VANCOUVER, British Columbia, Aug. 08, 2023 (GLOBE NEWSWIRE) -- Fortuna Silver Mines Inc. (NYSE: FSM) (TSX: FVI) is pleased to provide an update on its exploration programs at the Séguéla Mine in Côte d’Ivoire, the Yaramoko Mine in Burkina Faso, and the Baborigame Project in Mexico.

Paul Weedon, Senior Vice President of Exploration at Fortuna, commented, “Infill drilling at the Sunbird Deposit to upgrade geologic confidence has concluded, with the next phase of estimation, optimization, and design having commenced as part of reserve development and expected life-of-mine extension for the Séguéla Mine. With this underway, the focus has returned to generating new anomalies and testing prospects, with positive near surface results at Barana emphasising the regional potential; such as drill hole SGRD1647 intersecting 90.9 g/t Au over an estimated true width of 1.8 meters.”

Mr. Weedon continued, “Recent drilling of Zone 55 at the Yaramoko Mine has identified high grade mineralization extending at least 130 meters beyond the current resource envelope to the west, confirmed by recent mine development in the area, with intervals such as 32.8 g/t Au over an estimated true width of 3.1 meters in drill hole YRM-23-GCDD-203.”

Mr. Weedon concluded, “In addition to the encouraging results from West Africa, first pass drilling to test geological concepts at our Baborigame Project in Mexico was successful in testing several vein arrays, intersecting multiple mineralized zones such as 2.7 g/t Au and 155 g/t Ag over an estimated true width of 4.04 meters in drill hole BAB-22-004.”

Séguéla Mine, Cote d’Ivoire

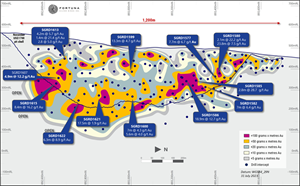

Sunbird Deposit drilling highlights:

- SGRD1586: 12.7 g/t Au over an estimated true width of 18.9 meters from 147 meters

- SGRD1580: 22.2 g/t Au over an estimated true width of 2.1 meters from 115 meters and 7.5 g/t Au over an estimated true width of 23.8 meters from 128 meters

- SGRD1615: 16.2 g/t Au over an estimated true width of 8.4 meters from 270 meters

- SGRD1585: 28.7 g/t Au over an estimated true width of 2.8 meters from 151 meters

- SGRD1599: 4.7 g/t Au over an estimated true width of 13.3 meters from 81 meters

- SGRD1281: 10.7 g/t Au over an estimated true width of 5.6 meters from 199 meters (re-entered hole)

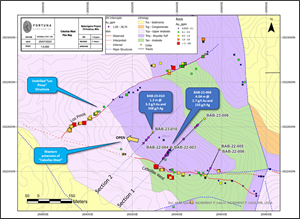

Infill drilling for increased geologic confidence at the Sunbird Deposit was recently completed, with 47 holes drilled totalling 11,075 meters of an expanded 15,126 meter program, increased from 9,500 meters due to continued positive results. Drilling has intersected high grade mineralization close to the margins of the pit optimization limit. Drill hole SGRD1580 intersected several zones of mineralization including 22.2 g/t Au over a true width of 2.1 meters and 7.5 g/t Au over a true width of 23.8 meters while a re-entered drill hole, SGRD1281, intersected 10.7 g/t Au over a true width of 5.6 meters on the margin of the current pit optimization shell (Figure 1). Results will be incorporated into an updated Mineral Resource and Mineral Reserve estimate prior to pit optimization and design of a revised Séguéla life-of-mine planned for release in the fourth quarter of 2023.

Further drilling to test the depth potential of the southerly plunging high grade shoots is planned for the second half of 2023. Refer to Appendix 1 for full results of all holes drilled in this phase of the Sunbird exploration program.

Figure 1: Sunbird Deposit long-section showing select recent drilling results (looking west)

