First and only reminder for trading and investing is: What worked in 2023 may or may not work in 2024. Factors and news which worked this year and dictated price and trend this year MAY/MAYNOT WORK IN 2024.

Chase the momentum or the Herd. But use trailing stop loss.

Never take extra risk above your own financial limitation. I would suggest a twenty percent risk taking capability at the most should be taken and not an iota more.

Be flexible.

Invest for the long term on asset classes which has strong fundamental. Review the change in fundamental outlook (of every asset class) every two months.

I am bullish on gold, silver, copper and platinum and base metals in 2024. I will prefer to be neutral in crude oil and natural gas. Dark horse should be Nickel and Silver in 2024.

The pace of rise will be different for each of them. How? I will not be surprised if gold and silver see negative month on month return for a few months. But overall return in 2024 could still be over fifteen percent. Your nerves will be tested if gold gives negative returns month to month.

GOLD

Gold is ever green. Continue to invest on significant crash with fifteen percent as margin money for long term investment in future. Short term traders, monthly investors need to have a flexible mindset. Short selling opportunities will be there in gold for day traders, very short term investors.

SILVER

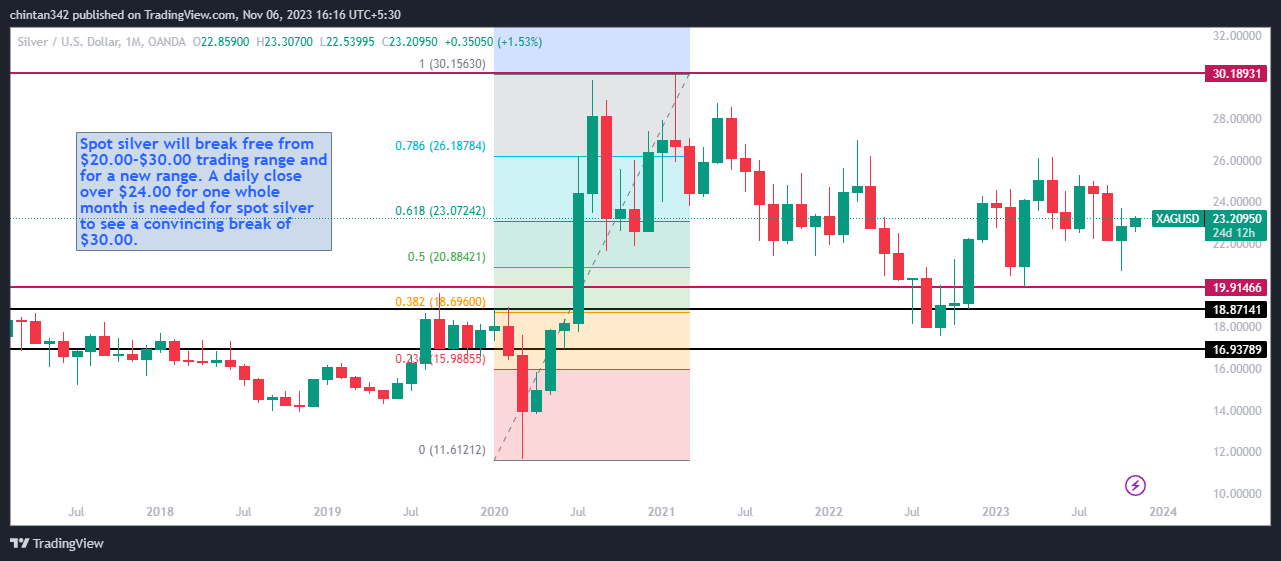

Silver continues to underperform. $20.00-$30.00 wider trading range will be broken in the next fifteen months and new range will be there. Significant crashes (if any) are in invest with a stop loss below $18.50 for long term investment and a stop loss below $20.50 for very short term investment. Day traders and jobbers and weekly traders of silver should profitably enjoy trading in silver.

SURPRISE FACTORS OF 2023 WHICH MAY OR MAY NOT THERE IN 2024

US Ten Year Bond Yield rising to five percent was not expected at the beginning of this year. Bond yields rise is dependent on central bank interest rate hike policy. Central banks need to continue with interest rate hike for US and global bond yield to rise in 2024. A sustained interest rate pause (and not an interest rate cut) a will cause traders switching away from bonds to other asset classes. Trend of US ten year bond yields on or from February 2024 should continue for the rest of 2024. Inverse correlation will be there between (i) Gold and bond yields. (ii) US ten bond yields and Asian forex price.

