our newsletter trading books are filled with both fundamentally-superior mid-tiers and juniors, smaller gold miners which we’ve long specialized in at Zeal.

GDXJ has stumbled recently, dropping 15.5% from mid-July to mid-August. That was right in line with GDX’s 15.9% retreat in that same span, which was driven by gold pulling back 4.5%. Huge gold-futures selling flared as the US Dollar Index blasted up 3.5% on Fed-hawkish US economic data. But the mid-tiers remain in a powerful upleg, which catapulted GDXJ 66.9% higher from late September to mid-April.

While mid-tier gains usually well outperform the majors during gold uplegs, much of their outsized rallies accrue later as those uplegs mature. Gold and its miners’ stocks have to climb on balance for some time before they generate widespread greed. That self-feeding psychology increasingly entices traders to pour into smaller miners to chase their upside momentum, really accelerating it as gold uplegs near climaxes.

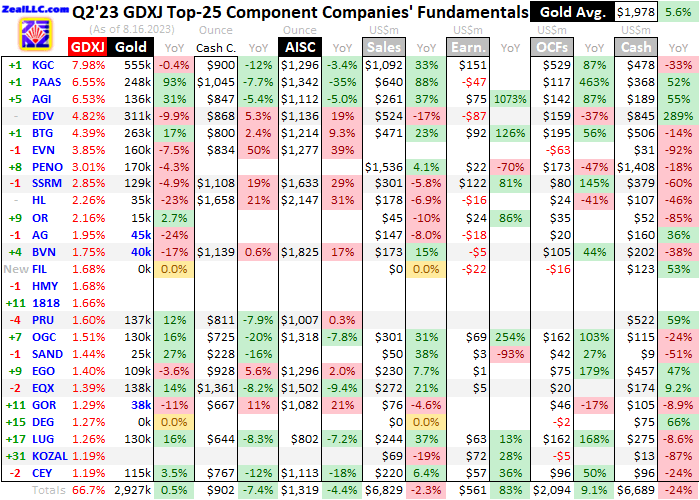

For 29 quarters in a row now, I’ve painstakingly analyzed the latest operational and financial results from GDXJ’s 25-largest component stocks. Mostly mid-tiers, they now account for 66.7% of this ETF’s total weighting. While digging through quarterlies is a ton of work, understanding smaller gold miners’ latest fundamentals really cuts through the obscuring sentiment fogs shrouding this sector. This research is essential.

This table summarizes the GDXJ top 25’s operational and financial highlights during Q2’23. These gold miners’ stock symbols aren’t all US listings, and are preceded by their rankings changes within GDXJ over this past year. The shuffling in their ETF weightings reflects shifting market caps, which reveal both outperformers and underperformers since Q2’22. Those symbols are followed by their current GDXJ weightings.

Next comes these gold miners’ Q2’23 production in ounces, along with their year-over-year changes from the comparable Q2’22. Output is the lifeblood of this industry, with investors generally prizing production growth above everything else. After are the costs of wresting that gold from the bowels of the earth in per-ounce terms, both cash costs and all-in sustaining costs. The latter help illuminate miners’ profitability.

That’s followed by a bunch of hard accounting data reported to securities regulators, quarterly revenues, earnings, operating cash flows, and resulting cash treasuries. Blank data fields mean companies hadn’t disclosed that particular data as of the middle of this week. The annual changes aren’t included if they would be misleading, like comparing negative numbers or data shifting from positive to negative or vice-versa.

The mid-tier gold miners’ overall Q2’23 performance proved quite impressive! Unlike the larger majors, the mid-tiers collectively grew their production. That helped force costs significantly lower, which drove profits much higher! This was a nice contrast to the GDX-top-25 majors’ latest quarterlies I analyzed in another essay last week, which were disappointing. The smaller gold miners are this sector’s growth engine.

Production growth trumps everything else as the primary mission for gold miners. Higher outputs boost operating cash flows which help fund mine expansions, builds, and purchases, fueling virtuous circles of growth. Mining more gold also boosts profitability, lowering unit costs by spreading big fixed operational expenses across more ounces. The GDXJ-top-25 mid-tiers achieved that, with production edging higher.

