- Hippo in the Pool

- Incentives Matter

- Rolling Recession

- Cancun, Memphis, Dallas, Paris, and Europe

I’ve often thought it would be fun to convene a therapy group of weather forecasters and economic forecasters. Both face the same frustration: Everybody wants a clear, simple answer they can’t possibly give, because they don’t know. Then they get blamed for being wrong anyway.

In both weather and the economy, the best we can do is define a range of possible outcomes and try to assign probabilities. It’s not wet or dry, recession or boom. There’s a lot of in-between territory. And “in between” (or as I call it, “muddling through”) is usually what happens. Our plans should consider the full range.

For example, my wife started preparing for the next hurricane as soon as a storm (Bret) appeared in the Atlantic. Initial reports show Bret aiming at Puerto Rico but will now miss us. I teased her about it but then she said, “Well, what about the two storms behind it?” She is correct. We should be ready.

I’ve been trying to explain inflation in this way. Yes, inflation is high. Yes, inflation is falling. Yes, inflation will stay elevated. And yes, inflation could rise again. All these can be simultaneously correct, and I think they are. But that doesn't mean they all will happen.

Today I want to expand on this muddle-through inflation forecast. There’s a specific reason I think inflation will improve from where it was a year ago, but not drop back to pre-COVID levels (at least for a while). Inflation from here is all about housing (and to some extent services, but those prices can fall as fast as they rose). And, as you’ll see, the housing sector has changed a lot in the last few years.

That, in turn, affects other expectations. I’ve said before we might have A Weird Recession, unlike the cyclical downturns we think of as “normal.” In fact, they occurred in a particular economic and political context which prevailed only over the last 150 years or so. Change the context and other things can change as well. With central banks no longer operating as originally intended, I think that’s where we may be.

Is recession still coming? Of course. But some funny things are happening on the way there.

Prices routinely rise and fall in a dynamic economy. Price inflation occurs when the general trend is higher. We try to measure it with imprecise benchmarks like the Consumer Price Index. CPI monitors prices for a hypothetical basket of goods and services thought to represent a typical household’s spending.

Housing is the biggest single expense for most families. Ditto in CPI, but it’s represented in a strange way. In the US people either buy a home or rent one. In CPI, we do both. The index assigns 7.5% weighting to “rent of primary residence” and 25.4% to “owner’s equivalent rent.” Together with some small ancillary items (hotels, dorms, etc.), they form the “shelter” component with a 34.6% weighting.

This percentage may or may not resemble your situation, but here’s the real point: When we talk about CPI inflation, housing prices are roughly one-third of the conversation. It’s not just one item on a list. Housing is the 800-pound gorilla, the elephant in the room, the hippo in the pool. It dominates everything else including food with 13.4% and energy at just under 7%. If housing prices are going one way, it’s very hard for total CPI to go the other way.

I know, all real estate is local, etc., etc. You can always find extremes. But there’s every reason to think the general tendency of home prices—which is what matters to CPI—will continue rising for many more years.

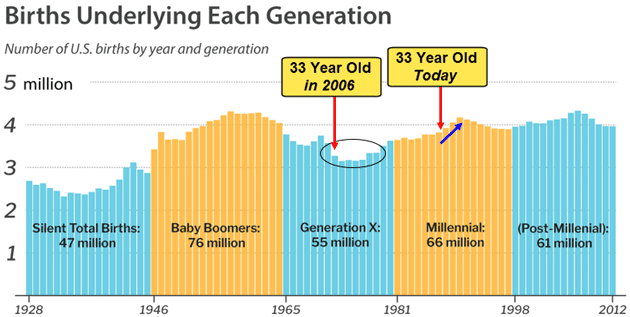

Let’s go back to my 2021 Tiny Housing Bubbles letter. It talked about how household formation is the key to housing demand. Single people become homebuyers when they settle down and think about having children. Barry Habib has data showing the age at which this happens has been remarkably steady around 33. The number of people that age defines housing demand. And guess what? Here’s a chart Barry made for me at the time.

Source: MBS Highway

The peak year for Millennial generation births was 1990. This year they turn 33. More will follow in 2024 and several years afterward. This should boost demand, especially for the kind of housing suitable for young families.

Unfortunately, such housing is in short supply.

Following World War II, we (I think wisely) decided homeownership was The American Dream and public policy should support this dream. Mortgage interest thus became a common tax deduction. It was, in effect, a tax subsidy that reduced the cost of buying a home. Taking advantage of it required one to itemize deductions, but that was rarely a problem.

