Gold market

The US Federal Reserve, whose job is to keep unemployment in check and inflation in the “Goldilocks” zone of 2%, is telegraphing three interest rate increases of 0.25% each (1% at the high end of the range) this year.

Bloomberg believes the Fed might be more aggressive: “Our baseline is for the Fed to hike five times, each 25 basis points, this year, and balance-sheet runoff to begin in July. Our in-house rule for the Fed’s reaction function flags an upside risk for a 50 basis-point hike in March followed by five 25 basis-point hikes in the rest of the year.” Anna Wong, chief U.S. economist

The Fed has been wracking its brains trying to figure out how to control inflation, which is at a 40-year-high, and interest rate hikes are normally the usual panacea to cool an overheated, high-inflation economy.

The US Labor Department said that its Producer Price Index (PPI) rose 0.2% from November to December, bringing producer prices to a record-high 9.7%, the biggest calendar-year increase since data was first calculated in 2010.

The same report said US consumer prices increased solidly in December, led by gains in rental accommodation and used cars, culminating in the largest annual inflation rise in 40 years. Used-vehicle inflation is mostly driven by the shortage in semiconductor chips.

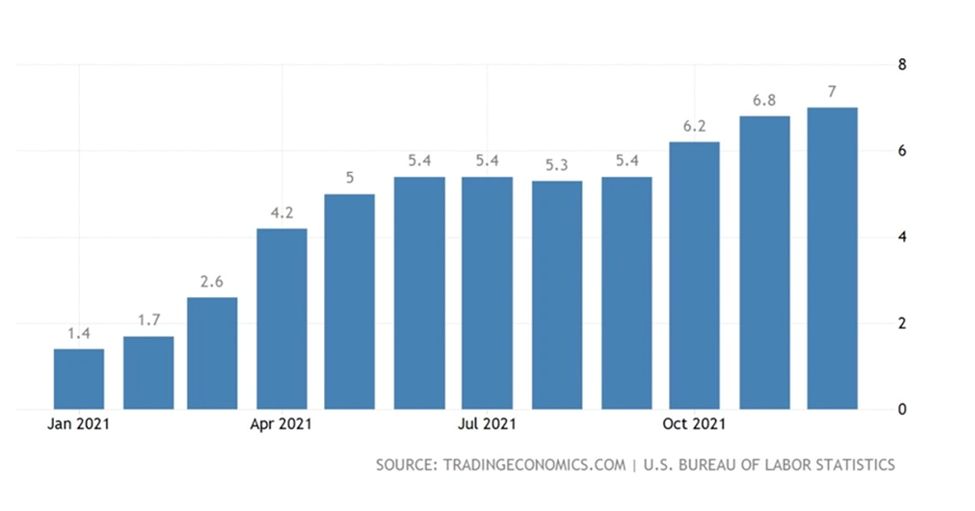

The Consumer Price Index (CPI) surged 7% in the 12 months through December, the biggest year on year increase since 1982. The CPI was 6.8% in November, and strikingly, only 1.4% in January, 2021. The historic price increases are mostly due to strong demand for goods and services exceeding available supplies in an economy still hampered by coronavirus pandemic restrictions. However, those hoping supply-chain disruptions will soon be ironed out and inflation heads back down, will be disappointed. There are in fact a number of reasons why current higher prices are likely to be with us for a long time)

US inflation rate (CPI)

US inflation rate (CPI)

As we have argued, the Fed (and the Treasury) is between a rock and a hard place, the Fed can’t raise rates enough to combat high inflation because doing so will wreck the economy. But it has to do something to quell rising prices, otherwise it is neglecting its mandate of keeping prices stable.

Why are higher rates a problem? Start with the fact that US consumer spending makes up 70% of the country’s economic output, or GDP. An equivalent percentage holds globally, i.e., the spending of consumers worldwide accounts for about 70% of global GDP.

This has important policy ramifications, regarding the capability of the US central bank to raise interest rates, because doing so will have an immediate effect on the spending habits of consumers. And with the Fed continuing to jawbone at least three three-quarters of a percentage point rate hikes this year, and others including us saying a 1% interest rate is not enough to fight inflation it’s worth asking, how much of a rate increase can Americans handle?

