The gold bulls kept running in September as gold set new record highs eight times and the price gained another 4.6 percent.

And it appears this bull market has plenty of momentum left in it.

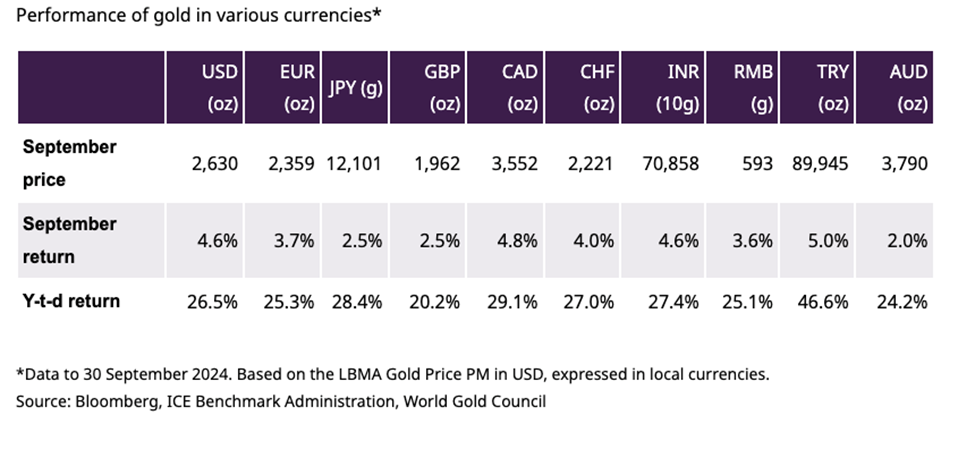

As of Sept. 30, gold was up 26.5 percent in dollar terms on the year.

According to World Gold Council analysis, dollar weakness was the primary factor driving the price of gold higher, as the supersized rate cut by the Federal Reserve put a significant drag on the greenback.

An uptick in geopolitical risk with deteriorating conditions in the Middle East also spurred safe-haven buying.

The biggest headwind for gold last month was the “momentum factor.” Strong returns in a prior month tend to pressure the following month’s returns lower and vice versa.

Gold charted solid gains in every other major currency as well.

Looking ahead, the World Gold Council projects a gold-friendly environment of lower yields, wavering spreads, and a continued elevated correlation between equities and bonds.

Two years ago, bonds and equities both lost value. It was the first time both charted declines in 53 years. Since that time, bonds and equities have continued to be highly correlated. As the World Gold Council noted, this correlation undermines diversification benefits and raises total portfolio risk.

Since gold tends to be uncorrelated, this raises its importance as a portfolio diversifier.

According to the World Gold Council, “A recent report, based on a simple macro framework combining yields and corporate spreads, suggests that correlation is set to stay on this track. If this pans out, it will present many investors with a fundamental challenge around how to approach diversification; risk managers will continue to be nervous and interest in a diversifier and hedge like gold will likely remain high.”

We also appear to be moving into a “risk off” investment environment. Historically, this has driven the strongest returns for gold.

The World Gold Council paints a bullish picture for gold in the near term.

“Against a backdrop of high equity-bond correlation and shifting macro phases, the outlook for gold offers investors diversification and a hedge against broader portfolio risk. Add to this support from central bank buying, rising demand from key markets like India, and the return of Western ETF investors, and the recent escalation in Middle East tensions, gold is well positioned to benefit from these evolving market conditions.”