Yen rising above 150.00 versus the US dollar was unthinkable at the beginning of this year. Predicating Bank of Japan moves is the most difficult among all central banks. I believe that usd/jpy at 150.00 was deliberately done by Japanese hedge funds at the behest of bank of Japan. Inflation was needed by bank of Japan and has been achieved. Yield Curve Control (YCC) policy by the Bank of Japan will dictate yen price moves versus other currencies. I expect a long term top to be formed in Yen/usdjpy followed by a move to 135.00 and 117.00 by end 2025. Price top for usd/jpy can be between 165.00 to 180.00 under the worst case scenario in case yen defies everything and continues to weaken.

Crash in copper and base metals was not expected by me this year. A Review for my faulty bullish view on base metals indicates that hedge funds were heavily long in copper and base metals on news of China fully reopening from covid. Chinese economy disappointed. Inventories in LME started rising. Long positions were converted to short positions in LME and CME and continues till date. Short selling in LME was also accompanied by falling volumes.

Israel and Hamas War: Geopolitical implications will be far reaching if the Israel-Hamas war continues for a few months. Crude oil will rise/zoom in the short term if this war continues to the first quarter of next year.

NEXT TWELVE MONTHS KEY FACTORS TO WATCH OTHER THAN ABOVE

Nearly forty countries will be going to democratic elections in 2024. Safe havens demand like gold should rise as traders and investors hedge against political instability. Some nations will see political instability. Regime change with new leaders will be there in some nations. For example, in India, a lot of forecasters are predicting a twenty percent fall in Indian stock markets in case the current BJP/NDA does not come to power once again and is also accompanied by a coalition deadlock. Volatility will rise in all asset classes in 2024 due to national elections. Gold will attract higher investment demand as hedge. Base metals can also rise if economic stimulus measures are announced just before election code of conduct comes into force. US presidential elections in November could impact interest rate decisions of June, July and September meetings.

Central banks will continue to buy gold and increase gold reserves: Central banks are doing ever thing to reduce dependence on the US dollar for global trade and investment. Russia is asking for payments in Chinese Yuan for its crude oil exports. India-Russia recently did a barter trade for arms. India will build and export cargo ships to Russia in exchange for S400 missile defense systems. Gold will see continued demand from central banks. World gold council publishes weekly number of gold demand trend. For more details one can visit www.gold.org. Central bank gold demand will ensure that gold price does not see a sustained period of short term bearish trend.

Crypto currency and crypto currency ETF and crypto currency mutual funds: IF or in case Bitcoin or crypto currencies are given the green light for exchange trade funds (ETF) and crypto mutual funds by US regulatory authorities, then they will attract huge investment inflows all over the world. Churning of some investment will be there. It is difficult to predict which asset classes will crash if and when US regulators approve crypto ETF and crypto mutual funds. We just need to wait and watch for new on crypto currencies.

China: Copper and base metals will zoom if Chinese retail spending rises next year. Chinese demand and Chinese production is still the key long term price dictator for copper and base metals. Shanghai could overtake LME for global base metals price fixation unless LME makes some changes.

US Dollar Index: A crash in US dollar index will be positive for precious metals, base metals and energies.

Interest Rate: Do not bets on interest rate cuts. Losses this year were made by traders who made bets interest rate cuts this year. Interest rate pause period can be much longer or much shorter than most of us expect. Interest rate cuts expectation are always bullish for global economy and also inflationary. Central banks will not risk giving early indication of interest rate so that inflation remains within manageable limits.

Bullish will be copper, base metals and emerging market currencies and stock markets even there is a long period of interest rate pause. Bearish will be bond yields and US dollar index and selected stock sectors if and when interest rates cuts are known. But remember that bond yields and US dollar index will be very volatile in the interest rate pause period.

|

KEY MOVING AVERAGES |

|||

|

|

50 |

100 |

200 |

|

DAILY |

|

|

|

|

SPOT GOLD |

$1,922.90 |

$1,926.30 |

$1,934.30 |

|

SPOT SILVER |

$22.82 |

$23.19 |

$23.27 |

|

|

|

|

|

|

WEEKLY |

|

|

|

|

SPOT GOLD |

$1,921.37 |

$1,863.10 |

$1,826.10 |

|

SPOT SILVER |

$23.37 |

$22.52 |

$22.71 |

|

|

|

|

|

|

MONTHLY |

|

|

|

|

SPOT GOLD |

$1,803.50 |

$1,533.90 |

$1,380.90 |

|

SPOT SILVER |

$22.33 |

$19.31 |

$20.39 |

SPOT GOLD TECHNICAL VIEW FOR 2024

BULLISH: Spot gold has to trade over $1803.50-$1826.10 zone for the next twelve months to rise to $2093.00 and $2216.40 and $2448.00.