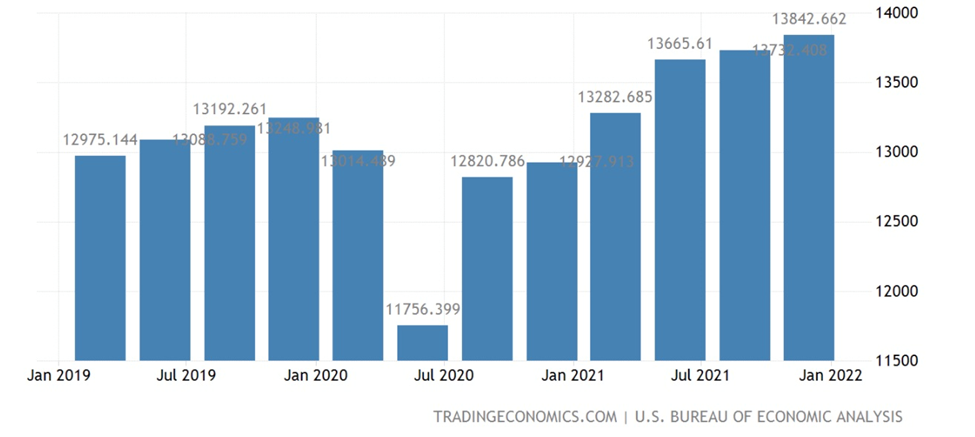

The chart below shows US consumer spending rising steadily since July 2020 on the back of economic recovery, however we have it on good authority that the good times may be coming to an end.

US consumer spending. Source: Trading Economics

US consumer spending. Source: Trading Economics

The Wall Street Journal recently reported that rising inflation and the spread of the omicron variant dented household spending, with consumer outlays declining by 0.6% in December compared to November.

This was despite only 3.9% unemployment in December, a boost in wages and a rise in gross GDP to 6.9%. But, when citing these stats, inflation has to be counted, and here is where we see the rot in the fruit, so to speak.

Last Friday’s report showed household incomes rose 0.3% in December, but that wasn’t enough to cancel out inflation which, as measured by the Personal Consumption Expenditures (PCE) index, rose 0.4% for the month and up 5.8% from a year earlier. According to WSJ, Adjusted for inflation, after-tax personal income declined 0.2% from November. It has decreased for five straight months and in eight of the last nine months, leaving households worse off.

Disturbingly high inflation helps explain why, despite more people working, many receiving higher pay, and an economy supposedly running hot during the busiest season for retailers, a lot of Americans decided to exercise restraint while picking out presents this year.

Another reason for parsimonious behaviour is ballooning household debt — a problem that will obviously be made worse by the Fed raising interest rates.

Families across the country are reportedly more than $15 trillion in the red, according to personal finance app Nerd Wallet, via Twitter. The average US household owes a whopping $155,622.

Forbes reported that, after growing for 10 quarters in a row, household debt in Q3, 2021 hit $305.1 billion. And despite after-tax incomes rising throughout the pandemic due to stimulus checks and other forms of government assistance, debt stood at 98.8% of after-tax income last September. In other words, for every dollar made, a dollar is owed.

The bulk of the new debt was mortgages, taken on during a period of near-zero-percent interest rates. According to Forbes, mortgages and home equity lines of credit in September stood at 63.2% of after-tax credit.

The interest rate on a 30-year, fixed-rate mortgage climbed for a fourth straight week to 3.64% in the week ended Jan. 14, the highest since March 2020. It has kept going to 3.74%, or 3.78% APR (Source: Bankrate.com).

As inflation eats away at consumers’ purchasing power, using up cash flow faster than before the price increases, many will be forced to make up the difference on credit.