Their collective output last quarter climbed 0.5% year-over-year to 2,927k ounces. While modest, it still trounced the GDX-top-25 majors which suffered ugly 4.7% YoY production shrinkage in Q2’23! And due to some composition changes, these elite mid-tiers’ production growth is understated. Two producers that don’t seem to report quarterly operational results surged into GDXJ’s upper ranks during this past year.

They are China’s Zhaojin Mining and Turkey’s Koza Altin Isletmeleri, which both failed to add any reported production to the Q2 sector total. They knocked Mexico’s Fresnillo and Canada’s K92 Mining out of the GDXJ top 25 over this past year. Those companies mined 152k and 31k ounces of gold last quarter. Add that in, and these elite mid-tiers’ overall output growth was closer to 6.8% YoY which is outstanding!

That’s much better than global gold miners as a whole according to the World Gold Council. After every quarter, it publishes the best-available global gold supply-and-demand data in its excellent Gold Demand Trends reports. The latest Q2’23 GDT released as August dawned revealed that overall worldwide gold-mining output grew 3.8% YoY to 29,687k ounces. The fundamentally-superior mid-tiers are leading that growth.

Our newsletter trading books currently have open positions in seven of these GDXJ-top-25 stocks. Their total production last quarter blasted up 24.1% YoY to 1,069k ounces! Being selective in picking the better gold stocks is essential for success trading this sector. But that sure isn’t easy, requiring lots of research time, knowledge, and experience to separate the wheat from the chaff. GDXJ contains both winners and losers.

Deploying capital in the former while avoiding the latter really increases portfolio returns during major gold uplegs. But those losers aren’t GDXJ’s biggest drawback as a trading vehicle. Inexplicably this mid-tier-gold-stock ETF has big overlap with that GDX major-gold-stock ETF. Fully 14 of GDXJ’s top 25 stocks are also GDX-top-25 ones! The GDXJ-top-25 stocks weighted at 66.7% also comprise 26.8% of GDX’s weighting.

So GDXJ essentially carves out about a quarter of GDX and expands it near two-thirds. That still makes for a great improvement, as GDXJ excludes GDX’s deadweight larger major and super-majors dragging down sector performance. They’ve generally failed to grow their production for years at the vast scales they operate. The GDXJ-top-25 stocks that are also GDX ones rank from 12th to 33rd in that major ETF.

I’ve long argued that both GDX and GDXJ would better serve investors if their holdings were mutually-exclusive. With one company operating both, that shouldn’t be difficult to do. All the super-majors and majors should only be in GDX, while the mid-tiers and juniors alone populate GDXJ. These gold-stock ETFs would trade differently then, greatly boosting their appeal by targeting different segments of this sector.

Circling back to production, plenty of these mid-tiers are forecasting better output during the second half of 2023. SSR Mining for example declared “In the second half of the year, we expect all four of our operations to deliver improved consolidated production of approximately four hundred thousand gold equivalent ounces at reduced costs...” That would be much better than SSRM’s 303.5k GEOs mined in H1’23.

The odds of the GDXJ top 25 reporting still-bigger production in this currently-underway Q3’23 are pretty good. According to that comprehensive global gold data from the WGC’s GDT reports, quarterly mine output tends to climb as calendar years march on. On average during Q1s, Q2s, Q3s, and Q4s since 2010, sequential world gold-mine output has run -8.6%, +4.8%, +6.9%, and +0.3% quarter-on-quarter.

Those weaker Q1s mostly result from northern-hemisphere winters, which adversely impact gold-mine operational efficiencies through bitter cold up north and heavy rains down south. Most of the world’s gold mines are found on the top half of the globe, which contains over 2/3rds of this planet’s land. After winter lulls in Q1s, production really ramps up sequentially in both Q2s and Q3s. GDXJ mid-tiers should reflect that.

The GDXJ top 25 appeared to break that mold last quarter, with Q2’s 2,927k ounces produced actually falling 8.6% QoQ from Q1’23. But that was really distorted by two components. South Africa’s Harmony Gold hasn’t yet reported its latest Q2 results that end its fiscal year, but it yielded a big 346k ounces in Q1. And IAMGOLD produced another 138k in Q1 but fell out of the GDXJ-top-25 ranks since. That totals 484k.

