It was just two days ago, that we wrote about last week’s slide in the silver price from around $24, to around $22.50. Well, yesterday and today the price ascended back to around $24. The question is whether silver is now just as scarce as it was, scarcer, or more abundant? Read on…

But First, Bitcoin

First, we want to touch on what has been happening in the world of bitcoin. We will even break our preference to criticize it only when it’s skyrocketing (the basis of most criticism of bitcoin—or gold and silver—is when the price drops).

Within a period of about 17 hours, bitcoin dropped about $1,500. Prior to that it was skyrocketing. It had been on quite a tear, just about doubling from its low on September 7.

Just imagine if your mortgage doubled! You’re going along, paying about $1,500 a month in September. And boom, before Christmas, you’re now paying $2,900. Could you stay in your home? We can’t answer that without knowing more about your financial situation. However, if it’s not a mortgage on a house, but instead a loan to finance growth of your business, then we are quite confident. Virtually all businesses would default. Few make such a high return on capital that they could survive a doubling of their monthly payment.

Bad for Borrowers

Bitcoin is unsuitable to borrowing, other than to finance a bitcoin “mining” system (an amusing term). If you finance anything from hamburgers to a real mine such as gold or copper, forget about borrowing bitcoin. This is not a hidden flaw. Nor is it something we say to promote gold. This is precisely what bitcoin proponents promise you will happen. The very same people who tell you it’s money openly admit it has a property that makes it suicide to borrow.

That same property, which makes it unsuited to debtors—i.e. bad to have on the liability side of the balance sheet—is attractive on the asset side. So people buy it because it’s going up. And some people did buy it, that fateful minute 1,155 minutes ago. They paid $19,845. Then just 1,035 short minutes later, they sold it for $18,356. A loss of $1,489, or 7.5%.

One might quibble, and demand how we know someone paid $19,845. Well, that’s just how markets work. That was the price on our screen, which means someone bid it up to that level.

The next quibble is to say that probably the people who paid that much did not sell 17 hours and fifteen minutes later. But these bitcoin-advocates-at-all-costs are hoisted by their own petards. Bitcoin, they contend, is money! In their definition, money means a medium of exchange. This means that people are supposed to be using it for, you know, exchanges. Real goods and labor are presumably trading for bitcoin constantly. So, yes, we assert that if the bitcoiners are correct, there are people who lost 7.5% in 17 hours.

Bad for Savers

This makes bitcoin unsuitable for the asset side of the ledger for conservative balance sheets. Such as savers. Would even the bitcoin diehards recommend their widowed grandmother put 100% of her life savings into bitcoin?

Without savers or borrowers, this alleged money is not used for financing productive activity. It is not useful for finance, as it is unsuited to both savers and entrepreneurs.

This leads us to an underappreciated characteristic of the dollar. Many wonder why the dollar is as stable as it is, being subject to the abuse by its manager that it is. Every debtor makes a relentless bid on the dollar. They are dumping every product they can make, every service they can provide, on the bid price. They must raise dollar cash to service their debts, or else their creditors will foreclose on their businesses and homes. One should not underestimate how this supports the value of the dollar (especially to those who measure it in terms of its purchasing power).

Bitcoin lacks this mechanism (or any) to stabilize its value. It has only a mechanism to stabilize its quantity. It’s a strong mechanism (other than the perverse incentive that may grow to undermine it one day). However, value is not proportional to quantity. It just isn’t. As bitcoin’s daily volatility proves every day.

Medium of Exchange? Nope.

If it cannot be used for finance, if it is unsuited to borrower and lender alike, then what is it used for? Some would contend it is used as a medium of exchange. After all, some merchants do accept it. Let’s look at that.

Few merchants make so much profit margin, that they can take the risk of a 7.5% loss in less than a day. They just want to be paid in dollars. They know the wholesale price that they pay the distributor for the goods. And they add in a (small) profit. That is their selling price.

They hire a third-party currency exchange (TPCE). The TPCE converts the merchant's dollar prices to bitcoin, and adds on a fee. When a buyer comes along with bitcoin to buy a product, the TPCE finds a fourth party who wants to trade dollars for bitcoin. The TPCE brokers the dollars from the fourth party, the bitcoin from the buyer, and the goods from the vendor. In the end, the vendor has dollars, the buyer has the goods, the fourth party has the bitcoin, and the TPCE has its fee. Everyone gets what he wants.

Is this truly using bitcoin as a medium of exchange? Not quite. It is using bitcoin as a means of speculation. The reason why the buyer wants to spend bitcoin—and why he is willing to pay the TPCE’s fee on top of the price of the goods—is that he bought bitcoin a month or two ago. At a much lower price.

In fact, usage of bitcoin in online transactions is closely correlated to the price action.

Medium of exchange? Hardly. Medium of speculation (and of capital consumption).

