It has felt like we have been talking about the Federal Reserve rate cut for months and months. Finally we have something to say about it: The Fed decided to cut rates, and they cut rates by 50 basis points. Gold responded in true form and touched another record high.

At the time of writing gold is down slightly on the back of positive jobs data in the US, but overall the picture looks very good indeed.

Of course the rate cut was no surprise to anyone. Powell was about as explicit as one could be in his Jackson Hole speech. However, how much rates would be cut was a real debate.

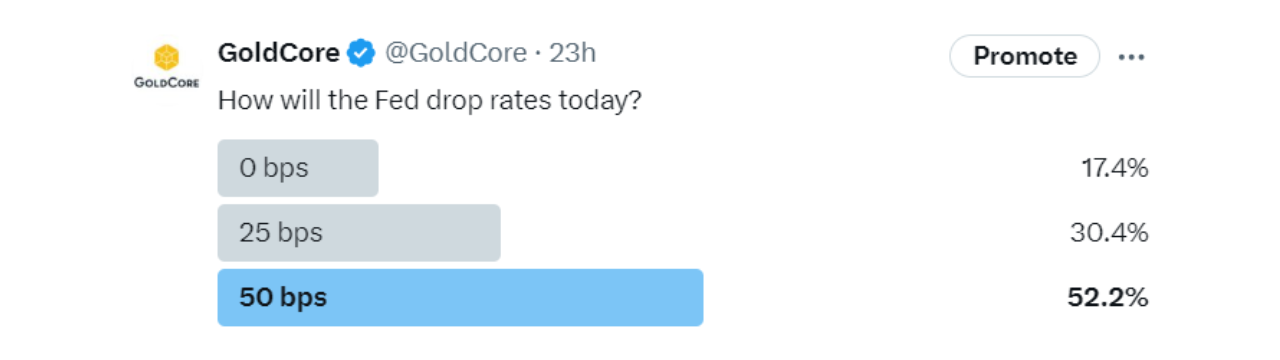

A half percent cut was not expected by the majority of bank analysts, but it was predicted by the majority of those who responded on our Twitter poll!

In this video we ask if the 50bps move was a confidence move or a crisis move. We're leaning towards crisis. We also touch upon what this will mean for the price of gold and silver in the coming months. Spoiler alert - new highs and maybe even silver over $50 by February.

In this video we ask if the 50bps move was a confidence move or a crisis move. We're leaning towards crisis. We also touch upon what this will mean for the price of gold and silver in the coming months. Spoiler alert - new highs and maybe even silver over $50 by February.

It's not just the Fed who have been working out monetary policy this week. The Bank of England's Monetary Policy Committee also had a big decision to make. They decided to hold rates at 5% this month, following steady inflation data.

It seems a little blinkered to point at central bank decisions and ask how they will affect the value of our portfolios, when it’s not exactly an exaggeration to say the world is in a state of war right now. It is bigger, longer lasting actions that will end up affecting portfolios, more than single rate decisions.

As a result, these global circumstances are causing significant concern for investors, who are eager to preserve their wealth despite the increasing challenges. This has led many to wonder whether gold might offer some protection in these uncertain times.