Calibre Mining, a company which acquired B2Gold's Nicaraguan assets in the not so distant past provided multi-year initial production and cost guidance. Calibre posted solid Q1 numbers, only to report very weak Q2 numbers, though primarily a result of the 10-week suspension of mining activities at its assets.

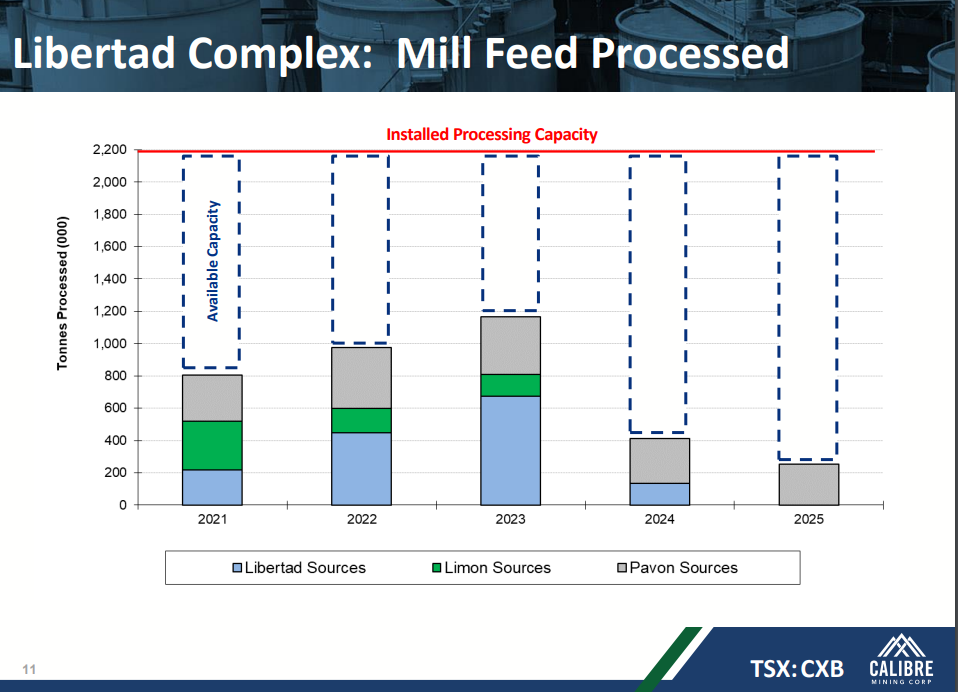

Per the PEA at the Libertad Complex, 2021-to-2023 average annual production will be 120k oz. Au with AISC of $906/oz. This doesn’t include any drilling results after year end 2018, other than Jabali and Panteon underground, which have more current drilling results and a mid-2020 effective date. Calibre will focus on near-mine and infill drill programs to provide additional mill feed. The company will have 1.5mtpa of average tons of surplus capacity (from 2021-to-2025), which leaves room for material near-term organic growth.

The 10-year outlook at the Limon Complex (open-pit only) is for average annual gold production of 50-70k oz. with AISC of $900-$1,100/oz. The open-pit reserves as of year end 2019 will be mined from 2020-2023. Additional open pit mineral resources as at year end 2019 has the potential to extend the mine life through 2031. In other words, these are preliminary estimates and company-wide average annual production is likely to be increased upwards, given the significant excess mill capacity and Calibre's hub-and-spoke strategy. Read Full Press Release Here.

Disclosure: Calibre is a Sponsor of Goldseek. This author owns common shares of Calibre Mining.

Chief Mining Analyst with GoldSeek.com and SilverSeek.com. Author of the Gold Seeker Report weekly newsletter and analyst at the 24K Gold Fund. Previously he was the Senior Mining Equity and Economic Analysis at The Morgan Report. He was a Co-Founder and Director of Lemuria Royalties, before it was acquired in March 2018. He also co-authored The Silver Manifesto with David Morgan in 2015.

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, Gold Seek LLC have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com, Gold Seek LLC makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com, Gold Seek LLC only and are subject to change without notice. GoldSeek.com, Gold Seek LLC assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto. The company is may or may not be a sponsor of this, or any other related, websites. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction. Please see our full disclosure statements for more information.