Then something happened in 2017 which I think was unintended, as far as housing was concerned, but is proving significant.

That year’s tax changes raised the standard deduction to a much higher level that, combined with the Fed’s low-rate regime, meant most non-wealthy homeowners no longer got any additional benefit from their mortgage interest. And it’s adjusting even higher with inflation; a married couple filing jointly will get a $27,700 standard deduction this year. You now have to own a very large home and/or have many other deductible expenses to need to itemize.

(Note: The above is my own understanding but I’m neither a CPA nor the son of a CPA. Please get professional advice before you make any tax decisions.)

As I always say, incentives matter. Non-wealthy households no longer have a tax incentive to buy a home and other incentives not to. It is probably not coincidence homebuilders have largely stopped building what we once called “starter homes.” And when they do build such homes, it’s often for investors who plan to rent them to the young families who would once have been homebuyers.

Other things are happening, too. Many cities and suburbs have adopted zoning regulations and building codes that discourage smaller homes. The “work from home” trend makes people want more space and different floor plans. All this adds up to a qualitative mismatch between home demand and home inventory, pushing prices higher. This shows up in the inflation numbers.

Now remember the 34.6% CPI housing weight. Imagine (very hypothetically) all other prices hold steady and housing rises 10% in a year. Overall CPI would still rise 3.46%. That’s a pretty unlikely scenario, particularly with rental rate growth slowing. But note, slower rent growth isn’t the same as rent (either actual rent or owner’s equivalent) falling.

More realistically, imagine we settle back to 5% housing price growth and 2% on everything else. That would put overall CPI growth close to 3%. But given what I expect for energy prices, I think 2% growth in the non-housing components is somewhat optimistic. Slow growth in China is currently capping energy prices. That won’t last indefinitely.

Reasonable assumptions say the rest of the 2020s will probably see 3%+ average CPI inflation. It will likely be a bit lower in the Fed’s favored PCE gauge, which has a smaller housing weight, but still enough to keep rates elevated. Remember, Jerome Powell has said multiple times they want positive real rates across the entire curve. That gives them little room to cut rates unless inflation falls far more than we expect.

(Sidebar: The public has grown used to CPI and that is what the vast majority of the media writes about. So when PCE is low enough for Powell and team to start thinking about declaring victory and going home, the media headlines will be talking an inflation number above 3%. The markets and businesses will be screaming for lower interest rates just like they do now, but the Fed’s incentive will still be higher for longer. They really do intend to drive a stake in the inflation vampire's heart.)

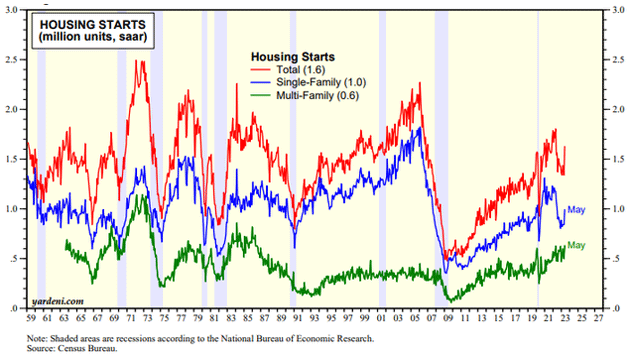

For that to happen we’d have to see housing prices not just stabilize but outright fall. Absent lower demand, which is demographically unlikely (people must live somewhere), it would require significantly more housing supply. That’s not impossible. Housing starts ticked up in last week’s report (and the buying of previously owned homes is up! At 6%+ mortgage rates!). But they’re also running well below previous housing booms. It’s also not clear the homes now being started are the kind first-time homebuyers want to buy and can afford.

Source: Yardeni QuickTakes

Bringing inflation down to the sub-2% level we enjoyed for so long would require a major slowdown in the growth of housing prices. The macro supply and demand factors don’t currently point that way. Starts and permits are up but it’s nothing like the frantic activity of the pre-2008 boom. Kind of like the shale industry, builders learned their lesson about risk.

If housing won’t slay inflation, what would? A recession, of course. But when?

History says Fed tightening cycles usually end with recession. The reason is pretty simple, too: Higher interest rates take a long time to reduce economic activity enough to affect inflation. This lag time makes calibrating rate hikes difficult. By the time the Fed knows it hiked too much, the recession is already underway.

Currently, Jerome Powell and other policymakers think they’ve suppressed inflation enough to at least slow down the pace. But the tightening they’ve already done will continue having effects for months, possibly enough to trigger recession. But when?

