Price moves in all metal futures will be two way. Reasons are (a) Gold June future expiry. (b) Base metals future expiry. (c) US first quarter GDP number of Thursday can reverse the current trend of precious metals and base metals. (d) There is a position squaring and rebuilding for key central bank meetings world over between 8th June and 24th June.(e) Higher volatility in crypto currencies will affect precious metals and base metals.

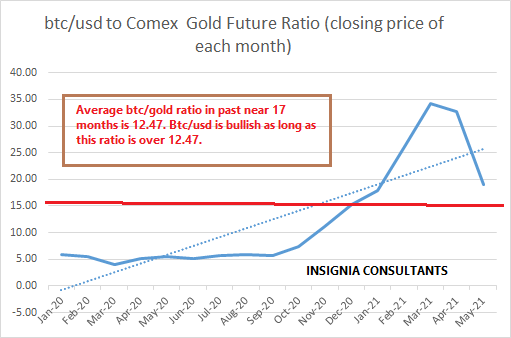

Bitcoin (btc/usd) to Comex Gold Futures Ratio

I have been suggesting that one should use profit from bitcoin/crypto currency trading to invest in physical gold. Crypto currencies have made huge number of millionaire and billionaire worldwide over the past fifteen months. Mount Gox is now history. Crypto currencies are no more a Ponzi scheme which the world media is projecting. Let’s a look at Bitcoin (btc/usd) to gold ratio. To make it simple, I am using ratio on the closing price of each month.

## May btc/gold ratio is current price in Asia on 24th May 2021

** Bitcoin price data source: www.investing.com

Bitcoin/Gold ratio tells us that

- Btc/usd is bullish in the long term as long this ratio trades over 12.47.

- The real rally in btc/usd and fall in gold price began from end November when the ratio was 11.09.

- Gold price will see a very quick rise only if btc/gold ratio trades below January 2021 closing price of 17.92. (current ratio of 18.97).

- Gold price will reach new all-time high if btc/gold ratio trades below 17.92 for at least two consecutive weeks.

- Bitcoin to gold ratio will be a key indicator to watch to determine the trend of either of them.

Crypto currency view

1. BTC/USD has a key long term support at $25923. As long as btc/usd trades over $25923, it will keep on targeting $50,000. The next big sell off will be there only on a fall below $25923.

2. ETH/USD current rally started from $1233.40. ETH/USD will vanish only if it trades below $1233.40 for the rest of the year.

3. A thirty percent downside risk is not ruled out for most crypto currencies IF the fall continues this week.

4. The pace of rise and the pace of fall of Bitcoin and all crypto currencies is the key.

A lot of precious metal traders are also trading in crypto currencies. “Insignia Consultants” gets more queries in India ON “how to trade and invest in crypto currencies” THAN commodities. The general expectation in India is that there will be one hundred percent profit in less than three months in crypto trading. These are over exaggerated investment return expectations. It is a crypto casino and nothing else for the world. One can get near hundred percent annualized return by trading/investing in stocks and commodities. But getting over three hundred percent annualized return is absurd. The real traders invested in bitcoin at $10,000 and exited between $50.000 and $59,000. This is my experience based on queries we get. Everyone wants to invest in crypto currencies due to dangerously high past returns with a casino type risk.

Physical Gold is a safe haven. Invest in gold as a safe haven. Gold investment is not a hit or miss game. In India gold investment has become the savior for millions of families. Some sold gold to move to their own home (away from rentals). Some took advantage of higher gold prices to expand their business. But for large Indians physical gold is being used to survive and also meet covid care expenses. Bitcoin and crypto currencies are not liquid and also not legal in India. I am not against crypto currencies. I am just trying to caution everyone not to get swayed by crypto currency hype and invest all your savings in crypto currencies.

To all the investors and positional traders, June and July month should be the biggest month of the year. There will be small phases of boom-bust, boom-bust type of price moves in all metals and energies. You all need to stay alert till the end of July.

Trend for gold and silver is bullish only if key resistances are broken today. As long as copper trades over $9566 it will rise to $10802. Copper will move into a short term bearish phase only if it trades below $9566 for a few consecutive days. Nickel needs to trade over $16300 to be in a short term bullish zone.

Spot gold: View: Current price $1883.90 (i) Key support: $1850.90 and $1869.60 (ii) Key resistances: $1894.70 and $1911.40 (iii) Gold needs to break $1895-$1905 zone to rise to $1918.60 and $1930.10. (iv) Gold price will crash if it trades below $1866.70 or gold not break $1894.20 today.