Remove that to make the last couple quarters more comparable, and the GDXJ top 25’s aggregate output actually surged 7.6% QoQ even besting Q2 sector averages! So these elite mid-tier gold miners have a good chance of enjoying another average 7%ish QoQ production surge in this currently-underway Q3. That would further improve their already-impressive fundamentals, driving down costs and boosting profits.

Unit gold-mining costs are generally inversely proportional to gold-production levels. That’s because gold mines’ total operating costs are largely fixed during pre-construction planning stages, when designed throughputs are determined for plants processing gold-bearing ores. Their nameplate capacities don’t change quarter to quarter, requiring similar levels of infrastructure, equipment, and employees to keep running.

So the only real variable driving quarterly gold production is the ore grades fed into these plants. Those vary widely even within individual gold deposits. Richer ores yield more ounces to spread mining’s big fixed expenses across, lowering unit costs and boosting profitability. But while fixed costs are the lion’s share of gold mining, there are also sizable variable costs. That’s where recent years’ raging inflation really hit.

Energy is the biggest category, both electricity to power ore-processing plants including mills and diesel fuel necessary to run fleets of excavators and dump trucks hauling raw ores to those facilities. Other smaller consumables range from explosives to blast ores free to chemical reagents necessary to process various ores to recover their gold. So higher variable costs continue to heavily impact the world’s gold miners.

Cash costs are the classic measure of gold-mining costs, including all cash expenses necessary to mine each ounce of gold. But they are misleading as a true cost measure, excluding the big capital needed to explore for gold deposits and build mines. So cash costs are best viewed as survivability acid-test levels for the mid-tier gold miners. They illuminate the minimum gold prices necessary to keep the mines running.

These elite GDXJ-top-25 mid-tiers reported average cash costs of $902 per ounce in Q2, which dropped a big 7.4% YoY! That was their first annual retreat in 11 quarters, to their lowest level since Q4’21 before inflation really went crazy. These smaller gold miners are actually doing better than GDX-top-25 majors, which saw their cash costs surge 4.0% YoY to $955 last quarter. And GDXJ’s cash costs are skewed high.

Hecla Mining and Buenaventura have long reported unusually-high costs, which they don’t even bother explaining anymore in their quarterlies. Excluding these outliers, the rest of the GDXJ top 25’s cash costs plunge to just $836! Both these companies are also GDX-top-25 ones, and excluding them the majors’ Q2 cash costs were still higher at $896. The mid-tiers continue to report better fundamentals than the majors.

All-in sustaining costs are far superior than cash costs, and were introduced by the World Gold Council in June 2013. They add on to cash costs everything else that is necessary to maintain and replenish gold-mining operations at current output tempos. AISCs give a much-better understanding of what it really costs to maintain gold mines as ongoing concerns, and reveal the mid-tier gold miners’ true operating profitability.

The GDXJ top 25’s AISCs also fell rather sharply last quarter, down 4.4% YoY to $1,319 per ounce. That was the first annual AISC decline in a whopping 21 quarters, a very-welcome trend reversal! The elite mid-tiers’ collective AISCs hadn’t been lower since Q1’22, which was again before the brunt of inflation forced variable prices much higher. Those GDXJ AISCs also easily bested the GDX top 25’s $1,380 average.

But again HL and BVN are extreme outliers, reporting lofty $2,147 and $1,825 AISCs in Q2. Kicking them out, the rest of the GDXJ top 25 averaged a much-better $1,224. Without those same two companies, the GDX top 25’s were still higher at $1,299. Again the mid-tiers’ fundamentals remain superior to the majors’, which is a key reason their stock prices’ upside potential is considerably greater during big gold uplegs.

The mid-tiers’ falling costs along with rising gold prices were really amplified in earnings. A great proxy for how gold miners are faring as a sector simply subtracts average AISCs from quarterly-average gold prices. Despite gold pulling back in much of Q2 spooking traders, the yellow metal still averaged an all-time-record high $1,978! That less those $1,319 AISCs yielded big implied unit profits of $659 per ounce!

