Intraday volatility will be very high before the release of US July inflation numbers this week. Traders are confused on the short term trend of the US dollar index and bond yield. Incoming news will be the key.

Just trade in the technical. Do a support trading. Keep in mind the key weekly support and intraday support à check if they are holding or unable to hold à make your intraday trade based on support trading.

US Inflation numbers, CPI and PPI this week can cause a short term technical breakout or a technical breakdown in all asset classes.

Consumer price inflation (CPI) and Producer Price Inflation (PPI) are the last major US economic data releases for the next four weeks. US July inflation needs to come in lower or lowest side of the expectation to cause a selloff in US dollar Index, renewed rise in US stocks, global stocks, base metals and energies and also a sharp gain of Asian currencies versus the US dollar.

In case CPI, PPI or July inflation comes in higher, then there will be a minimum five percent sell off in global stock markets and also base metals and energies before the end of August and the balance multiplier effect.

Global central bankers meeting at Jackson Hole on 25th August (after this week) will the next major event.

I expect a fall in both CPI and PPI. I also do not expect any interest rate surprises in Jackson Hole meeting of central bankers. I will prefer looking at economic outlook change (if any, other than interest rate stance) and updated Ukraine impact and outlook and updated US China relations impact and outlook. Interest rate flip-flop among traders change every millisecond. What does not change every day is the economic outlook and impactful political events.

Asian nations like India and Indonesia face energy price risk. Nymex/WTI is expected to trade between $90-$100 for the rest of the year. Petrol and Diesel price in Asia is set be in a rising trend once the Monsoon season gets over. The multiplier impact of a sustained rise in crude oil price is something we know. Keep a close watch on your local currency versus the US dollar.

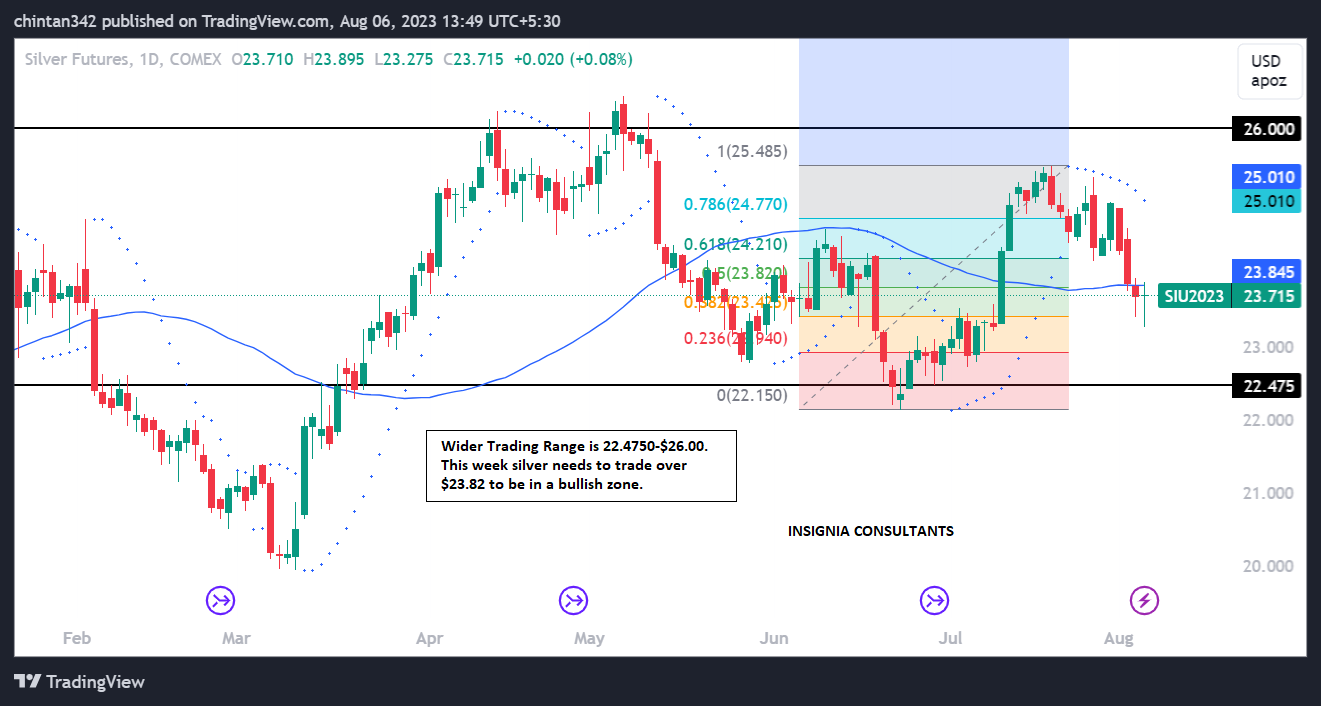

COMEX SILVER SEPTEMBER 2023 (current market price: $2362.20)

- Key price to watch: $2384.40

- Weekly View for silver: Silver has to trade over $2311.00 this week to rise to $2457.10 and $2542.60.

- Crash or sell off will be there only if silver September trades below $2311.00 any day in USA session this week.

- Silver will also crash if it does not break $2457.00 this week to $2286 and more.

GREEDFLATION IS THE NEW TERM I LEARNT THIS WEEK - From an article on MarketWatch

“Greedflation,” or the practice of companies raising prices to protect their profit margins, is alive and well, based on the number of companies that have so far acknowledged raising prices yet again, even as inflation readings have come down and as some acknowledge that their input costs are falling.

At the same time, companies continue to emphasize on earnings calls that their customers are showing signs they are weary of higher prices and are shopping more frequently at more stores, while spending less per trip.

(The above is just for your knowledge. The next time you buy anything, remember Greedflation. You can also invest in stock which are more into Greedflation for short term. In my view Greedflation stock will see frequent boom-bust type price moves.)

Disclaimer: Any opinions as to the commentary, market information, and future direction of prices of specific currencies, metals and commodities reflect the views of Chintan Karnani. In no event shall I have any liability for any losses incurred in connection with any decision made, action or inaction taken by any party in reliance upon the information provided in this material; or in any delays, inaccuracies, errors in, or omissions of Information. Nothing in this article is, or should be construed as, investment advice. All analyses used herein are subjective opinions of mine and should not be considered as specific investment advice. Investors/Traders must consider all relevant risk factors including their own personal financial situation before trading.

Disclosure: I do not trade/invest in spot gold and spot silver and even in comex future.

NOTES TO THE ABOVE REPORT

- ALL VIEWS ARE INTRADAY UNLESS OTHERWISE SPECIFIED

- Follow me on Twitter @chintankarnani

- PLEASE NOTE: HOLDS MEANS HOLDS ON DAILY CLOSING BASIS

- PLEASE USE APPROPRIATE STOP LOSSES ON INTRA DAY TRADES TO LIMIT LOSSES.

- THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF REPORT

- ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLAR UNLESS OTHERWISE SPECIFED.