Modern Monetary Theory, or MMT, posits that rather than obsessing about how large a country’s debt has grown, and the ongoing annual deficits that fuel debt, focus should instead be on government spending.

From Dr Mike Walden, You Decide: Are We Looking at a Test of MMT?

“Traditional economic theory states the federal government can pay for its spending in three ways. It can tax income away from households and businesses to fund the spending. Or, it can borrow money from private sources to pay for spending. Last, the federal government can borrow funds from the country’s central bank, the Federal Reserve.

With the first method, the costs of the spending are immediately paid by taxpayers. When borrowing from private sources, there are two costs. The first is regular interest payments on the loans, and the second is payment of the principal (the amount borrowed) when the term of the loan ends, unless the loan is refinanced.

With the third method – borrowing from the Federal Reserve – there is a unique aspect. When you or I pay taxes, we are sending money we’ve earned to the government. Similarly, if we willingly loan money to the federal government because we want to include federal investments, called Treasury securities, as part of our investment portfolio, we are again using money we’ve earned.

But when the Federal Reserve loans money to the federal government, it is not using money the central bank has earned. Instead, the Federal Reserve uses money it has created. That’s right, the Federal Reserve has the unique ability to print money, although in today’s economy the creation is done digitally.

In the past, the Federal Reserve was careful about how much money it created for fears of sparking faster increases in prices, that is, higher inflation. In fact, there’s been substantial research from numerous countries showing a link between faster money creation and higher inflation.

But now enter MMT. MMT questions the assumption of an automatic link between money creation and inflation. Specifically, MMT says if the government spending financed by newly created money makes the economy more productive – thereby leading to faster economic growth and more jobs and income – then the inflation rate won’t rise. In addition, a larger economy will make debt payments more affordable for the federal government.”

Government is therefore given a free pass on spending, because the only thing it has to worry about is paying the interest on its debt. Do that, and the debt can keep growing, with no consequences because countries borrowing in their own sovereign currencies don’t face hard debt limits because they can’t go broke.

Governments do not need to “come up with the money” to spend, like raising it through taxation. It just prints money.

The South China Morning Post reported in January that China is fast-tracking 102 major infrastructure projects in 2022.

Beijing is advocating for so-called “new infrastructure”, including 5G, ultra-high-voltage power transmission, big data centers, industrial internet and artificial intelligence.

A proposed new economic model for China creates a template that other developing nations can use to fund major spending initiatives they previously couldn’t afford, since it involved changing their currencies into US dollars, the world’s reserve (and most expensive to convert to) currency.

The upshot will be a global need for commodities that surpasses anything we have ever seen before, even the last commodities super-cycle in the 2000’s driven by China’s insatiable hunger for fuels, metals, building materials and foodstuffs, as its economy grew at double digits.

$2.3T construction push

China, the world leader in electric vehicles and battery production, is moving forward rapidly on its plans to electrify and decarbonize.

President Xi Jinping in 2020 announced the country is aiming for carbon neutrality by 2060. (carbon neutral means emitting the same amount of carbon dioxide into the atmosphere as is offset by other means)

The country says it will boost the share of non-fossil fuels in primary energy consumption to around 25% by 2030.

The Made in China 2025 initiative seeks to end Chinese reliance on foreign technology by investing in a number of key sectors, including IT and robotics.

