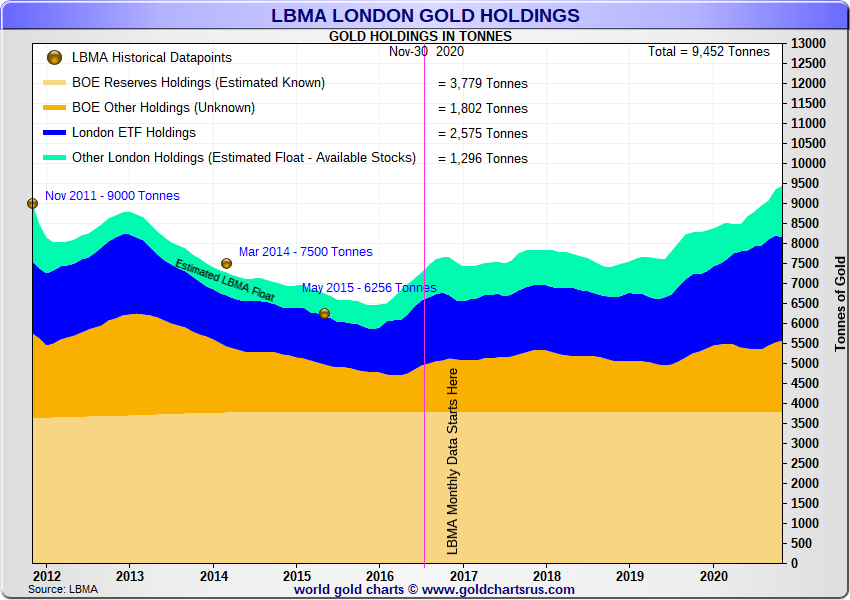

Last week, the London Bullion Market Association (LBMA) published its latest monthly update on gold holdings in the LBMA vaults in London, claiming that there are now record gold stocks of 9452 tonnes of gold held in these vaults.

The vault data in question covers the London vault holdings of seven LBMA members which operate commercial vaults in London, as well as the gold vault holdings held at the Bank of England’s London gold vaults. These seven vault operators comprise three bullion banks – HSBC, JP Morgan, and ICBC Standard Bank – and four security firms – Brinks, Malca-Amit, G4S and Loomis. The LBMA vault data is reported on a 1 month lagged basis.

According to the LBMA, as of 30 November 2020, the London vaults (including those of the Bank of England) held 303.891 million troy ounces of gold, or 9452 tonnes.

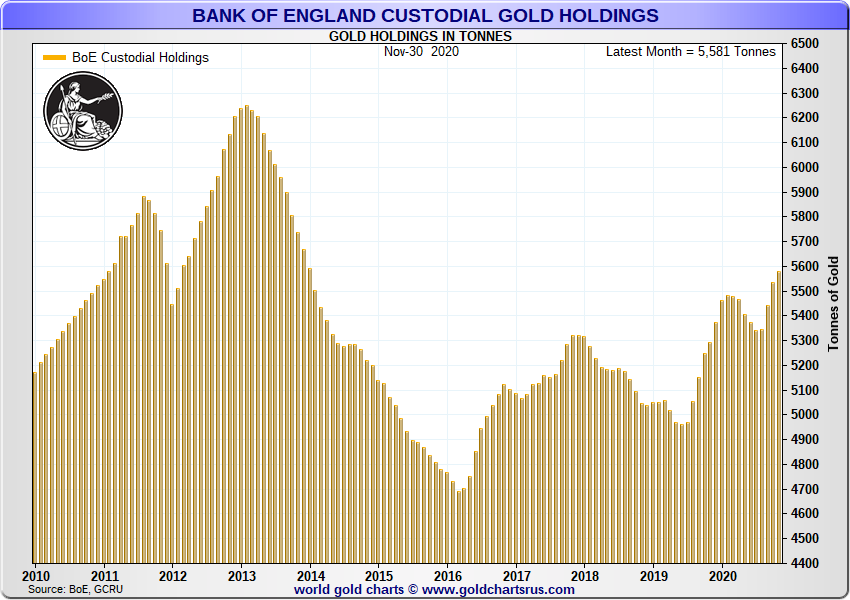

Separately, the Bank of England, which also reports its gold vault data on a one month lagged basis, last week reported that the gold holdings in its vaults as of the 30 November 2020 totalled 179.423 million ozs of gold, or 5580.8 tonnes. While most of the gold held in the Bank of England vaults is held in custody of behalf of central banks, commercial (bullion) banks also have gold accounts at the Bank of England.