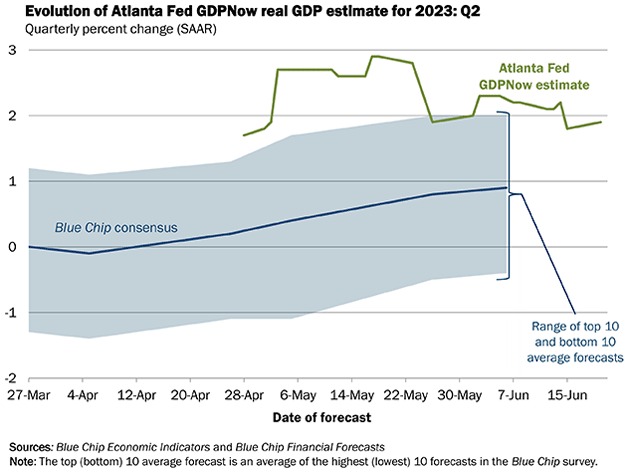

The Atlanta Fed’s GDPNow estimate points to 1.9% real growth in Q2. You can see in the green line this is the low end of its recent range. Nevertheless, even if it drops to 1%, which is roughly the Blue Chip private economist consensus, recession doesn’t seem to be here yet. This is more like the typical 2019 pre-COVID reading: not great but still positive.

Source: GDPNow

Ed Yardeni noted this week that housing starts are what gave GDPNow that most recent uptick. Residential investment has actually been dragging on overall GDP growth; a sustained change would be significant.

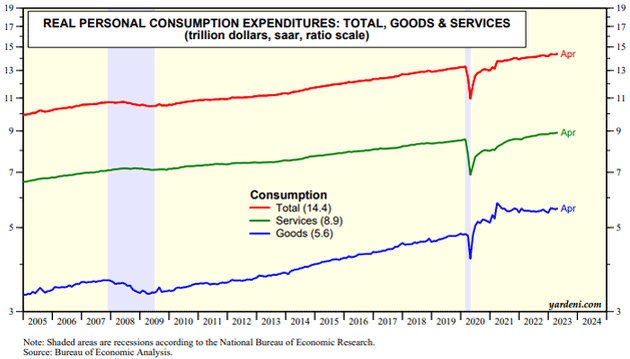

Yardeni has been saying for some time the long-expected recession is already underway as a “rolling recession,” hitting different segments sequentially instead of all at once. Now he’s looking for a “rolling recovery” as consumers keep spending. Here’s Ed:

“Inflation-adjusted consumer spending on goods has been in a growth recession since the second half of 2021 as consumers pivoted toward buying more services and fewer goods (chart). It is widely expected that consumer spending could turn negative once consumers' excess saving runs out later this year. We don't agree. We expect goods demand to start growing again later this year once it returns to its pre-pandemic uptrend. We also expect that consumers will have enough purchasing power to keep the economy growing.”

Source: Yardeni QuickTakes

You can see in that blue line how goods consumption has been unusually volatile but seems to be resuming the pre-2020 trend. I suspect this is related to the strong labor market and rising wages. These give workers more confidence and boost their spending.

We’ve seen geographically rolling recessions before. If you’re old enough, think back to the late 1980s when some regions of the United States actually went into recession but the whole country never did. Something similar, but sector-based, is plausible.

Mark Zandi is also betting against a near-term recession. He outlined five reasons in a new report this week:

- Consumers still have excess savings to supplement job income, which has also been growing. They aren’t spending with abandon but it’s enough to keep the economy growing.

- With workers so hard to find, businesses are doing everything they can to avoid layoffs. Many struggled to replace the people they laid off in 2020 and don’t want to go through that again.

- Household and business debt loads aren’t excessive, and the low rates of 2020‒2021 allowed many to refinance and lock in historically low rates.

- Inflation expectations are, as Jerome Powell says, “well-anchored.” People and businesses seem convinced the Fed will do what is needed to control inflation, which reduces the odds they will do the things that keep inflation higher.

- The Ukraine-driven energy spike doesn’t seem to have caused any lasting damage. Everyone adjusted and prices have pulled back.

These all make sense but can change, especially #5. Mark agrees a recession is coming eventually; he just doesn’t think it’s imminent.

(By the way, Ed Yardeni and Mark Zandi both spoke at SIC and you can still order transcripts here.)

And finally, my good friend Victor Sperandeo (widely known as Trader Vic), pointed out in his recent letter yet another reason recession has not yet appeared.

“In fiscal year 2022, the government spent $6.27 trillion. That works out to $17.178 billion a day.”