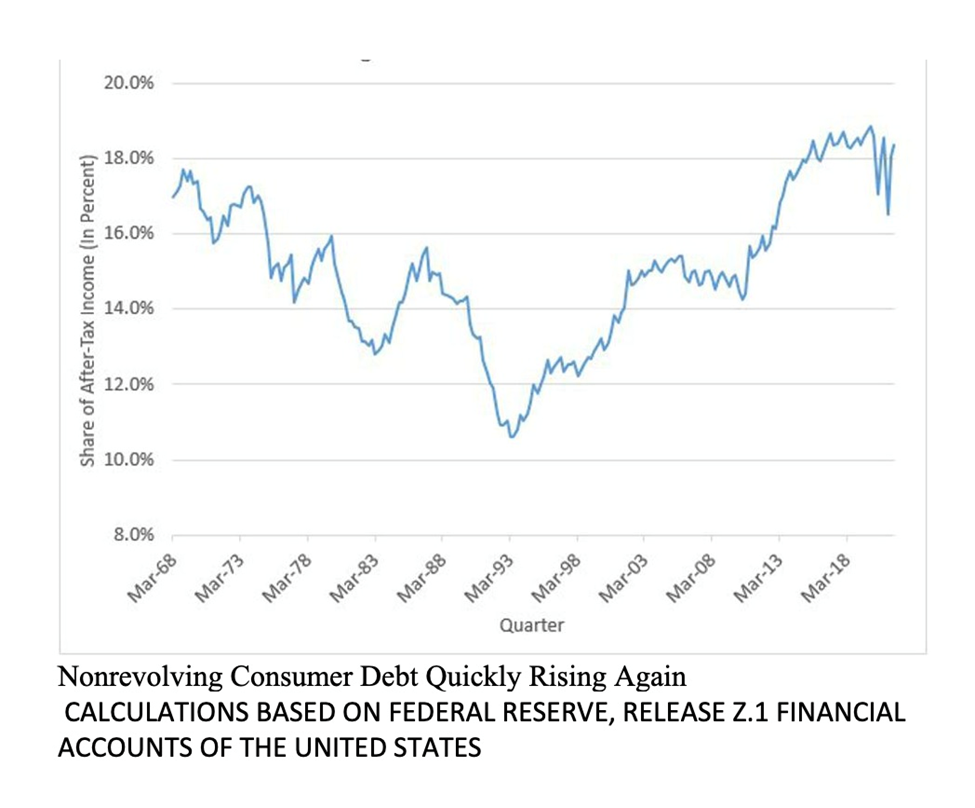

Forbes notes credit card debt rose faster than after-tax incomes in the summer of 2021, exceeding $1 trillion in September. Households also took out more car and student loans, owing $3.3 trillion of such debt the same month. This amounted to 18.4% of after-tax income, compared to 16.% in March 2021 and approaching the record-high 18.9% at the end of 2019. (see chart below)

The average credit card interest rate is currently 20.45%, according to The Balance.

As an indication of how tight finances are getting for some families, data from the US Census Bureau’s Household Pulse Survey showed that 17.5% of African-Americans, 14.2% of mixed-race people, and 14% of Latinos borrowed from friends or family to pay for expenses in September. This compares to 6.7% of White Americans and 6.7% of Asian Americans.

The US consumer is directly affected by higher interest rates because mortgage rates and credit card interest increases will follow suit. But there are two other ways consumers will feel the pain. The first is corporate debt and the second is government debt.

According to the Federal Reserve and the Securities Industry and Financial Markets Association (SIFA), US companies now face the highest debt levels on record, at more than $10.5 trillion. In 40 years the amount of corporate bonds outstanding has grown by over 2,000%, from 16% of US GDP in 1980, to 50% of GDP in 2020.

These debt levels were massive even before the coronavirus (about $9 trillion), with rock-bottom interest rates left over from the financial crisis making it very easy for corporations to borrow money.

Most of the $10.5T in US corporate debt is made up of bonds (the other part is loans), which are divided into investment-grade and high-yield/ junk bonds.

Independent ratings agencies decide on the classification, based on a company’s ability to make their debt payments to bondholders.

Right now the corporate bond picture looks good because interest rates are so low. It’s very easy for companies to issue bonds and to get investors to purchase them. They much prefer to do this rather than dip into their own cash piles, or issue stock which dilutes the share float.

But problems occur when companies get reckless with their debt, resulting in a status downgrade. Currently there are a number of companies teetering on the edge of investment-grade status. When they are downgraded to junk bond status, a lot of bond investors sell these “fallen angels”. In 2020 50 companies worth $200 billion in debt were downgraded, including Macy’s, Ford and Occidental, compared to $40-50B in a normal year.

Companies unable to find enough investors to buy their corporate bonds may go bankrupt. Equally bad, if a company is unable to pay back the principal plus interest on bonds when they reach maturity, the firm could default on its loans.

The huge amount of corporate debt is benign for now, but what happens when the Fed hikes interest rates to deal with rising inflation?

“Even a 100, 150-basis point interest rate could spell doom for a company that’s living on the edge,” says a CNBC video, referring to so-called zombie companies that are drowning in debt, to the point where they could default on their loans. These companies are only making interest payments, they’re not investing in their businesses or employees, meaning they ultimately are dragging down national economic growth.