With the Bank of England holding 5580.8 tonnes of the 9452 tonnes LBMA total, this would mean that there were a combined 3871.2 tonnes of gold held across the ‘LBMA vaults” i.e. the London vaults of the three banks and the four security firms. A majority of this gold is held on behalf of gold-backed Exchange Traded Funds (ETFs).

Breakdown of physical gold held in the Bank of England and LBMA vaults in London, November 2020. Source: www.GoldChartsRUs.com.

Breakdown of physical gold held in the Bank of England and LBMA vaults in London, November 2020. Source: www.GoldChartsRUs.com.

Based in data from the GoldChartsRUs website, which tracks the gold holdings of gold-backed ETF holdings, we know that as of the end of November 2020, ETFs held a combined 2575 tonnes of gold in London vaults.

The Real Number

Excluding these ETF holdings, this would imply that a residual 1296.2 tonnes of gold was held across these seven vaults that cannot be accounted for by ETF holdings. In other words:

All London vaults – Bank of England vaults = LBMA vaults

LBMA vaults – ETF London holdings = Residual gold

9452 – 5580.8 = 3871.2

3871.2 – 2575 = 1296.2 tonnes of gold

Since the LBMA began reporting London gold vault data (from July 2016 onwards), the latest figure of 9452 tonnes is indeed a record total. It is also higher than the approximate 9000 tonnes of gold that the LBMA claimed was held in London in late 2011 (see LBMA presentation here, page 3 of slides).

Looking at the growth of LBMA and Bank of England gold vaults stocks during 2020, we can see the following. From the beginning of January 2020 to the end of November 2020, the LBMA claims that the combined London vaults added a net 1126.5 tonnes of gold. Of this total, the Bank of England vaults added a net 207.5 tonnes, while the other seven vaults (LBMA vaults) added a net 919 tonnes of gold.

Physical gold claimed to be held in the Bank of England vaults in London. Source: Source: www.GoldChartsRUs.com.

Physical gold claimed to be held in the Bank of England vaults in London. Source: Source: www.GoldChartsRUs.com.

Not Explained by ETFs

Hidden within these vault holdings changes is the fact that from January to July 2020, Bank of England gold vault stocks declined by a net 31.2 tonnes, and then rose between August and November by a net 238.8 tonnes.

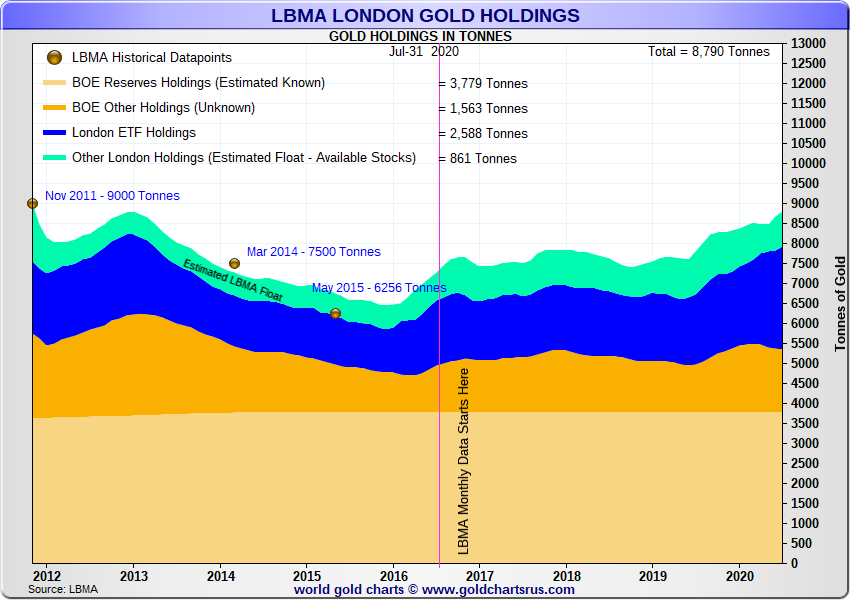

The growth of the LBMA vault holdings (excluding the bank of England vaults) also followed a similar pattern, with the LBMA vaults adding a net 127.93 tonnes between January and May, but then a much larger net addition of 791 tonnes between June to November (particularly from June – August when a net 531 tonnes flowed in, and in October when 185.6 tonnes flowed in to the LBMA vaults).

