Tiny bars of gold are flying off the shelves in South Korean convenience stores.

This is yet another example of the movement of gold from West to East.

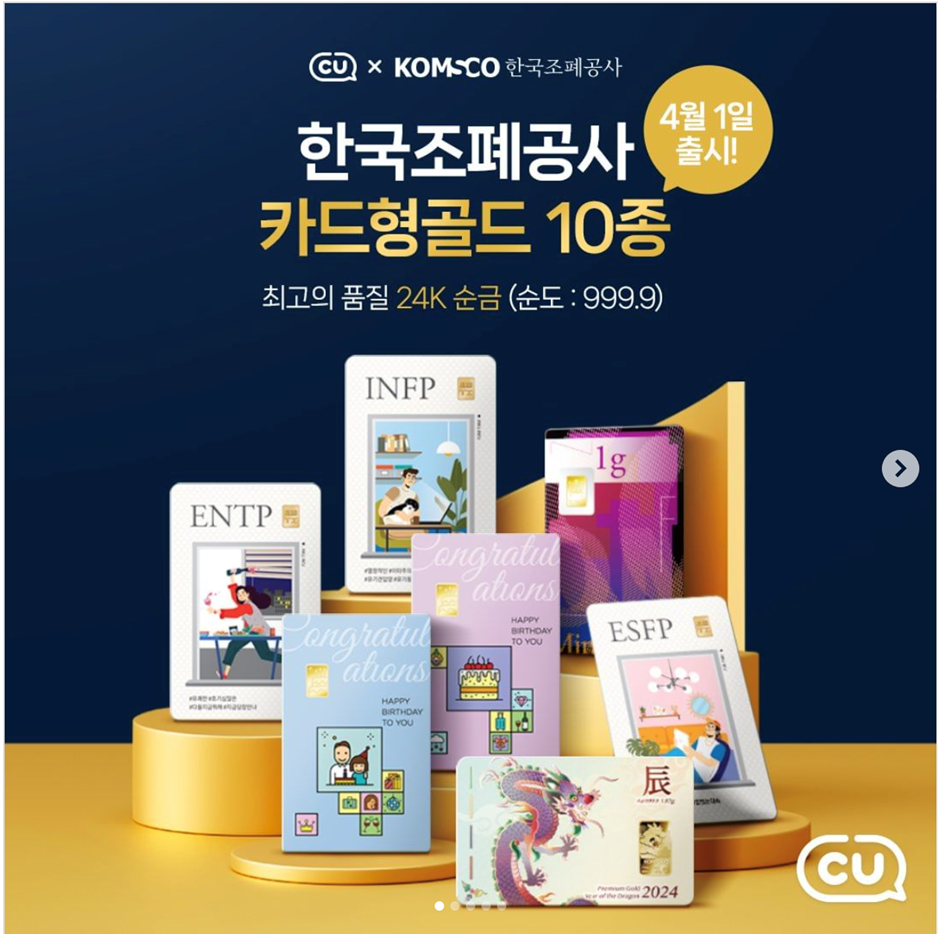

Korea’s largest convenience store chain, CU, has teamed up with Korea Minting and Security Printing Corporation (KOMSCO) to offer customers fingernail-sized gold bars. The bars come in a range of sizes between 0.1 grams and 1.87 grams. The largest bars sell for 225,000 won, the equivalent of about $165.

The gold is packaged in cards that feature various graphics and messages.

The product is similar to gold beans popular in China.

CU began selling the gold bars in April. One-gram bars sold out within two days, and according to a Korean news report, CU had sold 60 percent of the total inventory by April 23.

According to CU, the company plans to expand its gold product range with heavier weights including 2-gram, 4-gram, and 10-gram bars.

According to the news report, the majority of customers were millennials in their 30s and 40s. They accounted for over 70 percent of the sales. Fractional gold bars are a convenient investment for young people with smaller incomes who want to own gold.

Demand for the small bars dovetails with a more general trend of increased gold demand in Korea. According to the World Gold Council, demand for gold coins and bars increased by 27 percent year-on-year in the first quarter of 2024. It was the sharpest increase in Korean physical gold demand in more than two years.

Like the U.S., Korea is dealing with sticky price inflation averaging around 3 percent. According to an article in the Korean Times, rising prices, especially food costs, are putting a squeeze on Korean consumers.

Inflation pressures are likely a factor in the surging demand for gold. Koreans have also been dealing with stagnant wages and record levels of debt.

The country also reflects a broader trend of strong gold demand in Asian markets. In effect, we’re seeing a movement of gold from West to East.

Asian demand helped drive overall gold demand to the highest first-quarter level since 2016.

According to the World Gold Council, profit-taking by Western investors contrasted with largely one-way investment demand in Asia. Bar and coin demand in China surged by 68 percent year-on-year to 110 tons. Gold bar and coin investment in India jumped by 19 percent year-on-year. Meanwhile, physical gold demand fell modestly in U.S. and European markets.

Rapidly increasing gold reserves of emerging market central banks primarily in the East have also supported gold demand.

The impact remains unclear, but there is no doubt that gold's axis is moving to the East - particularly China.