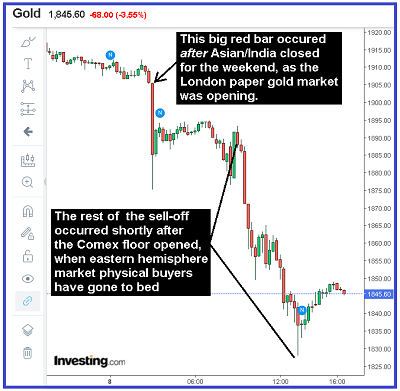

Gold and silver gave precious metals bulls a harrowing ride on the “down” price elevator on Friday, as gold had as much as $82 removed from its price and silver was hammered as much as 10%. However, make no mistake, the bulk of the sell-off occurred in the paper derivative markets of London and NYC. This graphic shows Comex February paper gold over the last 24 hours:

Very little if ANY physical gold transacted in institutional size during this price ambush. The sell-off did not start until AFTER the Asian physical markets had closed for the weekend and London was open. The first big push below $1900 didn’t start until 3:00 a.m. The next leg down – from $1890 to $1827 occurred after the Comex floor opened. This was a pure paper market endeavor.

Furthermore, the sell-off was not triggered by any specific news or events. In fact, and I leave it to the readers to verify for themselves, at least 90% of the time gold is price-ambushed like this ahead of and concurrently with the release of the Government’s monthly non-farm payroll report. Today’s report was far worse than expected and this should have been a bullish catalyst for the gold price (and silver).

A bounce in the dollar and rising interest rates do not explain today’s price-action in gold. A study by Adam Hamilton that goes back to the early 1970’s demonstrates that gold’s best periodic rate of return occurs while interest rates are rising. This is because rising rates, among other things, reflect the expectation of rising inflation.

In all probability, today’s price manipulation is in advance of another big round of money printing by the Fed. If you doubt this connection, look at the price action in gold in the summer of 2008, ahead of the bailout of the big banks by Ben Bernanke, and look at the massive gold price hit in March, ahead of an even bigger money printing operation initiated by Jay Powell.

I would suggest that the Fed is gearing up another large money printing operation – possibly bigger than the one in March – in order to fund the a multi-trillion dollar spending (“stimulus”) program once the Biden Government takes over the White House (see this: Washington Post).

The motive to prevent the gold price from rising is two-fold. First, it’s an effort to support the U.S. dollar, which has lost over 12% of its value vs the euro, yen, pound and swiss franc since March. Second, and more importantly for keeping the U.S. stock market propped up, it’s an attempt to prevent a soaring price of gold from reflecting the escalating risks embedded in the global financial system, of which the U.S. is the biggest component.