Physical gold held in the LBMA and Bank of England vaults in London, July 2020, including ETF gold. Source: www.GoldChartsRUs.com.

Interestingly, since the end of July, the additions to the LBMA gold vaults have not been flowing into gold-backed ETFs. In fact, ETF gold holdings stored in London have declined. On 31 July 2020, there were 2588 tonnes of ETF gold held in London LBMA vaults. At the end of November 2020, there were 2575 tonnes stored, i.e. 13 tonnes less. But during the same time (between July and November), the gold inventories of the LBMA London vaults rose by a net 423.2 tonnes.

Including the 13 tonnes ETF holdings decline, the LBMA data now implies that 436.2 tonnes of gold have flowed into the LBMA vaults that cannot be accounted for by ETF holdings. In other words, at the end of July, there were 860 tonnes of gold in the LBMA vaults (excluding Bank of England vaults) that could not be accounted for by ETF holdings. At the end of November this had risen to 1296.2 tonnes in the vaults that could not be accounted for by ETF holdings.

This ‘residual’ amount of 1296.2 tonnes is sometimes referred to as the “London gold float”. But perhaps float is the wrong word since much of this physical gold could be held by entities such as investment institutions, family offices, sovereign wealth funds, and high net worth individuals, who are holding physical gold in allocated form and storing it in some or all of the LBMA London vaults. A 436 tonne increase in this allocated gold category could be indicating that more and more entities who previously held unallocated gold claims against the bullion banks, are now ‘allocating’ these gold claims in the form of allocated gold, while contnuing to store it in the London ‘Good Delivery’ gold storage network.

Some of this ‘residual’ gold also obviously belongs to the LBMA bullion banks, but how much is difficult to say. Ned Naylor-Leyland, interviewed a few months ago by BullionStar here said that the bullion bank London float is practically zero and expands and contracts based on the volume of unallocated gold credit. In a similar vein, Daniel March, also interviewed recently by BullionStar (see here), refers to this bullion bank float as the working stock of the bullion banks and explains that it is the collateral for the bullion banks’ unallocated gold trade flow. Unallocated gold here being the bullion banks’ gold credit unit of trading.

A quorum of the BTC community either already understands (below) or will soon understand that breaking highly-levered paper gold markets could result in BTC-like returns in a compressed period of time. https://t.co/GzmZ3Ah8CV

— Luke Gromen (@LukeGromen) January 9, 2021

Conclusion

An obvious drawback of the LBMA trade data is that it does not, like the way the COMEX New York gold vault report does, provide a breakdown of how much gold is held in each of the LBMA vaults. Nor is any of this LBMA vault data independently audited. As such, none of the LBMA data and the claimed gold holdings can be verified by any third parties.

Perhaps most importantly, the LBMA vault data is in no way transparent and does not provide any breakdown into how much of the gold in the London vaulting system is available to underpin the London market’s massively leveraged unallocated daily ‘paper gold’ trading volumes. And these trading volumes are absolutely gargantuan.

The latest freely available LBMA trading data (for August 2020), shows that over the 20 trading days of August, there was an incredible 866.37 million troy ounces of gold equivalent of ‘paper gold’ traded in London. That’s 43.32 million ozs equivalent (or 1347 tonnes of gold) traded per day. Likewise, the latest LBMA clearing statistics, which reflect netted unallocated gold trades being cleared in the London Precious Metals Clearing Limited clearing engine, shows that in November 2020 there were 18.4 million ozs, or 572 tonnes (of gold equivalent), cleared each day. cleared each day.

Trumpeting record physical gold holdings in the London vaults is one thing, but it’s a very hollow proclamation if only a fraction of these total holdings are available to ‘back-up’ the gigantic fractionally-backed London paper gold edifice.