Asian Metals Market Update for 1st May 2023

“Insignia Consultants” completed Eighteen Years last week. One thing which I failed to understand of the markets and traders in the last eighteen years?

Risk taking appetite of retail traders has gone up in a very big way. Traders age group between 18 years to 35 years take a risk on their trades which cannot be written or said. A lot of them prefer an intraday trading return between two percent and five percent on the money invested as margin money. I personally considered an over two percent monthly return as good return. I have been not able to correctly judge the risk appetite of current retail traders. Extra large risk taking by retail traders is one the reason for knee jerk price moves and high volatility. Retail traders switch over to a different asset class faster than the speed of light. (if current investment does not give them the desired return). Retail traders trade and invest in everything including newer ones. We all need to go with the flow with the current investment climate and sentiment with the caveat that of ensuring capital protection and getting a return greater than real inflation in your country.

Except USA, most the nations are closed today due to “Labour Day”. Rumours, expectation and expectation before the Federal Reserve meeting can wild swings today. Overall intraday trend is still bullish as long as price trades over key support.

To avoid yourself being at the mercy of central banks, just remember that key weekly support and weekly resistance. Only failure to break and trade over $2050 in spot gold by 13th May will cause a sustained bearish trend. I am giving you a small view of when and how a short term bearish trend can arrive. Momentum, sentiment, intention to buy are all very bullish for gold and silver. I am looking for clues and technical which can cause a sharp sell off or even a bearish trend. I need to prepare myself for the unexpected. Unexpected will only be a short term bearish trend.

China’s factory activity unexpectedly shrank in April. Base metals can trade with a softer bias, unless the US dollar sinks and/or global stock markets rise. Inventory levels are below pre-pandemic levels in most corporate in the retail space.

May to middle October price trend of base metals is dependent on consumer demand outlook between Thanksgiving and Valentine day. I expect the starting of an interest rate cycle by the Federal Reserve on/from 1st November meeting. Expectations for the same can begin anytime from now. Consumer durable demand and overall retail spending will zoom once the world knows that the worst is over with mortgage payments and interest rate. The multiplier effect will be in the form of sharp increase in global inventories, increase in warehouse rent and renewed hiring in anything which is related to consumer. Base metals demand and base metals price will also rise as companies know that consumers will be able to accept higher price and continue to spend. Housing demand, home prices and brighter outlook for this sector will cause copper and aluminum price to gallop. However, the next two quarter are still a wait and watch.

FOMC MEETING AND ECB MEETINGS

Clarity of timing of interest rate pause OR further continuity of interest rate hike is needed for a big one way price gold, silver, copper, US dollar index and all asset classes. A 0.50% interest rate hike by the European central bank followed by a pause in future meetings will be very bullish for euro/usd, euro/jpy, gold, silver and bearish for global bond yields.

Traders reaction will be very wild after the FOMC meeting. Temporary reaction for a few hours will be there after ECB meeting. US April nonfarm payrolls number if the comes in below 80,000 will increase bets for a interest rate pause irrespective of FOMC two days before.

Core inflation is falling very slowly. Inflation will not sink in a month or two. It will take a few months for inflation to see a sustained fall and within manageable limits. I am against any trading strategy which is based on inflation.

Spot Gold

- Daily support: $1961.40, $1972.60 and $1978.00

- Daily resistance: $1998.60 and $2011.40

- Spot Gold has to trade over $1978.00 to be in an intraday bullish zone and rise to $2001.50 and more.

- Mild sell off will be there if spot gold trades below $1978 with $1970.10.

- Crash point is $1961 till tomorrow.

Spot Silver:

- Daily Support: $24.62 and $24.87

- Daily Resistance: $25.48

- Spot silver has to trade over $24.87 to rise to $25.92 and more.

- Crash or sell off will be there if spot silver trades below $24.87 after London opens.

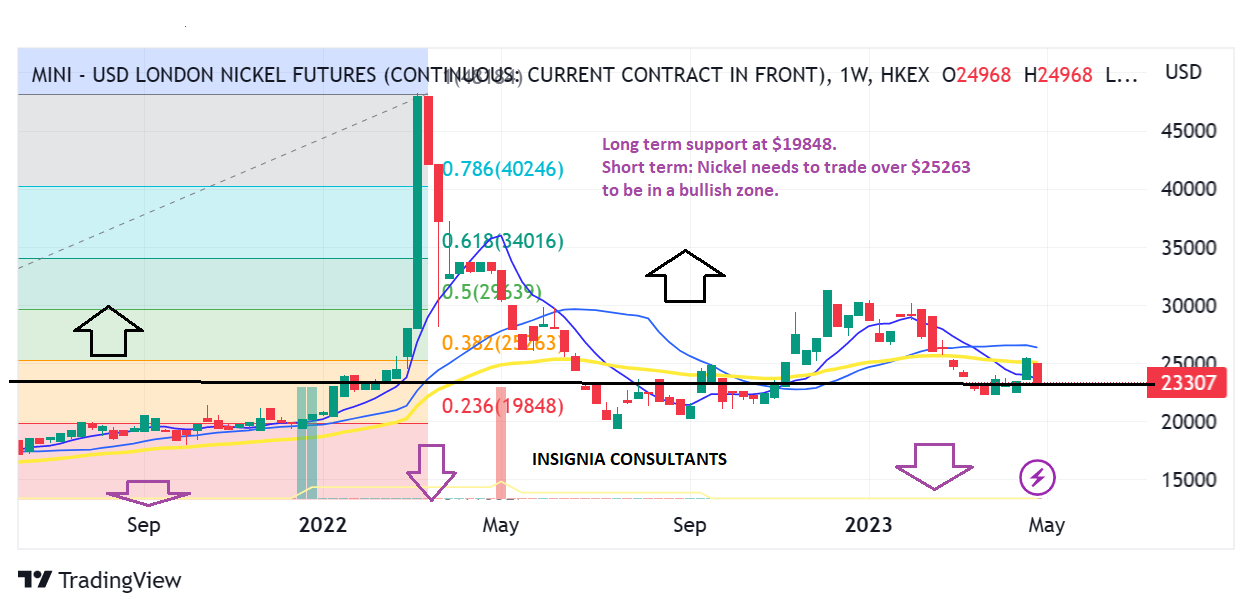

LME NICKEL SPOT (closing price on 28th April: $24259.00)

- 50 day MA: $24116.00

- 100 day MA: $26338.00

- 200 day MA: $24734.00

- 100 week MA: $23926.00

- Weekly View for Nickel: Nickel has to trade over $21419-$21719 zone in the month of May to be in a long term bullish zone and rise to $26338 and $28437.

- Nickel can fall first to $23527 and $21719 in case $25600 is not broken in the next two weeks.

- Watch $24100. Nickel can move $3000 either side from $24100.