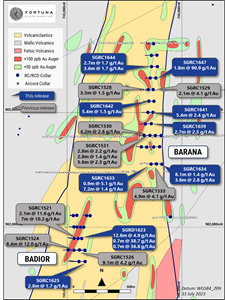

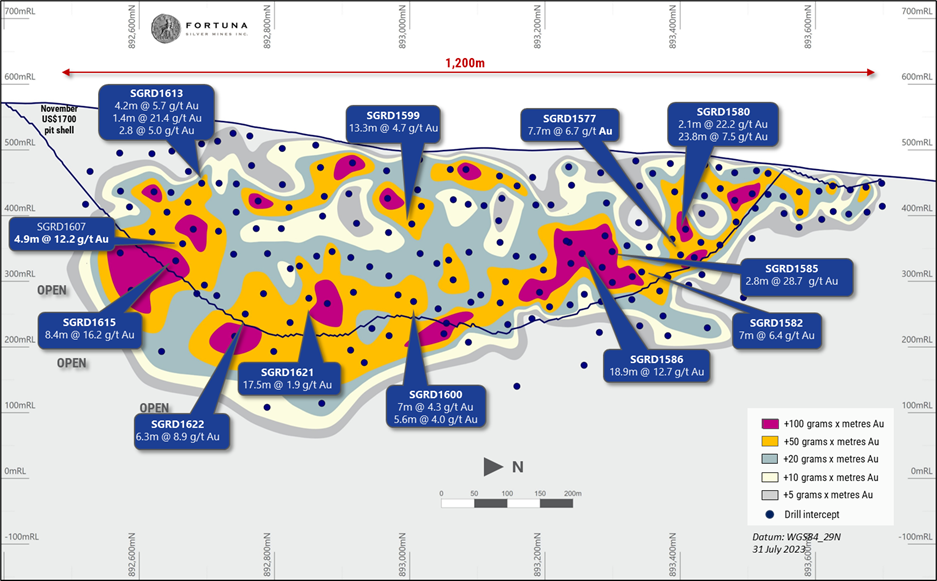

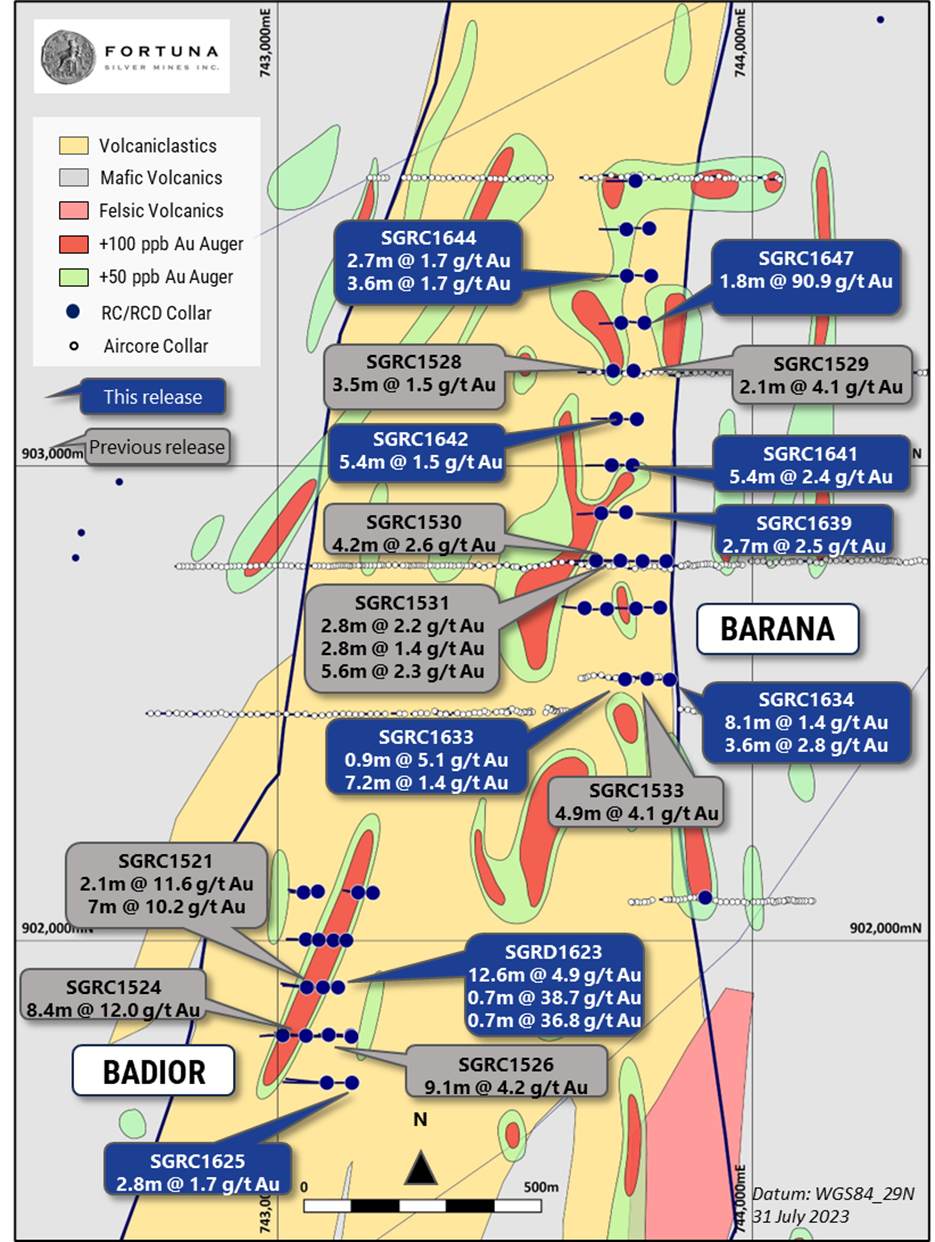

Barana and Badior drilling highlights:

- SGRD1647: 90.9 g/t Au over an estimated true width of 1.8 meters from 43 meters (Barana)

- SGRD1634: 1.4 g/t Au over an estimated true width of 8.1 meters from 77 meters (Barana)

- SGRD1641: 2.4 g/t Au over an estimated true width of 5.4 meters from 67 meters (Barana)

- SGRD1623: 4.9 g/t Au over an estimated true width of 12.6 meters from 110 meters (Badior)

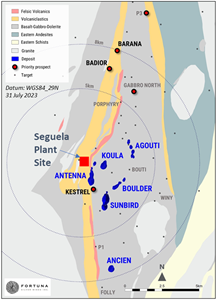

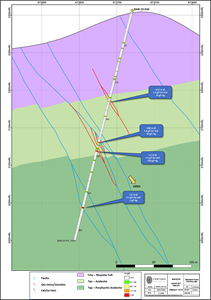

At the Barana and Badior prospects (Figure 2), 30 holes totaling 3,907 meters were drilled (Figure 3) with the objective of testing the strike extent and continuity of mineralization identified in the first scout drilling program (refer to Fortuna news release dated December 5, 2022). In addition, the drilling program was designed to provide greater understanding of the key structures associated with mineralization controls as well as grade distribution along the principal structures.

Further drilling is planned for later in 2023. Refer to Appendix 1 for full results received for all drill holes drilled in this phase of the Barana and Badior drilling program.