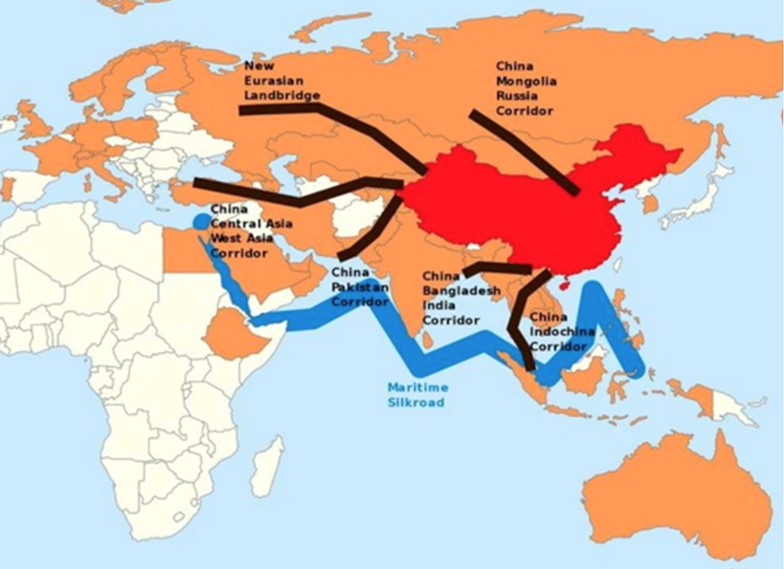

Both “MIC2025” and China’s Belt and Road Initiative (BRI) are part of Beijing’s most recent Five-Year Plan, which calls for developing and leveraging control of “core technologies” such as high-speed rail, power infrastructure and new energy, all of which require extensive minerals.

While the United States in November passed a trillion-dollar infrastructure package that includes money for roads, bridges, power & water systems, transit, rail, electric vehicles, and upgrades to broadband, airports, ports and waterways, China is looking to outspend it by a large margin.

At Beijing’s behest, local governments have reportedly drawn up lists of thousands of “major projects,” they are being pressured to see through. Planned investment in 2022 amounts to at least 14.8 trillion yuan (US$2.3 trillion), according to a Bloomberg analysis.

That’s more than double the new spending in the infrastructure package the US Congress approved last year, which totals $1.1 trillion spread over five years.

Notably, the composition of the stimulus spending will be less on infrastructure than manufacturing, including factories, industrial parks and technology incubators. The construction push is part of the central government’s plan to meet its targeted 5.5% growth rate this year.

The manufacturing imperative

Now that China has secured most, if not all, of the minerals it needs to create what is essentially its own trading ecosystem, or sphere of influence, with BRI member countries, the work is beginning on how to build a manufacturing base from which to generate a huge range of products to sell to them.

It’s important to recognize that these aren’t the Chinese goods of old. No more cheap plastic toys and kitchen appliances. Statements from China’s leadership indicate the country is moving into high-technology sectors that will lead the world and relegate the US to second place.

In describing the ‘14th Five-Year Plan’, President Xi indicated that China will move away from its previous economic trajectory, stating that “we must strive to promote the common prosperity of all people and achieve more obvious substantive progress. … [We must] no longer simply talk about heroes based on the growth rate of GDP.”

The plan outlines a number of policies that are designed to support the development of scientific research and advanced manufacturing. According to the Hong Kong Trade Development Council, the Chinese government is looking to target such cutting-edge fields as: artificial intelligence (AI), quantum information, integrated circuits (ICs), life and health, brain science, biobreeding, aerospace technology, deep earth and deep sea, and implement a series of forward‑looking and strategic National Science and Technology Major Projects. (2.4.2) Support will also be given to Beijing, Shanghai and the Guangdong‑Hong Kong‑Macao Greater Bay Area (GBA) to establish global technology innovation centres, and to Huairou of Beijing, Zhangjiang of Shanghai, the GBA and Hefei of Anhui to develop comprehensive national science centres.

China considering MMT

We know that China has big plans for manufacturing, i.e. the $2.3T infrastructure package consisting of thousands of major projects put forth by local governments.

The question is, how does China pay for it?

The country’s local governments are reportedly facing a fiscal crunch because of a plunge in land sales, a major source of revenue, constraining their ability to spend and forcing them to borrow more.

On top of that, GDP growth in China is set to lag the United States, something that concerns Beijing. Calls are therefore growing louder for the Chinese government to boost fiscal stimulus, regardless of higher debt levels, an approach that is drawing comparisons to MMT.

Heretofore, China’s conservative economists would have rejected this unconventional economic theory.

Rather than ramping up stimulus, like the US, China’s focus has been on reining in government debt and curbing financial risks. Now this approach is being questioned.

“There’s a new understanding of debt in macroeconomics,” Bloomberg quotes a senior researcher at the National Institution for Finance and Development, a top government think tank. “Unlike the private sector, the government can continue to borrow new funds to repay old debts. The only requirement for this to go on is that interest rates remain low.”