That not only soared 33.8% YoY, but was the highest absolutely for the GDXJ top 25 in eight quarters! And without that pair of outliers, the mid-tiers’ profits would’ve rocketed 53.2% higher to $754 per ounce. Both are on the higher side of the past 29 quarters’ range running from $288 to $928. The mid-tiers and juniors are actually faring far better fundamentally than most traders imagine given their battered stock prices.

And these unit earnings are likely heading even higher. During these last two quarters, the GDXJ top 25’s AISCs averaged $1,414 and $1,319. Yet these companies’ average full-year all-in-sustaining-cost guidance in Q2 reports ran much lower near a $1,268 midpoint. H2’23 AISCs will have to come in well under that to drag down 2023 averages around there. Rising production should prove the primary driver.

Let’s conservatively assume the mid-tiers report $1,200 AISCs in Q3 and Q4, which is still way too high to achieve guidance. In next week’s essay I’m going to analyze gold’s recent pullback driven by massive gold-futures shorting, which has pummeled Q3-to-date’s average price to $1,934. But gold is overdue for a sharp bounce on short-covering buying, so recovering to a $1,950 average this quarter seems reasonable.

That would yield huge implied unit profits of $750 per ounce in Q3, which would skyrocket 132% YoY! The mid-tiers haven’t enjoyed such fat earnings since Q4’20, again before extreme central-bank money printing unleashed this raging inflation. The mid-tiers and juniors will report their Q3 results leading into mid-November, which could amplify their resumed major upleg that will likely be well underway by then.

The GDXJ top 25’s Q2’23 hard accounting data reported to national securities regulators under Generally Accepted Accounting Principles or their equivalents in other countries were also strong. Overall revenues slumped 2.3% YoY to $6,829m, but that was skewed by Mexican silver-and-gold giant Fresnillo getting kicked out of GDXJ over this past year. Excluding it from the comparable Q2’22, sales grew 7.4% YoY.

That’s more righteous, right in line with 0.5%-higher production and 5.6%-higher gold prices. Better sales are essential for growing bottom-line earnings. Those soared 82.6% YoY across the GDXJ top 25 to hit $561m last quarter! But there were a couple of big unusual items flushed through income statements, led by Endeavour Mining’s $178m loss on selling discontinued gold mines. Without those, overall profits ran $662m.

Backing out other unusual items from the comparable Q2’22, the GDXJ top 25’s adjusted earnings rocketed up 130.1% YoY! There’s no fundamental justification for the weak gold-stock prices following this recent selloff. Cash flows generated from operations rose 9.1% YoY to $2,094m, but without Fresnillo a year earlier they surged a much-better 21.6%. Strong OCFs help finance essential mine expansions and builds.

These elite mid-tier gold miners have definitely been investing cash in growing their production. Exiting last quarter, their collective $6,689m cash hoards plunged 24.3% YoY. But without Fresnillo, that looked much better down 12.9% YoY. So the GDXJ top 25 still have billions to plow into boosting their output. They are also prime acquisition targets for larger majors failing to overcome their mines’ depletion organically.

These smaller mid-tier and junior gold stocks are poised to surge sharply with gold in coming months as it mean reverts higher. Improving trader sentiment on mounting upside momentum will be the main driver. But strong fundamentals undergirding any upleg can amplify its gains by attracting in more value-oriented investors. Our newsletter trading books are currently full of still-cheap smaller gold miners ready to soar!

The bottom line is the mid-tier gold miners just reported excellent results last quarter. They achieved big production growth trouncing the majors’ shrinkage, which forced all-in sustaining costs lower for the first time in years. That greatly boosted the mid-tiers’ earnings, improving their already-strong fundamentals. This bullish trend should persist in Q3 and Q4 with these companies forecasting higher output and lower costs.

Combined with much-better average gold prices, mining profits are likely to continue surging in coming quarters. That ought to increasingly attract back investors, accelerating gold stocks’ resuming upleg as they follow gold higher. With these smaller gold miners besting larger ones on all key fundamental fronts last quarter, they should win more favor. The best gold-stock upside potential remains in mid-tiers and juniors.