Companies unable to make payments on their loans could easily lay off workers to avoid going bankrupt. If that happens to you, you are a victim of rising interest rates. And let’s not forget companies will pass on higher interest costs to consumers by raising prices for their goods and services.

Then there is government debt. We’ve written extensively about the dangers of the mounting US debt load. The US debt to GDP currently sits at 127.6%.

The Congressional Budget Office (CBO) and the Committee for a Responsible Federal Budget (CRFB) — both reliable sources — project a deficit of $1.3T in 2022, and every year until 2031. This severely constrains the Fed’s policy options.

Each interest rate rise means the federal government must spend more on interest, reflected in the annual budget deficit, which keeps getting added to the national debt, which is almost $30 trillion. We are talking about interest costs nearing a trillion dollars per year, when the deficit is accounted for.

Another way for governments to deal with increasing deficits and debt servicing costs, is to raise taxes; tax increases place a comparatively heavy burden on the poor and the working poor.

Conclusion

Just as the Fed is between a rock and a hard place, regarding raising interest rates to deal with inflation, the US consumer is also in an unenviable position.

Wages have gone up, and many Americans have either been re-hired, or found a better job, but their pay increases haven’t kept up with inflation. Inflation has eroded consumers’ purchasing power, and things are about to get a lot worse if interest rates go up.

That’s because for many Americans, their credit cards are what they have to fall back on, when monthly expenses exceed income. This vicious cycle of spending and borrowing will continue, with minimum payments higher due to credit card interest rates in excess of 20%.

For some households a hike to the monthly mortgage payment will be the last straw. Those with locked-in terms are okay for now, but many will face a reckoning when it’s time to renew. Variable-rate holders will see a payment increase right away. How well they can handle it depends on how leveraged they are.

It all begs the question: if the Fed raises rates to fight inflation, will it also be kicking US consumers when they’re down, due to historic inflation? And believe me, the Fed needs consumers. They make up 70% of the economy. How is the Fed going to keep consumer spending going (it’s already slowing down) if its interest rate increases have the opposite effect, of stifling spending?

Higher interest rates are obviously bad news for gold, but we maintain that the Fed is severely limited in how much and how quickly it can raise. While Fed Chair Jerome Powell declared last week that officials were ready to raise rates at their next meeting in March, now it appears they are urging caution. On Monday, Atlanta Fed President Raphael told Yahoo Finance he does not favor a 50-basis-point hike in March, that would effectively double the current rate.

More evidence that what Fed officials say they will do, could be quite different from what they actually do.

The gold market is reacting positively to the Fed’s more dovish signal.

Rising geopolitical tensions continue to add to gold’s allure. There are a number of hot spots in the world today that could easily flare up into a conflagration that escalates into a shooting war or even the nightmare scenario of missiles being launched.

They include the ongoing threat of war between North and South Korea that would draw in the United States; tensions between the US, China and its neighbors over Taiwan; the potential invasion of Ukraine; and a recent flare-up in Iraq.

There are about 125,000 Russian troops on Ukraine’s border and the US on Monday warned that an invasion would be “horrific” for both sides.

“If that was unleashed on Ukraine, it would be significant, very significant, and it would result in a significant amount of casualties,” top US general Mark Mille said while speaking at the Pentagon on Friday. Well duh Captain Obvious. The Guardian said The Pentagon has already placed about 8,500 US troops on stand-by for possible deployment to Europe amid Russia’s military build-up near Ukraine’s border.

North Korea and dictator Kim Jong-un are back to saber-rattling following the failure of diplomacy between Kim and former President Trump. On Sunday North Korea reportedly fired what appeared to be its most powerful missile since US President Biden took office. According to NPR, Japanese and South Korean militaries said the long-range missile, capable of reaching the US mainland, reached an altitude of 2,000 kilometers and traveled 800 km, before landing in the sea.

Also over the weekend, CTV News reported that nine suspected ISIS fighters were killed by Iraqi airstrikes, in apparent retaliation for an ISIS attack on Iraqi army barracks earlier this month.

Gold and silver are traditional safe havens during periods of economic, political or military unrest. Precious metals are also an effective store of value that offer a hedge against inflation, unlike fiat currencies which consistently lose their value over time.

In today’s environment, it just makes sense for me to own some.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.