Sound familiar? Under MMT, the US government can never run out of money. It just keeps printing it, to pay the interest on its debts, allowing it to borrow without limits. Presumably the Chinese could do the same. But first, Beijing would have to grow more comfortable with debt.

While China’s debt to GDP ratio is low by international standards, about 40%, it doesn’t include large so-called hidden debts by local authorities. Previously, building more highways, railways and airports, the traditional “black-top infrastructure”, was seen as a way to stabilize the economy, but it resulted in a large increase in local government debts. Authorities have therefore vowed to reduce the government debt to GDP ratio this year, which in the US currently sits at 125%.

Beijing’s conservative position on debt also goes back to what happened following the financial crisis. The stimulus blitz that fueled China’s expansion saw debt levels climb. The formation of asset bubbles (real estate, for example) stoked fears of a market collapse.

In comparison, China’s stimulus response to covid was relatively spare, given that China, at least initially, nipped the problem in the bud; with far few cases and hospitalizations, China didn’t need to spend on the scale that the United States and other countries did.

Problem is, the under-powered stimulus is running up against a less than stellar economic recovery in China; growth forecasts have been downgraded, compared to the US, where GDP projections have risen. According to the OECD, the US is the only country forecast to have higher GDP in 2025 than predicted before the pandemic.

The Bloomberg article quotes Yu Yongding, a former adviser to China’s central bank, as saying the debt focus is hurting the economy by restricting the ability of local governments to invest more in infrastructure. Yongding says the central government should issue more debt to fund local spending, and buy local government bonds to lower interest rates if needed. Inflation would be the only constraint on such a policy, which in China is low, just 1.3% in May and averaging 2.1% over the past five years, below the government’s 3% target.

“Why not use expansionary fiscal and monetary policy to make the growth rate higher. If you see a rising CPI and an increase in financial vulnerabilities, then you stop,” he says.

This is precisely the approach taken by MMT advocates, and is similar to quantitative easing, whereby a central bank purchases bonds from regular banks to keep interest rates low.

Although, it should be noted that officials last year rejected a proposal to implement QE. China’s central bank currently accepts government bonds as collateral for short-term loans to banks but doesn’t buy them directly as central banks in the US, Europe and Japan do.

Another proponent of MMT as it relates to China is Yan Liang, a professor at Willamette University in Oregon, who is writing a book on the subject.

Liang begins by stating that the central bank could monetize debt by increasing loans to state-owned enterprises, or SOEs. This could bring long-term benefits, such as infrastructure creation. She notes that Chinese policymakers, unlike those on the West, are not driven by short-term economic rationales, therefore prolonged, multi-year spending programs involving strategic goals (eg., One Belt One Road, Made in China 2025) fit well with MMT.

Like other Chinese pro-MMT economists, Liang believes the central government should take on more debt. “A lot of the local level spending could be the central government’s responsibility in terms of financing,” she said in a 2021 Q&A article.

“From MMT’s perspective, if debt is in the sovereign currency then it doesn’t really matter what the interest rate is. The interest rate is irrelevant when it comes to pay-ability of government debt.”

While some worry that money-printing by the People’s Bank of China would devalue the yuan, at a time when Beijing is cutting deals with other countries (like Russia) in its own currency to circumvent the US dollar, Liang maintains that the way to get around this is to implement capital controls — i.e., this is how China would implement MMT.

Capital controls limit the flow of foreign capital in and out of a domestic economy. They are often implemented during an economic crisis to prevent a run on the banks, such as the 2015 sovereign debt crisis in Europe involving an insolvent Greece.

Not just the US and China

MMT’s central idea is that a country can’t go broke by spending in its own currency. However, one of the marks against it, is that MMT is only appropriate for rich countries. It’s alright for the United States to spend without restraint, because it holds the reserve currency (or China, whose currency is beginning to rival the US dollar). But emerging-market economies like say Turkey or Brazil, whose currencies are relatively weak, can only get so far.