CRASH, SELL 0FF OR BEARISH TREND will be there if spot gold does not break and trade over initial long term resistance of $2093.90 to $1874.90 and $1752.40.

Spot gold will also crash or move into a short term bearish phase if there is a daily close below $1934.00 for ten consecutive trading sessions.

SPOT SILVER TECHNICAL VIEW FOR 2024

BULLISH: Spot silver has to trade over $18.82 for the next twelve months to rise to $26.86 and $30.88 and $33.95.

CRASH, SELL 0FF OR BEARISH TREND will be there if spot silver does not break and trade over $26.86 by end June 2024 to $18.82 and $17.70.

Spot silver will also crash or move into a short term bearish phase if there is a daily close below $20.90 for ten consecutive trading sessions.

|

2024 FOMC MEETINGS |

|

|

|

|

|

JANUARY |

30-31 |

|

MARCH |

19-20 |

|

APRIL/MAY |

30TH AND 1ST |

|

JUNE |

11TH AND 12TH |

|

JULY |

30TH AND 31ST |

|

SEPTEMBER |

17TH AND 18TH |

|

MOVEMBER |

6TH AND 7TH |

|

DECEMBER |

17TH AND 18TH |

March and July meeting and pre meeting moves is the key for me. Interest rate expectation or higher chance of an announcement of interest rate cut will be much higher in Federal Reserve meetings of March and July.

I am not giving any view on the quantum of interest rate cut next year. Quantum of interest rate cut will be dependent on trajectory of energy price and a sustained fall in US CPI and PCE below the two percent threshold limit. Yeah, if CPI and PCE in USA remain below two percent for three consecutive months, I am sure that interest rate cut will be between 0.50% to 1.00% by the Federal Reserve next year.

But in case, just in case, due to whatever reason inflation zooms up say stays over three percent, then pause or another half a percent interest rate can be there.

TO CONCLUDE

At the end of the day, making profit is the key. Do whatever do you but make a profit. Make good profit. Blah, blah writing is very easy. Taking a risk and making a profit and continuously making trading/investment profit is the key. Follow the golden rule of ensuring that capital is intact come what may and profits will automatically come.

2024 volatility should provide opportunities for short selling in all asset classes. Investment and good day trading opportunities in all asset classes. But watch the trend of your local currency versus the US dollar. Usd/inr, usd/idr, usd/php and other Asian currencies etc will all see very sharp two way price moves. Local physical price trend of precious metals and base metals may or may not be in sync with global price.

Physical dealers, large metals consuming factories, and scrap recyclers all need to reassess their optimum inventory strategy every three weeks at the most for the next one year.

Do not convert hedging into a speculative open position. I conclude my 2024 forecast with this message. Happy Diwali. Enjoy the festivals.

Disclaimer: Any opinions as to the commentary, market information, and future direction of prices of specific currencies, metals and commodities reflect the views of Chintan Karnani. In no event shall Chintan Karnani have any liability for any losses incurred in connection with any decision made, action or inaction taken by any party in reliance upon the information provided in this material; or in any delays, inaccuracies, errors in, or omissions of Information. Nothing in this article is, or should be construed as, investment advice. All analyses used herein are subjective opinions of the author and should not be considered as specific investment advice. Investors/Traders must consider all relevant risk factors including their own personal financial situation before trading. Prepared by Chintan Karnani

Disclosure: I trade in gold and silver and metals in general in India’s MCX commodity exchange. I may or may not have open position at any point of time.

PLEASE NOTE: HOLDS MEANS HOLDS ON A DAILY CLOSING BASIS

PLEASE USE APPROPRIATE STOP LOSSES ON INTRADAY TRADES TO LIMIT LOSSES.

THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF THE REPORT

ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLARS UNLESS OTHERWISE SPECIFIED.