Trend of Gold and Crude Oil After FOMC+NFP+US SENATE ELECTIONS + CPI

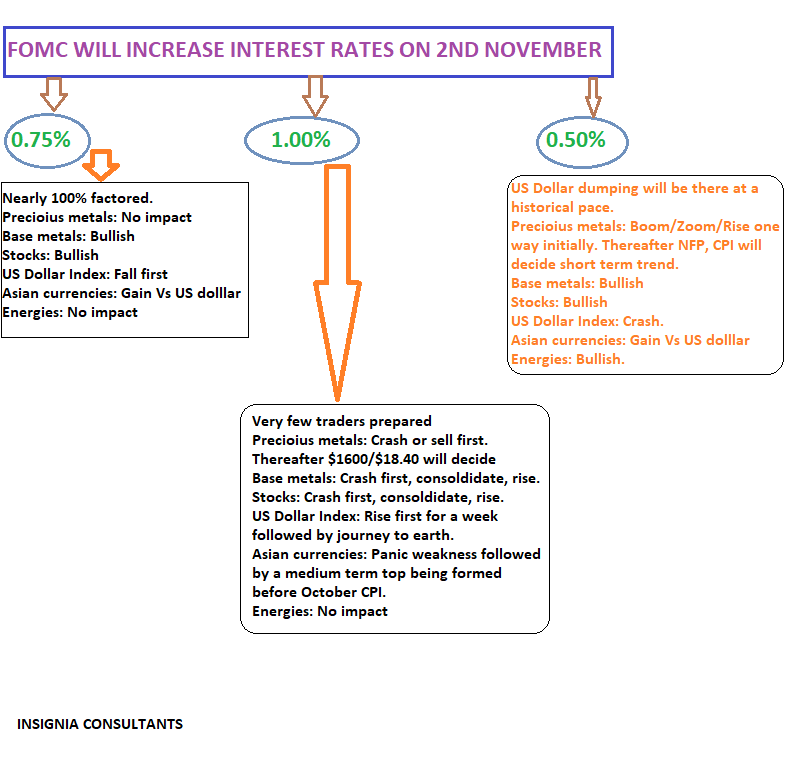

2nd November (3rd November for Asians): FOMC interest rate decision and Outlook.

4th November: US October nonfarm payrolls and allied numbers.

8th November (9th November for Asians: US Senate elections.

10th November: US October Consumer Price Index (CPI numbers).

FOMC is overhyped. NFP, CPI and even adverse result for democrats can change and should change the medium-term trend of precious metals, base metals, US dollar index and bond yields. Even for stocks, there will be a cyclical shift. Big money can be made in short term trading in all asset classes between November FOMC and December FOMC.

Evaporate all your biases, thoughts, change your perception, take a calculated risk and go for the kill. Optimism is fine. Over optimism and over risk taking will cause you to dig your own grave of losses.

No one expects a 25bps interest rate hike. Bets are also being placed for a 0.50% interest rate hike in December Federal Reserve meeting and 0.50% in January 2023 Federal Reserve meeting. The world does not expect the Federal Reserve to raise interest rates beyond January 2023 meeting (in 2023). Any change will increase volatility.

Inflation control is the oomph factor which has caused this year’s historical interest rate hike by western central banks. US October CPI and PPI have to come in lower. Their outlook has to be lower to cause a grand crash in the greenback and also make nations happy.

CPI on 10th November should have a bigger impact than FOMC or NFP. Trend (in all asset class) after CPI should continue till the first week of December. In between Thanksgiving retail sale in USA will impact bond yields and greenback.

Crude oil demand will be on the higher side till the Valentine day. Soccer World Cup, Christmas and New Year will ensure that airlines operate at full capacity on international destinations. Retail spending this Christmas will not go kaput even when we are experiencing hyper-inflation. I will be tempted to buy naked call options for end January 2023 in crude oil if there if a fall of more than $15 for a strike price over $120 in WTI/Nymex. Natural Gas better stay away.

COMEX GOLD DECEMBER 2022 (Current Market Price $1640.70)

- 200 week moving average: $1696.10

- 50 month moving average: $1664.90.

- Gold needs to trade over $1615.60 till Monday to rise to $1673.90 and $1703.10.

- A daily close over $1673.90 on 3rd November and 4th November will push price to $1762.40 and $1802.40 much quicker than most of us expect.

- Gold will crash if it does not break and trade over $1683.50 between 3rd November and 7th November to $1606.10 and $1586.

WTI CRUDE OIL current contract 2022 (current market price 28th October $87.07)

- 50 week moving average: $86.80

- Crude oil will break $80-$100 trading range and form a new range in the next two weeks.

- US President Biden has tried to suppress crude oil price with a continuous release from the US strategic petroleum reserve. Trend of crude oil price between 9th November and 4th December will break either bulls or bears.

- In the next seven days crude oil has to trade over $83.80 on daily closing basis to rise to $96.10 and $99.90.

Trend changes in millisecond when retail investors are highly fearful on their short term trades and long term investment. Global investment climate is fragile.

Physical premium is very high in India, China, and most in Asian nations (in gold, silver, and copper.). There is a big disconnect between Comex future and physical market. Downside risk will be limited as long as premiums are high. Look for signs of short squeeze in silver and copper in the month of November.