Here’s the thing, though. China, Turkey and Brazil, for example, may not have the reserve currency (the USD), but they do have sovereign currencies, in that their currencies are not controlled by outsiders (the Chinese yuan used to be pegged to the US dollar but the peg was removed in 2005). Furthermore, as long as they print money in their own currency, there is nothing stopping any country from printing and lending money to local governments, state-owned enterprises, etc., who can just pay the interest on the loans, in local currency (as China’s MMT advocates are proposing it does).

Basically it’s all about creating the conditions for holding less foreign/ hard currency. Instead of exporting as much as possible to build up foreign reserves (China’s economic model when it was transitioning from an agrarian to manufacturing economy), a country would start to become self-sufficient in areas like food and energy, so that it doesn’t need as much foreign currency.

If you think about it, this is precisely the kind of thinking that covid and the war in Ukraine has engendered. As we have been writing about, the war has exacerbated existing problems with the supply of a number of commodities including wheat, fertilizer and metals. Many commodities aren’t just getting more expensive, they’re getting scarce.

Indeed, from Bloomberg’s ‘Introducing the Chokepoint Economy, When Shortages Start to Matter’, the experience of the past year seems to suggest that governments are more focused than ever on addressing scarcity in their economies rather than abundance. The dramatic experience of 2020 has taught policymakers that the relative flow of goods and capital can matter more than the absolute levels.

That means ‘chokepoints’ rather than ampleness may be a more useful framing for the future direction of the world’s biggest economies.

And from Tellimer Research’s ‘MMT: Just an obscure theory or a nuclear rocket leaving emerging markets behind’ (paywall),

Building new factories and power plants—as well as tanks, warships, planes, and missiles—requires lots of metal, lots of energy, and lots of specialized manufacturing equipment. Supply of all those inputs was already under strain due to the pandemic, and Putin’s aggression will make them even harder to come by…

A world in which everyone is building up new factories and powerplants, not to mention more robust military capabilities, is de facto a commodity intensive one. It’s one reason to think that, supply disruptions aside, this bid for raw materials could last for some time.

Conclusion

According to Modern Monetary Theory, if debt is in the sovereign currency, then the interest rate doesn’t matter. As long as the currency stays local, the government can always print more money to keep paying the interest.

China has been concerned about its local governments going into debt to pay for infrastructure programs, but it now has an MMT model.

China is fast-tracking 102 major infrastructure projects in 2022, for a total spend of US$2.3 trillion.

Towards this goal, the Ministry of Finance has allocated US$188 billion worth of bonds, that local authorities are urged to issue, to fund construction projects and to leverage private investment.

Who is going to buy these bonds? If China follows the MMT model the government would buy them, thus lowering interest rates, in much the same way that QE works now for Western governments. Beijing could also grant loans to SOEs (state-owned enterprises) to build infrastructure under long-term strategies such as Made in China 2025 or the Belt and Road Initiative. It all makes perfect sense and it seems to me that China has been planning to do this for a long time.

China’s BRI is a clever way of making itself independent of the global economy and the US dollar reserve currency that most commodity trades are settled in. Through BRI, China will have a trading ecosystem of 130 countries. According to estimates by McKinsey and other consulting groups, between US$4 trillion and US$8 trillion will be spent on the BRI by 2049.

The other important point about China adopting MMT to pay for tens of trillions in yuan worth of new infrastructure ($1 trillion = ~6,500 trillion yuan), is it isn’t only China that could do this. A government that pays the interest on its loans with money printed in the local currency, can borrow in perpetuity and keep adding to its debt.

Think about what this means.

A world where everybody is building new factories, power plants and beefing up their militaries, paid for with borrowed money courtesy of MMT, is commodity-intensive, not to mention more dangerous (if you build an army you are likely to use it, methinks).

If you thought supply disruptions are a problem now, just wait until China adopts MMT and other developing nations follow their model — I’m thinking India, Indonesia and many countries in Africa will be next. The unprecedented buildup in factories, power plants, and other facilities demanded by new-economy manufacturing infrastructure, will lead to a raw commodities explosion the likes of which we’ve never seen before in our lifetimes, and probably never will again.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.