- Socialism’s biggest pillar, arguably, is fiat money. It is embraced by most political parties, even those claiming to be “right wing” or “capitalist”.

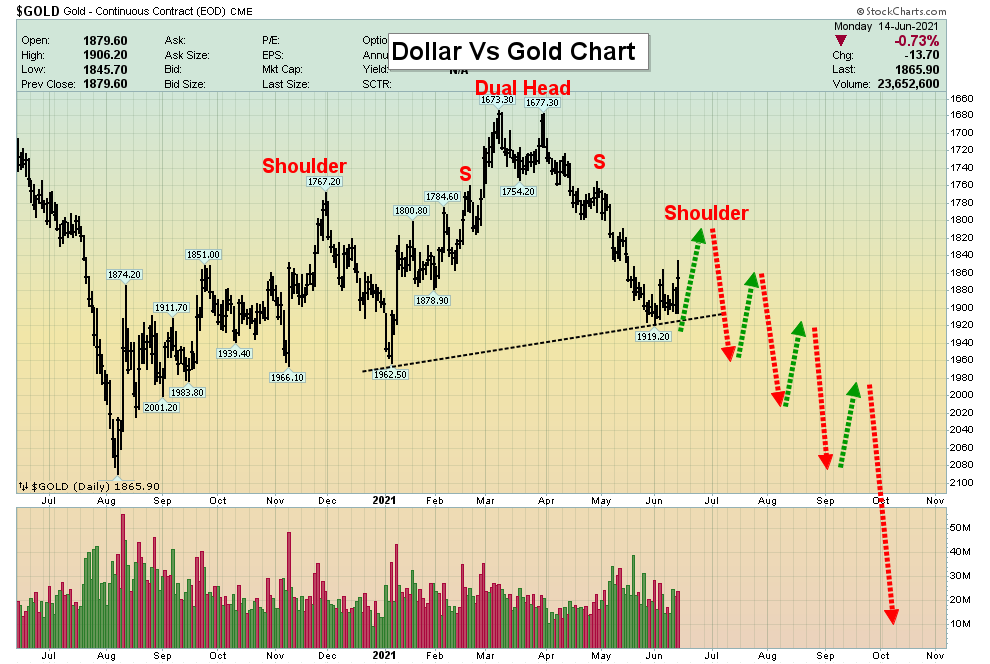

- Please click here now. Double-click to enlarge this long-term “train wreck” chart of the dollar versus gold.

- The fiat-oriented end of the American empire is as inevitable as that of previous empires… and perhaps more so given the technology that allows fiat money to be printed electronically.

In the medium-term, the dollar is staging what looks to be a very modest right shoulder rally in a big H&S top pattern.

In the medium-term, the dollar is staging what looks to be a very modest right shoulder rally in a big H&S top pattern.- Investors are told that a Fed “taper” is negative for gold and great news for the US empire of debt and fiat. Unfortunately, the actual situation appears to be dire.

- To understand why, please click here now. The world’s greatest fund managers are losing all confidence in the Fed’s ability to keep the fiat ship afloat.

- Investors may be about to relive a “super-sized” 1970s life, with rising rates causing an exodus from the dollar.

- Then, the dollar collapsed against gold as rates surged but the US government was able to stave off hyperinflation by forcing all oil to be sold in dollars.

- Now, America is an oil exporter and electric cars will make gas cars obsolete. So, if the world loses confidence in “Fed Speak”, all that is left to hold US Humpty Dumpty fiat on the wall is probably… war. The bottom line:

- Gold is money, and the time to stack it is now. Whether the investor’s stack is coins, bars, or jewellery does not matter.

- India’s thirst for gold is insatiable. I refer to Indian citizens as the world’s “titans of ton”. The Corona numbers there are dropping again. It’s only a matter of time (and not much) before Indian gold demand skyrockets again. Elsewhere, China just imported 100+ tons in May and US mint coin sales are soaring.

- A global stampede out of fiat and into “private money” gold, silver, crypto, and commodities seems imminent.

- It will happen when the current transitory wave of inflation gets replaced with one that is much bigger.

- My suggestion for stock market investors is to move to a short-term approach. That will help minimize the risk that a new inflationary wave crushes their holdings. Some long-term gains can be booked, with partial proceeds going into gold and silver miners.

- Please click here now. As this Bloomberg chart shows, the miners have become “cash cows on steroids”.

- Please click here now. Double-click to enlarge this GOAU daily chart. Investors who followed my suggested path have booked solid profits after buying in November and selling just a month later.

- I urged investors to buy in March again, and to sell more recently. The profits booked were stellar.

- The current “main stage” play is to hold core positions. Short-term traders can buy the dips, using the lows around $21.25, $20.50, and $19.85 for stoplosses.

- Please click here now. Double-click to enlarge. On the daily chart for GOAU, the 20,50 moving average series can be helpful.

- The latest buy signal is intact, and a dip to the red 50DMA line could be a good entry point for mine stock enthusiasts.

- What about GDX… do the moving averages work as well as they do for GOAU? Please click here now. Double-click to enlarge. The technical action for GDX is not as crisp and clean as for GOAU, but it’s still incredibly positive.

- A focus on gold bullion support zones for mine stock buying should be an investor’s “magic marker”.

- “Fed Speak” day is tomorrow. If the Fed downplays the horrifying fire that is engulfing the government’s fiat money system, legendary investors like Paul Tudor are ready to go all in on the inflation trade.

- Now could be the time, for gold bugs to get ready too!

Thanks!

Cheers

St