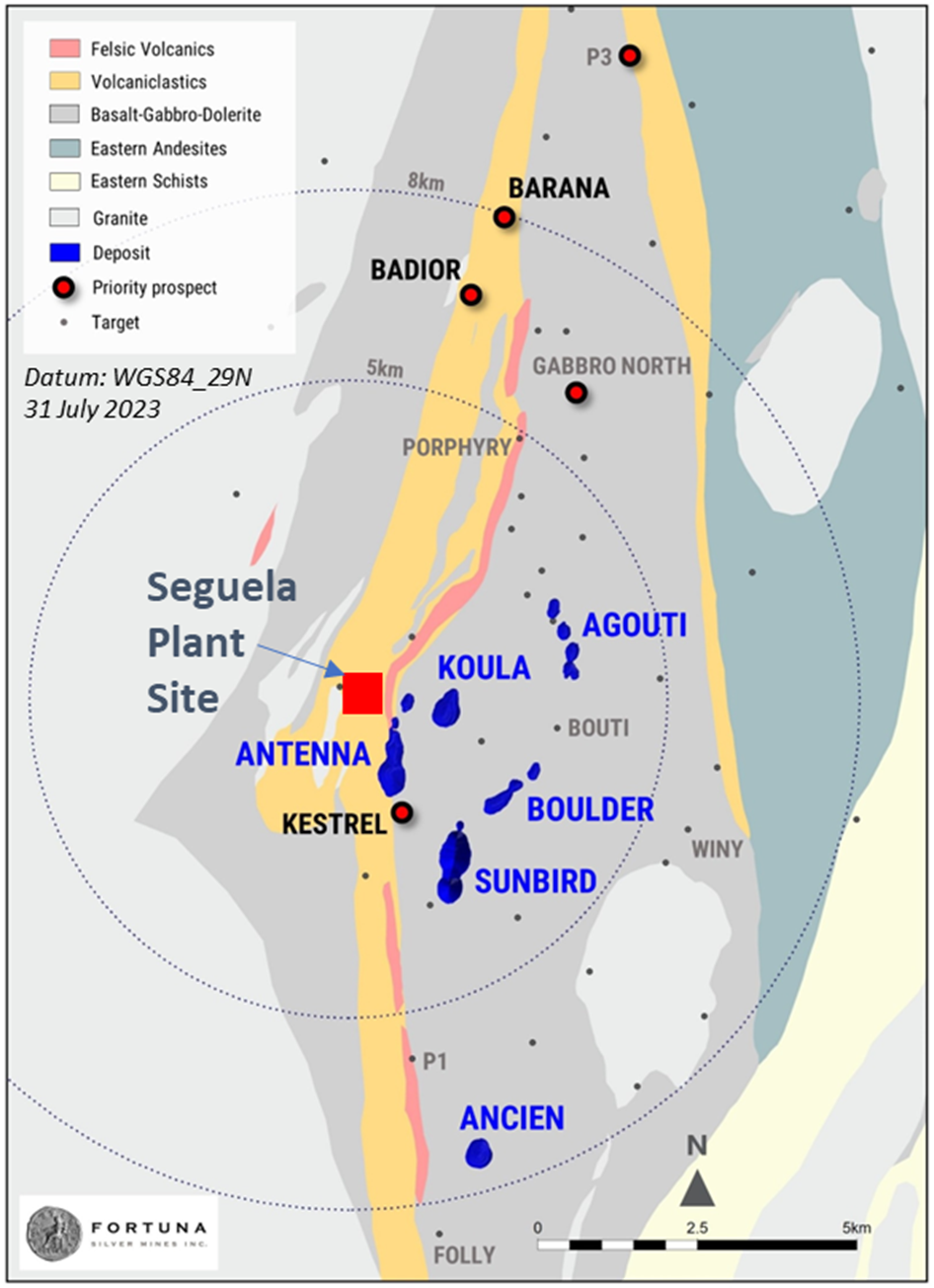

Figure 2: Séguéla Mine location plan highlighting key exploration prospects

Figure 3: Barana and Badior plan showing recent drilling results

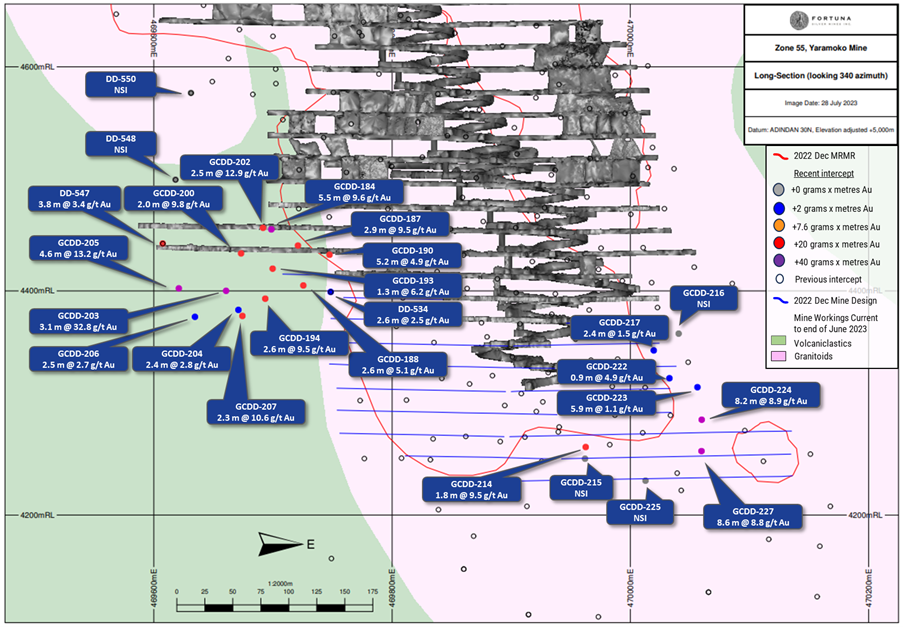

Yaramoko Mine, Burkina Faso

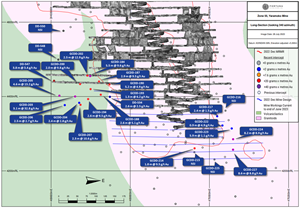

A successful drilling program of 29 holes for a total of 7,011 meters was completed at the Yaramoko Mine, testing the strike and vertical extent of high grade extensions to the Zone 55 mineralization to the west, and limited strike extent testing to the lower east levels of the underground operation. Based on the positive exploration results, management expects to provide an updated Mineral Resource and Mineral Reserve estimate for the Yaramoko Mine before the end of the year.

Zone 55 drilling highlights:

- YRM-22-GCDD-184: 9.6 g/t Au over an estimated true width of 5.5 meters from 254.10 meters

- YRM-23-GCDD-203: 32.8 g/t Au over an estimated true width of 3.1 meters from 287.90 meters

- YRM-23-GCDD-205: 13.2 g/t Au over an estimated true width of 4.6 meters from 302.28 meters

- YRM-23-GCDD-224: 8.9 g/t Au over an estimated true width of 8.2 meters from 120.95 meters

- YRM-23-GCDD-227: 8.8 g/t Au over an estimated true width of 8.6 meters from 140.10 meters

Drilling to the west has intersected new high grade mineralization beyond the boundary of the 2022 Mineral Resource (refer to Fortuna news release dated March 21, 2023), with recent mine development extending approximately 130 meters beyond the previous design (Figure 4). Drilling will continue to test the depth potential in the second half of 2023, which remains open and where the deepest intersection returned 10.6 g/t Au over a true width of 2.3 meters in drill hole GCDD-207.

Figure 4: Zone 55 long-section showing recent drilling results

Step-out drilling to the east and at depth has also continued to identify the Zone 55 mineralized structure beyond the limits of the 2022 Mineral Resource boundary, with encouraging results including drill hole GCDD-224 returning 8.9 g/t Au over a true width of 8.2 meters at (Figure 4). Drilling will continue in the second half of 2023. Refer to Appendix 2 for full results of all holes drilled in this phase of the Yaramoko exploration program.

