Over 5000 years of recorded history, gold has proven itself to be real money. Gold’s value is in its use as money. That value is unquestioned.

Whatever arguments are put forth against gold’s use as money are attempts by government to free itself from the restrictions that gold imposes. Gold, when used properly, limits the ability of government to inflate and debase its money.

Gold is original money and is the original measure of value for everything else. It was never a question as to what gold is worth. The equation of price and value was calculated using fractional units (ounces, grams, grains) of gold. Consumer goods and services were priced in gold.

PRICE OF GOLD IS IRRELEVANT

The price of gold is irrelevant as far as gold is concerned. Since gold is real (and original) money, attempts to put a price on it are misguided. The value of gold is in its use as money and putting a price on it does not tell us anything about gold.

The gold price tells us only what has happened to the medium used to measure the value of gold. In other words, the gold price in U.S. dollars tells us only what has happened, or is happening, to the dollar.

A higher gold price over time is a reflection of the loss of purchasing power in the U.S. dollar. A higher gold price does not in any way mean that gold is gaining in value.

The same relationship exists between gold and any other currency or medium used to price gold. Attempts to price gold in anything other than dollars won’t change anything with respect to the value of gold.

If the U.S. dollar were replaced as the world’s reserve currency, all that will matter with respect to the price of gold in dollars is whether the dollar loses additional purchasing power and how much.

If gold were to be priced in euros or yen, the only thing a rising gold price will tell us is that the euro or yen has lost additional purchasing power.

STOP ANALYZING GOLD

Attempts to analyze gold are pointless. Gold’s value has already been established. That value – its use as money – is constant and unchanging.

Gold in its role as money is a long-term store of value. What I can buy with an ounce of gold today is no more or less than what could be bought ten years , or one hundred years ago. An ounce of gold today is no more valuable than it was in Roman times, either.

Inferring anything about gold or its value based on changes in its price is fraught with confliction and contradiction. Assuming correlation – or inverse correlation – of anything other than the purchasing power of the U.S. dollar is misguided.

The price of gold is ALL about the U.S. dollar. (see What’s Next For Gold Is Always About The U.S. Dollar)

NO NEW HIGHS

Never has more been said about nothing than the latest references to “new highs in gold”.

When the price of gold peaked in August 2020 at $2058 oz. it was indicative of a ninety-nine percent loss of purchasing power in the U.S. dollar. The $2058 price was a one-hundred fold increase from its its original fixed price of $20.67 oz. and confirmed the effects of more than a century of inflation.

The one-hundred fold increase in gold’s price did not in any way, shape, or form tell us that the value of gold had increased. It was merely a reflection of the loss of purchasing power in the U.S. dollar.

When the gold price moved above $2000 oz. earlier this year, it peaked at $2053 oz. – nearly identical to the $2058 price in 2020.

Some say that the price got as high as $2080. Even if it did, it was not a new high for the gold price in real terms.

The effects of inflation since gold’s price peak in 2020 mean that for the gold price to make a new high in real terms, it would have to exceed $2300 oz. in today’s cheaper dollars. As it is, the “new high” in gold’s price was short by $300 oz., or fifteen percent.

That is only in reference to the high in 2020, though. When comparing the gold price in today’s dollars to the peak in 1980, gold’s price needs to be $2650 oz. just to match the 1980 peak.

UNDERSTANDING PRICE vs VALUE

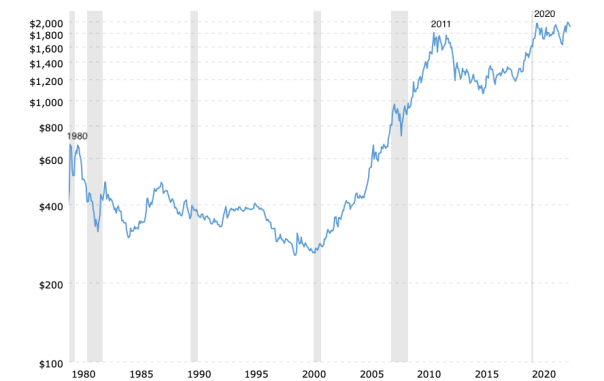

The chart immediately below is a history of gold prices since 1980…

Gold Price History 1980-2023

As seen on the chart above, the price of gold tripled ($680 to $1895) between 1980 and 2011. Nevertheless, none of that increase represented real profits or an increase in value.

The entire increase over those three decades was attributable to the effects of inflation that occurred after 1980.

Likewise, the increase in price between 2011 and 2020 accounted only for the effects of inflation after 2011 and up to 2020.

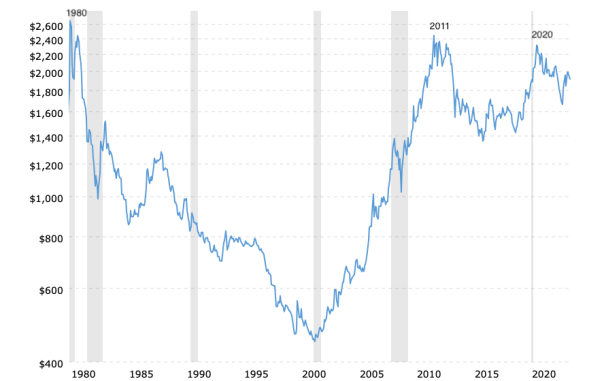

These things and more can be seen on the chart below which stands in stark contrast to the previous chart…

Gold Price History (inflation-adjusted) 1980-2023

Looking at both charts again, the following things are apparent:

- Gold’s series of price peaks (inflation-adjusted) since 1980 are successively lower than each previous peak; 2011 was lower than 1980, 2020 was lower than 2011, 2023 was lower than 2020. (Chart No. 2)*

- Gold at $2000 oz. today is cheaper than at $680 oz. in 1980 (Chart No. 2).

- Gold’s value hasn’t increased (Chart No. 2); only its price (Chart No. 1).

- Gold continually moves higher in price only (Chart No. 1); not in value (Chart No. 2).

Major turning points in the gold price (1980, 2001, 2011, 2016, 2020) are correlated with changes in dollar strength/weakness.

*One factor which might be keeping gold from matching its previous price peaks is that the overall effects of Federal Reserve inflation are continuing to have less and less impact. (see Everything Peaked in 1980 – The Waning Effects Of Inflation)*

SUMMARY AND CONCLUSION

Gold is real money and the original measure of value for everything else. The U.S. dollar and all fiat currencies are substitutes for real money/gold. All governments inflate and destroy their own currencies.

The price of gold in U.S. dollars or anything else tells us nothing about gold. A higher gold price in dollars tells us in hindsight how much purchasing power the dollar has lost – nothing more, nothing else.

No matter how high the price of gold goes in U.S. dollars, the value of an ounce of gold remains the same. Gold is literally priceless.