Checking the Fundamentals

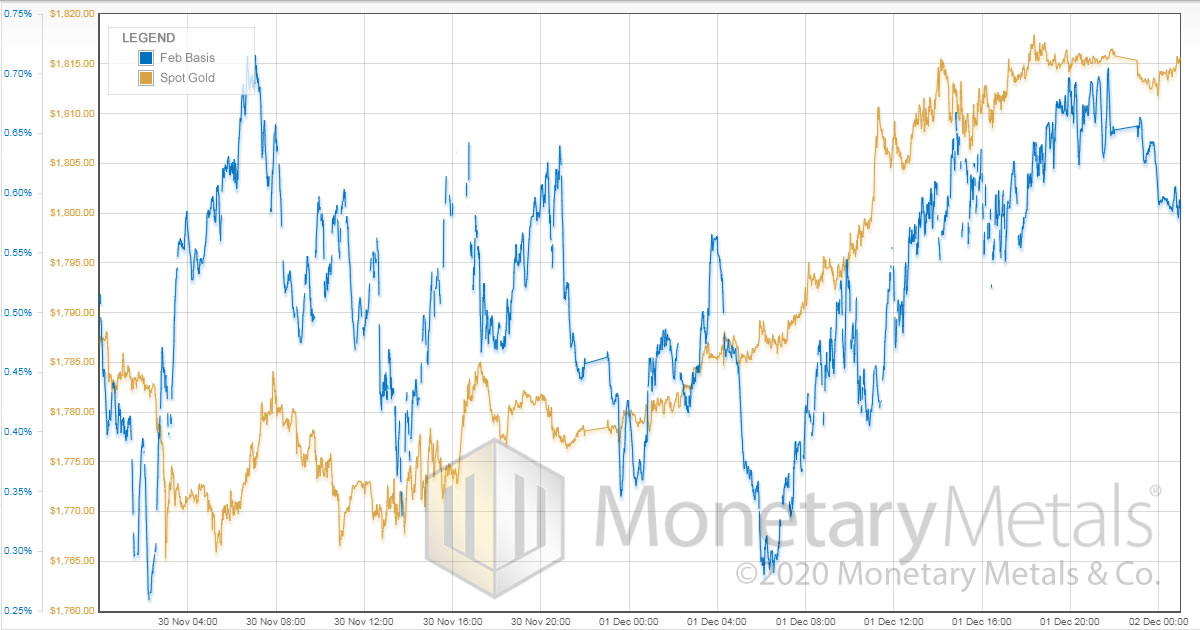

Now on to gold. Here’s the graph.

Early last week, the price was around $1,875 and the basis around 0.7%. Then they fell to $1,780 and 0.3%. By the end of Tuesday, the price was up to $1,815 and the basis to 0.7%. The abundance of gold to the market is basically the same, now at $1,815 as then at $1,875. That is not what you want to see, if you’re speculating on the gold price.

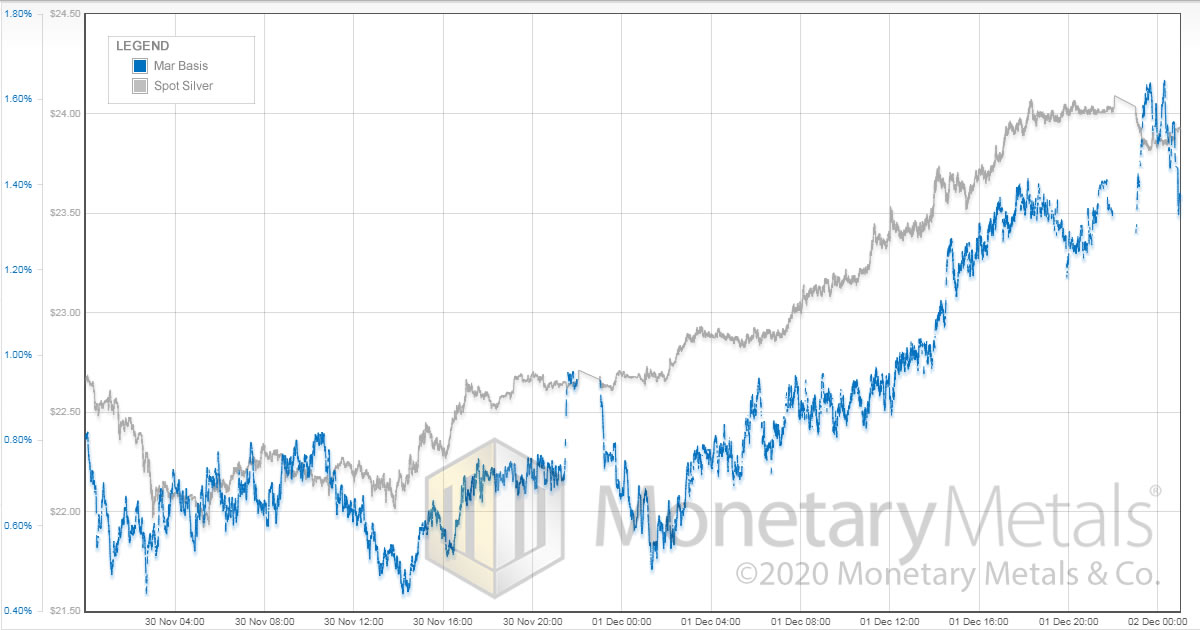

Now, the silver graph.

Unlike gold, the price of silver is back up to what it was at the start of last week. The basis was 1.75% at that time. Now, it’s under 1.6%. So unlike gold, silver is slightly scarcer and it’s back to the same price.

Does this signify a further drop in the gold silver ratio, reverting it back closer to its long-term mean (no, we don’t refer to the historical ratio of 16, but the postwar level around 50)? This will bear further watching.

© 2020 Monetary Metals