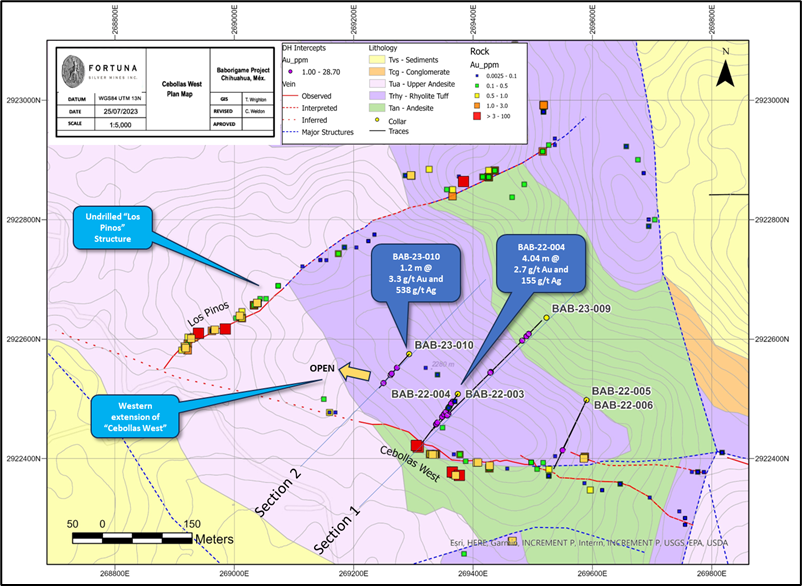

Baborigame Project, Mexico

A program of 14 diamond drill holes over two phases totaling 3,902 meters was conducted between late 2022 and 2023 as part of a “proof of concept” evaluation of the Baborigame Project. Baborigame is located within the central Sierra Madre Occidental, a major mountain range system of the North American Cordillera, in southwestern Chihuahua, Mexico.

Baborigame drilling highlights:

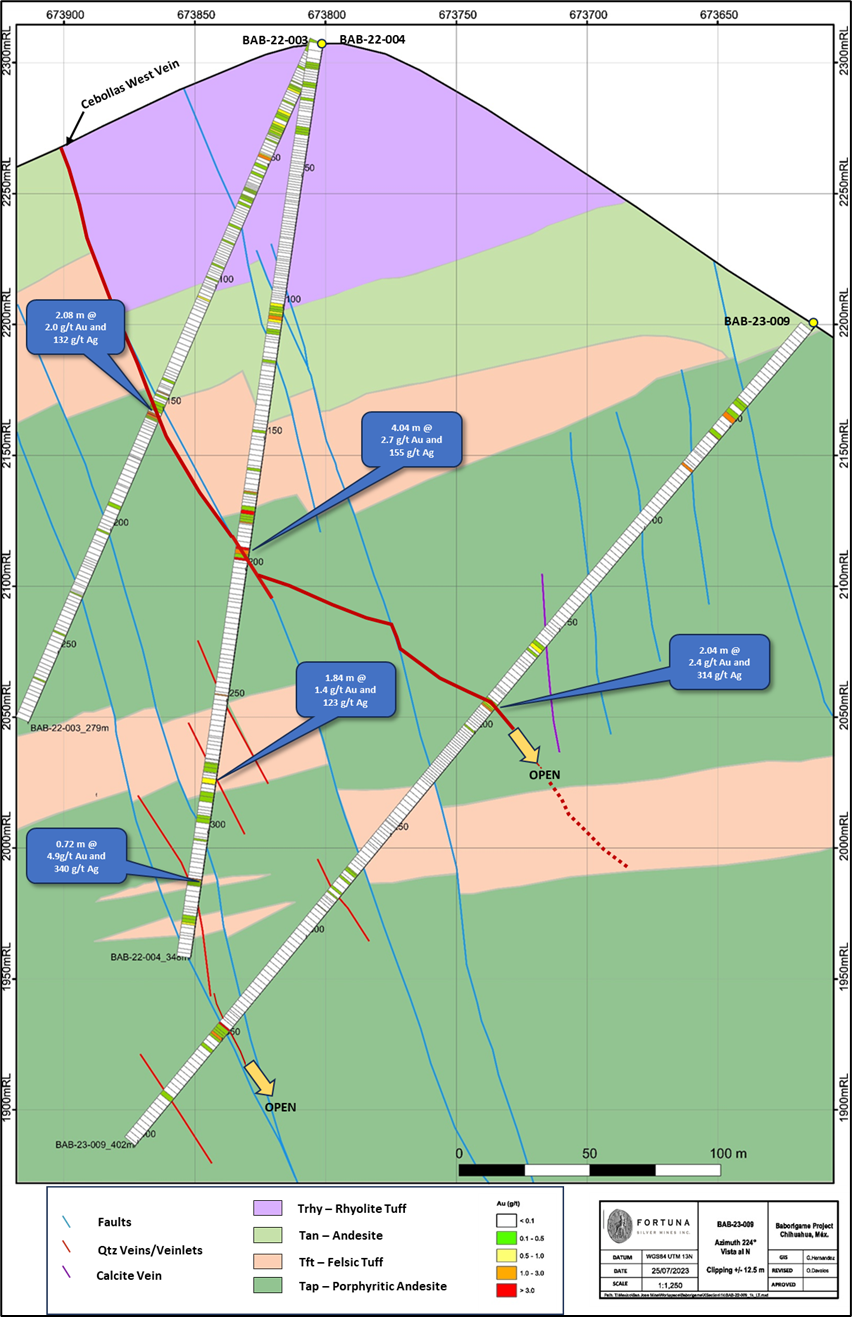

- BAB-22-004: 2.7 g/t Au and 155 g/t Ag over an estimated true width of 4.04 meters from 192.00 meters

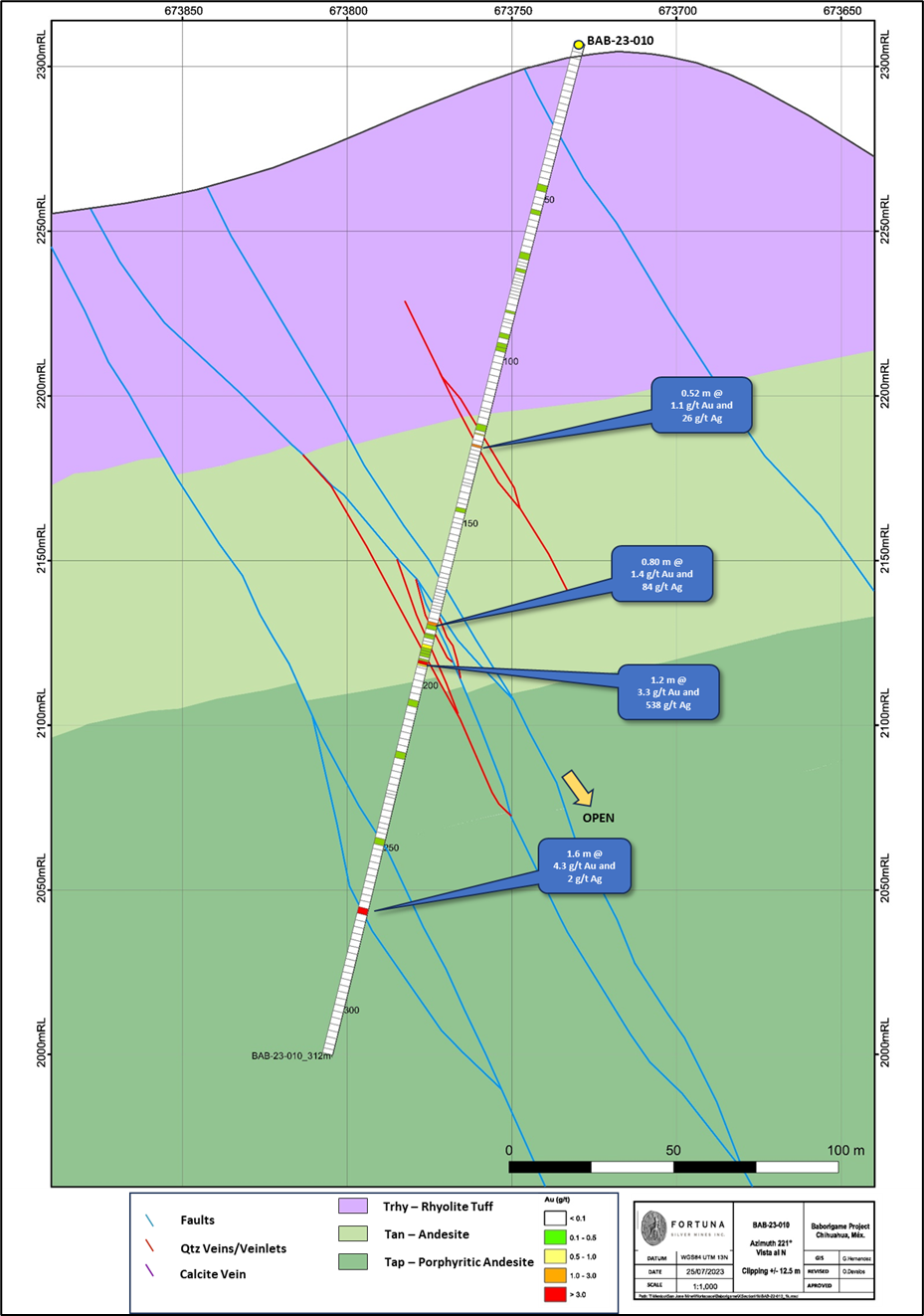

- BAB-23-010: 3.3 g/t Au and 538 g/t Ag over an estimated true width of 1.20 meters from 191.00 meters

- BAB-23-009: 2.4 g/t Au and 314 g/t Ag over an estimated true width of 2.04 meters from 188.15 meters

Exploration drilling focused on testing key structural zones at productive geologic horizons beneath high-level epithermal expressions observed at surface (Figure 5), 10 of the 14 drill holes returned positive exploration results and warrant further work. Further drilling is scheduled for the second half of 2023 targeting the western extension of Cebollas West and the undrilled Los Pinos structure where surface rock sampling returned up to 10 g/t Au and 369 g/t Ag. Refer to Appendix 3 for full results of all holes drilled in this phase of the Baborigame exploration program.

