It's almost as if the central bankers at the Federal Reserve are throwing darts at the wall to determine the trajectory of monetary policy.

And I'm not convinced there is even a dartboard on the wall.

And yet, people keep selling gold and silver based on what these people say!

The Fed wrapped up its June FOMC meeting yesterday (June 12). Once again, it didn't do anything. Interest rates remain unchanged in a range between 5.25 and 5.5 percent.

The official FOMC statement remained mildly hawkish, giving no hint that rates will come down anytime soon.

"The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent."

In his post-meeting press conference, Federal Reserve Chairman Jerome Powell continued the hawkish tone, even as the mainstream trumpeted a May CPI report that hinted at cooling price inflation (maybe).

“We see today’s report as progress and as, you know, building confidence. But we don’t see ourselves as having the confidence that would warrant beginning to loosen policy at this time.”

Powell even refused to take another rate hike off the table, although he downplayed the possibility more than he did after the last meeting.

“Not to eliminate the possibility of hikes, but no one has that as their base case. No one on the committee does.”

Dot Plot Speculation

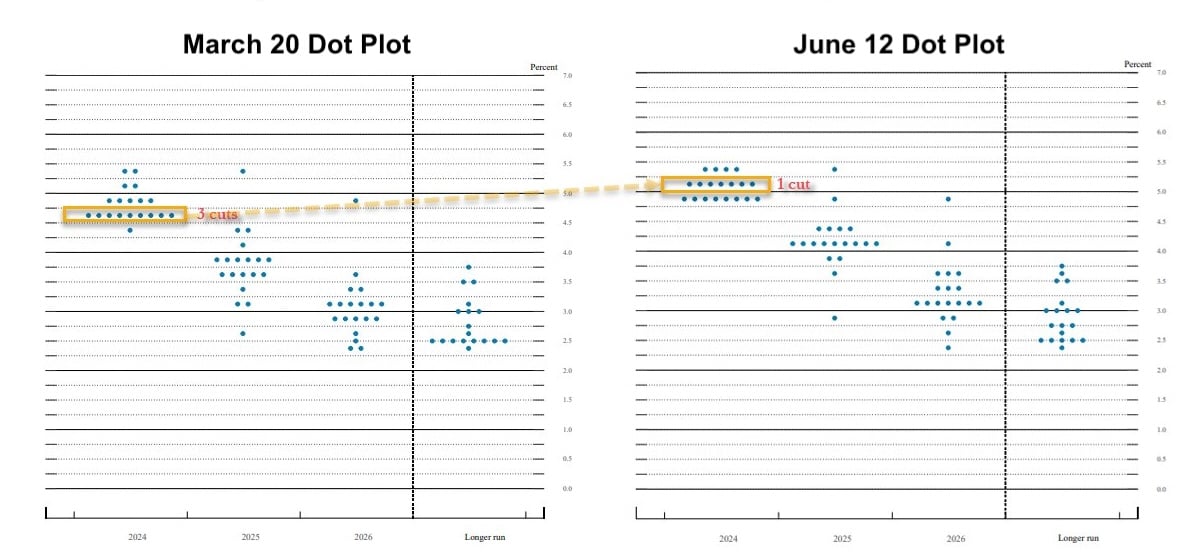

The big news was the release of a new set of dot plots projecting the trajectory of interest rate policy. They looked quite different than they did just a few months ago.

In late March, 10 FOMC members projected rates at 4.625 percent by the end of the year. Now there are none. In other words, nobody expects three cuts this year and a growing number of committee members don't think they will cut at all. The rest are almost equally split between one and two cuts.

Stop and think about this just a few months ago, the FOMC was convinced that three rate cuts were the appropriate trajectory of monetary policy.

What a difference two and a half months make.

Of course, this should come as no surprise. The Federal Reserve members are notoriously bad a projecting the trajectory of interest rates, even though they're the ones literally setting the rates.

How bad is their track record?

Fund manager David Hay analyzed past dot plots and found the FOMC only got interest rate projections right 37 percent of the time. And as Hay pointed out, “They control interest rates!”

For instance, in March 2021, the FOMC projected the interest rate would still be zero in 2022. The actual 2022 rate was 1.75 percent. And in 2023, the vast majority of FOMC members thought the rate would still be at zero. The actual rate was over 5 percent.

The FOMC would probably get much better results by flipping coins or gazing into crystal balls.

This doesn’t exactly inspire confidence that these people know what they’re doing, does it?

Now, you might say, “Well, Mike, monetary policy is a complex business. You can’t expect them to get it right every time.”

And that might be a fair assessment.

The problem is it doesn’t seem like they ever get it right.

What Is an Investor to Do?

So, what is a gold and silver investor to do with this info?

The mainstream consensus has been to sell gold and silver anytime Powell & Company comes out hawkish, or good economic data indicates the economy is still rolling along. (This is because there is a misguided notion that a strong economy creates inflation. It doesn't. Money creation causes price inflation.) The mainstream buys gold and silver when the Fed gets doveish or CPI data indicates price inflation might be cooling. This raises hope that interest rate cuts are in the pipeline.

Yesterday, we got both kinds of news!

The Fed was hawkish, but the May CPI report indicated (or at least seemed to on the surface) that price inflation is in retreat.

This seems to have put mainstream investors in a bind. The price of gold and silver reflects that, whipsawing back and forth. There was very little change on Wednesday. Thursday morning, the price of gold and silver were tanking. Gold was down about $15 an ounce. Then news broke that producer prices rose far less than expected in May, putting the brakes on the sell-off.

I'm just going to throw this out there. Instead of making knee-jerk moves based on the last thing on X (formerly known as Twitter), folks might be wise to look at the underlying dynamics.

The reality is the Fed is stuck between a rock and a hard place. The central bank has not done enough to slay price inflation. But the Fed has made monetary policy "sufficiently tight" to break things in this debt-riddled, bubble economy. It has already sparked a financial crisis that continues to bubble under the surface. The world is still buried in debt. Governments continue to borrow and spend. There are still all kinds of malinvestments in the economy.

It’s only a matter of time before the economy unravels. That’s when the markets will get the rate cuts they desperately want – even though inflation still has a heartbeat.

Of course, that means more price inflation.

The fundamentals right now are supportive of gold and silver, no matter how many dots Fed people put on a plot.