As Vic shows, that spending doesn't happen all at once but is spread out over several years. Plenty of stimulus money is still working through the system.

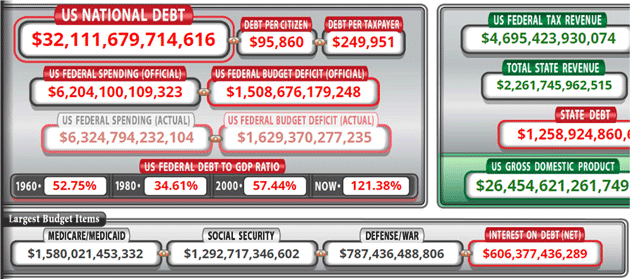

Notice the total U.S. debt and deficit below from the US Debt Clock. We are running a $1.6 trillion deficit, which is slightly more than 6% of GDP. The government’s interest expense is over $600 billion annually, even though a good portion was financed at lower rates. As those bonds roll off and we have to finance at higher rates, not to mention increasing the debt at a rate that will double it in just over 10 years, interest is going to consume the budget. That is one of the triggers for what I call The Great Reset.

Source: US Debt Clock

The 2020‒2022 fiscal stimulus clearly boosted (at least for the short term) GDP and inflation. And while the current level of stimulus doesn’t approach that of the previous two years, it is still gargantuan. It does have an impact.

(Sidebar: When you add state and local debt to federal debt you find that the total debt is almost $37 trillion and a total government debt-to-GDP ratio of 135%. Italy? Greece? Just saying. We should pay attention...)

The labor shortage is another hard-to-assess factor. This week we sent Over My Shoulder members a report by my friend Bill Dunkelberg of NFIB. He showed how inability to fill open positions both raises wages (good for workers and consumer spending) but also suppresses GDP growth by preventing business expansion. We just don’t know how that will shake out.

To me, the more interesting question is what this recession will look like, whenever it comes. Of course, they’re all unique in their own ways. This one was never going to be a rerun of 2020 or 2008 or 2000. But the basic recession characteristics—GDP, employment, consumer spending—are common threads. I really wonder if this one will have the same kind of effects.

At the beginning of the Fed tightening cycle, I said they would go to 5% fed funds rate and not stop until unemployment hit 5%. We are at 3.7% unemployment while Jamie Dimon and others say to expect a 6% federal funds rate. I find Dimon’s forecast interesting because he has access to the whispering of Fed officials that you and I don't have. The FOMC is clearly telling us they plan to take fed funds to 6%.

If you had asked me if I thought we could see 6% fed funds rate concurrent with below-4% unemployment, I would have said those numbers are not on my bingo card. A recession with housing as strong as it is today? And forecasted to stay strong? You can look at all the history you want, but you won't find a recession that looks like that. We are in new territory... This way there be Dragons.

I keep thinking back to the sandpile principal. Everything is stable until suddenly it’s not, and we never know what the trigger will be. I don’t think the business cycle is dead. Recession is coming. Or maybe, like Ed Yardeni says, the recession is already here, hiding in plain sight.

We will get answers in due course. Meanwhile, we must think the unthinkable and be ready for anything.

Cancun, Memphis, Dallas, Paris, and Europe

This time next week Shane and I will be in Cancun where I will be acting as the best man for my son Henry's wedding. What a privilege! Two weeks later we will be at Freedom Fest (see below), then Dallas the second week of August before starting to think of Europe where we will be in Paris to celebrate Charles Gave’s 80th birthday.

I am really looking forward to once again returning to FreedomFest. My longtime friend Mark Skousen (40 years!) has put together his best conference, a celebration of libertarian philosophy and economics. I will see lots of old friends (looking forward to dinner with George Gilder [assisted by a local reader] and then a night at BB King’s) but there are some people I really want to meet who will also be there. I will be speaking/on a panel at least three times and you will be able to find me near the King Operating booth. You can see the line-up and if you decide to attend use the special code MIKEROWE77 to get a $77 discount. Mike is a featured speaker whom you may know as the host of “Dirty Jobs” and as an advocate for technical trade training. Presidential candidates, economists, and a lot of fun. Barbecue and Blues. Look me and Shane up if you come.

On a business note, partner Ed D’Agostino and I are looking for some help growing our audiences on social media. If you know of someone who is skilled with Twitter and other social platforms, please pass along this link where they can learn more.

It is time to hit the send button, so let me wish you a great week! And speaking of social media, don't forget to follow me on Twitter!

Your looking forward to making new friends analyst,

|

|

John Mauldin |

P.S. If you like my letters, you’ll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price.

Click here to learn more.