Figure 5: Baborigame plan view of drill testing at Los Pinos and the western extension of the Cebollas West zone; refer to Figure 6 and Figure 7 for cross-sections 1 and 2

Figure 6. Cross-section 1 of drill testing at Los Pinos and the western extension of the Cebollas West zone

Figure 7. Cross-section 2 of drill testing at Los Pinos and the western extension of the Cebollas West zone

Quality Assurance & Quality Control (QA-QC)

All drilling data completed by the Company utilized the following procedures and methodologies. All drilling was carried out under the supervision of the Company’s personnel.

All reverse circulation (RC) drilling at Séguéla used a 5.25-inch face sampling pneumatic hammer with samples collected into 60-liter plastic bags. Samples were kept dry by maintaining enough air pressure to exclude groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails. Once collected, RC samples were riffle split through a three-tier splitter to yield a 12.5 percent representative sample for submission to the analytical laboratory. The residual 87.5 percent samples were stored at the drill site until assay results were received and validated. Coarse reject samples for all mineralized samples corresponding to significant intervals are retained and stored on-site at the company-controlled core yard.

All diamond drilling (DD) drill holes at Séguéla were drilled with HQ-sized diamond drill bits whereas Yaramoko diamond drill holes were cored with NQ2-diameter drill bits. The core was logged, marked up for sampling using standard lengths of one meter or to a geological boundary. Samples were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location at the Company´s core yard at the mine site. The other half was sampled, catalogued, and placed into sealed bags and securely stored at the site until shipment.

All Séguéla RC and DD core samples were shipped to ALS Laboratories’ preparation laboratory in Yamoussoukro for preparation and then, via commercial courier, to ALS’s facility in Ouagadougou, Burkina Faso for finishing. All core samples from Yaramoko were transported by commercial courier to ALS’s facility in Ouagadougou. Routine gold analysis using a 50-gram charge and fire assay with an atomic absorption finish was completed for all samples. Quality control procedures included the systematic insertion of blanks, duplicates and sample standards into the sample stream. In addition, the ALS laboratory inserted its own quality control samples.

All DD drill holes at Baborigame were drilled with HQ-sized diamond drill bits and reduced to NQ if ground conditions warranted. The core was logged, marked up for sampling using standard lengths of two meters or to a geological boundary. Samples were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location at the company core yard at the project site. The other half was sampled, catalogued, and placed into sealed bags and securely stored at the site until shipment.

All Baborigame DD core samples were shipped to ALS Laboratories’ preparation laboratory in Zacatecas for preparation and then to ALS’s facility in Vancouver, Canada for finishing. Samples were analyzed using a 33 element four acid ICP and trace Hg along with a 30-gram fire assay for gold. Over limits for Au, Ag, Pb, and Zn were analyzed using an appropriate method. Quality control procedures included the systematic insertion of blanks, duplicates, and sample standards into the sample stream. In addition, the ALS laboratory inserted its own quality control samples.

Qualified Person

Paul Weedon, Senior Vice President of Exploration for Fortuna Silver Mines Inc., is a Qualified Person as defined by National Instrument 43-101 being a member of the Australian Institute of Geoscientists (Membership #6001). Mr. Weedon has reviewed and approved the scientific and technical information contained in this news release. Mr. Weedon has verified the data disclosed, and the sampling, analytical and test data underlying the information or opinions contained herein by reviewing geochemical and geological databases and reviewing diamond drill core. There were no limitations to the verification process.

About Fortuna Silver Mines Inc.

Fortuna Silver Mines Inc. is a Canadian precious metals mining company with five operating mines in Argentina, Burkina Faso, Côte d'Ivoire, Mexico, and Peru. Sustainability is integral to all our operations and relationships. We produce gold and silver and generate shared value over the long-term for our stakeholders through efficient production, environmental protection, and social responsibility. For more information, please visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Silver Mines Inc.

Investor Relations:

Carlos Baca | info@fortunasilver.com | www.fortunasilver.com | X | LinkedIn | YouTube

Forward looking Statements

This news release contains forward looking statements which constitute “forward looking information” within the meaning of applicable Canadian securities legislation and “forward looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 (collectively, “Forward looking Statements”). All statements included herein, other than statements of historical fact, are Forward looking Statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual events or results to differ materially from those reflected in the Forward looking Statements. The Forward looking Statements in this news release include, without limitation, statements about the Company’s plans for the exploration on the Sunbird deposit at the Séguéla Mine; the anticipated exploration and development programs at the Sunbird deposit, together with the investment, nature, implementation and timing thereof; the timing for, and anticipated results of the exploration programs at the Sunbird deposit at the Séguéla Mine, and the intention and proposed timing of an updated mineral resource and mineral reserve estimate and revised life-of-mine for the Séguéla Mine; planned drilling for the remainder of 2023 at Barana and Badior at the Séguéla Mine, Zone 55 at the Yaramoko Mine, and at the Baborigame Project; the intention and proposed timing of an updated mineral resource and mineral reserve estimate for the Yaramoko Mine; the Company’s business strategy, plans and outlook; the merit of the Company’s mines and mineral properties; mineral resource and reserve estimates; timelines; the future financial or operating performance of the Company; expenditures; approvals and other matters. Often, but not always, these Forward looking Statements can be identified by the use of words such as “estimated”, “potential”, “open”, “future”, “assumed”, “projected”, “used”, “detailed”, “has been”, “gain”, “planned”, “reflecting”, “will”, “containing”, “remaining”, “to be”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by the Forward looking Statements. Such uncertainties and factors include, among others, changes in general economic conditions and financial markets; changes in prices for silver, gold and other metals; the timing of the Company’s proposed exploration programs at the Sunbird deposit, Barana, and Badior at the Séguéla Mine ; Zone 55 at the Yaramoko Mine, and at the Baborigame Project; the success of the Company’s proposed exploration programs; technological and operational hazards in Fortuna’s mining and mine development activities; risks inherent in mineral exploration; fluctuations in prices for energy, labor, materials, supplies and services; fluctuations in currencies; uncertainties inherent in the estimation of mineral reserves, mineral resources, and metal recoveries; our ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; governmental and other approvals; political unrest or instability in countries where Fortuna is active; labor relations issues; as well as those factors discussed under “Risk Factors” in the Company's Annual Information Form for the financial year ended December 31, 2022. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward looking Statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward looking Statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to expectations regarding the results from the exploration programs conducted at the Séguéla Mine; expected trends in mineral prices and currency exchange rates; the accuracy of the Company’s information derived from its exploration programs at the Company’s mineral properties; current mineral resource and reserve estimates; the presence and continuity of mineralization at the Séguéla Mine; that the Company’s activities will be in accordance with the Company’s public statements and stated goals; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained; that there will be no significant disruptions affecting operations and such other assumptions as set out herein. Forward looking Statements are made as of the date hereof and the Company disclaims any obligation to update any Forward looking Statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that Forward looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on Forward looking Statements.

Cautionary Note to United States Investors Concerning Estimates of Reserves and Resources

Reserve and resource estimates included in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by a Canadian company of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and mineral resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Reserves.

Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission, and mineral reserve and resource information included in this news release may not be comparable to similar information disclosed by U.S. companies.

APPENDIX 1. Séguéla Mine, Côte d´Ivoire: Sunbird Deposit drill results

|

Notes:

- EOH: End of hole

- NSI: No significant intercepts

- ETW: Estimated true width

- RCD: Reverse circulation with diamond tail | DD: Diamond drilling tail | RC: Reverse Circulation drilling

APPENDIX 2. Yaramoko Mine, Burkina Faso: Zone 55 drill results

Notes:

APPENDIX 3. Baborigame Project, Mexico: Drill results

Notes:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Figure 1

Sunbird Deposit long-section showing select recent drilling results (looking west)

Figure 2

Séguéla Mine location plan highlighting key exploration prospects

Figure 3

Barana and Badior plan showing recent drilling results

Figure 4

Zone 55 long-section showing recent drilling results

Figure 5

Baborigame plan view of drill testing at Los Pinos and the western extension of the Cebollas West zone; refer to Figure 6 and Figure 7 for cross-sections 1 and 2

Figure 6

Cross-section 1 of drill testing at Los Pinos and the western extension of the Cebollas West zone

Figure 7

Cross-section 2 of drill testing at Los Pinos and the western extension of the Cebollas West zone

This email was sent to you at editorials@goldseek.com by Stockwatch (www.stockwatch.com) as part of your package of Stockwatch services, and in accordance with your email preferences on file. You may unsubscribe at any time, or change your email preferences within Your Account settings at the Stockwatch website. THIS IS NOT A RECOMMENDATION TO BUY OR SELL ANY SECURITY. You may contact Stockwatch by email at webmaster@stockwatch.com, by phone at 1-800-268-6397 (1-604-687-1500), or by mail to Stockwatch, PO Box 10371, 700 West Georgia Street, Vancouver, BC, V7Y 1J6, Canada. "Stockwatch" is a registered trademark of Canjex Publishing Ltd. Copyright © 2023, Canjex Publishing Ltd. All rights reserved.